- >News

- >Why is Hedera Hashgraph (HBAR) Outperforming the Crypto Market Right Now?

Why is Hedera Hashgraph (HBAR) Outperforming the Crypto Market Right Now?

Every year brings a swath of new cryptocurrencies and platforms to the attention of investors, and this year it’s the turn of Hedera Hashgraph. Its native token HBAR has outperformed most other major coins in the past few weeks, having risen by 142% since January 1 (compared to 50% for bitcoin and 43% for ethereum). Yet it’s not an entirely new platform, having launched its mainnet in beta in September 2019. Since then, it has continued to develop almost under the radar, neglected in a sector where newer platforms such as Solana, Avalanche and Aptos have attracted more hype as potential ‘Ethereum killers.’

Yet in recent months, Hedera Hashgraph has been able to more convincingly position itself as a would-be Ethereum rival, thanks to a combination of upgrades, growth and new partnerships. And even if it may never overtake Ethereum as a layer-one network, its superior efficiency and scalability could make it the platform that enterprises end up using for their blockchain needs.

Why Hedera Hashgraph Is Going Up Right Now

Starting with short-term reasons for HBAR’s recent price rises, the cryptocurrency enjoyed a big rally on February 7, when it went from $0.069058 to $0.077016 in about an hour. This was a rise of 11.5%, and it was caused by the announcement that US multinational tech giant Dell was becoming a member of Hedera Hashgraph’s Governing Council, joining the likes of Google, IBM and Boeing (among numerous other heavyweights).

Source: Twitter

Not only does this announcement mean that Dell will play a role in Hedera Hashgraph’s governance and run a Hedera node, but also that it wants to use the platform’s technology. In particular, Dell will be using Hedera’s technology to develop decentralized applications for edge computing, which is a relatively new branch of computing related to smart technology and the Internet of Things.

In other words, it’s a massive endorsement for Hedera that one of the biggest names in tech has chosen it as a launchpad for explorations into distributed ledger technology. And as noted above, this set off a rally that continued for several days, with HBAR ending up at $0.098084 — an eight-month high — on February 13, marking a 42% gain since February 7.

HBAR price over the past 90 days. Source: CoinGecko

However, HBAR’s recent good fortunes began some time before February, with the coin beginning to rise steadily from January 1 onwards. Indeed, as noted above it has more than doubled in price since the New Year, and as recently as February 13 was 168% up on its January 1 price.

Was there a particular piece of news that sparked this surge? Well, actually no, because what’s mostly responsible for HBAR’s gains this year has been the organic growth and adoption enjoyed by Hedera Hashgraph.

There are various indicators of this growth. Perhaps most impressively, Hedera’s Twitter account announced on February 13 that its network had processed four billion transactions to date. What’s remarkable about this is that it passed the three billion mark as recently as January 22, indicating that its network is growing exponentially.

Source: Twitter

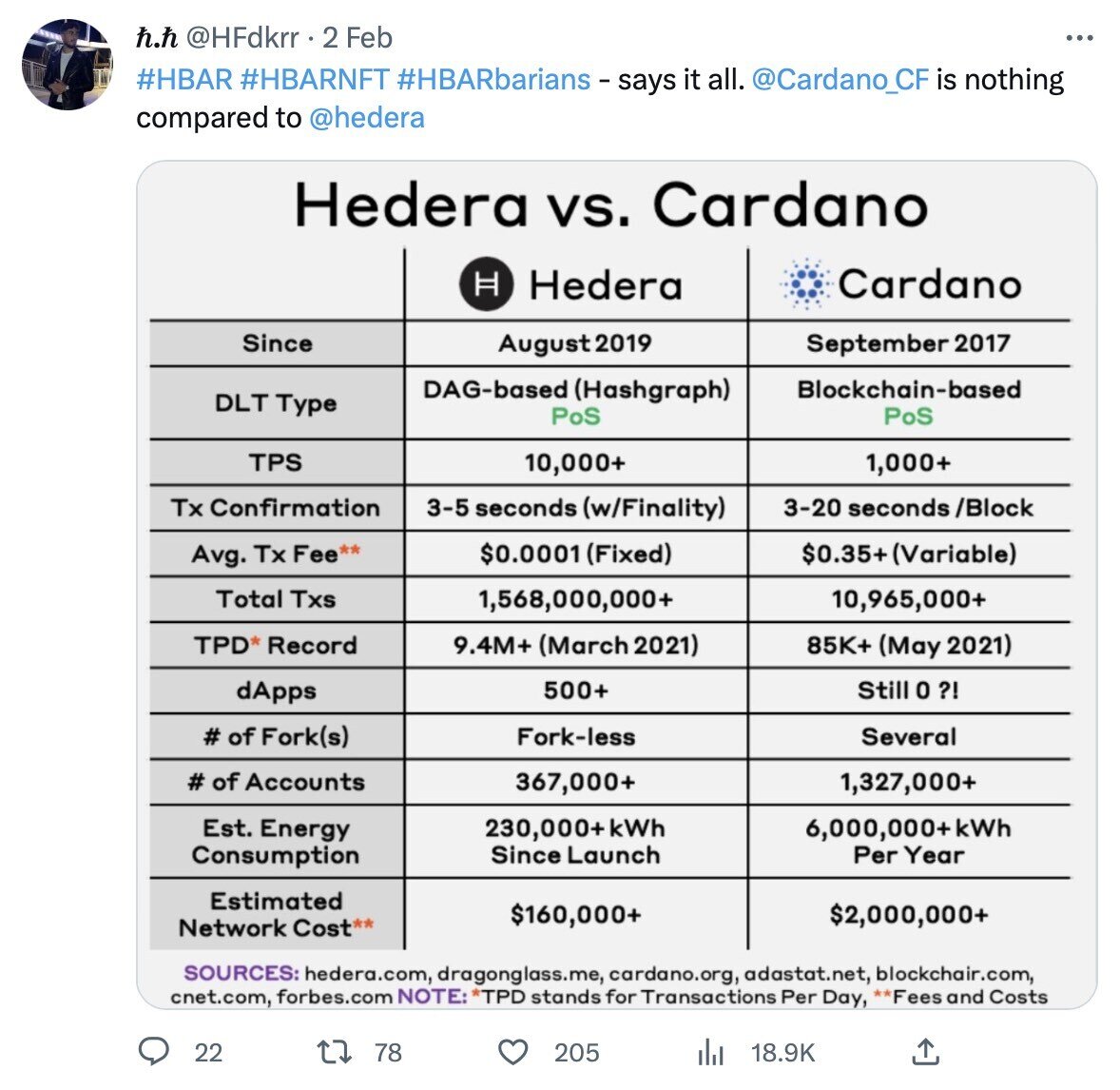

To put this in some perspective, Cardano — which launched its mainnet in 2017 — has processed a grand total of 61.6 million transactions to date, according to Cardanoscan. Yes, some of Hedera’s (and also Cardano’s) transactions are going to be trivial (i.e. involving just the exchange of metadata), yet the fact that most aren’t is indicated by the network’s growing total value locked in, and by its growing number of dapps and partnerships.

Hedera’s total value locked in has risen by 95% since January 1, and by 215% since the middle of August, when SaucerSwap (its biggest decentralized exchange) launched. While it does remain at a fairly modest $45.71 million (compared to $126 million for Cardano and $30 billion for Ethereum), it has risen more faster than the TVL of many other chains (e.g. Avalanche’s grew by 31.5% and Solana’s by 32% since January 1).

Much of this has to do with the steady launch of new applications, with DEXes in particular serving to attract new users. For example, aside from SaucerSwap’s launch in August, Hedera has also welcomed the launch of Tangent Finance in July, HeliSwap in September, and Pangolin Exchange in February. Some of these apps are growing quickly, with Pangolin already marking $8 million locked in, despite going live on February 8.

Source: Twitter

Needless to say, with HBAR being Hedera’s native token, the launch of new apps means growing demand for the token, which helps explain its steadily rising price over time.

Speed, Scalability… and Centralization

And there’s a reason why apps, users and even major corporations are choosing Hedera over other potential platforms: scalability. Hedera is significantly more scalable than many of its rivals, and the main reason for this is that it doesn’t use a blockchain, but rather a hashgraph.

As summarized in its whitepaper, Hedera’s “hashgraph consensus algorithm provides near-perfect efficiency in bandwidth usage and consequently can process hundreds of thousands of transactions per second in a single shard.” Basically, the key difference between a blockchain and Hedera’s hashgraph is that the latter doesn’t discard valid blocks that are created at or around the same time as the one block that ends up being added to the chain.

Source: Twitter

More simply, Hedera’s different approach to achieving consensus enables it to process many more transactions per second than many other blockchains, and at a fraction of the cost. This is why apps that have recently launched on Hedera have been quick in gaining traction, with SaucerSwap boasting a confirmation time of only eight seconds, for instance (in contrast to the Ethereum-based Uniswap, which requires around 27 seconds).

However, such speed comes at a cost, and for some Hedera remains a centralized platform. In fact, such accusations have followed the platform around since its launch in 2019, and there are a number of basic reasons for this.

Firstly, Hedera has only 28 nodes, with these nodes being the members of its governing council. Secondly, Hedera has almost made the novel commitment of never allowing itself to undergo a divisive hard fork, with its whitepaper declaring, “Hedera technical and legal controls ensure the platform will not fork into a competing platform and cryptocurrency.” This may likely attract more enterprises to use it, but it implies a degree of closedness to difference and, arguably, to innovation.

Still, such misgivings aren’t stopping Hedera from having a very good 2023. And with its extremely low energy consumption coming at a time when interest in ESG investing is only growing, it may end up being one of the fastest-growing platforms (and coins) of 2023, if not beyond.