- >News

- >Will Other Countries Follow El Salvador’s Lead in Making Bitcoin Legal Tender?

Will Other Countries Follow El Salvador’s Lead in Making Bitcoin Legal Tender?

El Salvador has become the first nation-state in the world to accept bitcoin as legal tender, after its Legislative Assembly approved plans set forward by President Nayib Bukele.

The cryptocurrency sector is hailing the vote as a historic milestone for Bitcoin, with some figures urging or expecting other nations — particularly in Latin America — to sooner or later follow El Salvador’s example.

However, while the world may expect use and ownership of bitcoin to increase (to some degree) in El Salvador, it remains unlikely that other countries will ape El Salvador and adopt bitcoin as legal tender, at least for the foreseeable future. That’s because El Salvador’s acceptance of bitcoin arises from very specific historical conditions, with Bukele facing a debt crisis which his increasingly authoritarian actions are making it harder to solve via conventional means.

Still, if any other relatively marginal nation faces a similar debt crisis and has no other means of raising cash, El Salvador may soon gain some company as the only country (right now) that accepts bitcoin as legal tender.

El Salvador Accepts Bitcoin As Legal Tender: What Does It Mean?

El Salvador’s Legislative Assembly voted to make bitcoin legal tender by a ‘supermajority’ of 62 out of 84 possible votes. The cryptocurrency’s use as legal tender will therefore enter law in 90 days. After 90 days, shops and businesses will be legally required to accept bitcoin whenever it’s offered as payment or as a settlement of debts, unless (and this is a big ‘unless’) they cannot provide the technology needed to transact in bitcoin.

Source: Twitter

The new law states that the government will “promote the necessary training and mechanisms so that the population can access bitcoin transactions,” although it’s not clear yet what form such training or mechanisms will take.

That said, the government has revealed it will maintain a fund in US dollars in order to ensure the convertibility of BTC into USD. In speaking with (Castle Island Ventures partner) Nic Carter, Bukele explained that this fund will assume the “price risk” taken on by businesses when they accept BTC, essentially making up for any shortfall in the event that bitcoin declines (relative to USD) following a transaction.

Bitcoin podcaster Stephan Livera paraphrases Nayib Bukele’s conversation with Nic Carter. Source: Twitter

Other details of the mechanisms, processes and technology involved are currently thin on the ground, although it has been revealed that El Salvador will be using Bitcoin largely via the Lightning Network, with LN-based payment solutions being provided by Strike.

Despite the paucity of details, many within the cryptocurrency industry are heralding the news as momentous for Bitcoin, for crypto, and even for humanity.

Source: Twitter

Some figures are even going so far as to call on other countries to take El Salvador’s lead, if only to reduce the risk of the United States or IMF ‘punishing’ El Salvador for its actions.

Source: Twitter

President Bukele also expects other countries to follow, according to his conversation with Nic Carter.

Source: Twitter

Cash Grab?

This final claim from Bukele is highly questionable, however. Firstly, because it’s unlikely to have a big positive impact on El Salvador, at least not for a while. Secondly, because few (if any) other nations will join El Salvador in accepting bitcoin as legal tender, since most aren’t subject to the same pressures, problems and personalities.

Bukele has claimed that the law “will bring financial inclusion, investment, tourism, innovation and economic development for our country.” Much has been said about financial inclusion in the context of the law, with Bukele also claiming that 70% of El Salvadorans don’t have access to traditional financial services.

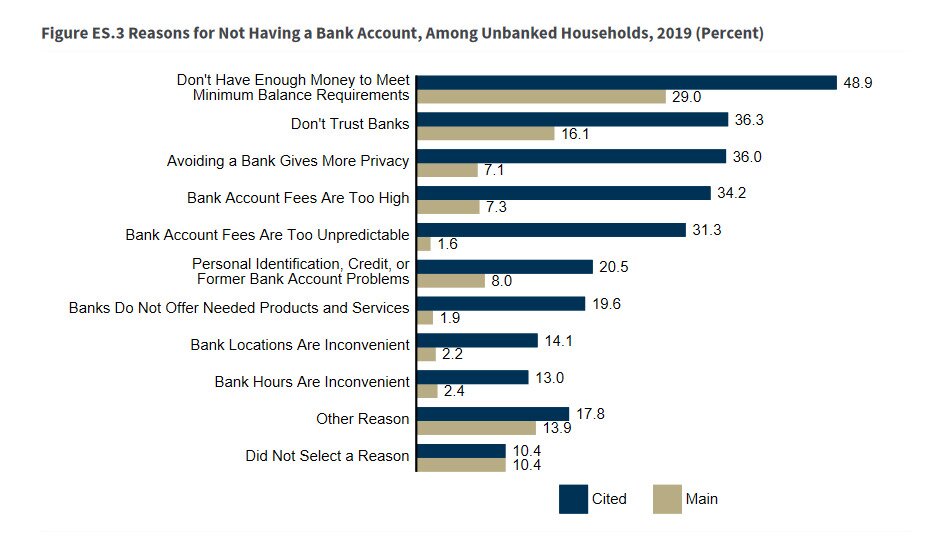

It’s likely true that many El Salvador residents do indeed lack access to financial services. That said, it’s not clear how Bitcoin or making bitcoin legal tender will change this, since recent surveys have shown that the number one reason for not having a bank account is: a lack of money.

Source: Twitter

If you don’t have money, how are you going to buy bitcoin in order to use it? What’s more, how are you going to afford the transaction fees imposed by Bitcoin and/or the Lightning Network, as small as they may (or may not) be?

Also remember that businesses are legally obliged to accept bitcoin only if they have the technical means to do so. While details remain scarce, this could potentially be a get-out clause which saves individuals and entities from actually having to accept the cryptocurrency. So it could be months or years before a significant number of businesses in El Salvador actually do begin accepting bitcoin, if at all.

But El Salvador’s impetus in accepting bitcoin as legal tender likely doesn’t come from a political desire to increase financial inclusion. It comes mostly from its financial and political problems, with the nation saddled with debt of around $7.7 billion (its GDP is $27 billion) and issues with the IMF over whether it can receive a $1 billion loan.

The recent authoritarian actions of Bukele’s government — including the ousting of all four judges on El Salvador’s Supreme Court — have made it increasingly less likely that the nation will receive such a loan. As such, it needs a new source of emergency funding.

Enter Bitcoin. More skeptical commentators are loosely divided on whether Bitcoin’s confirmation is part of an impulsive cash grab, or whether it’s an outright scam to launder money via the cryptocurrency. Either way, it stems from the country’s need for financing.

Source: Twitter

Looking at the first hypothesis, bitcoin is being raised to the status of legal tender in order to increase government revenues, investment into the country (potentially from Bitcoin whales and firms), and economic activity in general. This is likely true at least to some extent, since World Bank data shows that remittances constituted $6 billion of El Salvador’s $27 billion economy in 2019. Given that remittances have generally been enabled by foreign payment service companies (which take a percentage as fees), using bitcoin could enable El Salvadorans to actually keep more of the money they send to each other. In turn, it could allow the government to raise more in tax.

Of course, this assumes that El Salvadorans at home and abroad will actually shift to using Bitcoin, while it also assumes the reliability of infrastructure provided by Strike and the Lightning Network (which is no stranger to bugs). But the likelihood of this happening on a significantly large scale is, at the moment, highly questionable. Because even though popular money remittance services in El Salvador (such as Wise and Revolut) do indeed charge a pesky fee, so do the Bitcoin and Lightning networks.

For example, Wise will charge you around $16 to send $1,000 from the United States to El Salvador, yet the average Bitcoin transaction fee has been above this amount for much of 2021. Lightning Network fees are intended to be lower (although there’s no real data on how high/low they will be in the event the LN is widely adopted), but with the more experimental nature of the technology, and the fact that money remittance fees aren’t massive anyway, it’s hard to imagine that El Salvadorans will migrate en masse to an unfamiliar — and not necessarily that-much-cheaper — platform.

In light of this, the claim that something a little shifty is going should be entertained. Seeing as how the Bitcoin law will establish a fund to guarantee BTC convertibility into USD, some critics have suggested El Salvador will be used to launder and buy dirty bitcoin, and that (individuals within) the government has received or will receive a big bung to pass the law. Others have suggested that El Salvador’s convertibility fund will end up being backed largely by a ‘USD-pegged’ stablecoin, so that the government can pluck ‘money’ out of thin air and then buy up BTC (which can be sold on for profit).

Source: Twitter

To be fair, such claims are entirely speculative and lack conclusive evidence. What remains clearer, however, is that El Salvador’s current financial and economic situation is relatively unique (including its reliance on remittances), so it’s unlikely that a significant number of other nations will follow its lead in the near future.