- >News

- >Which ‘Ethereum Killers’ Can Succeed Now That the Merge is Complete?

Which ‘Ethereum Killers’ Can Succeed Now That the Merge is Complete?

The Merge is here, and rarely has hype for Ethereum — and what it can achieve — been so pronounced. Its supporters have already begun predicting it will soon ‘flippen’ Bitcoin, while even much of the mainstream media has started reporting on the Merge with something approaching semi-approval, implying that a shift in attitude to crypto may be taking place. Yet in the midst of all the excitement, it’s easy to forget that other layer-one utility blockchains also exist, and that many of these are already proof-of-stake.

Yes, the Merge may be a big event for Ethereum, but proof-of-stake consensus isn’t really new in crypto, with the very first PoS platform — Peercoin — launching way back in 2012. At the same time, the Merge won’t make Ethereum more scalable and cheap overnight (although it will reduce its energy consumption by 99%), meaning that other layer-one blockchains may still have an advantage over it for a while yet.

This article takes a look at the five biggest of these. It outlines their main features and strengths, while also running through their latest developments. Of course, with Ethereum still easily the biggest layer-one blockchain in terms of value locked in even before it switched to PoS, they have their work cut out if they ever hope to catch up with it.

Cardano (ADA)

Launched in 2017, Cardano is one of the oldest layer-one rivals to Ethereum, and was founded by Ethereum co-founder Charles Hoskinson. It’s already a proof-of-stake blockchain, having been developed with the Ouroboros PoS consensus protocol, which was designed by a team of researchers led by Professor Aggelos Kiayias of the University of Edinburgh.

In terms of its research and development credentials, Cardano is arguably the most interesting of Ethereum’s peers. However, it has evolved relatively slowly, having only just introduced smart contract capabilities last year. Likewise, it currently accounts for $84.43 million in total value locked, in contrast to $32.8 billion for Ethereum and $5.54 billion for Tron (about which more below).

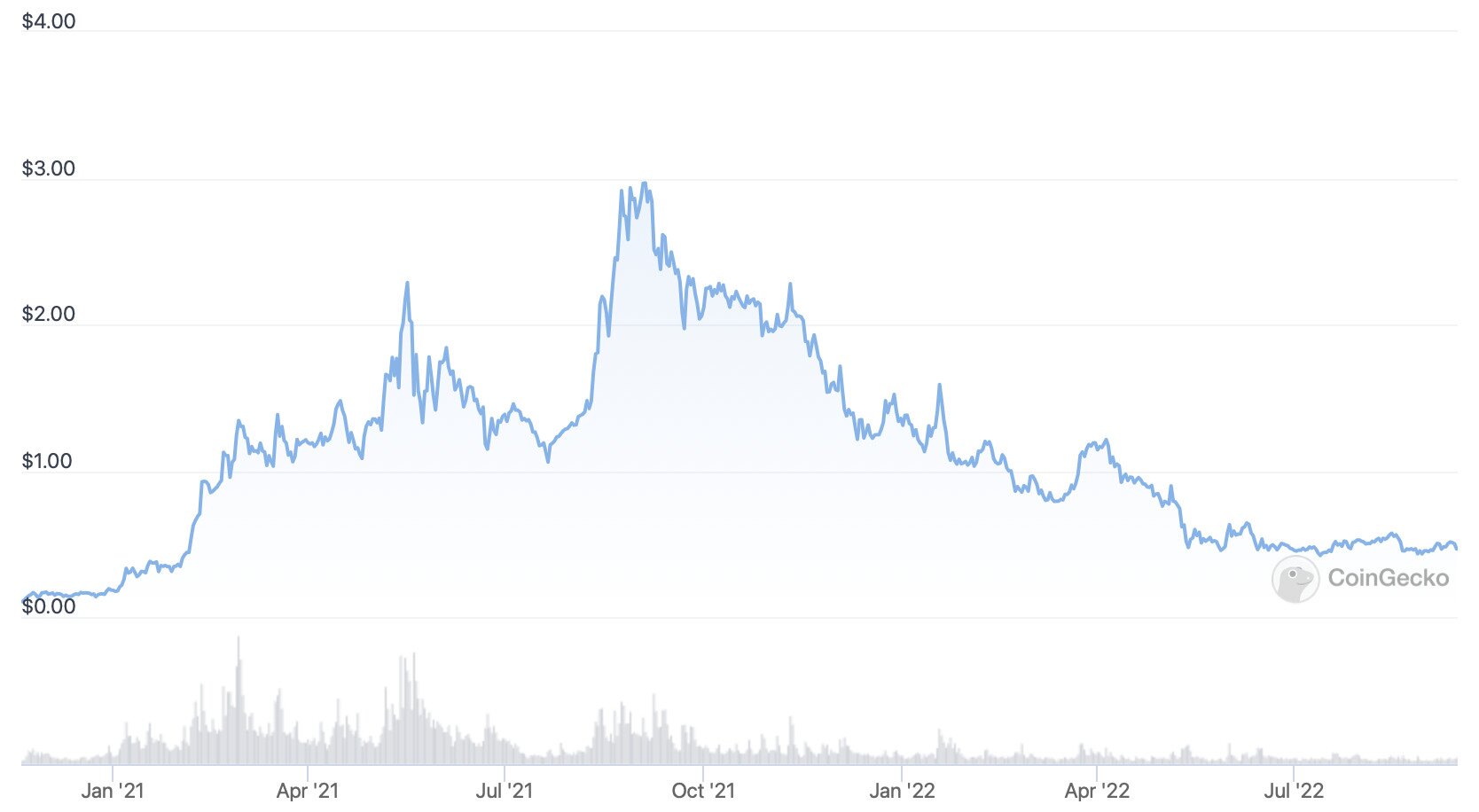

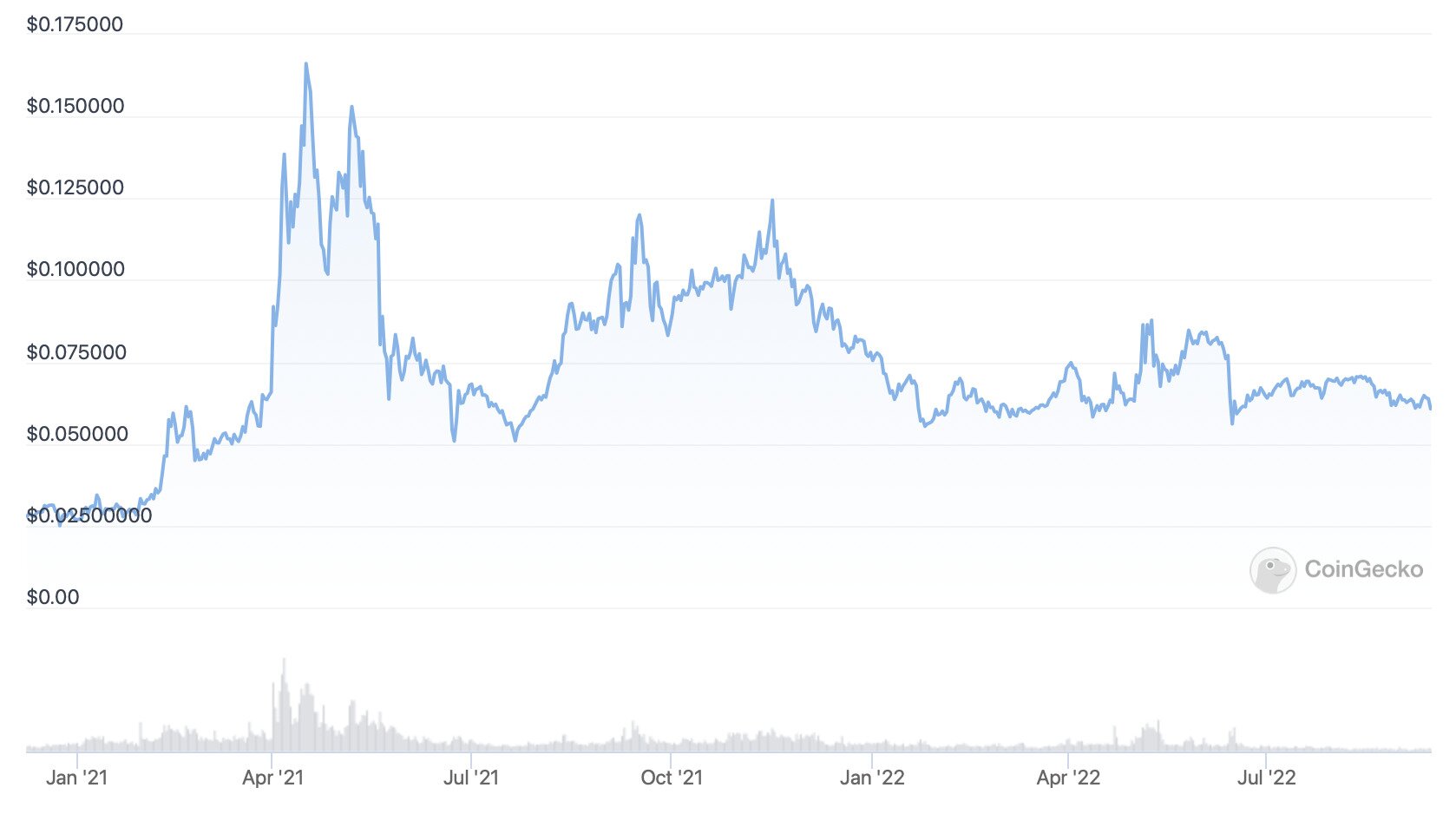

ADA’s price history since the end of 2020. Source: CoinGecko

Nonetheless, its native token ADA remains a top-10 cryptocurrency, with a market cap of $16 billion. At the same time, it is witnessing considerable development, with over 1,000 projects building on its network, 94 launched, and 50 million transactions processed to date. This is a strong foundation for future growth.

Solana (SOL)

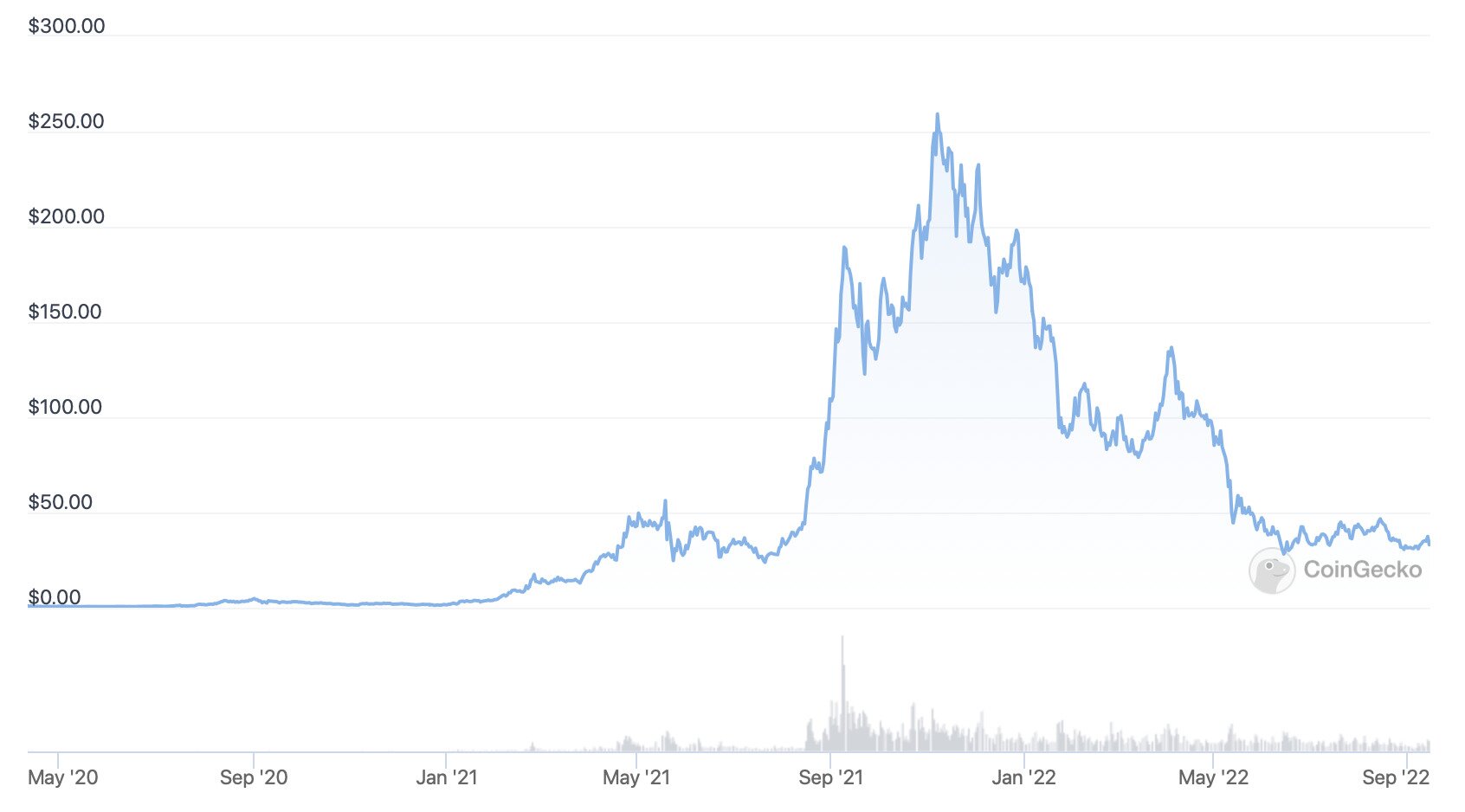

Launched in 2020, Solana is another layer-one blockchain platform, using a mix of a proof-of-stake consensus mechanism and a more novel proof-of-history protocol (which verifies the order of events). It had a very big 2021, with its native token SOL rising from $1.52 at the start of that year to $259.96 by November.

Solana’s rise was helped by its scalability, with developers claiming it can reach 50,000 transactions per second (in contrast to around 15 for Ethereum). It saw its total value locked rise to just over $10 billion in November 2021, on the back of apps building on its network rather than Ethereum’s.

Source: CoinGecko

However, the end of 2021 and the start of 2022 witnessed Solana falling victim to a number of unfortunate outages, all of which seriously dented its reputation as a reliable blockchain. This hurt the price of SOL and its development, although in recent months a number of much-needed upgrades have been brought in to improve its reliability, while it’s looking forward to a couple of significant integrations with other platforms.

Polkadot (DOT)

Polkadot is another blockchain founded by a co-founder of Ethereum, in this case British developer Gavin Wood. It contrasts quite distinctly from other layer-one chains, in that it’s composed of a central ‘relay’ chain (Polkadot itself) and a number of connected parachains, which are basically sidechains rendered interoperable with the relay chain by Polkadot’s protocol. This architecture is intended to make Polkadot indefinitely extensible and scalable.

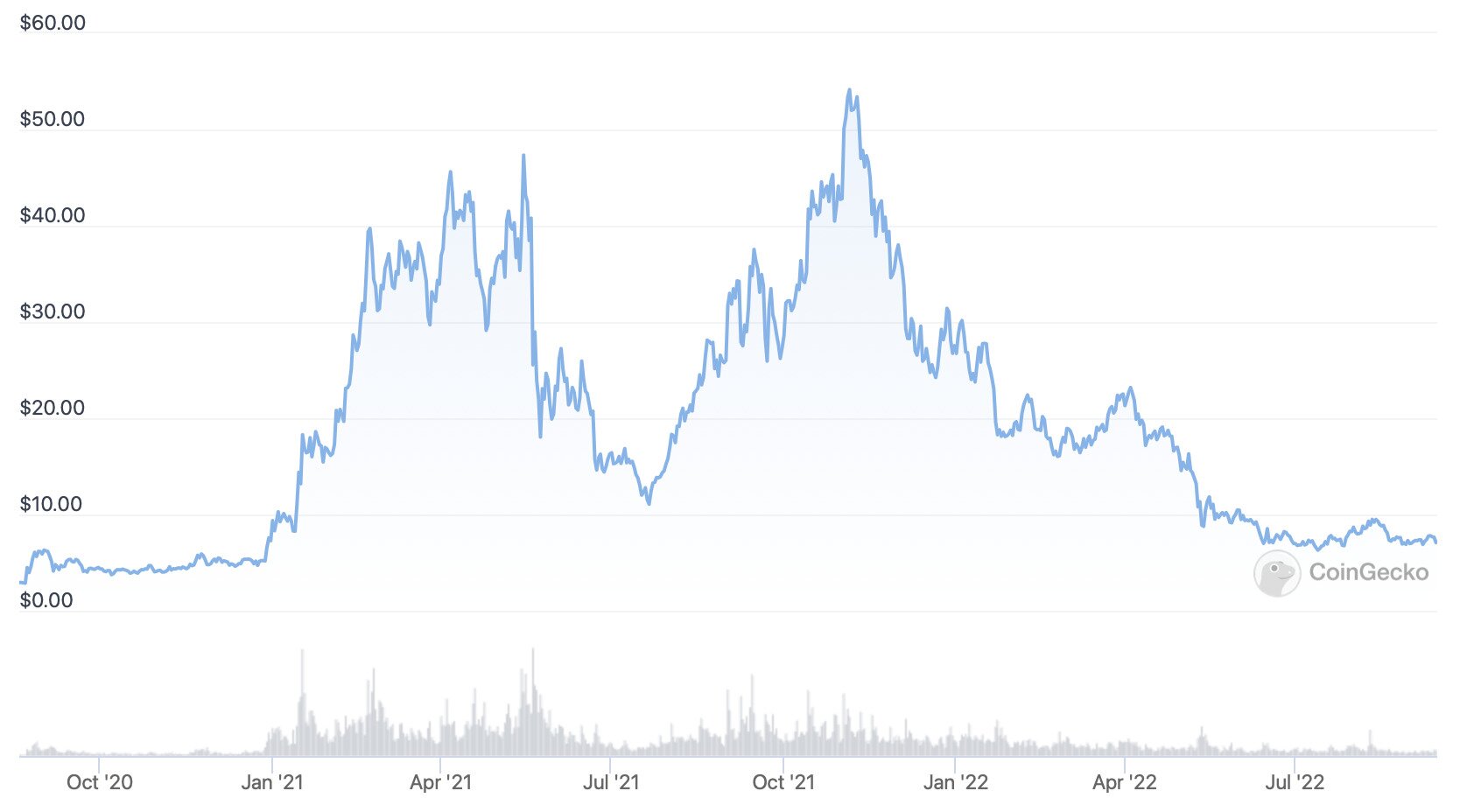

Its mainnet went live in May 2020, while in late 2021 it began auctions to decide which platforms will occupy parachain slots. So far, it has conducted 26 of these auctions, with enterprise blockchain platform Aventus being the latest winner.

Source: CoinGecko

Since it began these auctions and accepting apps and platforms to its network, Polkadot’s total value locked in has risen considerably over the past year, from nothing to just over $192 million. This is a modest number in absolute terms, but it suggests that Polkadot is already gaining mass quite quickly.

Avalanche (AVAX)

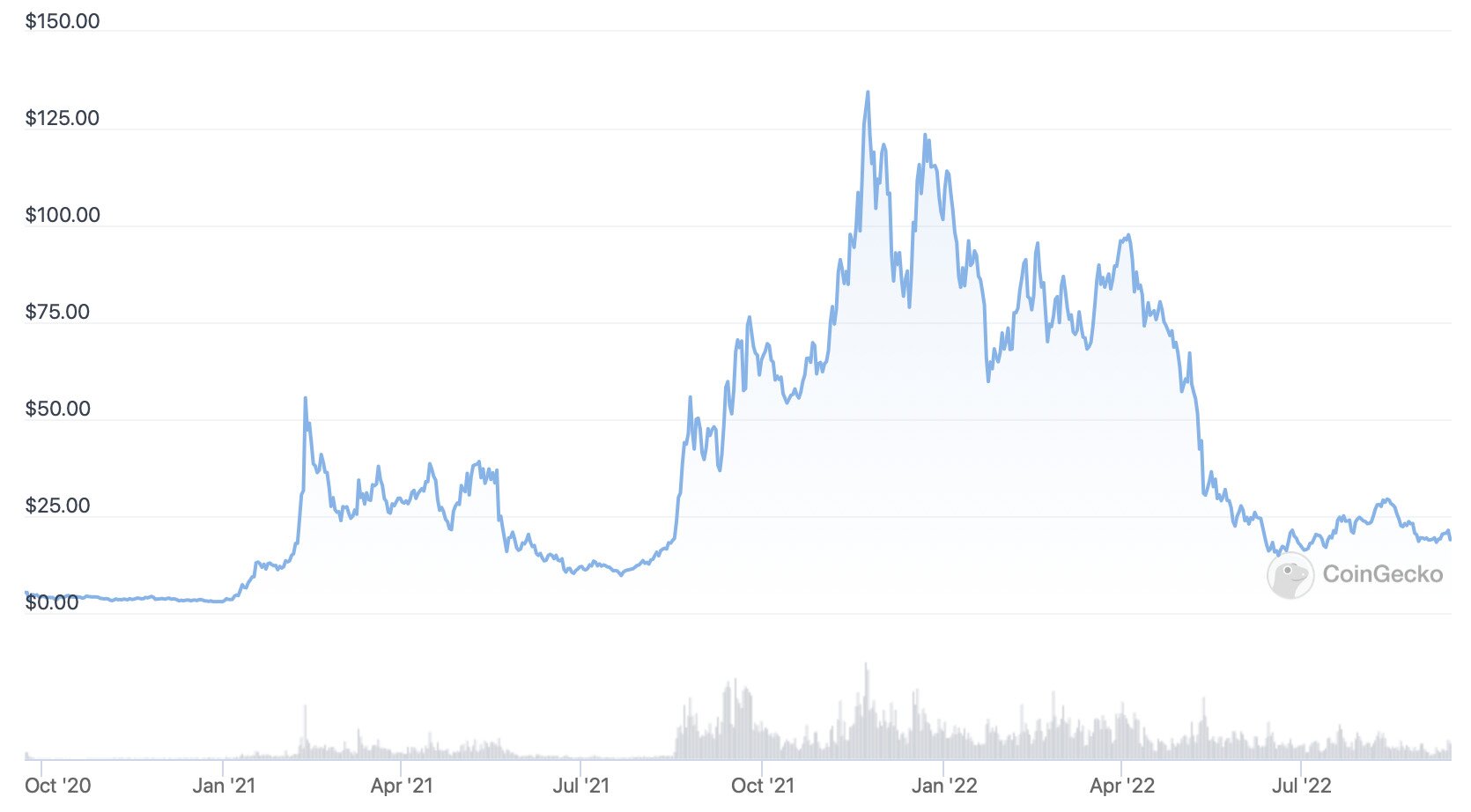

Founded in 2020 by Cornell University’s Emin Gün Sirer (and several co-founders), Avalanche is a proof-of-stake blockchain that can process over 5,000 transactions per second. Notably, it attracted considerable venture capital funding in September 2021 ($230 million), and then again in April of this year ($350 million), underlining its potential and the quality of its team.

As with Solana, Avalanche grew partly on the back of Ethereum’s issues with high transaction fees, with its total value locked in surging to just over $12 billion in December of last year.

Source: CoinGecko

Its growth has cooled off during the current downturn, although it has celebrated some interesting launches and partnerships in recent weeks, including a deal with KKR — one of the biggest investment management firms in the US — to tokenize some of its funds. This sets it up nicely for further growth in improved macroeconomic conditions.

Tron (TRX)

Launched in 2018, Tron is a proof-of-stake blockchain network that can support smart contracts and facilitate around 2,000 transactions per second. Despite founder Justin Sun being subject to considerable criticism from much of the wider cryptocurrency community, it has grown into the third-biggest layer-one network in terms of total value locked, with its figure standing at $5.55 billion.

This growth has come off the back of low fees and comparatively high throughput, with a number of applications moving to Tron rather than in Ethereum in recent months. Of note is the fact that there is now more Tether (USDT) running on Tron than on Ethereum, with USDT users preferring to avoid higher fees when transferring sums.

TRX’s price history since late 2020. Source: CoinGecko

One recent development is that Tron launched USDD, its very own algorithmic stablecoin, in the wake of the Terra collapse in May. This stablecoin also briefly lost its peg with the US dollar in mid-June, but not to the extent that Terra’s UST did, while it has since regained parity.