- >Corretoras

- >Resenha sobre a corretora eToro

- Excelente para iniciantes

- Plataforma consolidada de negociação geral/cripto

- Empresa de confiança na comunidade

- Aceita cartões de crédito para depósitos e resgates

Análise geral

Prós

Os traders têm acesso aos mercados tradicionais

O recurso de negociação social permite o monitoramento de outras negociações de usuários

O recurso de cópia de negociação permite que os usuários sigam e copiem a negociação de outros usuários

Fácil entendimento para novos traders de criptomoedas

Uma das opções mais confiáveis do mercado

Contras

Grande número de taxas diferentes a serem observadas nesta plataforma

Os norte-americanos não têm tantas opções de negociação quanto os traders de outras partes do mundo

O número de criptomoedas disponível para negociação é um pouco limitado

CFDs possuem riscos extras que podem não ser adequados para novos traders

Não está disponível em 45 estados

Resumo da eToro

Métodos de depósito da eToro

Processo de inscrição

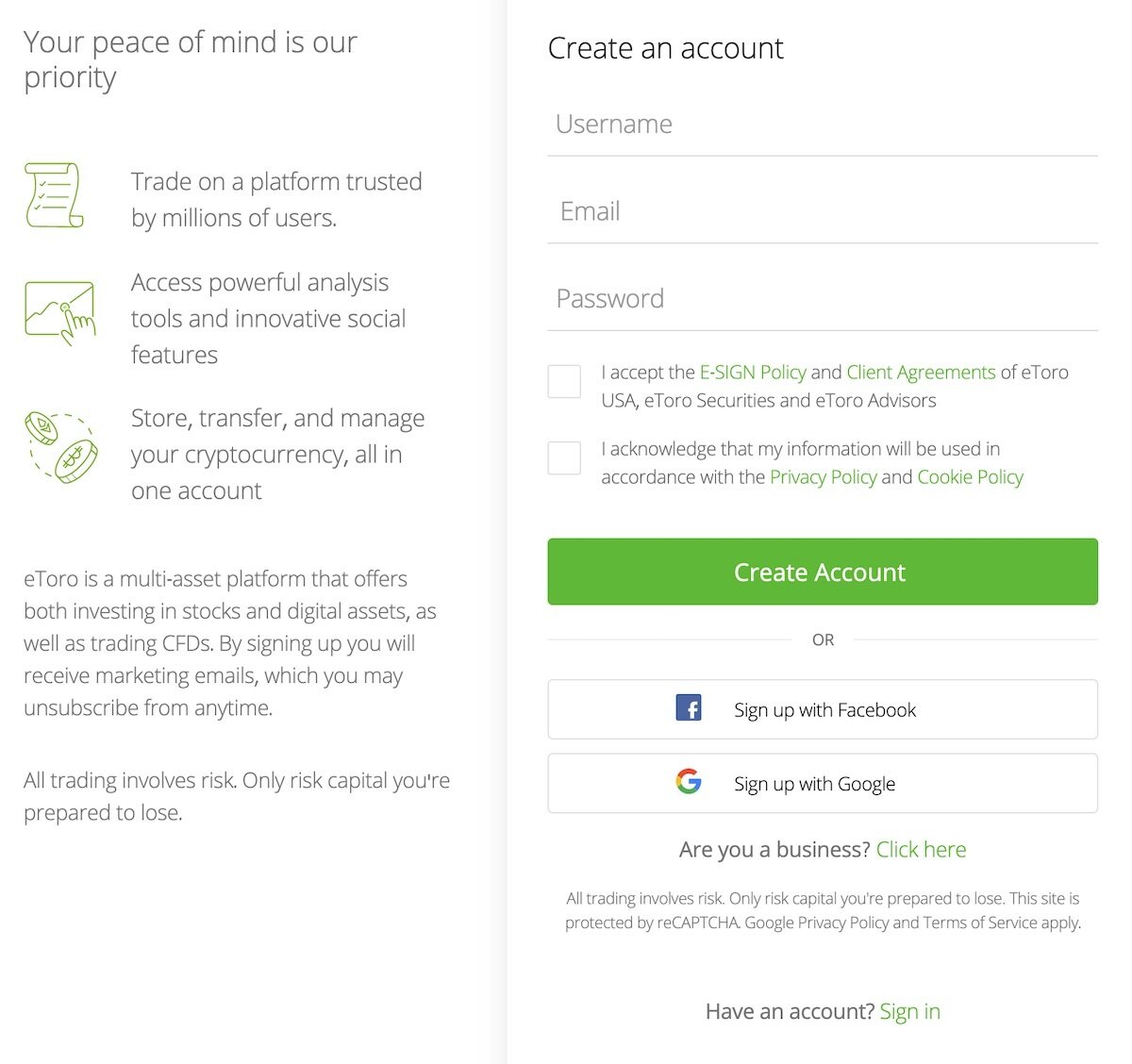

A eToro tem um processo de inscrição bastante simples e direto, embora as informações pessoais precisem ser verificadas antes que o usuário possa começar a negociação. Para abrir uma nova conta na eToro, siga as seguintes etapas:

- Acesse a página inicial da eToro e clique no botão “Inscreva-se agora” ou “Negocie agora” para começar.

- Insira seus dados pessoais na próxima página, incluindo nome, sobrenome, endereço de e-mail, nome de usuário, senha e número de telefone. Também é possível criar uma conta pelo Facebook ou Google.

- Antes de enviar todas as suas informações, leia os Termos e Condições da eToro e as outras políticas com as quais você está concordando. Informe que você leu e concorda com estes termos antes de se inscrever em uma conta.

- Depois de enviar suas informações básicas, é necessário passar pelo processo Conheça seu cliente (KYC), que é usado para verificar a identidade e restringir a lavagem de dinheiro na plataforma. Para esta parte, é necessário fornecer uma conta ou um documento válido que comprove sua residência e passaporte ou alguma outra identificação emitida pelo governo. O processo KYC também envolve um questionário que deve ser preenchido para que a eToro saiba como atender melhor você.

Quais criptomoedas podem ser compradas?

Embora a eToro não ofereça uma grande variedade de criptomoedas para negociação, grandes nomes do mercado de criptomoedas podem ser encontrados nesta plataforma. Incluindo:

O que é a eToroX?

A eToroX é uma corretora cripto independente operada pela eToro.

A plataforma oferece um número maior de benefícios em comparação com a eToro tradicional, incluindo mais de 80 diferentes pares de negociação de criptomoedas, linhas de crédito e serviços de API. O serviço é regulado pela Comissão de Serviços Financeiros de Gibraltar. A plataforma é basicamente uma corretora OTC (over-the-counter) para traders de alto volume.

Infelizmente, a eToroX está restrita às seguintes partes:

- Fundos de cobertura

- Fundos de capital de risco

- Corretores

- Pessoas físicas de alta renda

- Day traders

- Algotraders

A eToro é mais do que suficiente para qualquer um que esteja começando no setor de criptomoedas e é muito fácil comprar sua primeira criptomoeda na plataforma.

A eToroX e a carteira NÃO estão disponíveis para clientes dos EUA.

Aplicativos compatíveis com a eToro

Os usuários da eToro podem interagir na plataforma por meio de dispositivos móveis ou computador. A plataforma de negociação pode ser acessada por meio de um navegador da web. Você também pode usar aplicativos disponíveis para Android e iOS.

Além do aplicativo de negociação da eToro, há também a carteira eToro de múltiplos ativos, que pode ser usada pelos traders para conseguir mais funcionalidade com seus ativos. No entanto, deve-se observar que esse recurso não está disponível para todos os criptoativos e ainda é uma carteira custodial.

A eToro é segura?

A eToro é uma das empresas mais seguras do setor de criptomoedas por estar em conformidade com os regulamentos CySEC, FCA e ASIC. Todos os fundos dos clientes são mantidos em bancos seguros e as informações pessoais são protegidas por criptografia SSL. É muito improvável que você perca dinheiro na eToro. Muitas análises da eToro fazem referência à forte segurança da plataforma.

A princípio, não era possível resgatar sua própria criptomoeda da plataforma, mas a eToro fez atualizações significativas nesse setor com a carteira eToro Money que permite aos usuários resgatar criptomoedas.

Em geral, a CryptoVantage recomenda proteger grandes quantidades de criptomoedas usando uma carteira pessoal para evitar qualquer possível problema com as corretoras.

Atendimento ao cliente da eToro

A eToro possui excelente atendimento ao cliente por conta do seu longo histórico no setor de negociação.

Você vai encontrar um centro de ajuda com diversos tópicos, além da capacidade de publicar tíquetes de suporte. A eToro não oferece suporte por telefone no momento, mas isso é bastante comum na maioria das plataformas de negociação de criptomoedas.

As taxas cobradas em sua negociação de criptomoedas são extremamente simples: a eToro cobra uma taxa única, simples e transparente de 1% para comprar ou vender cripto.

Os traders de alto volume (mais de USD 5.000 por mês) conseguem o benefício de um gerente de contas mediante solicitação.

Taxas da eToro

As taxas cobradas aos usuários da eToro podem ser difíceis de entender totalmente. Há uma variedade de taxas diferentes associadas à plataforma, e diferentes criptomoedas trazem taxas diferentes ao fazer negociações.

Embora não haja taxas para depósitos, há uma taxa fixa de USD 5 adicionada a cada resgate. O valor mínimo para resgate é de USD 30. Também há taxas adicionadas aos depósitos e resgates se for feita uma conversão de moeda para processar o pagamento. Além disso, a eToro cobra taxas fixas por criptomoedas que são resgatadas para a Carteira eToro.

Por fim, é importante destacar que a eToro cobra uma taxa de inatividade mensal de USD 10 para contas que não foram acessadas por 12 meses.

A eToro oferece forex e CFDs?

A eToro oferece negociação de forex (câmbio) e CFDs (Contrato por diferença), apesar de que nenhum deles está disponível para clientes nos EUA.

O que é forex da eToro? Forex simplesmente se refere a um mercado global onde as pessoas podem comprar e vender moeda internacional. É atrativo principalmente para clientes que podem não ter acesso a ações tradicionais e têm valores de capital relativamente pequenos.

Já os CFDs são principalmente uma forma de os investidores fazerem apostas se o preço de uma ação ou ativo aumenta ou diminui. Permite que os usuários fiquem expostos a determinados ativos sem realmente deter. Pode ser mais flexível (e acessível) do que as commodities tradicionais, ações ou contratos futuros.

Como negociar forex na eToro

É realmente muito simples conseguir lucro nos mercados de forex disponíveis na eToro. Se você estiver em uma área permitida, terá acesso a sua conta eToro mais básica.

Alguns dos pares de moeda mais comuns na eToro incluem:

- EUR/USD

- USD/JPY

- EUR/GBP

- USD/CAD

Lembre-se de que a negociação Forex pode ser arriscada (especialmente se você estiver usando alavancagem), portanto, tenha cuidado. Há muito menos informações sobre a negociação de forex em relação à negociação tradicional de ações. Esse é outro motivo para ter cuidado.

História da eToro

A eToro foi fundada em 2007 em Tel Aviv pelos irmãos Ronen Assia, Yoni Assia e o empresário David Ring. Assia continua sendo o CEO até hoje.

A plataforma revolucionou a abordagem de negociação de ações, graças ao recurso CopyTrader, que permitia que investidores de varejo seguissem traders bem-sucedidos. Ao longo dos anos, a eToro gerou mais de USD 162 milhões em depósito inicial.

Em 2014, a eToro adicionou a criptomoeda à sua plataforma, sendo uma das primeiras a adotar a criptomoeda em instituições.

Em 2022, a eToro veiculou um anúncio famoso durante o Super Bowl (apelidado de “Crypto Bowl” por conta do número de anúncios de criptomoedas) apresentado por Shiba Inu Coin e Bored Ape Yacht Club.

A empresa cresceu e passou a operar em mais de 140 países com escritórios nos Estados Unidos, Chipre, Austrália e Reino Unido. Sua sede principal continua sendo no centro de Israel. A eToro é popular principalmente na Europa, além de muitos países da América Latina, como Brasil.

Aviso da eToro

A eToro é uma plataforma de múltiplos ativos que oferece investimento em ações e ativos cripto, bem como negociação de CFDs.

Observe que os CFDs são complexos e apresentam um alto risco de perda rápida de dinheiro devido à alavancagem. 78% das contas de investidores de varejo perdem dinheiro ao negociar CFDs com esta operadora. Pense bem se você conhece o funcionamento dos CFDs e se pode correr o alto risco de perder dinheiro.

O desempenho passado não é uma indicação de resultados futuros. O histórico de negociação apresentado é menor que 5 anos completos e pode não ser suficiente como base para a decisão de investimento.

A cópia de negociação é um serviço de gerenciamento de carteira, fornecido pela eToro (Europe) Ltd., que é autorizado e regulado pela Comissão de Valores Mobiliários do Chipre.

O investimento em criptoativos é altamente volátil e não é regulamentado em alguns países da UE. Sem proteção ao consumidor. Podem ser aplicados impostos sobre os lucros.

A eToro USA LLC não oferece CFDs e não garante e não assume nenhuma responsabilidade quanto à exatidão ou integridade do conteúdo desta publicação, que foi preparada por nosso parceiro usando informações específicas que não pertencem a entidade publicamente disponíveis sobre a eToro.

Perguntas frequentes sobre a eToro

A eToro permite um tipo especial de instrumento de negociação, conhecido como contratos por diferença (CFD). É um tipo especial de negociação de derivativos que os usuários podem apostar nos movimentos de criptomoedas com alavancagem adicional. Em vez de comprar o ativo subjacente, os CFDs permitem que os usuários façam uma aposta com base em um feed de preço.

Os usuários devem ter certeza de que compreendem os riscos envolvidos na negociação de CFD antes de começar. Ao negociar na margem, os traders podem ser completamente eliminados rapidamente.

A princípio, todos os pares de negociação de criptomoedas eram CFDs, mas a plataforma agora também oferece negociação real de criptomoedas.

Deve-se observar que a negociação de CFD não está disponível para os norte-americanos.

Há duas formas interessantes pelas quais os usuários da eToro podem basicamente colocar suas contas no piloto automático e permitir que outros usuários tomem todas as decisões difíceis. São elas: CopyPortfolios e CopyTrading.

O CopyPortfolios permite que os usuários tenham acesso a uma cesta específica de ativos ou a uma estratégia de negociação predeterminada por meio de um único feed. Por exemplo, os usuários podem criar seu próprio portfólio de ativos cripto com base nas moedas que acreditam que terão o melhor desempenho no próximo ano. Outros usuários podem verificar essas carteiras e decidir comprar uma das estratégias específicas de outros usuários.

O CopyTrading funciona exatamente como diz o nome. Os usuários podem copiar automaticamente as decisões de negociação de outros usuários. Faz parte do uso da eToro como uma plataforma social em que os usuários podem seguir os traders mais lucrativos e tentar lucrar simplesmente seguindo seus conselhos, em vez de escolher estratégias individuais de negociação de criptomoedas.

A Carteira eToro faz parte do principal avanço da plataforma para o setor de criptomoedas. Com este aplicativo, os usuários podem transferir criptoativos da plataforma de negociação para sua própria carteira, enviar esses ativos para outras carteiras, receber pagamentos em criptomoeda e converter diferentes criptoativos dentro da carteira.

Este sistema de carteira está atualmente disponível para dispositivos Android e iOS. No entanto, não pode ser usado por usuários em todos os países.

A Carteira eToro é uma solução de armazenamento custodial, o que significa que a eToro detém os criptoativos em nome de seus usuários. Desta forma, os usuários da Carteira eToro não estão realmente usando uma rede de criptomoedas. Na verdade, basicamente eles detêm IOUs de criptomoedas emitidas pela eToro.

A eToro usa diversos fatores para determinar seus principais traders. É claro que os traders que conseguem mais lucros terão melhor classificação. No entanto, é importante destacar que os traders que não estão tendo muito volume de negociações podem ter ainda uma classificação alta por conta dos grandes ganhos percentuais em seus investimentos originais.

Fatores como o número de posições por dia ou semana, a duração das posições e a quantidade de alavancagem das negociações também desempenham um papel nesse processo.

Os traders mais populares na plataforma da eToro e que ganham muitos seguidores podem ter renda extra. Esses traders são pagos uma vez por mês com base no nível do investidor popular. Esse nível é determinado pelo número de usuários que seguem o trader e a quantidade de dinheiro que esses usuários aplicam nas negociações copiadas das decisões do investidor popular.