- >News

- >What Are the Biggest Mysteries in the History of Cryptocurrency?

What Are the Biggest Mysteries in the History of Cryptocurrency?

The word ‘crypto’ evokes a certain degree of mystery and unknowability. This isn’t really surprising, given that it’s derived from ‘cryptocurrency,’ which in turn is derived from cryptography, the science of encoding information so that it can’t be read by third parties. In other words, cryptocurrency is mysterious by design.

Indeed, cryptocurrencies are usually built to maintain the pseudo-/anonymity of its users and evade centralized control. It’s because of this that the cryptocurrency sector has produced more than a few unsolved mysteries over the years, and there’s little doubt it will produce a few more in the years to come. This article unpacks the five biggest mysteries in crypto to date, with explanations on their latest statuses and developments.

The Mystery of the Missing QuadrigaCX Millions

In 2017 and 2018, Vancouver-based QuadrigaCX was Canada’s largest cryptocurrency exchange, with around 350,000 users. Sadly for those users the platform was little more than an elaborate scam, with co-founder Gerald Cotten having prior experience of defrauding unsuspecting individuals via the magic of the WWW.

Cotten founded QuadrigaCX in late 2013, and while it quickly gained prominence within Canadian cryptocurrency circles, investigations by the Ontario Securities Commission and journalists revealed that it had been run along fraudulent lines from at least 2016. In particular, Cotten appeared to have used user fiat deposits to trade cryptocurrencies on other crypto-exchanges, while he had also set up fake accounts for himself on Quadriga and traded fake cryptocurrencies in exchange for real money.

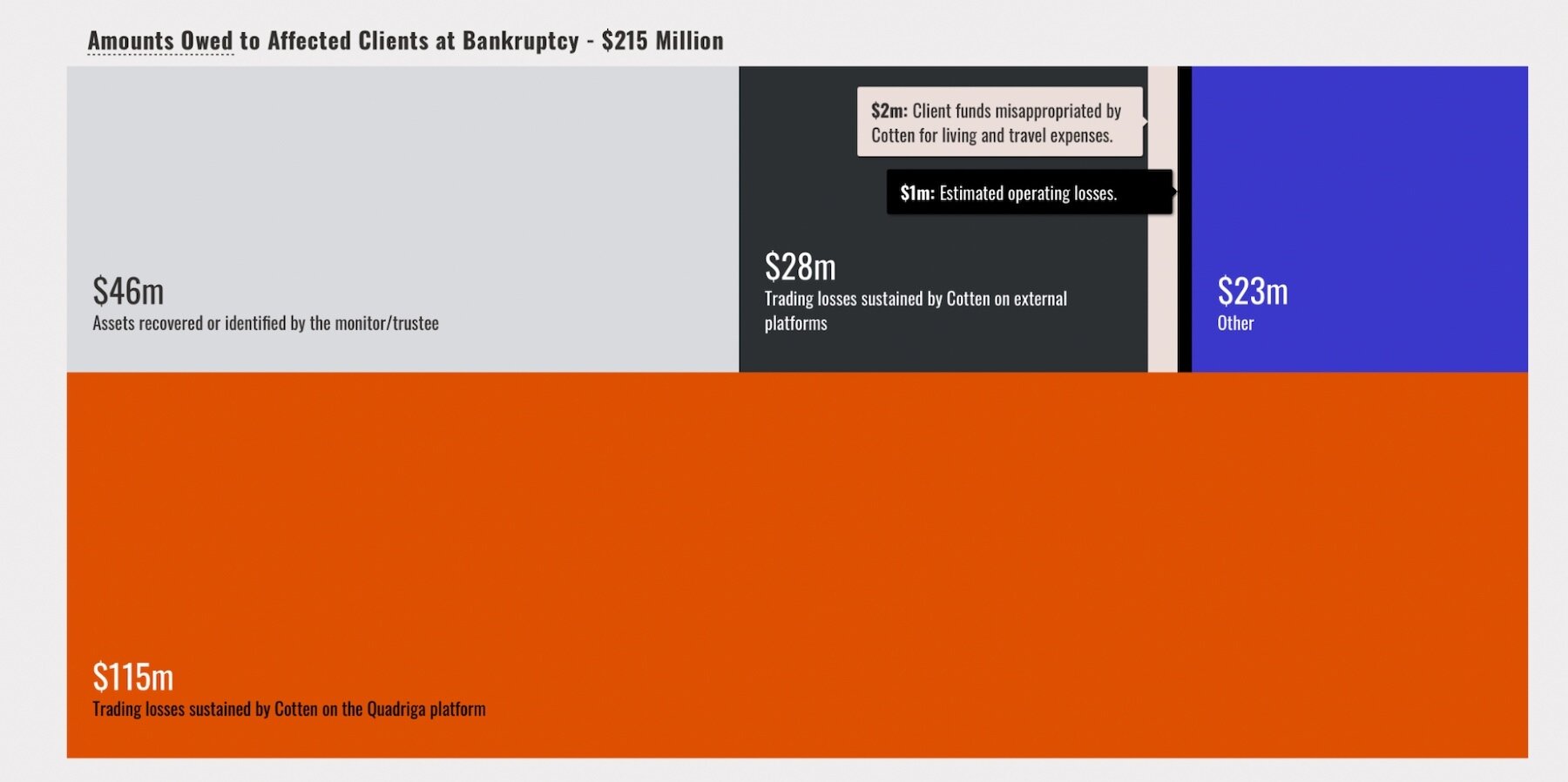

Originally, Cotten’s unexpected death (at the age of 30) in December 2018 led observers and reporters to conclude that around (US) $250 million in user deposits and cryptocurrencies had been lost for good, given that only Cotten had access to the private keys controlling Quadriga’s wallets. However, the OSC investigation mentioned above reported that Ernst & Young had recovered $46 million in assets to compensate Quadridga users, while “most of the $169 million asset shortfall resulted from Cotten’s fraudulent conduct.”

Source: Ontario Securities Commission

So by the time Cotten died, the vast bulk of user deposits had already been lost. As for whether Cotten really is dead, it’s worth pointing out that the Indian doctor who treated him, Jayant Sharma, has confirmed that photos of the late Quadridga founder were those of the man who died in his hospital.

Who is Satoshi Nakamoto?

Everyone knows that ‘Satoshi Nakamoto’ is the creator of Bitcoin, the world’s first cryptocurrency. Sadly, no one knows who this person really is, with the name ‘Satoshi Nakamoto’ being a pseudonym for some other individual or, perhaps, a group of individuals.

The pseudonymous Nakamoto first appeared on a cryptography mailing list in October 2008, where he directed around a hundred or so cryptographers to a white paper ‘he’ had written and posted on the recently registered bitcoin.org domain. It was from these beginnings that this individual managed to accumulate a number of collaborators, who helped him launch Bitcoin and refine its code via a series of updates. Then, in April 2011, he sent his last ever known email, a reply to developer Gavin Andresen. He also removed his name from the copyright claim in the Bitcoin code, before promptly disappearing.

No one has heard from Nakamoto since, while the latter’s Bitcoin wallet is said to hold around 1.1 million BTC. At least one person — Australian entrepreneur Craig S. Wright — has claimed to be Nakamoto, but has so far failed to produce any incontrovertible evidence to this effect (such as moving the aforementioned 1.1 million BTC). Other candidates have been suggested by journalists and various amateur sleuths, with creators of earlier forms of decentralized electronic money — such as Nick Szabo and Adam Back — being prime candidates, as well as the earliest users of Bitcoin itself (e.g. Hal Finney).

However, everyone who has been publicly identified as Nakamoto has flatly denied the claim, meaning that the search for the elusive Bitcoin creator goes on. It’s probably one crypto mystery that will never be solved.

Where is the Crypto Queen?

Crypto abounds in scams, and possibly the biggest to date is the OneCoin Ponzi. Launched in 2014 by Bulgarian Ruja Ignatova, it promised to be the next Bitcoin and attracted at least $4 billion in investments (some estimates go as far as nearly $16 billion), from large and smaller victims alike. But with the coin listed only on OneCoin’s own exchange, few if any investors could actually trade their tokens for real cash, even though the OneCoin company had claimed they’d risen as high as €30 (from a starting point of €0.50).

The mystery here lies in the fact that, in October 2017, Ignatova disappeared without a trace. She boarded a flight from Sofia (in Bulgaria) to Athens, Greece, with no one being able to track her whereabouts ever since. In early 2019, US authorities charged her in absentia with wire fraud, securities fraud and money laundering, although a popular BBC podcast about her suggested that she now resides in Frankfurt under a false identity.

What’s Really Backing Tether and Its USDT Stablecoin?

Tether (USDT) remains the cryptocurrency market’s biggest stablecoin in terms of supply, with a market cap of $73 billion (as of writing). More importantly, its 24-hour trading volume consistently overshadows that of any other cryptocurrency (including bitcoin), meaning that the overall cryptocurrency market is reliant on it for liquidity.

Tether claims that every single USDT token is backed 1:1 by actual US dollars or dollar equivalents that it holds in reserve, a claim which helps maintain market faith in the stablecoin’s value and stability. However, critics have claimed that Tether’s reserves aren’t all that Tether makes them out to be.

That is, while Tether states that around 28.5% of its reserves are in commercial paper (i.e. short-term corporate bonds/loans), more than a few critics claim that such paper is really a large collection of IOUs from crypto-exchanges. These exchanges supposedly provide IOUs to Tether, receive USDT in return, and then use this USDT to buy — and pump — crypto.

Source: Twitter

Needless to say, Tether categorically denies this, and has recently claimed that its reserves are now more than 50% made up of US Treasury bills. But without having undergone a full audit, no one can ever really be sure of this, so the unsolved mystery lives on.

Who Hacked the Ethereum DAO in 2016?

Possibly crypto’s biggest hack of all-time was the DAO breach in June 2016, when attackers exploited a number of bugs in order to siphon off some 3.6 million ETH (now worth around $6.84 billion). The DAO ran on the Ethereum blockchain, and its violation resulted in the latter being hard forked in order to rollback the transaction that enabled the theft (resulting in the creation of Ethereum and Ethereum Classic).

While the fork effectively reversed the hack, it left the matter of who was responsible for the hack unresolved. That is, until February of this year, when cryptocurrency author and podcast host Laura Shin revealed the results of her own investigations. She suggested that 36-year-old Austrian programmer — and founder of failed crypto-credit card company TenX — Toby Hoenisch was the person responsible. Forensic analysis from Chainalysis enabled Shin to track the movement of the stolen ETH to four crypto-exchanges, with an employee at one exchange confirming the node to where cryptocurrency was later withdrawn.

Despite the substantial amount of evidence amassed by Shin and her sources, Hoenisch (predictly) denied he had anything to do with the hack. However, he has failed so far to provide any evidence contradicting these claims, so his identification has more than a veneer of plausibility.