- >News

- >What Do All the Sudden Banking Failures Mean for Crypto?

What Do All the Sudden Banking Failures Mean for Crypto?

Just when it seemed as though the cryptocurrency market had begun its long-awaited recovery, it fell again last weekend, and hard. In fact, it fell so sharply that its total cap as a whole declined by 7% in a day and by 13.5% in a week, with bitcoin (BTC) falling as low as 16% in the seven days to Friday. The short-term trigger was the news that Silicon Valley Bank had collapsed, barely a few days after fellow crypto-friendly bank Silvergate had announced its voluntary liquidation. Yet SVB’s downfall is only one factor out of many that are undermining the market right now, with ongoing interest rate rises and the threats of stringent regulation also playing a significant role.

That Silvergate, Silicon Valley and now also a third bank — Signature — could collapse in such a short space of time indicates just how far the global economy is from a full and stable recovery. Indeed, with financial institutions suggesting last week that the Federal Reserve may actually ramp up its rate hikes this year, it’s clear that the cryptocurrency market is far from reaching the kind of solid economic foundation it would need for a new bull market.

And with the Biden administration outlining a 30% tax on cryptocurrency mining in its latest budget, the market may have to weather a few more months of last year’s crypto winter before it witnesses real recovery. That said, bitcoin (BTC) witnessed a big rally on Monday amid growing concerns about banking stocks, suggesting that a loss of faith in the financial system could actually end up helping crypto (or at least some cryptocurrencies) more than it hinders them.

Another Banking Crisis

The respective demises of Silicon Valley Bank and Signature Bank were a little different in nature from that of Silvergate Bank, in that both were actually closed by US regulators (placed into federal receivership). However, much like Silvergate, SVB suffered a run of withdrawals, forcing it to sell various assets it held at a substantial loss, while an attempt to raise money by selling additional stock failed (as did an attempt to put itself up for sale). Similarly, Signature Bank also suffered a big wave of customer withdrawals, with its run being fuelled by concerns arising from the earlier SVB and Silvergate failures.

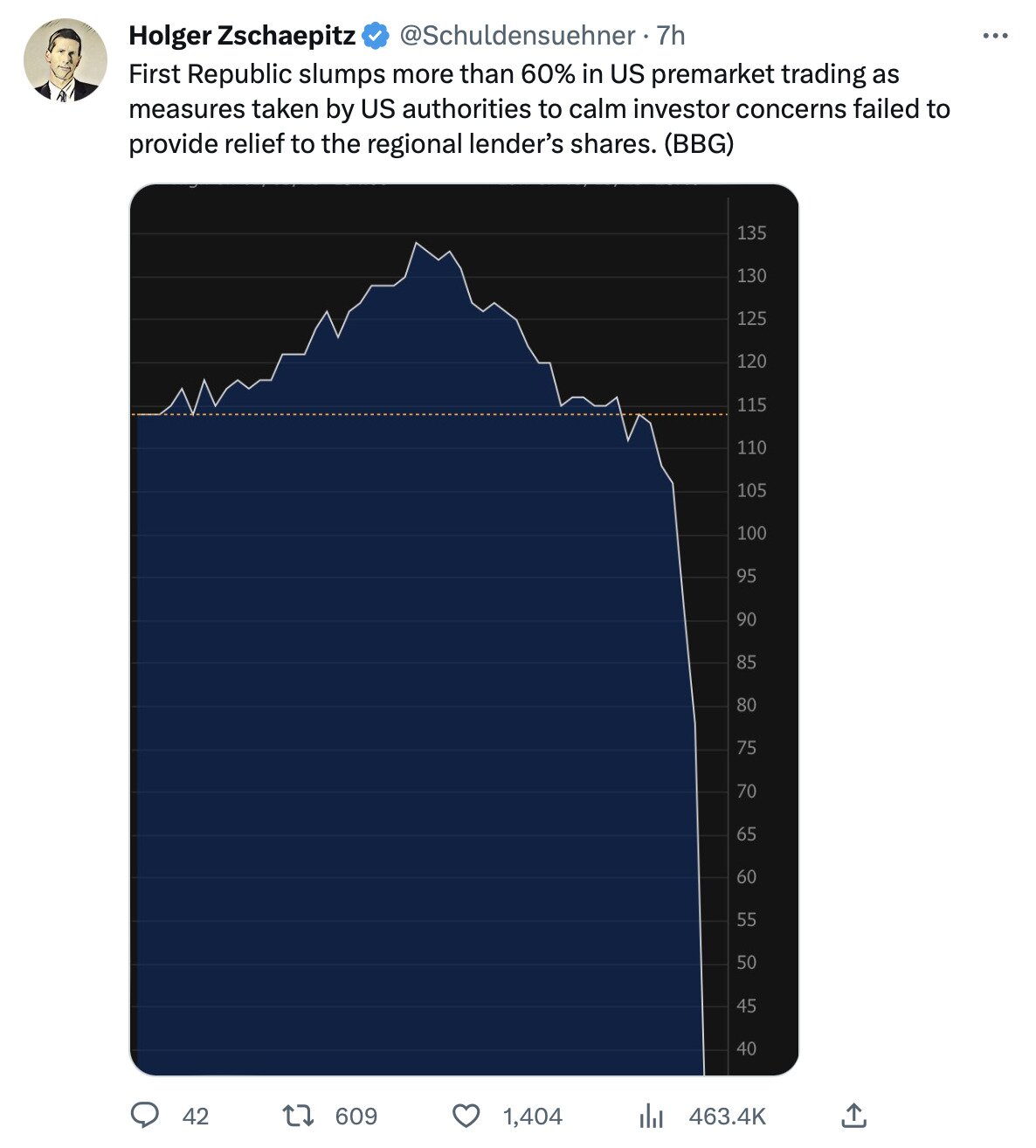

The fun doesn’t stop there, however, since other banks have found themselves in trouble in recent days. This includes First Republic, which has seen its stock price dive as investors become increasingly fearful and risk averse. And to a significant extent, it also includes a number of other US banks, with even the biggest financial institutions in America (and around the world) seeing their stocks take a beating.

Source: Twitter

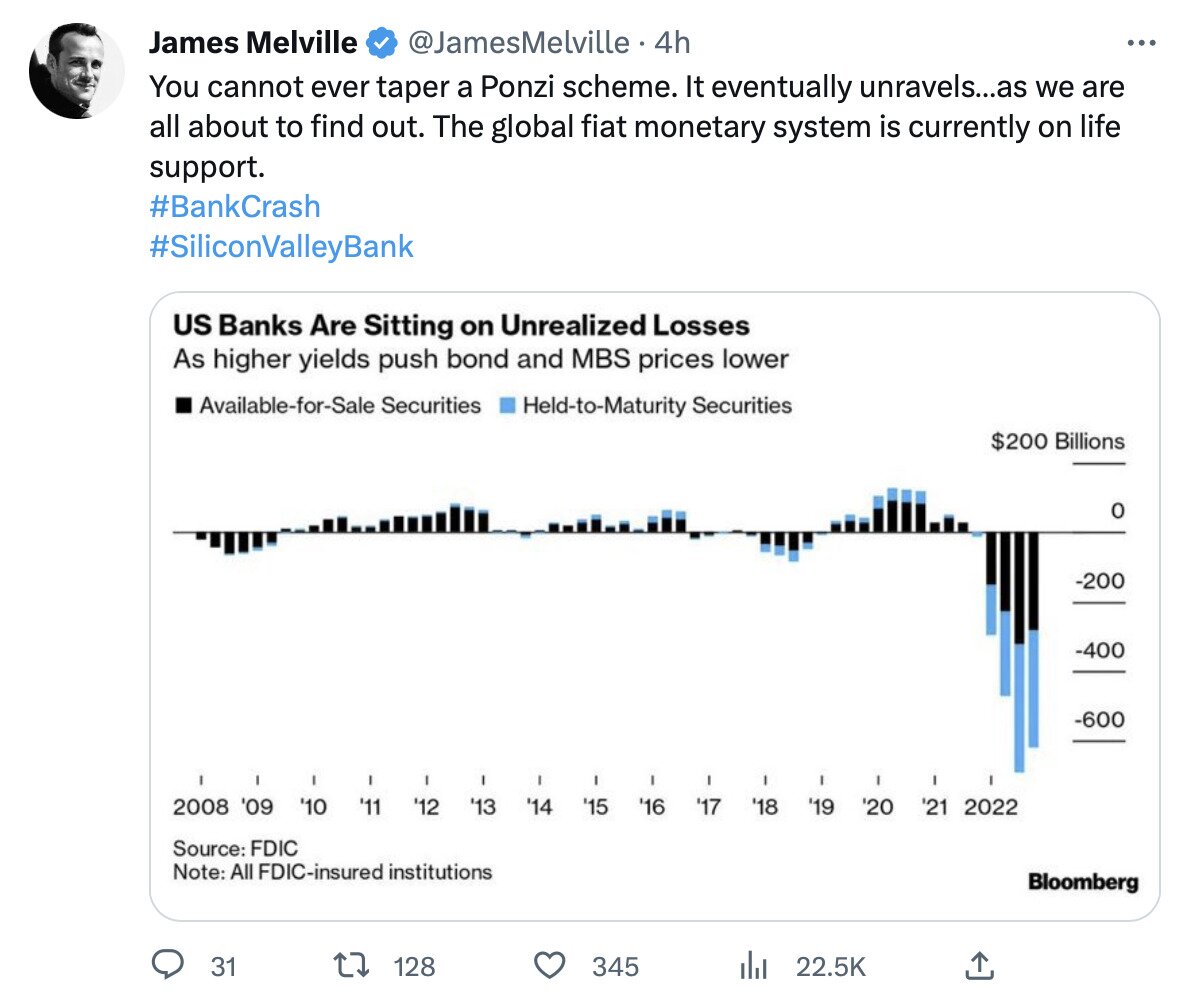

A big part of the reason why banks are facing a crisis at the moment is that so many of them are sitting on (big) unrealized losses. According to data compiled by Bloomberg, they’re currently stuck with losses on bonds of somewhere in the region of $600 billion, and if more of them are faced with runs, they too could be forced to realize such losses.

Source: Twitter

And the reason why the bonds (and mortgage-backed securities) in their possession have lost so much value is because of the Federal Reserve, which has been on a mission over the past 12 months or so to raise interest rates. The thing is, when a central bank raises rates, it tends to make holding bonds less attractive, particularly if rates climb above the yields offered by bonds.

This is exactly what’s happening to the US (and Western) banking system right now, forcing the Federal Reserve, the US Treasury and other bodies to step in yesterday with a package of measures to help. This includes guaranteeing customer deposits above $250,000 (which FDIC doesn’t normally do) and offering “additional funding to eligible depository institutions” so they can meet withdrawal requests.

Rates, Regulation and Recovery

On a more fundamental level, what the unfolding banking crisis also points to is the poor health of the global economy, which has failed to fully recover from the Covid-19 pandemic. Inflation remains high in many developed nations, with the Federal Reserve and other central banks suggesting that more rate hikes are yet to come. For instance, traders have been betting on the Fed pushing its base rate up to 6% this year (up from roughly 4.5%), something which will only suppress the global economy for longer.

This includes the cryptocurrency market, which despite seeing something of a mini-resurgence since the start of 2023 hasn’t really come anywhere near recapturing the heights of late 2021. Bitcoin did rise as high as $24,972 on February 20, making for a gain of 50% since January 1, yet its performance — as well as that of the market as a whole — was seriously detailed by the failure of Silvergate Bank, followed by the collapses of Silicon Valley Bank and Signature Bank.

And even $24,9721 is 63% down from BTC’s all-time high of $69,044, signaling how market conditions are still muted. This is also made worse for crypto by the threat of incoming regulation, with the Biden administration outlining a federal budget for 2024 that includes a 30% tax on the electricity used to mine cryptocurrencies such as Bitcoin (news of which helped bring down prices over the weekend).

Source: Twitter

On top of this, the recent bank and exchange failures within crypto have heightened the urgency of lawmakers when it comes to introducing specific cryptocurrency regulations. The EU has called for the fast-tracking of cryptocurrency capital rules for banks in recent weeks, while recent months have seen the Biden administration respond to FTX’s bankruptcy and other blowups by urging Congress to bring in comprehensive legislation.

Combined with high interest rates, high inflation and investor uncertainty, these regulatory overtures highlight how the economic environment still remains unfavorable to cryptocurrency. In such a context, investors are still looking to de-risk, which means that crypto can’t really mount a substantial comeback, at least not yet.

This negativity aside, Monday saw an interesting market reaction to the various news concerning the ongoing banking crisis. Having fallen by around 16% between Thursday March 9 and Friday March 10, bitcoin rose as high as $24,469 on Monday March 13, making for an 18% gain in 24 hours. Many observers have taken this for a sign that investors are fleeing to safer havens, with gold also up in the wake of this latest banking drama.

Source: Twitter

While things remain in a very precarious situation, it’s possible that the Fed’s intervention will prevent a real banking crisis on the level of 2008. This at least is the opinion of analysts, who are generally predicting that regulators will nip things in the bud this time.

“Unlike in 2008, the government has stepped in early and stepped in hard,” said Brad McMillan, Chief Investment Officer for the Massachusetts-based Commonwealth Financial Network. “While we can certainly expect market turbulence—and we are seeing it this morning—the systemic effects will be limited. We are not set for a rerun of the Great Financial Crisis.”

Even if we may be spared another 2008, this new banking mess is only likely to boost the standing of Bitcoin and certain other cryptocurrencies in the long run (while also probably resulting in the Fed lowering interest rates). That’s because Bitcoin has continued to operate without a break or outage since 2009, and regardless of how many banks fall by the wayside in the coming weeks, it will continue to operate for many, many more years to come.