- >News

- >Wrapped Bitcoin Supply Jumps Over 4,000% in Less Than 3 Months

Wrapped Bitcoin Supply Jumps Over 4,000% in Less Than 3 Months

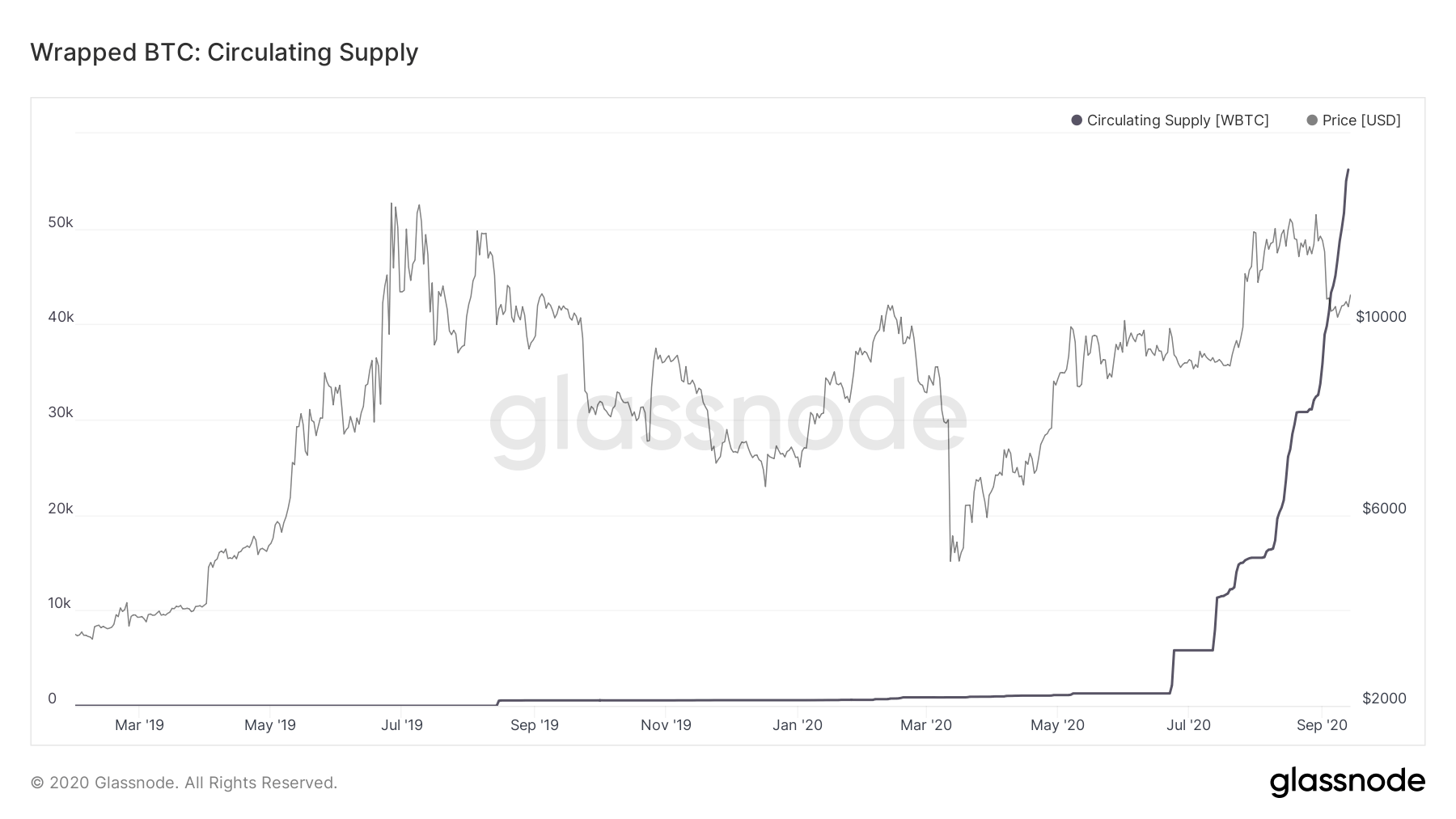

The circulating supply of wrapped bitcoin (wBTC) has spiked by 4,233% in just under three months. According to data from glassnode, the supply rose from 1,297 wBTC on June 22 to 56,203 wBTC September 13, representing the biggest increase in any cryptocurrency over the same period.

The explosion in wrapped bitcoin’s supply has happened in parallel with a similar explosion in the value of the decentralized finance (DeFi) ecosystem. But what exactly is wBTC? And what is it for?

We take a look at this relatively new cryptocurrency and explain how and why it’s driving the growth of DeFi. Put simply, it provides bitcoin holders with an entry-point into DeFi, which at the moment promises some tantalizing — if not sustainable — returns via yield farming.

The Explosion in Wrapped Bitcoin

Wrapped Bitcoin is an ERC-20 token, meaning that it runs on the Ethereum blockchain. Launched in January 2019, it’s the product of a variety of firms involved in DeFi, including BitGo, Kyber Network, Republic Protocol, MakerDAO, Dharma, Airswap, and others.

Wrapped bitcoin is managed by a decentralized autonomous organization (DAO), which is run by the above companies (and others). Whenever a user deposits bitcoin with the DAO, they receive a corresponding amount of wBTC, which is pegged 1:1 with BTC. Users can later redeem wBTC for BTC with the DAO, with BitGo acting as the custodian of the deposited BTC.

Generally, bitcoin holders convert into wBTC via an approved “Merchant,” who then swaps the BTC for wBTC directly with the DAO. A full list of Merchants can be found on the wBTC website.

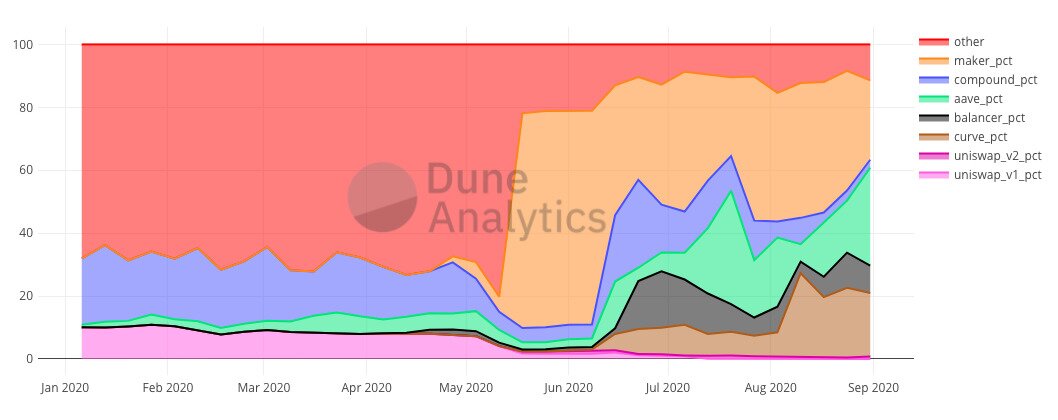

And what do holders of wBTC do with their ERC-version of bitcoin? Well, they predominantly stake or deposit it in various DeFi platforms. As the table below from Dune Analytics indicates, the likes of Maker, Aave, Balancer, Curve, and Compound currently count amongst the most popular destinations for wBTC.

Source: Dune Analytics

Looking at Maker, holders are likely using wBTC to do the following. By depositing wBTC with Maker as collateral, they will receive a loan in DAI (pegged 1:1 with the US dollar), worth 66% of the dollar value of the deposited wBTC (so $1,000 of wBTC receives $666 in DAI). They then use this DAI to purchase bitcoin, which they hope will rise in value.

Assuming that $666 of BTC rises to a value of $1,000, they can then buy $666 in DAI (while pocketing the $444 difference) and use this to pay off their loan with Maker, which will return the wBTC they originally deposited as collateral. They will end up with a profit of roughly $1,944, having begun with wBTC worth only $1,000.

That is the essence of wBTC’s purpose with DeFi. Regardless of whether it’s Maker, Aave or Compound, users can basically earn additional returns or interest from their bitcoin, which may also rise in value at the same time.

This promise — which may be broken (spectacularly) during market downturns — accounts for why the use and supply of wrapped bitcoin has exploded in recent weeks and months.

As noted above, the supply of wBTC rose by 4,233% between June 22 and September 13.

Source: glassnode

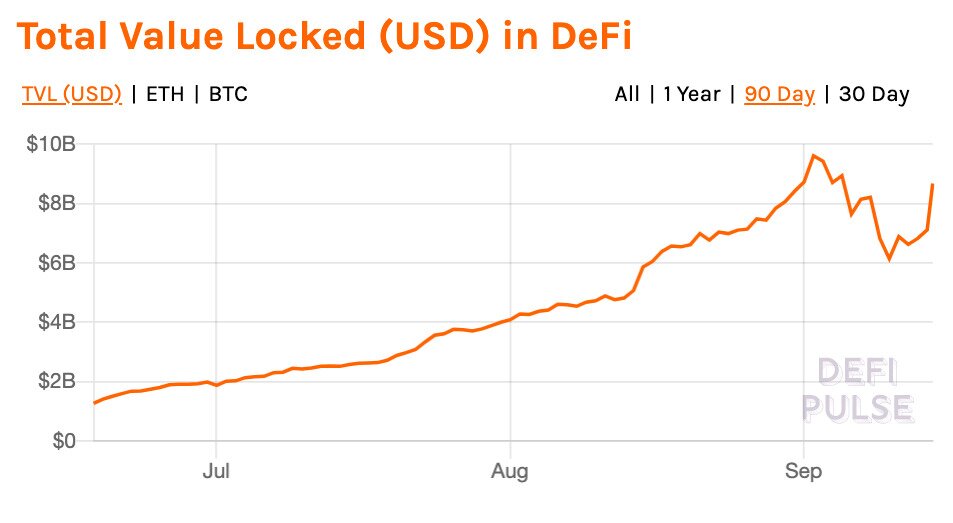

Over the same period, the total value of the assets locked into DeFi platforms rose from $1.685 billion to $8.67 billion, an increase of 414.5%.

Source: DeFi Pulse

In a post published in May, DappRadar wrote, “wBTC is potentially a major catalyst for the DeFi space. ETH being the biggest collateral asset is much smaller than BTC. As such, it is interesting to see its volume grow, which may introduce additional liquidity specifically on Ethereum DeFi and DEX dapps.”

The months following May appear to have proven this prediction correct, particularly after Maker introduced wBTC as an accepted form collateral that same month.

Potential Risks of wBTC

As with almost everything in crypto, the increasing involvement of wrapped bitcoin in DeFi is not without its risks.

Source: Twitter

Firstly, there are the counterparty risks alluded to above, which don’t affect bitcoin itself. Users have to trust the custodians of wBTC to handle their bitcoin. While the system is subjected to quarterly audits of transactions, there is still a non-negligible possibility that a custodian could potentially use users’ bitcoin for its own purposes (there is no indication that anything like this is happening).

Then there’s the systemic financial risk that comes with leveraged trading, which is basically what wBTC facilitates. This is a problem general to DeFi, but by providing significant additional liquidity to DeFi, wBTC potentially makes it much worse.

Source: Twitter

By encouraging people to take out loans in crypto in order to buy more crypto, the DeFi ecosystem is exposing itself to considerable systemic risk in the event of a big market crash. If cryptocurrency prices fall suddenly and significantly, users will be unable to repay loans, something which will magnify price drops (since lenders may be forced to sell to cover losses) and potentially put DeFi platforms at risk of collapse.

There’s also the strong likelihood that the high interest rates currently offered by certain DeFi aren’t sustainable over the long term. For the most part, this is because increasing demand for DeFi will result in lower rates, as users flood the market with crypto to borrow.

This will apply to wrapped bitcoin as much as to any other crypto currently used in DeFi. This is why we should expect the massive growth in wBTC circulation to ease up in the coming months.

Still, for now wrapped bitcoin — and DeFi — are enjoying their time in the Sun. Together they’re providing bitcoin holders with the promise of increasing their BTC returns during a period of unspectacular growth in the normal bitcoin market. This is unlikely to last forever, of course, so always invest only what you can afford to lose.