- >News

- >What’s Next for Ethereum Now That The Merge, Proof-of-Stake Are Complete?

What’s Next for Ethereum Now That The Merge, Proof-of-Stake Are Complete?

After years of waiting, Ethereum has finally completed its Merge. While the shift to proof-of-stake has enabled Ethereum to reduce its energy consumption by a massive 99%, it has failed to set the cryptocurrency market alight, with its total cap dropping by 8% since the Merge took place on September 15, and with ETH itself dropping by 18.1%.

For anyone hoping that the Merge would spark a renaissance of sorts for the cryptocurrency market and initiate a bull rally, such falls will likely come as a disappointment. However, the Merge is only the beginning of Ethereum’s march towards greater scalability and efficiency, with several upgrades due in the short- and long-term that will improve its functionality in various ways.

And once it does complete these upgrades, it’s likely that Ethereum will enjoy greater use and adoption, with demand for ETH increasing as a result. Of course, with the Federal Reserve still increasing interest rates, it still may be a few months before market conditions permit Ethereum to really grow.

Shanghai and Staked Ethereum Withdrawals

Now that the Merge is complete and Ethereum uses proof-of-stake consensus to verify its transactions, the next thing on its time is the Shanghai upgrade.

Shanghai will bring a number of improvements to Ethereum, with the most important from a trading/investing point of view being the ability to withdraw.

Source: Twitter

However, there is no hard timeframe for the implementation of Shanghai, with sources and commentators suggesting everything from six months to a year for the upgrade to come online.

Based on discussions on Github and elsewhere, things have really only just begun as far as Shanghai is concerned, with lead developers only just setting a framework for how the community would like to proceed on Shanghai-related work. As such, predictions for delivery are more or less guesswork, although one online resource — based on polling — has created a countdown that ends in just over 345 days, meaning around September 1, 2023.

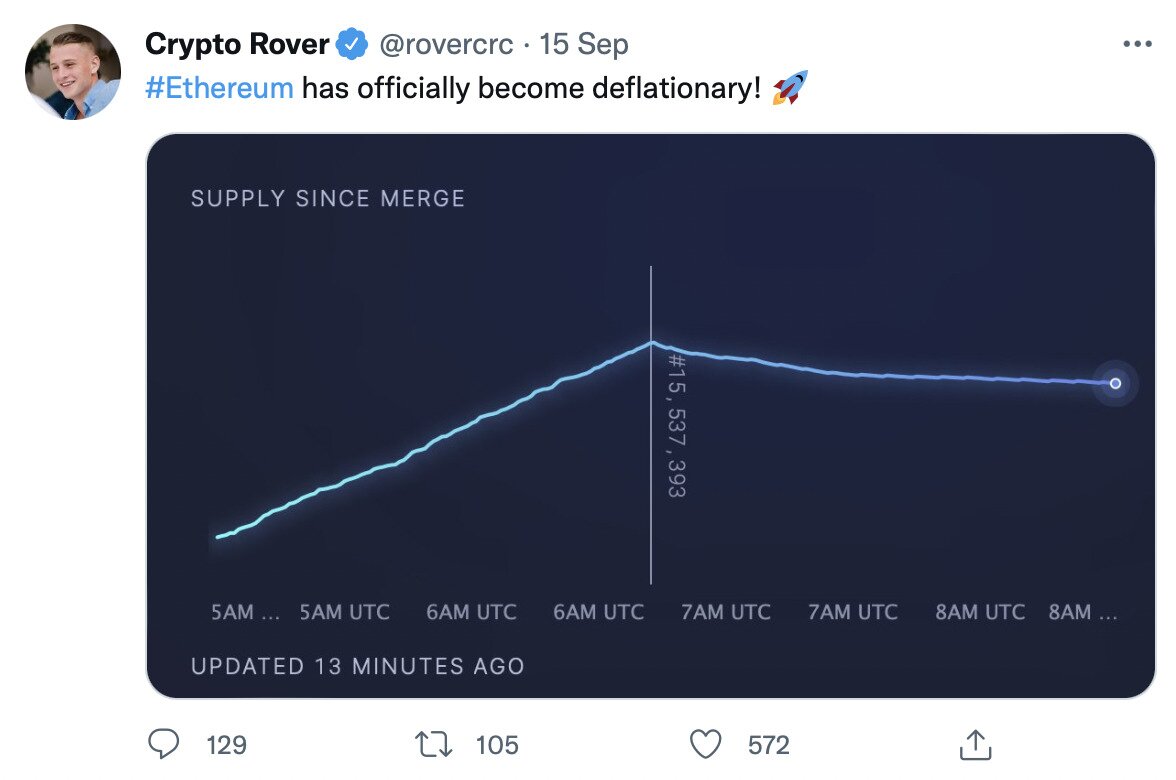

Source: Twitter

Plans were to allow withdrawals of 40,000 ETH per day once Shanghai is complete, but observers have noted that a specific Ethereum Improvement Proposal (EIP) with the code for withdrawals hasn’t even been written yet.

In other words, there’s an outside chance that Shanghai could ship without including the ability to withdraw staked ethereum. In this author’s view, this is unlikely, but it’s something that can’t categorically be ruled out at this stage.

This is potentially a big deal, since latest figures reveal that some 13.7 million ethereum has been staked in Ethereum’s new PoS consensus layer (i.e. the Beacon Chain). This is worth around $18.3 billion in terms of current prices, meaning a considerable amount of wealth is locked up right now.

And withdrawals really are vital to Ethereum’s future success as a PoS platform, since stakers and investors need to know that they’ll be able to get their funds back. Indeed, once withdrawals eventually go live, it’s likely that staking of ETH will increase considerably. In turn, this may increase the extent to which Ethereum is deflationary.

Source: Twitter

Sharding and Scalability

Looking at the bigger picture, the Merge lays the foundation for Ethereum to introduce sharding, a novel blockchain architecture through which the overall network is split into separate parallel parts. These parts would verify separate batches of transactions and blocks, so that every single node wouldn’t have to verify every single transaction.

Basically, sharding speeds up transactions by assigning specific blocks to specific shards. In turn, this will enable Ethereum to lower its notoriously high transaction fees, since capacity will be increased, meaning less competition for blockspace.

Source: Twitter

Originally, Ethereum planned to introduce 64 shards once the feature is introduced. This required at least 8.4 million ETH to be staked, yet because 13.7 million ETH has already been locked up, the network could potentially introduce more.

This would increase scalability further, while the fact that sharding makes it easier to run an Ethereum node (you could potentially use your normal laptop) also promises an additional boost.

However, the downside to all this is that it’s a pretty distant upgrade. The Ethereum Foundation’s official site is providing a timeframe of only 2023-24, implying that the market could be waiting for around two years. And given how long it waited for the Merge itself, the actual wait for sharding could be even longer than this.

Still, sharding would really be the upgrade that could cement Ethereum’s position as the dominant layer-one utility blockchain. It already accounts for around 57% of all total value locked in within the crypto ecosystem, and that’s even before the Merge — and its subsequent upgrades — has really even happened.

Centralization and Decentralization

As exciting as the future may be for Ethereum and its supporters/users right now, this future isn’t without its own particular issues and challenges. And while there are no specific plans to deal with the following challenges, they really should be dealt with soon if the Merge is really going to make good on its promise.

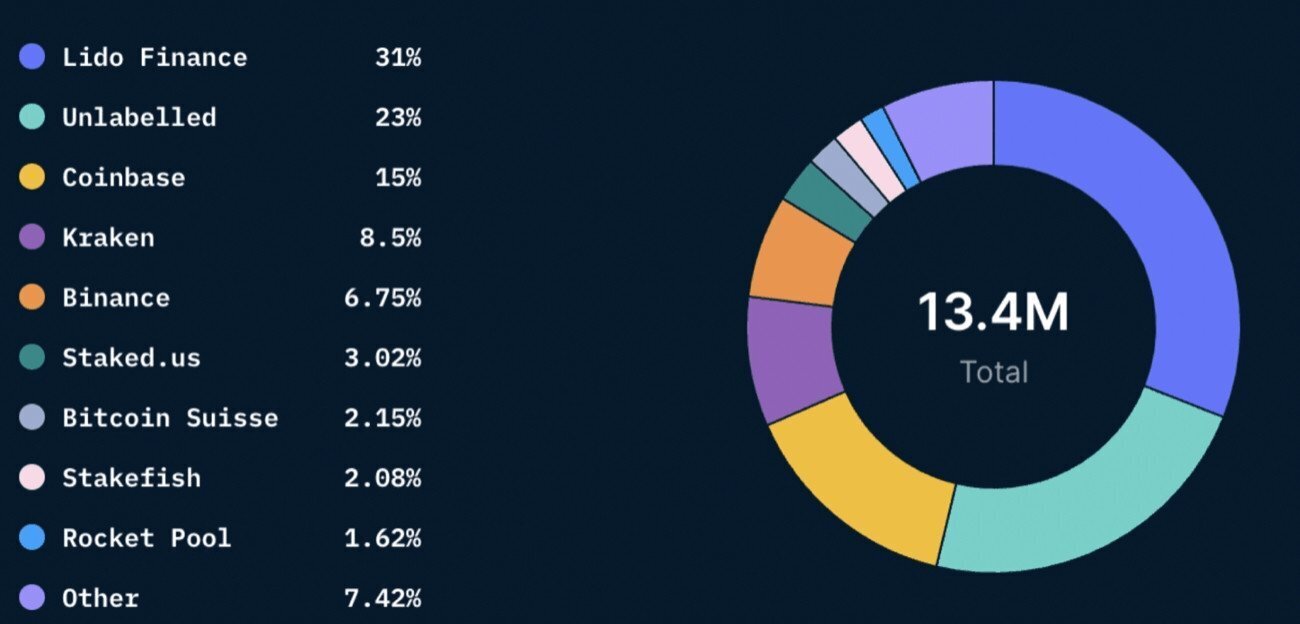

Firstly, centralization is already an issue when it comes to Ethereum staking. A recent report from Nansen revealed that 64% of all ETH staked in the platform’s Beacon Chain is controlled by only five entities, with Lido Finance alone accounting for 31% of all staked ETH. On top of this, Coinbase, Kraken and Binance — three of the biggest centralized exchanges in the world — control a combined total of 30%.

Source: Nansen

This is hardly a great development for a platform that’s ostensibly meant to be decentralized. Yet there’s a substantial body of opinion developing to the effect that staking breeds centralization, particularly in the form that Ethereum is now practicing it.

Commentators such as Udi Wertheimer have recently argued that staking can essentially be viewed as imposing a penalty for not staking, in that those who don’t stake ETH end up paying the fees that fund the yields received by stakers.

That plenty of ETH holders won’t be staking is currently made likelier by the fact that, to stake, you either have to own 32 ETH (c. $43,000) or pay the fees associated with staking pools. In its present form, this structure means that many aren’t going to stake ETH, freeing the way for the wealthy to accumulate even more wealth via staking.

Accordingly, one future update for ETH is to make it more accessible to stake, perhaps by reducing the 32 ETH requirement and the associated fees. Combined with sharding making it easier to run a node, this could potentially clear the way for even more participation in Ethereum, helping the latter to fulfill its early promise as a decentralized ‘universal computer.’