- >News

- >What is Aptos? And Why Has It Become Crypto’s Most Controversial Blockchain?

What is Aptos? And Why Has It Become Crypto’s Most Controversial Blockchain?

Move over Ethereum, there’s a new layer-one blockchain in town: Aptos. Yes, this may be an entirely uninspiring name, but the developers behind Aptos are already making some big claims for its network, not least that it can process over 100,000 transactions per second. When combined with the fact that Aptos basically represents the remnants of Facebook’s abandoned Libra/Diem project, it therefore becomes less than surprising that the new platform has attracted more than its fair share of attention.

It becomes even less surprising when you learn that Aptos actually launched its mainnet last week, and that rather than attaining more than 100,000 transactions per second, observers clocked it at a much less impressive 4 tps. Such a gap between expectation and reality has caused Aptos to become something of an in-joke in certain corners of the cryptocurrency community, yet its native token is now already the 45th-biggest by market cap, with listings on Binance, Coinbase, FTX and OKX.

This acceptance by the market’s biggest exchanges all-but forces bystanders to take Aptos seriously, and with venture capital backing worth $350 million, it could indeed end up becoming the ‘Solana killer’ that some in the media are already painting it as being.

What is Aptos?

Aptos is a blockchain start-up formed by ex-employees of Meta, Facebook’s parent company. Its co-founders, Mo Shaikh and Avery Ching, departed Meta as recently as December 2021, giving some indication of just how new the company is.

However, with their credentials — as well as their use of the ideas and technologies developed for Libra/Diem — they were quickly able to attract major funding. Namely, they closed a $200 million round in March of this year (led by a16z, Tiger Global, Katie Haun, Multicoin Capital, 3 Arrows Capital, FTX Ventures, and Coinbase Ventures), and then a $150 million round in July.

Such financial backing has enabled Aptos to speedily develop its network, which is defined by a “modular approach” to transaction processing, as its whitepaper puts it. In simpler terms, this means it can verify transactions in parallel, while also simultaneously executing other important blockchain functions, such as storage and ledger certification.

It’s because of its parallel execution capabilities that Aptos claims it can reach over 100,000 transactions per second. On top of this, it also offers smart contrat functionality, a variety of custodial options, and support for complex transactions, making it (in theory) an ideal platform for enterprise use cases. It’s also worth highlighting that it makes use of Libra/Diem’s Move programming language, something which enables the Aptos team to claim that its blockchain “has been developed over the past three years by over 350+ developers across the globe.”

Three years of development might imply that Aptos has had the chance to iron out any figurative creases and ensure its blockchain will work smoothly. However, the launch of its mainnet on October 17 appeared to contradict any such claims, with an engineer on Twitter quickly noting that it was averaging four transactions per second upon launch, with many of these not really being transactions, but rather “validators communicating and setting block checkpoints and writing metadata to the blockchain.”

Source: Twitter

At the same time, it didn’t seem like average users could actually interact with the Aptos blockchain. Even worse, its official Discord channel was disabled for several hours after launch, preventing actual and potential users from discussing problems.

To be fair, the following days did see Aptos’ transaction count increase, with chief engineer Josh Lind taking to Twitter to declare that it was averaging 27 tps, with some peaks of more than 70 tps. As of October 21, there had been roughly 2.5 million transactions, of which 55% were actual token transfers. Lind also reported that there were 570,000 daily active users.

Source: CoinGecko

Most such users were likely the customers of the exchanges that had listed Aptos’ native token, APT. Following its launch, APT reached an all-time high of $13.73 on October 19, yet on the very same day it dumped to its all-time low of $6.73. As of writing, it has recovered by 40%, reaching a price of $9.49.

Why Aptos is Controversial

Discussion of APT and its price leads nicely to why Aptos is attracting controversy. While its current failure to come anywhere near 100,000 tps may be bad enough, commentators have also pointed out that around 80% of APT’s total supply is staked, meaning that it’s predominantly held by its founders and early private investors.

Source: Aptos

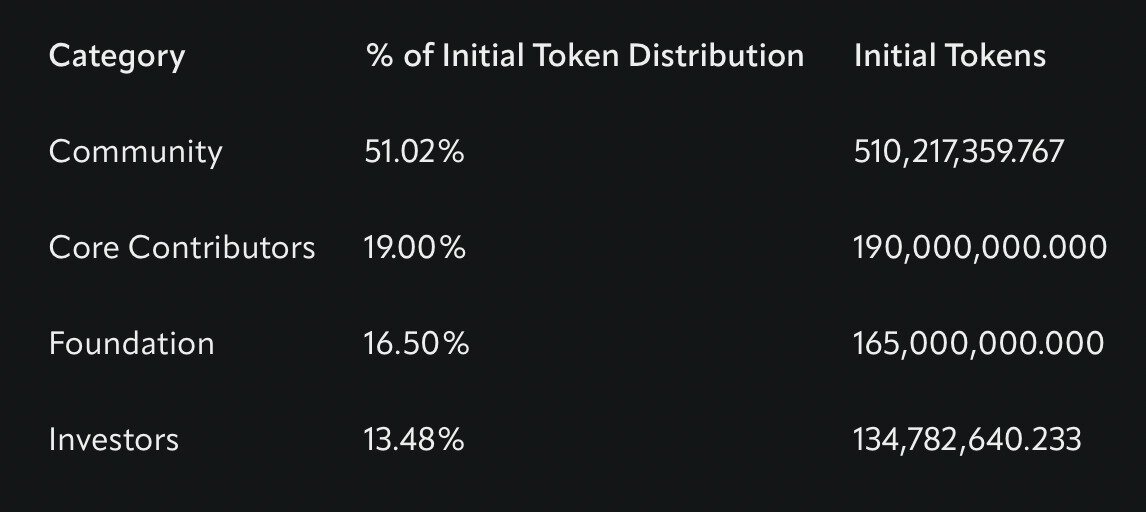

However, Aptos has actually offered a breakdown of its tokenomics, although critics will argue that it doesn’t really undermine their claims. According to Aptos, 19% of APT’s total supply will go to core contributors, 16.5% to the Aptos Foundation, 13.48% to investors, and 51% to its “community.”

What does “community” mean in this case? Well, Aptos explains that this refers to developers building on its platform, with teams being offered “grants, incentives, and other community growth initiatives.” This tranche of APT will apparently be released over a 10-year period.

While this takes some weight away from early investors and the core Aptos team, the distribution still means that insiders are receiving all of the available APT supply. This sets up retail investors for big falls in the future, as foreshadowed by the fact that the price of APT tumbled soon after its first exchange listings.

At the same time, there’s no getting away from how Aptos grew out of Facebook, possibly one of the most unpopular companies on the planet. It has also received big VC funding, something which arguably puts it at odds with the decentralized ethos of Bitcoin and so much of the cryptocurrency ecosystem as it exists today.

Indeed, many figures on Crypto Twitter are already describing the platform as centralized. Then again, with the likes of Binance and Coinbase being two of the biggest firms in crypto, centralization doesn’t necessarily mean a platform won’t succeed.

But with Ethereum (and other existing blockchains) already being proof-of-stake and arguably faring better in terms of decentralization, it’s clear that Aptos will have to do more than simply flaunt the resumes of its team (and it’s not the only ex-Facebook blockchain on the block, with Sui also under development). Launching its mainnet is already a step in the right direction, but with plenty of work to be done, it remains to be seen whether it can fully emerge from the long shadow of Facebook.