- >News

- >Why the Collapse in the British Pound is Good News for Bitcoin and Cryptocurrency

Why the Collapse in the British Pound is Good News for Bitcoin and Cryptocurrency

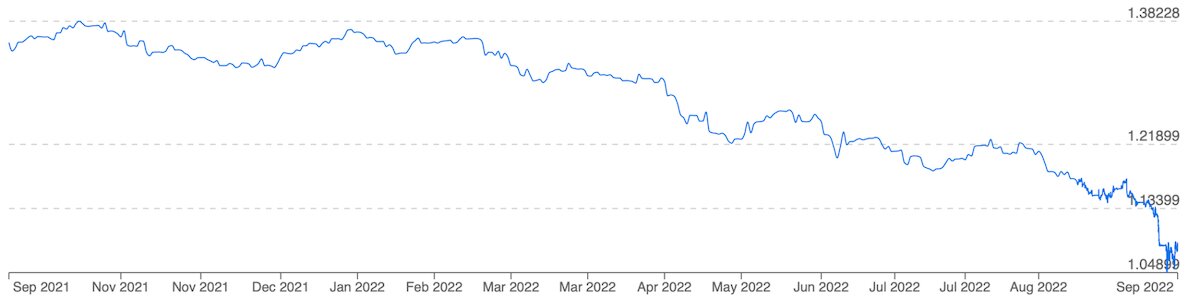

Cryptocurrency naysayers like pointing out just how volatile bitcoin and other virtual currencies are, but this week it’s been the turn of a ‘stable’ fiat currency to fluctuate just a little too much for comfort. Yes, the British pound — often considered one of the most dependable and ‘popular’ national currencies in the global economy — took a nosedive in terms of its value against the US dollar, falling to its lowest level against USD since 1985 on Monday September 26.

GBP’s plunge to $1.03 marked a 12% decline in only a week, with the UK’s national currency also falling by 27% compared to last May and by 40% since July 2014. These are surely alarming figures for anyone who earns and saves in British pounds, yet they had an unexpected effect in the UK.

Namely, Monday’s dive resulted in a sudden surge in volume for the GBP/BTC trading pair, with panicked Brits apparently turning to bitcoin to protect themselves against the pound’s loss in value (and potential future losses). This offers a very current and strong reminder of the fact that currency inflation and devaluation is good for cryptocurrency adoption, even if a strong US dollar may be working in the opposite direction right now.

The British Pound’s Loss is Bitcoin’s Gain

While the full details aren’t entirely relevant to this article, a spending and taxation plan announced by the UK government on Friday September 26 ended up spooking the market, with new tax cuts appearing alongside high government spending.

Investors tend not to like such contradictions between lower taxation and higher spending (meaning more government borrowing), so when Forex markets opened again on Monday September 26, currency traders began selling GBP in high numbers.

As stated above, the pound fell to $1.03 at one point, before settling around $1.08, a level which still represents a 24% loss compared to GBP’s 2021 high.

The pound’s value against the US dollar over the past year. Source: XE.com

Almost needless to say, GBP holders and anyone with assets priced in GBP didn’t appreciate this dip, with analysis firms soon reporting that bitcoin trading volume for GBP hit a record high in response.

In fact, transaction volume for the GBP/BTC trading pair across eight major international crypto-exchanges jumped to a record high of $846 million (c. $920 million) on September 26, according to data crunched by Kaiko Research. This compares to a much more modest average of roughly £54.1 million per day for much of 2022, making for an increase of 1,463%.

Let that sink in: GBP/BTC trading volumes spiked by well over 1,000%. This was obviously no coincidence, testifying to the power of attraction bitcoin holds when a national fiat currency hits decidedly hard times.

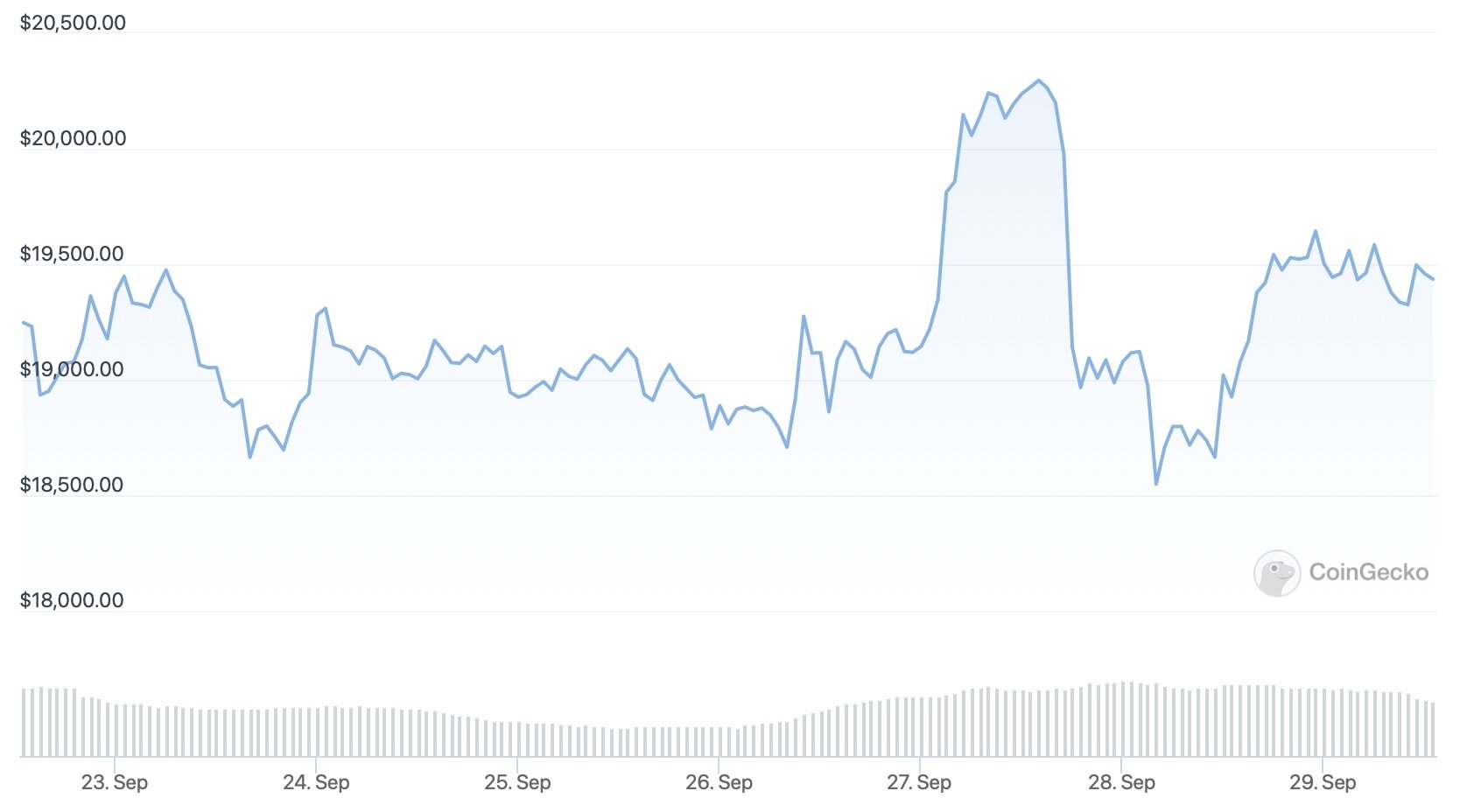

What also wasn’t likely a coincidence was the fact that the price of bitcoin rose to a seven-day high of $20,296 within 24 hours of the pound’s collapse.

Bitcoin’s price over the week between September 22 and 29. Source: CoinGecko

Clearly, with an increase in pounds chasing roughly the same number of bitcoins, something had to give. However, BTC dipped again in the following days, most likely because existing holders decided to cash out amid ongoing macroeconomic negativity and uncertainty.

Still, the effect of the pound’s fall was clear, increasing bitcoin ownership at a time when around 34% of UK residents already owned some form of cryptocurrency, according to a study published on September 21 by VoucherCodes. This percentage is likely to increase even further in the coming months, with the pound yet to rise from $1.08 and with the UK government refusing to U-turn on its widely rebuked new economic plans.

Inflation and Devaluation Drive Cryptocurrency Ownership

The past week’s excitement provides further evidence of the occasionally observed fact that weak/falling national currencies tend to increase cryptocurrency ownership. Aside from mere speculation, this would seem to be the single biggest driver of adoption.

Witness, to take another example, Turkey, which is experiencing an (official) inflation rate of 80% right now, and has been living through double-digit inflation for quite some time now. Such inflation has resulted in a significantly high level of cryptocurrency ownership in relation to other nations, with some five million Turkish residents operating accounts at cryptocurrency exchanges, as of January of this year.

As CoinShares’ head of research, James Butterfill, told Reuters this week, “There is a high correlation to bitcoin volume growth and political/monetary instability.”

Similar Patterns Playing Out Around the World

This correlation isn’t evidenced only in the UK and Turkey, but also in other areas. Just look at Argentina, where inflation is also close to 80% and where the number of companies paying salaries in cryptocurrencies rose by 340% in the 12 months to March 2022.

We also see similar patterns in Ukraine and Russia, with both nations suffering the economic fallout from a protracted military conflict, and with both seeing surges in bitcoin trading volumes in the days and weeks following Putin’s invasion.

Likewise, Nigerians have been confronted with a declining naira, and in response they have turned to bitcoin and other cryptocurrencies, with local peer-to-peer trading platforms enjoying 250% increases in volumes during certain weeks of this year.

Such evidence paints a clear and consistent picture, which is that substantial inflation and/or instability often results in the uptake of cryptocurrencies. So while most of us can certainly shudder in fear at what the future has in store for us (what with the Ukraine-Russia war waging on and conflict beckoning elsewhere), it’s possible that this period may herald a steady (if not spectacular) increase in cryptocurrency ownership.

Of course, one fly in the ointment here is the US dollar, with CoinShares research noting in September that bitcoin “has a high inverse correlation” to USD. Part of the reason why the British pound (and other currencies, such as the euro) have declined recently is because of a strong dollar, and it’s highly probable that the latter has something to do with the cryptocurrency market’s ongoing woes.

In other words, we may not see a really momentous increase in bitcoin and cryptocurrency ownership until the US dollar begins to slide off its pedestal as the world’s strongest currency. And while such an eventuality may be at the top of every Bitcoin maximalist’s wishlist, there’s every chance it couldn’t happen without some real political and economic upheaval, so investors may have to be careful what they wish for.