- >News

- >What’s With the Sky-High Bitcoin and Ethereum Transaction Fees Right Now?

What’s With the Sky-High Bitcoin and Ethereum Transaction Fees Right Now?

If you’ve tried to send funds using the Bitcoin network in the past week or so, you may have noticed that transaction fees are pretty high right now. From an average of about $2 on April 26, they’ve since rocketed up to $31. This is their highest level since April 2021, with their rise meaning that some Bitcoin blocks are occasionally paying miners more in fees than they are in block rewards (which are currently set at 6.25 BTC).

The primary cause of this surge is the ongoing trend for Ordinals, non-fungible tokens that run on the Bitcoin blockchain. These have caused a rush in demand for block space, yet Bitcoin isn’t the only network experiencing high demand right now. Joining it is Ethereum, which has seen its average fees climb as high as $27 in recent days, mostly as a result of XEN, a new ERC-20 cryptocurrency that lets its users mint its $XEN token for free (not including Ethereum transaction fees).

The emergence of Ordinals and XEN testifies to the interest that can be generated by new and innovative platforms, with both quickly attracting strong followings. Yet at the same time, they also bear witness to the bottleneck widespread blockchain adoption continues to encounter, with high usage resulting in negative feedback that makes even higher usage less likely. Fortunately, both Bitcoin and Ethereum are working on upgrades that will make them more scalable in the future, without the discouragingly high transaction fees.

Ordinals Send Bitcoin Transaction Fees Surging

There’s something almost funny about Ordinals causing Bitcoin to have exorbitantly high transaction fees, given that Bitcoin maximalists like to pride themselves on being above the whole mania for NFTs and the more faddish elements of the cryptocurrency space. Still, NFTs on Bitcoin is now a fact, and it’s one that has resulted in a sudden upsurge in Bitcoin usage.

Not only have average transaction fees risen steeply since the end of April, but so too has the number of transactions Bitcoin is processing per day. These have gone from around 270,000 at the beginning of the year to somewhere around 600,000, with May 1 witnessing an all-time high of 682,000.

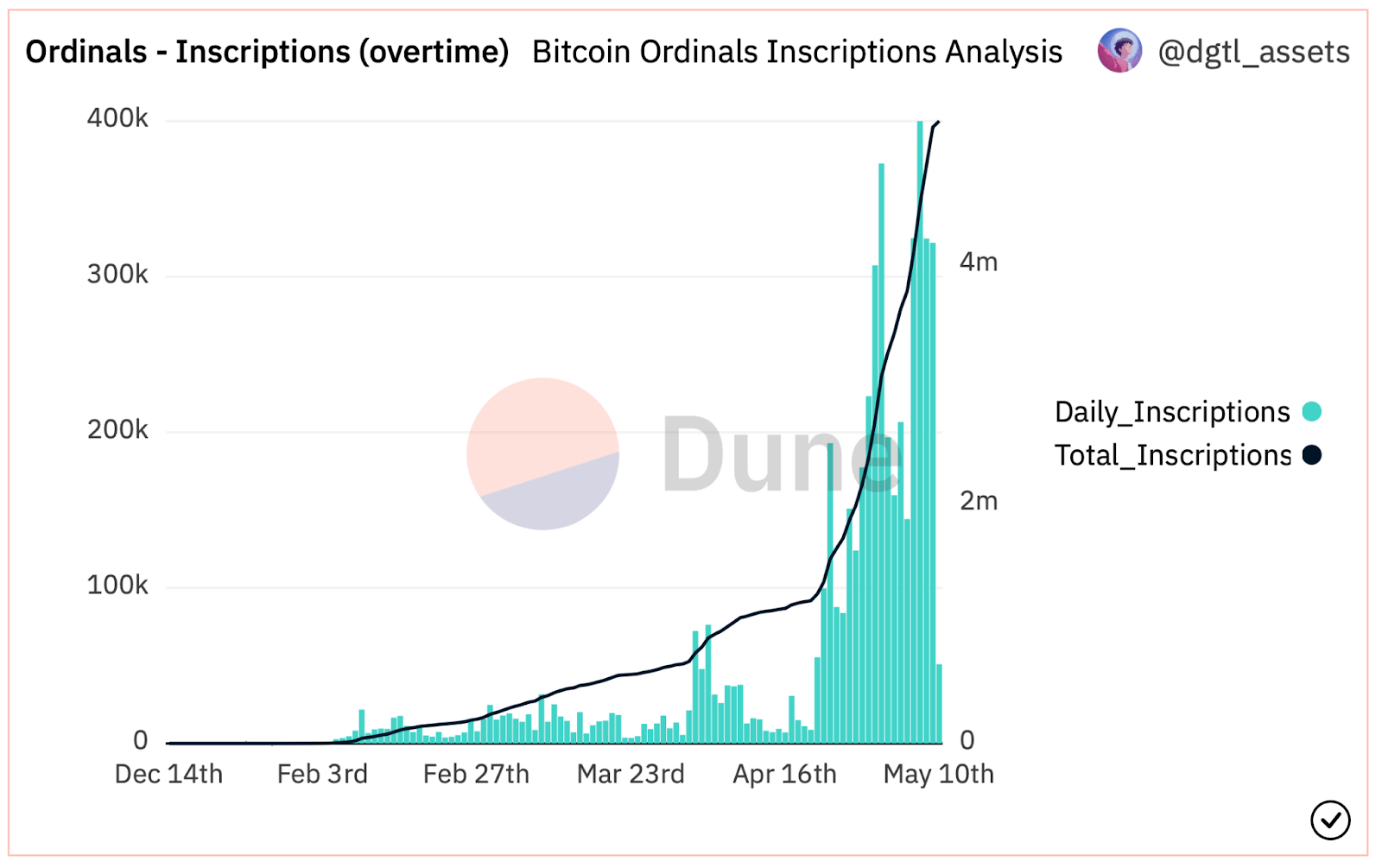

Enabled largely by the 2021 Taproot upgrade, Ordinals are media (e.g. images, text) that have been inscribed on the Bitcoin blockchain. To date, over 5.1 million such inscriptions have been made to date, highlighting just how popular Ordinals have become. In fact, four million of these have come in the past month, with over two million being made since the beginning of May.

Source: Dune

The popularity of Ordinals has been fed by major exchanges, with the likes of Binance and OKX recently enabling users to buy and sell such NFTs on their respective platforms. Indeed, Ordinals are already pretty big business, with Galaxy Digital publishing a report in March which estimates that its market will be worth around $4.5 billion by 2025. And according to Dune, Ordinals have generated roughly $30 million in Bitcoin transaction fees alone.

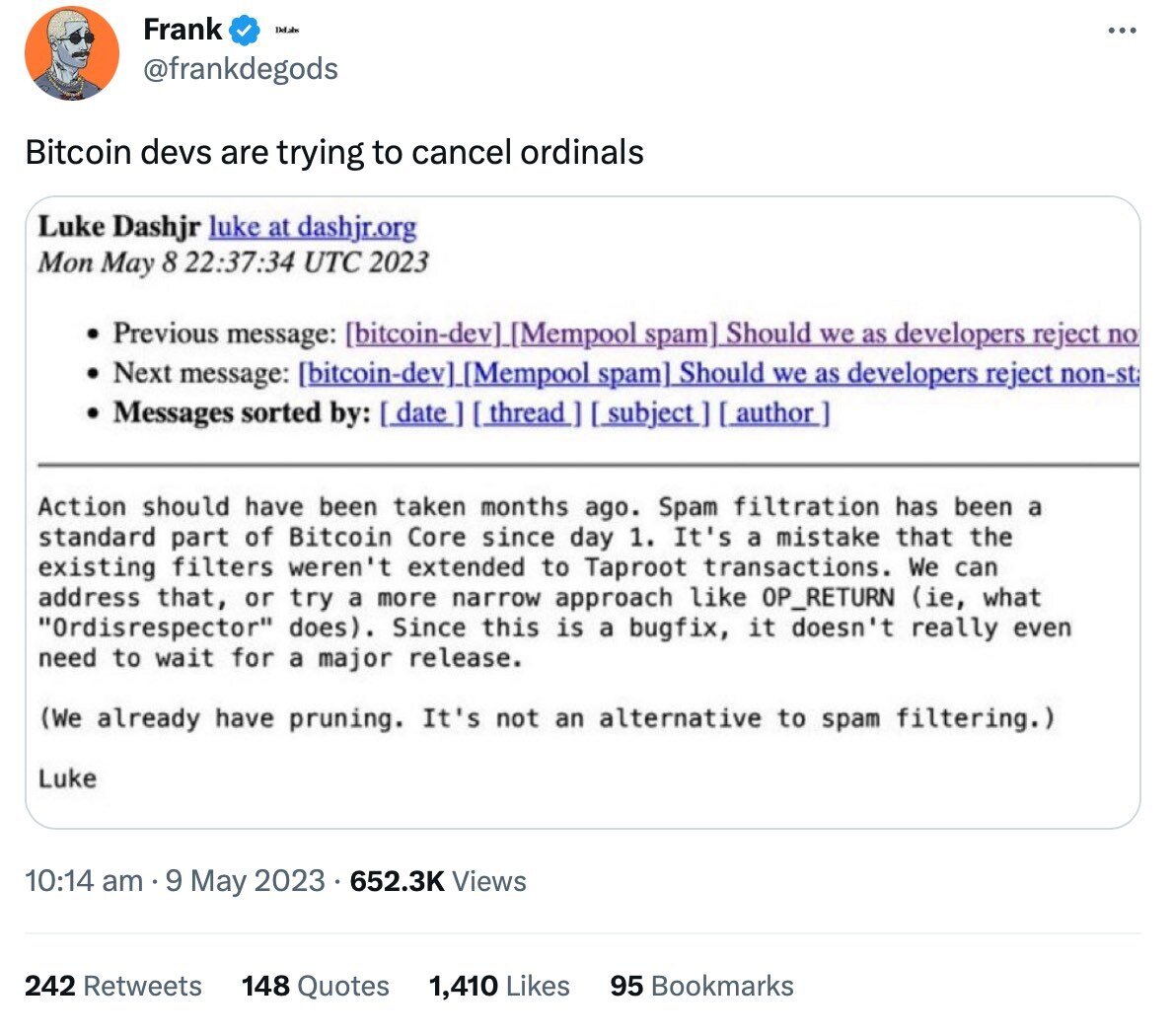

Of course, not everyone is happy about the emergence and rise of Ordinals, even if they show how Bitcoin can still be developed in interesting and surprising ways. Long-time Bitcoin developer Luke Dashjr has even gone so far as suggesting an update which would stop Ordinals entirely, while many Bitcoin maxis on Crypto Twitter have simply criticized the NFTs for redistributing BTC from “degenerate JPEG traders to stronger hands.” At the same time, various observers have noted that the number of unconfirmed transactions on the Bitcoin blockchain has increased substantially.

Source: Twitter

On the other hand, even diehard Bitcoiners have noted that, despite the questionable merits of NFTs, Ordinals are overall a good thing for Bitcoin. This includes MicroStrategy’s Michael Saylor, who has said in a recent interview that the NFTs are positive for adoption and for miners.

And speaking of miners, the fact that they’ve been collecting much more in fees in the past few weeks is arguably very good for the security of the Bitcoin blockchain. Some have long asked what will happen to Bitcoin when all BTC is mined and there’s no longer a block reward, with the implication being that the lack of a reward will disincentivize mining. Well, Ordinals and their popularity shows how the growing usage of Bitcoin could provide miners with more than enough fees to compensate.

Ethereum and XEN

Ethereum has been experiencing a similar spike in fees as a result of XEN, which launched in October and which aims to be a “universal cryptocurrency” for “the masses” (according to its litepaper). It attempts to do this by enabling any user to mint their own XEN tokens, without paying a fee to its protocol. Unsurprisingly, this generated a rush among users, who all wanted to mint XEN early so they could cash out for big gains at a later date.

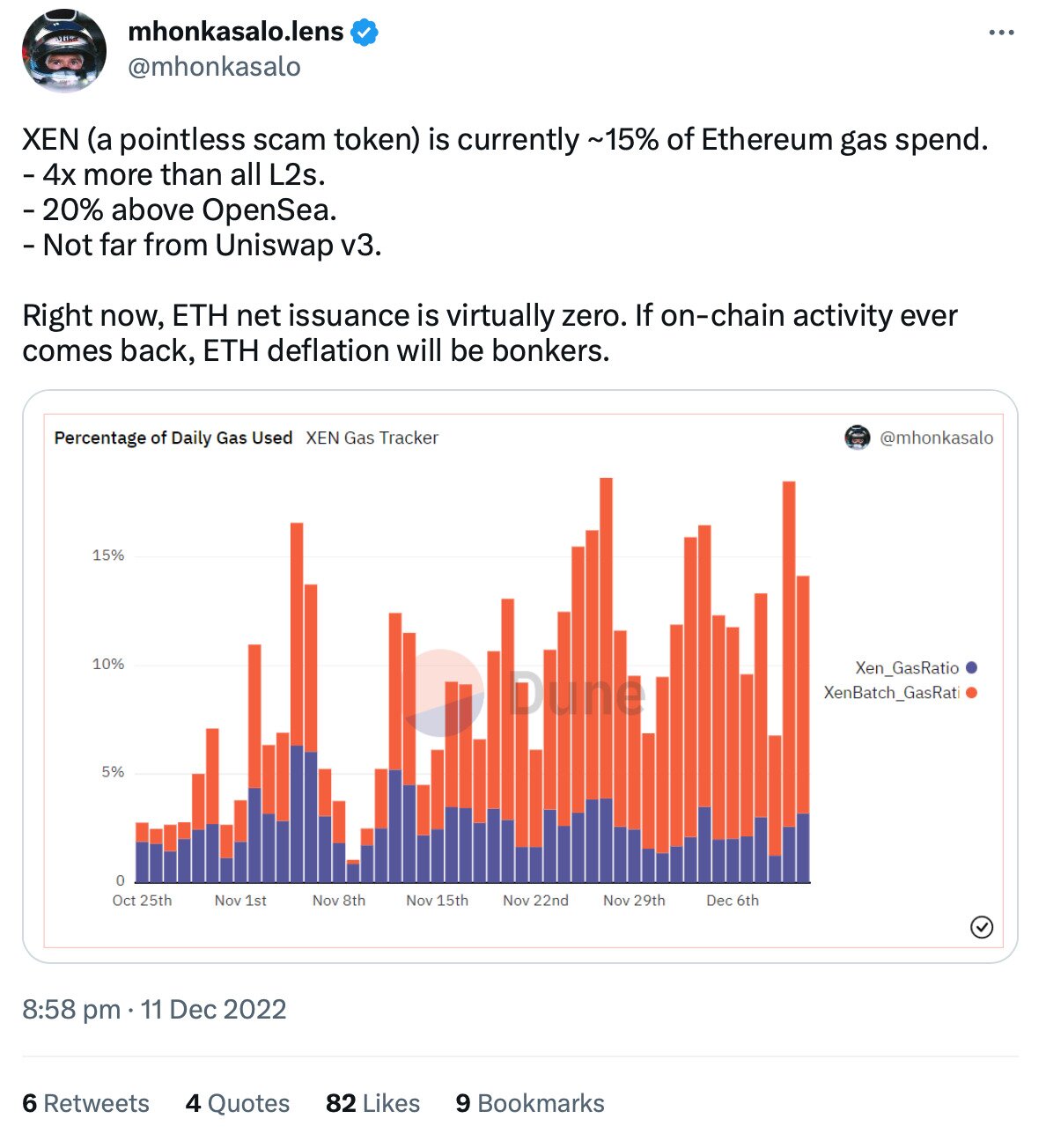

Source: Twitter

Because XEN runs on Ethereum, its growing popularity has made the latter’s blockchain more expensive to use. Readings in the past few months have shown it accounting for anything between 11% and 15% of all Ethereum fees paid, while its launch in October saw it account for 40% of all Gas.

Source: Twitter

As with Ordinals and Bitcoin, XEN has caused Ethereum transactions and fees to spike in recent weeks and months. However, XEN’s impact on Ethereum hasn’t been as big as Ordinals’ impact on Bitcoin, particularly in terms of transaction numbers, which have remained more or less stable for the past year. XEN is now also available on nine other networks, including BNB Chain, Polygon and Avalanche, meaning that its impact is also relatively spread out. On top of this, the fact that its price is down by 99% since October suggests that interest has waned a little in it, as does its very low trading volume.

Still, XEN’s appearance in the past few months highlights the need to continue work on developing Ethereum and improving its scalability. Yes, many may scoff at XEN and its questionable mint-it-yourself design, but if Ethereum wants to be a universal blockchain platform, its supporters have to make peace with the fact that it will be accommodating all kinds of apps. For this reason, ongoing updates to Ethereum-based layer-twos — including work on danksharding (which will enable “millions of transactions per second”) — remain very important.

Much the same goes for Bitcoin. While fundamental and radical changes to its core layer can’t be expected, the development of the Lightning Network brings the real possibility of cheaper and faster transactions for most users. And in this respect, it’s interesting to note that Binance is now working on using the Lightning Network for withdrawals, largely in response to the spike in fees caused by the Ordinals craze.

Which goes to show that, even if most Bitcoin maximalists don’t approve of Ordinals, the latter is already spurring more development, and helping to make Bitcoin more capable of handling wider adoption.