- >News

- >Why Flash Crashes Won’t Derail 2020’s Bitcoin Price Rally

Why Flash Crashes Won’t Derail 2020’s Bitcoin Price Rally

Bitcoin suffered a flash crash last week, as the biggest cryptocurrency by market cap fell nearly $1,000 in less than an hour. After a period of surprisingly low volatility, the sudden crash — which had been preceded by a strong rally to $12,000 — seemed to confirm that its turbulence was back with a vengeance.

But as the name suggests, this latest flash crash is just another blip on bitcoin’s road to record highs. Contrary to anyone who would take it as more evidence of ‘manipulation’ or an irrational market, it was the fairly predictable result of how bitcoin is traded by legitimate investors.

Automatic liquidations were the major cause of the crash, as long positions were wound up after a whale most likely took profit from the rise to $12,000. The bitcoin price has since recovered, indicating that the dip was a temporary deviation from a longer term upwards trend.

Still, investors should be prepared for further flash crashes along the road, particularly as traders use a combination of leverage and algorithmic trading to go long on bitcoin. Such crashes won’t be a malfunction, but rather a normal part of the bitcoin market, as well as a chance to buy bitcoin at a relative discount.

Flash Crash = Shaking Out Of Leveraged Traders

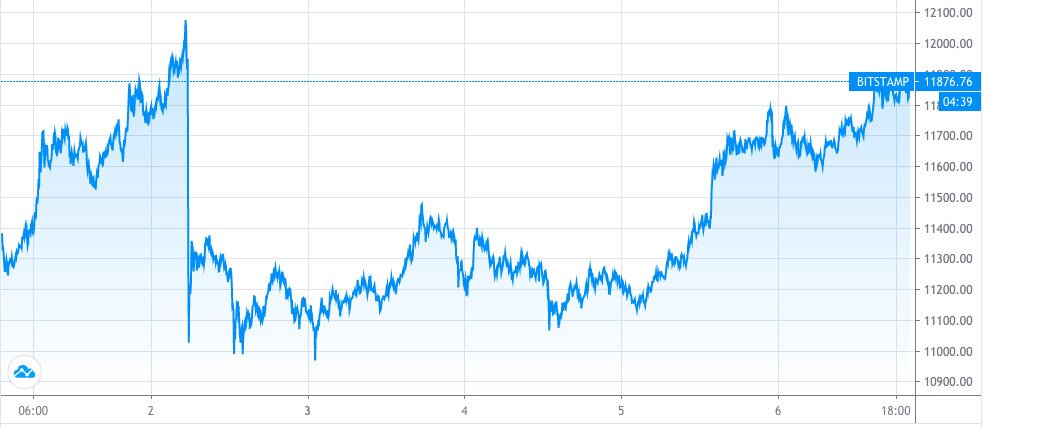

Preliminary reports of last Sunday’s flash crash suggested that the bitcoin price had dropped by as much as $1,500 in several minutes, at least on certain exchanges (such as Bitstamp).

Data from CoinMarketCap and CoinGecko suggests that the overall dip wasn’t quite as bad as that. Both aggregator sites indicate that the price of bitcoin fell from roughly $11,950 at 4:06am (UTC) to $11,190 by 5:09am. TradingView’s chart for Bitstamp bitcoin prices show a drop from just under $12,100 at 4:10am to about $11,000 at 4:35am.

Source: TradingView

Regardless of the exact size of the drop, the flash crash was still significant. So significant that figures within the crypto industry, such as StormX CEO Simon Yu, were fearing another wave of negative articles and comments about bitcoin’s volatility.

Source: Twitter

However, Bitcoin flash crashes are nothing new. They’re also nothing unusual, unpredictable, or unpleasant.

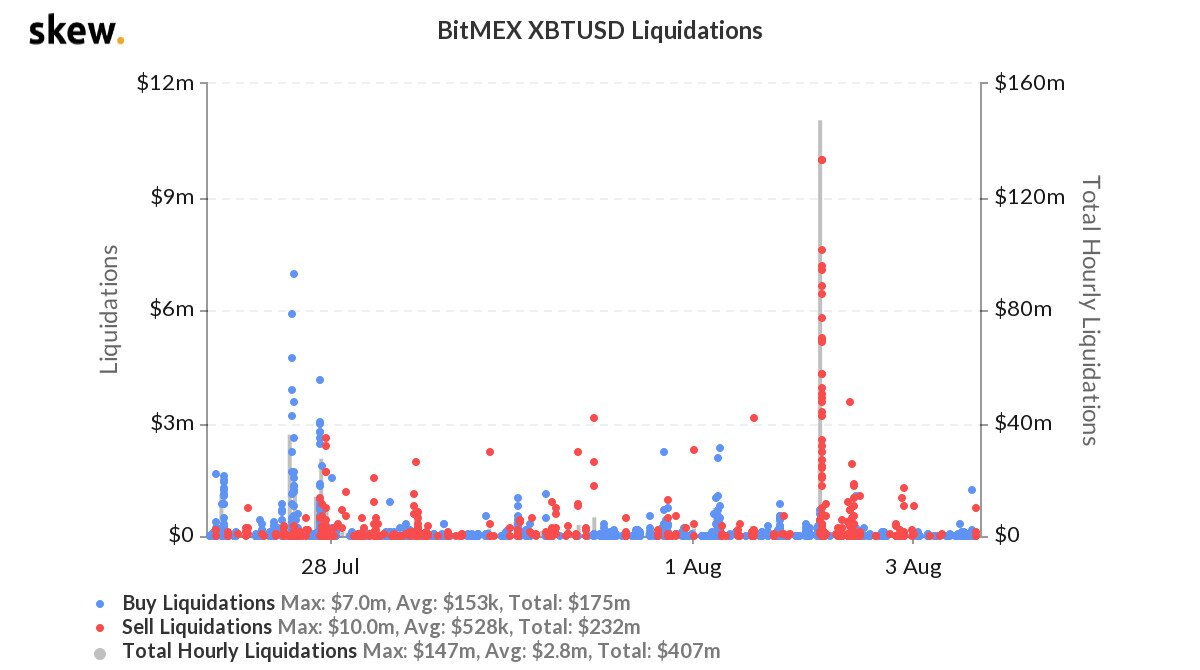

As with previous crashes, the main cause of the sudden drop was the simultaneous liquidation of millions of dollars’ worth of long positions. According to data collected by London-based analyst company Skew, hourly liquidations peaked at just over $147 million on BitMEX.

Source: Skew

What this means is that millions of dollars’ worth of long positions were closed after the bitcoin price dipped below a pre-selected level. Traders holding these positions effectively sold the equivalent amount of bitcoin at the same time, causing the price to plummet within a matter of minutes. They had no choice in the matter, since the sales were triggered automatically.

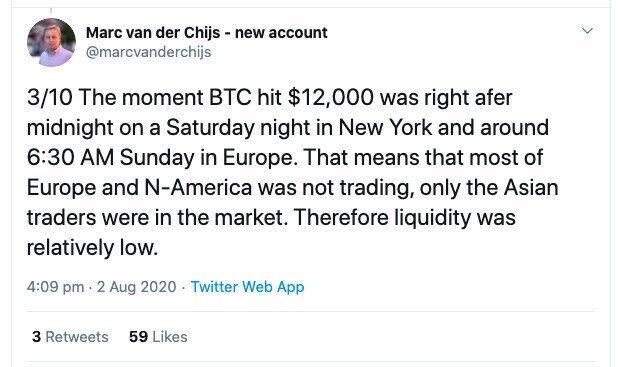

As suggested by Hut 8 Mining founder Marc van der Chijs, a whale set off this process by causing the initial price dip that precipitated a massive cascade of liquidations.

Source: Twitter

The flash crash involved liquidations for leveraged positions (i.e. for traders who borrowed to buy bitcoin). We could therefore view the crash as a process of weeding out traders who artificially inflate the bitcoin price (via borrowing), leaving the market with a higher proportion of traders who buy bitcoin with money they actually own.

Fortunately, the bitcoin price quickly recovered, and is flirting with $12,000 once again (as of writing). This suggests that the momentum that pushed the price up to $12,000 in the first place has been maintained, driven by economic weakness in the US, US-China tensions, and a flight to stores of value such as gold.

Prepare For More Flash Crashes, And Don’t Be Scared

The growing attractiveness of bitcoin is something investors should bear in mind for the near future. Flash crashes will inevitably happen again in the short and medium term, especially for as long exchanges like BitMex offer margin trading at up to 100x leverage.

Traders should remember that they’re an almost inevitable aspect of the bitcoin market, given its relative immaturity and lack of liquidity. This relative illiquidity is made worse by the fact that the market is 24/7, meaning that trades are being made in shallower markets while deeper markets (e.g. the United States) sleep.

Source: Twitter

The bitcoin market is also increasingly algorithmic. Basically, traders use or program algorithms to automatically make trades for them, given certain conditions. Exchanges such as BitMex offer application programming interfaces (APIs) which support algo-traders, while there are also services, such as AlgoTrader, which offer automated trading services.

Algorithms permit the kind of high-frequency trading which increases the probability of flash crashes. They’re very popular right now, particularly among bigger traders, so other traders should expect more flash crashes to happen.

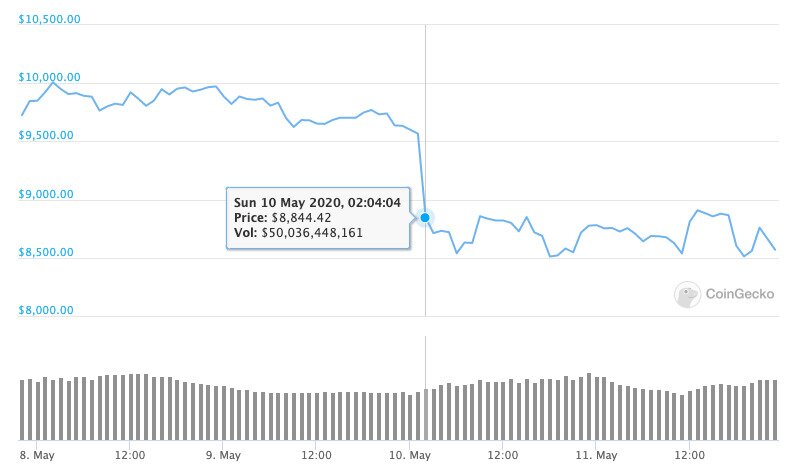

The bitcoin market does seem to be witnessing a higher number of flash crashes at the moment. There was a $751 flash crash in early June, which again seemed to be driven largely by automatic liquidations. There was also a flash crash on May 10, when the price of bitcoin fell by over $1,000.

Source: CoinGecko

This pattern will continue for the foreseeable future. The point is, previous flash crashes in recent months have taken place amid a more general long-term increase in bitcoin’s price.

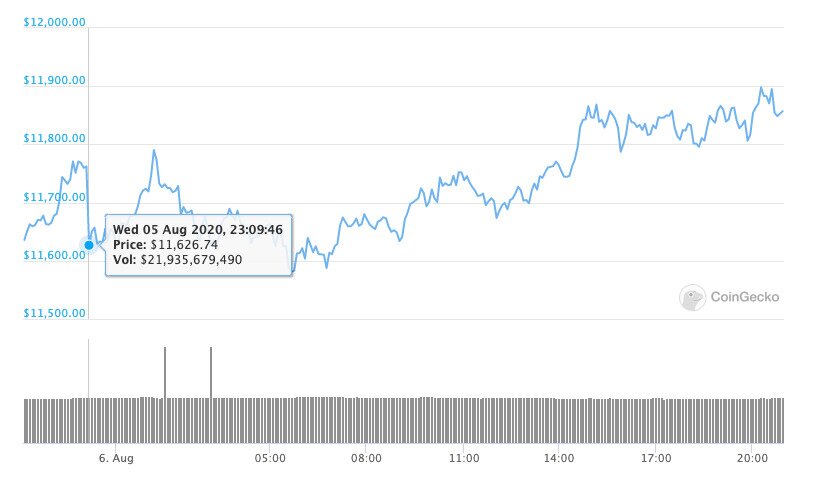

Last Sunday’s flash crash won’t derail bitcoin’s ascent to new yearly highs, and neither will subsequent flash crashes. Over the past few days we’ve even seen at least one mini-flash crash (on August 5), but this didn’t upend the general trend towards a higher price.

Source: CoinGecko

Flash crashes are as much of an opportunity as anything else. They’re how the market shakes out leverage traders. As such, they provide other investors with the opportunity to buy bitcoin at sub-market prices as it rises to its next price level.