- >News

- >Will Canada Be a Major Crypto Hub as USA Struggles with Regulation?

Will Canada Be a Major Crypto Hub as USA Struggles with Regulation?

The cryptocurrency market is a global market, except it isn’t. Rules and regulations vary from one region and country to the next, creating a patchwork of different environments where certain practices and cryptocurrencies can flourish, and where certain others end up being restricted. So while crypto trading may be fairly open in, say, Switzerland, it’s an entirely different story in China, which has prohibited cryptocurrencies for several years (despite moving ahead with plans for a central bank digital currency). For this reason, it would be somewhat misleading to say there’s a single worldwide market for cryptocurrencies, meaning that retail investors should do their homework before buying digital assets in any given territory.

For a long time, Canada sat somewhere near the permissive end of the cryptocurrency trading spectrum, with the North American nation becoming home to a growing number of exchanges and trading platforms over the past few years. However, this appears to have begun changing, with the introduction of new requirements by the Canadian Securities Administrators resulting in several high-profile exchanges — including Binance, Paxos, dYdX and OKX — leaving the country. Such an exodus raises the possibility of Canada losing its status as one of the most crypto-friendly countries in the world, and of Canadians finding it harder to buy and sell digital assets.

But as this history and future of crypto trading in Canada will show, the industry is hardly likely to disappear from the country altogether, especially when it’s had such a strong presence for so long. And even if some trading platforms do disappear for now, the introduction of consumer protections may end up only increasing demand for cryptocurrency in the longer term, helping to legitimize the market in the eyes of retail investors. It might even become a more compelling option for crypto companies compared to the USA.

Early Years: 2009 - 2013

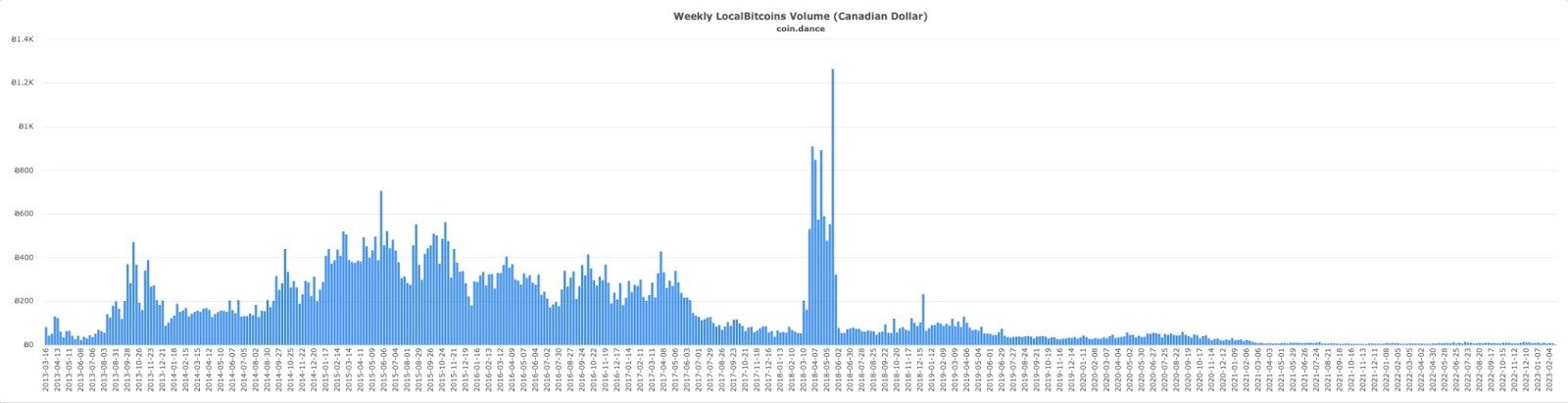

As far as Bitcoin’s infancy is concerned, Canada didn’t play a particularly prominent role, at least not in the sense of there being any notable Canadian developers involved in the original cryptocurrency during its earliest years (although Canadian-Russian Vitalik Buterin would co-found Ethereum in late 2013). Still, available data suggests that Canadians quickly took to buying and selling BTC, with data for the LocalBitcoins peer-to-peer exchange showing significant trading activity in Canada from early 2013 onwards (note there was a shift to centralized exchanges, which explains the drop off).

LocalBitcoins trading volume in Canadian dollars from 2013 onwards. Source: Coin Dance

Such trading wasn’t quite on the same level as that seen in the US or the UK, but it was significant enough that Canada was soon treated to a handful of its very own local cryptocurrency exchanges. This includes such platforms as CaVirtEx, Canadian Bitcoins, LibertyBit, Instabit, Vault of Satoshi and QuadrigaCX, which launched in November 2013 (more about this ill-fated trading platform below). Perhaps more impressively, Canada could also boast the first city in the world to open a publicly available Bitcoin ATM, Vancouver. Installed inside Waves Coffee House in October 2013, the ATM was buying bitcoin for $183.21 and selling it for between $207.37 and $211.32 in the days following its launch.

By this time, some companies in Canada had already been accepting BTC as payment for a couple of years, with Pacific Bliss Yoga being one of them. The company’s owner, Michael Bliss, was also co-founder of the city’s BitCoin Co-op, which helped organizations to begin accepting BTC, while also connecting BTC holders to businesses that accepted the cryptocurrency.

2013 was also the year that saw the launch of the Bitcoin Alliance of Canada, a non-profit organization founded by cryptocurrency entrepreneur Anthony Di Iorio and tasked with representing crypto-related businesses and promoting Bitcoin to the general population. BAC organized the Bitcoin Expo that took place in Toronto in April 2014, although it seemed to become less active after this event and no longer operates.

However, even if the Canadian populace was slowly gaining a fondness for Bitcoin, the same couldn’t exactly be said for Canada’s banks. Most of the big Canadian financial institutions of the time — RBC, TD, BMO, CIBC, Scotiabank and National Bank — had actually taken the step of halting banking services for the aforementioned local exchanges by late 2013. This heavy handedness came despite the fact that FINTRAC (the Financial Transactions and Reports Analysis Centre of Canada) had said on record that Bitcoin brokerages don’t have to register as financial service companies, since it didn’t classify BTC as a currency for legal purposes.

Boom to Bust: 2014 – 2018

The following years continued in much the same vein, with Canada’s fondness for Bitcoin and cryptocurrency growing steadily, although with a not-insignificant number of problems along the way.

By the latter half of 2014, there were reports that a small number of companies had actually begun paying their employees in bitcoin. An Ontario-based payroll provider, Wagepoint, reported in September of that year that ten companies it served had employees it paid in BTC, with most of these being tech firms. A few months previously (June), the Canadian government had legally classified BTC as property, with a Canada Revenue Agency spokesman saying that paying employees in bitcoin effectively equates to paying them in goods.

Of course, aside from the people who bought BTC as an investment and the small number of people who chose to receive their pay in it, a similarly sizable cohort used it for less-than-savory purposes. In February 2014, the Globe and Mail reported that a Quebecois man had been arrested for using bitcoin for money laundering, with undercover US Secret Service agents tracing the individual’s use of LocalBitcoins.

A month later, Canadian police opened an investigation after Edmonton-based “bitcoin bank” Flexcoin collapsed, following the latter’s claim that it had lost around $600,000 in BTC in a hack. What’s interesting is that this came weeks after the similar collapse of the much bigger Mt. Gox exchange, which despite being based in Japan served thousands of Canadian traders. In fact, such was Mt. Gox’s popularity in Canada that it ended up facing a class-action lawsuit in the country, filed in March 2014 on behalf of its Canadian users (this suit was dismissed on the “consent of all parties” in June 2016).

Despite such episodes, cryptocurrency trading continued to grow in the following years, with such major exchanges as Coinbase and Kraken establishing operations in Canada in the summer of 2015. Canadian exchange Shakepay also launched in 2015, as did the non-custodial BTC exchange Bull Bitcoin. The next year saw US-based platform Gemini begin serving Canadian customers, with co-founder Cameron Winklevoss declaring in June 2016 that its entry into Canada was “just the beginning of Gemini’s international expansion.” This was followed in 2017 by the launch of local exchange Coinberry.

Such expansion prepared the ground for what was to follow in late 2017, a period during which Bitcoin and the wider cryptocurrency market enjoyed its most publicly visible and biggest bull rally to date. BTC famously surged to a then-record high of $19,783 (or about CAD 25,421 at then-current exchange rates), driving more retail investors into its market. Such was the intensifying fervor that one couple in British Columbia poured much of their life savings — about CAD 100,000 — into bitcoin mining.

The thing is, the quickly expanding interest in Bitcoin and other cryptocurrencies led to a bubble, which couldn’t last. Almost as soon as BTC reached its then-all-time high in December 2017, prices began to fall. Not only did this result in new investors losing money, but it also put strain on a number of Canadian exchanges, as their users rushed to sell and withdraw.

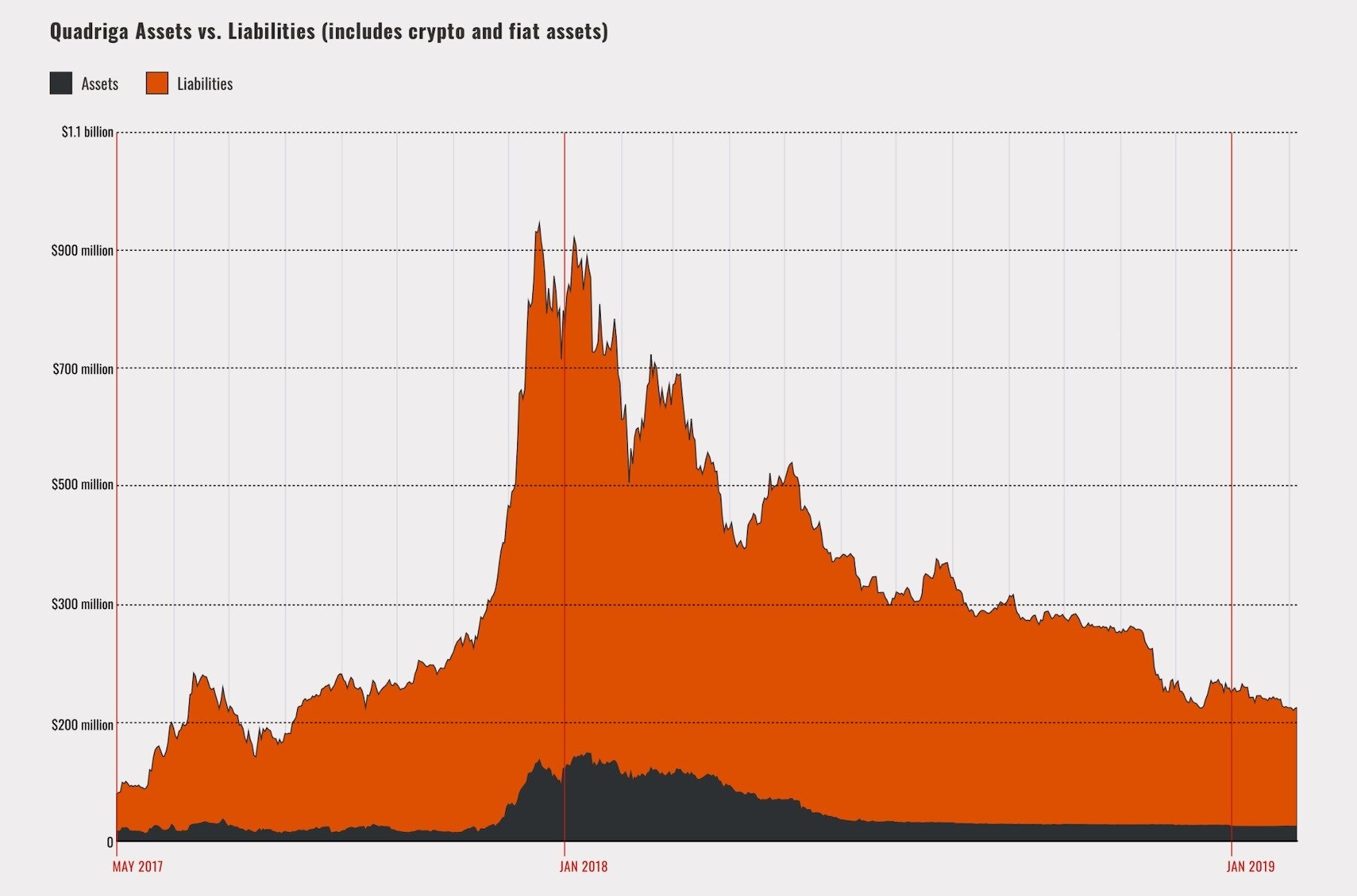

QuadrigaCX’s assets (black) against its liabilities (red/orange) between early 2017 and early 2019. Source: OSC

One of these exchanges was the aforementioned QuadrigaCX, which suffered a very slow death over the course of 2018 as its 300,000+ customers sought — and often failed — to withdraw millions in Canadian dollars and cryptocurrencies. It effectively collapsed in December of that year, following the death of founder and CEO Gerald Cotten (who was holidaying in India), with a subsequent investigation by the Ontario Securities Commission finding that “the platform owed approximately $215 million to clients” by the time of his death. The report also concluded that the exchange was fraudulent more or less from the start, and that Cotten “had injected so many fake assets into the platform” by November 2016 that it was all-but inevitable it would collapse sooner or later.

Regulation and Recovery: 2019 - 2023

It didn’t take long for QuadrigaCX’s flagrant fraud and spectacular collapse to prompt Canadian lawmakers and regulators into looking more closely at possible cryptocurrency regulations. Up until the exchange’s demise, the Canadian government and authorities had more or less taken a laissez-faire approach as far as crypto was concerned, by Quadriga’s Ponzi scheme more or less changed that overnight.

A couple of months after Quadriga’s formal closure in early 2019, the Canadian Securities Administrators (CSA) and the Investment Industry Regulatory Organization of Canada (IIROC) jointly announced that they were “considering a set of tailored regulatory requirements” in order to address the “novel features and risks” of cryptocurrencies and crypto-related platforms.

Two years later, in March 2021, both bodies published the result of their joint consultation, issuing new guidance for crypto-asset trading platforms that stipulated mandatory licensing for certain platforms, while also outlining the situations in which existing securities legislation applies to crypto-handling businesses.

As CSA Chair Louis Morisset explained at the time, “The guidance in [the regulator’s] notice details steps platform operators need to take to comply with securities legislation as they prepare to fully integrate into the Canadian regulatory structure.”

In other words, the update was a sign that cryptocurrency was becoming more mainstream within Canada, a claim supported by the fact that the crypto market had begun enjoying something of a resurgence in the period between the opening of the regulators’ consultation and the issuing of new guidance. Bitcoin had risen to $55,000 (c. CAD 69,200) by the time the CSA and IIROC released their guidance in March 2021, while data from CryptoCompare indicates that Bitcoin trading in Canadian dollars reached its peak during this year.

In fact, daily BTC-CAD volumes (according to the CryptoCompare data) were well above hundreds of millions of (Canadian) dollars from about June 2021 until the end of the year. This testifies to just how much interest in cryptocurrency had grown again in 2021, despite the downturn of 2018 and the relative stagnation of 2019.

Of course, things are almost never plain sailing in crypto, with the bull market of 2021 slowing down considerably in 2022, as a mix of rising interest rates and war in Ukraine sent investor appetite plummeting. Another sustained decline in prices led to Terra collapsing in May 2022, a fall which had considerable contagion effects, and which ultimately led to the bankruptcy of major exchange FTX in November 2022.

And given that FTX was another QuadrigaCX, albeit on a much larger scale, Canadian regulators moved quickly once again to tighten cryptocurrency regulations. A month after the exchange’s bankruptcy, the Canadian Securities Administrators (CSA) issued an update that required crypto-exchanges “to hold Canadian clients’ assets with an appropriate custodian and segregate these assets from the platform’s proprietary business.”

Source: Twitter

Given that FTX had commingled user funds with its own reserves, such a requirement is arguably very sensible. However, as noted above, it has resulted in Binance and OKX announcing their departure from Canada, something which will reduce choice for Canadian investors. In a Twitter Spaces AMA, Binance’s Changpeng Zhao suggested that the requirement to use third-party custodian providers was inherently risky, because such providers are “smaller than us and less tested, so we view that as a higher risk, not less risk.”

The Future

However, the CSA’s new requirements have potentially been vindicated by the SEC’s recently opened legal action against Binance, which accuses the exchange and its CEO of “commingling billions of dollars of investor assets and sending them to a third party, Merit Peak Limited, that is also owned by Zhao.”

Regardless of the veracity of these allegations, the CSA’s updated guidelines point to a future in which cryptocurrency trading becomes safer for the average Canadian retail investor. In the long run, the increased stability and safety of exchanges will only encourage more investors to enter the market, which again can only help the Canadian cryptocurrency market and industry grow.

In this respect, it’s encouraging to note that numerous major exchanges — including Coinbase, Kraken, Crypto.com and Gemini — have actually committed in recent months to complying with the new regulations. All have signed pre-registration undertakings with the Ontario Securities Commission, obliging themselves to register as broker-dealers and to secure their customers’ assets with a third-party custodian. Taken together, their compliance suggests that the tightened regime will actually help the industry to evolve in Canada and to provide more value to investors.

Needless to say, it may still take some time for the situation to stabilize, with the legal actions of the aforementioned SEC in the US likely to have ramifications in Canada, as well as elsewhere. On top of this, the global economy continues to stutter towards a recovery, with interest rates and inflation remaining high, and with GDP growth remaining modest in many parts of the world.

On the other hand, Canada itself recorded a 3.1% increase in its economic output for the first quarter of 2023, so there are signs that things are beginning to improve again. And when it does, Canada’s relatively open approach to cryptocurrency — along with some new and much-needed safeguards — could help it be at the forefront of the next bull market.