- >News

- >Will Tether Be Classified as a Security and Sued by the SEC?

Will Tether Be Classified as a Security and Sued by the SEC?

Tether is no stranger to controversy, given claims it’s responsible for pumping bitcoin’s price. It’s also no stranger to threats against its own existence, with the New York Attorney General currently investigating iFinex, the owner of Tether and the crypto-exchange Bitfinex.

It now has another potential existential threat to consider, with the President’s Working Group on Financial Markets — a group which consists of senior officials from the US Treasury, the Federal Reserve, the SEC and the CFTC — declaring in late December that stablecoins such as Tether (USDT) can be considered as securities.

In other words, depending on how it assesses Tether’s particular operations and market function, the SEC may declare that the stablecoin is a security, and as a result may sue Tether for failing to register USDT.

When combined with another threat to Tether — the potential passage of the STABLE Act — this suggests it may only be a matter of time before the stablecoin suffers a big, life-threatening blow. And with it, bitcoin and the wider cryptocurrency market would be damaged in turn.

Tether ‘May Constitute A Security’

Publishing on December 23, the President’s Working Group on Financial Markets (PWG) outlined a number of key regulatory considerations for stablecoins. This includes the need to comply with anti-money laundering (AML) guidelines, as well as the need to adopt business models that will reduce the threat posed by stablecoins to financial stability.

Most significantly, the four-page document also noted how stablecoins might be classified and regulated according to existing financial rules:

“Depending on its design and other factors, a stablecoin may constitute a security, commodity, or derivative subject to the U.S. federal securities, commodity, and/or derivatives laws.”

This statement obviously leaves the door open for Tether to be classed as either a commodity or derivative, rather than a security. However, certain Tether-Bitcoin skeptics suspect that the SEC is preparing to sue Tether, much like it opened legal action against Ripple — for selling an unregistered security — before Christmas.

Source: Twitter

Such speculation has gained some support from other, more prominent Tether skeptics, including Nouriel ‘Dr Doom’ Roubini, who has long been prophesying the end of USDT and, by extension, Bitcoin.

Source: Twitter

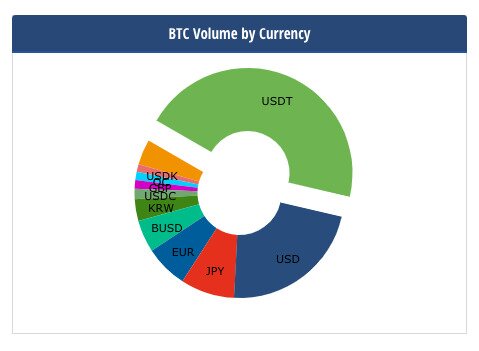

Make no mistake, if the SEC were to come after Tether much like it did with Ripple, the effect would most likely be disastrous for the cryptocurrency market. Even if you don’t accept that USDT is (significantly) inflating bitcoin prices, the mere fact that USDT is comfortably the biggest market by daily volume indicates just how much crypto depends on the stablecoin for liquidity.

Source: Twitter

For example, on December 25, bitcoin’s daily trading volume was equivalent to $36.78 billion, ethereum’s was equivalent to $13.6 billion, and USDT’s was equivalent to $56.53 billion. Basically, the whole cryptocurrency market depends on USDT for liquidity, so if you remove USDT, you remove a big chunk of demand for bitcoin and other cryptos.

Source: CryptoCompare

But Will the SEC Really Go After USDT?

Of course, it needs to be pointed out that it’s hardly certain the SEC will deem USDT as a security and therefore go after Tether. Tether, for one, don’t seem to think this is the case, as suggested by a tweet from Tether/Bitfinex CTO Paolo Ardoino following online speculation.

Source: Twitter

Yet as the PWG’s statement clarifies, just because a stablecoin is regulated under FinCEN doesn’t mean it can’t also be classed as a security and put under the purview of the SEC (in addition to FinCEN). However, less biased individuals than Ardoino also think the likelihood of an SEC action against Tether is slim. Here’s crypto-focused lawyer Jake Chervinsky offering his views:

Source: Twitter

It’s certainly true that it would be (relatively) hard to classify a stablecoin — which is meant to have a fixed price — as a security. That said, it certainly isn’t impossible, not least because the PWG’s statement says it stablecoins can be securities.

It’s arguable that Tether satisfies the common tests that define an asset as a security. Most notably, even though its price is nominally stable, many investors use it for speculation, with a May 2020 report from Flipside Crypto concluding that “Tether is mostly used for arbitrage” (i.e. buying low on one exchange and selling higher on another).

As with XRP/Ripple, USDT is also the product of a single enterprise (Tether), which promotes the use of USDT, works to develop USDT, and arguably increases its value as a tool for speculation. According to an article from InVigor Law Group, a crypto may also be a security if its promoter (in this case Tether) has “raised an amount of funds in excess of what may be needed to establish a functional network.”

In this case, Tether has continuously printed new USDT and sent USDT to exchanges, potentially raising funds in excess of what’s necessary to operate its network. It has also invested in bitcoin (some of its reserves are in bitcoin), adding more weight to this interpretation.

In sum, it may be difficult to establish that USDT is a security, but it certainly won’t be impossible.

Other Threats

If this weren’t bad enough, Tether is facing other significant challenges. First, there is the New York Attorney General’s ongoing investigation against parent company iFinex, which could potentially result in litigation. The NYAG claims that iFinex committed fraud by using USDT to hide around $900 million in losses suffered by Bitfinex, so if found guilty, iFinex — and Tether — could suffer a steep penalty.

Perhaps more worryingly, Democrat legislators introduced the STABLE Act at the end of 2020. This bill would effectively require stablecoin issues such as Tether to register in the United States as banks. Given that Tether has so far failed to undergo a full audit, this would be a condition it perhaps couldn’t fulfill.

At the time of the STABLE Act’s initial proposal, we stated that it faced a significant hurdle in becoming law: the Democrats needed to regain control of the Senate in a run-off election in Georgia. Well, the Dems have indeed regained the Senate, so the chances of the STABLE Act being passed have recently risen.

Taking all of this together, the future doesn’t look very bright for Tether, even if the Office of the Comptroller of the Currency has recently said that banks can conduct payments using stablecoins (which presumably includes USDT). That’s because the OCC has also recently lent weight to the idea of chartering stablecoin issuers as if they were banks, adding to the sense that Tether will face regulation or legal action sooner or later.

In the short term, any actions or regulations faced by Tether may have severe repercussions for crypto. But with institutions steadily entering the market, it’s becoming increasingly likely it will recover, and then some.