- >News

- >Whales Move Millions in Dormant Bitcoin, Ethereum. Should Investors Brace for a Selloff?

Whales Move Millions in Dormant Bitcoin, Ethereum. Should Investors Brace for a Selloff?

The function of money is to circulate, yet when it comes to virtual money — i.e. cryptocurrency — many people prefer it when the opposite happens. In fact, inactivity and holding have become such virtues within crypto that they even have their own acronym, HODL. Yet over the past week or so, the market has been startled to find that at least some of its participants have not been abiding by this watchword, and that some large, formerly dormant whales have begun moving bitcoin and ethereum after a long period of doing nothing.

The awakening of long-dormant cryptocurrency has raised alarm bells within the cryptocurrency community, with some observers speculating that either whales are preparing for a big selloff or that some old wallet generators have been compromised. However, a look at the wider facts and context reveals that, even with the movement of some formerly inactive BTC and ETH, holding has never actually been so prevalent among whales.

Data also shows that whales have been in accumulation-mode for the past few months, taking advantage of falling prices to grab themselves more cryptocurrency at a discount. And while the still-unsettled macroeconomic situation may mean that we’ll see a few more falls in the coming weeks, the fact that most whales are building up their stores of crypto suggests they’re preparing for the next bull market.

Dormant Whale Addresses Wake Up and Send Large Amount of BTC and ETH

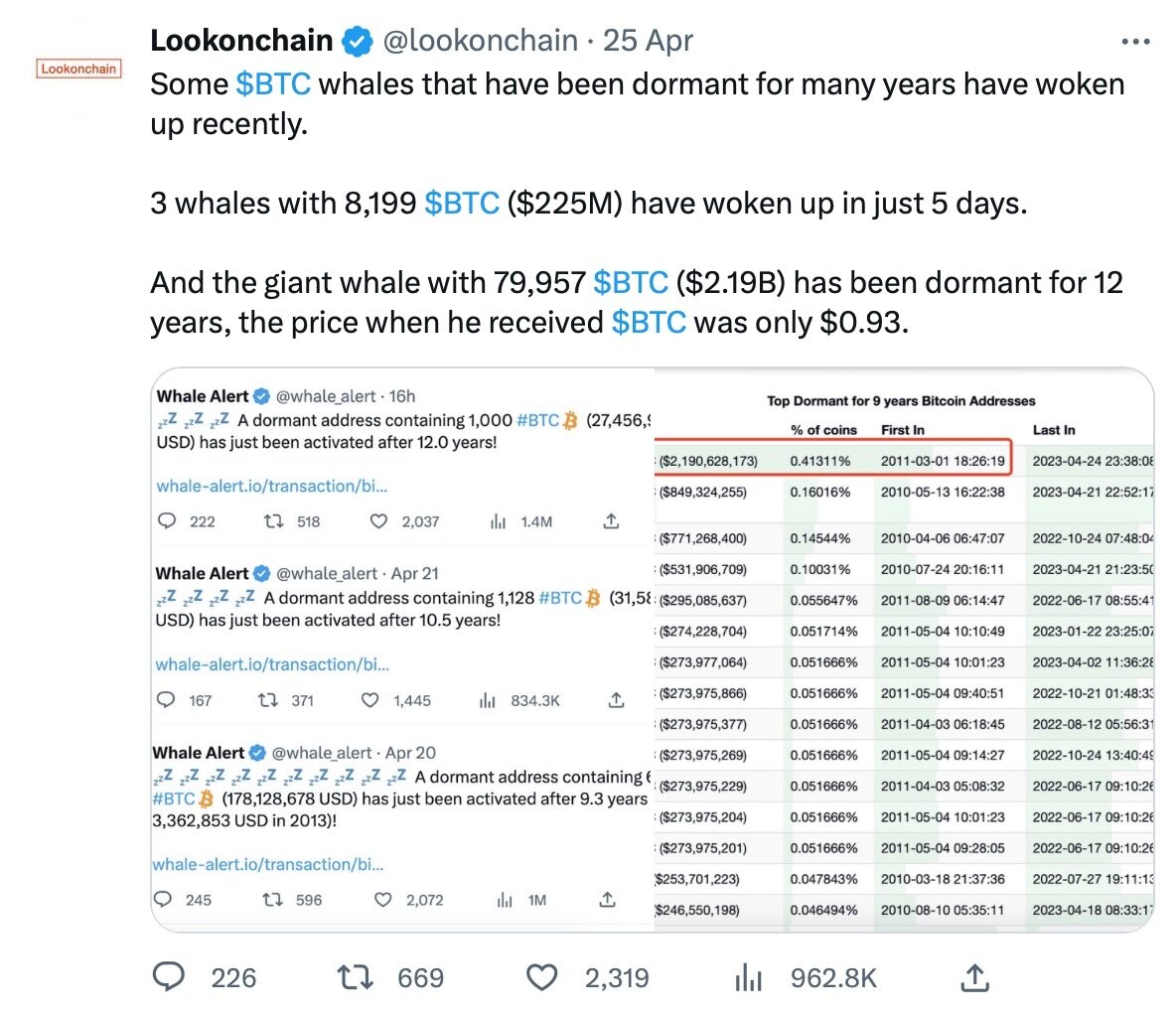

On the Bitcoin side of things, four major addresses — holding a combined total of just over $2.4 billion in BTC — have been reactivated in the past few weeks, despite all of them having been inactive for at least nine years.

Source: Twitter

Together, three of these addresses have transferred over 2,500 BTC since waking up, via transactions of around 279, 2,071.5 + 400 BTC, which together are worth $79.76 million. The fourth whale address — which actually sits on bitcoin worth over $2 billion — hasn’t sent anything yet, although it did receive a small amount of BTC after being dormant since 2011.

If that weren’t enough, three big Ethereum addresses have also woken up after several years of inactivity, moving a combined total of just over 150,000 ETH (or $287 million). One of these included an address that had received over 2,000 ETH from Ethereum’s 2016 ICO and that had been asleep for nearly eight years, and while this particular holder has moved only 1 ETH in recent days, the other two moved the rest of the 150,000 ETH.

Source: Twitter

The movement of such large amounts by whales that had been inactive for so long has almost inevitably caused speculation that a big market selloff may be incoming. In other words, there’s a fear among investors that recent rises have been as good as it can get for the market in the near future, so some whales — who may also be driven by their own financial needs — have decided to cash out now, before incoming falls.

Or you could even argue that these movements have helped cause some of the drops the market has witnessed in the past week or so, with BTC and ETH both falling in the couple of days following the above transfers. Either way, whales transferring out of a wallet is usually a sign of selling.

Speculation that Transfers Are the Result of Wallet Generator Hack

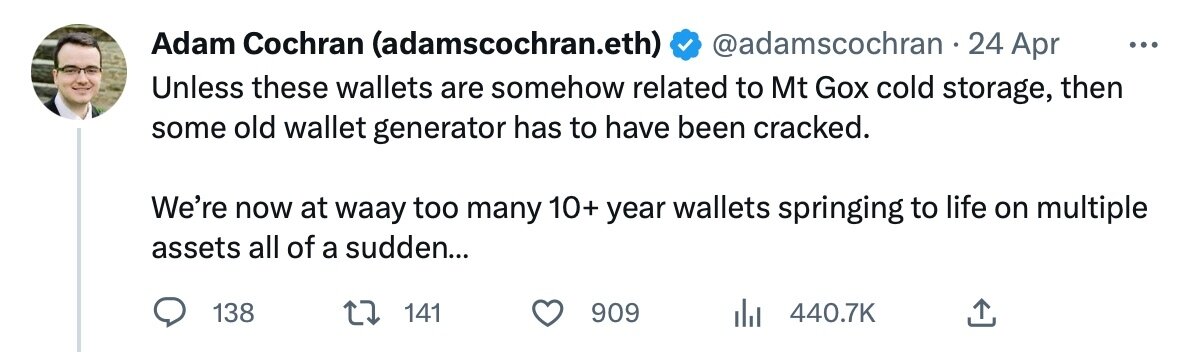

That said, some commentators have highlighted how unusual it is for long-dormant wallets to transfer funds, which doesn’t happen that often. Going further, some have even raised the possibility that the transfers are the result of a hacker compromising old wallet generators, which may have been used to generate the addresses used to store the aforementioned BTC and ETH.

This, at least, is the opinion of Cinneamhain Ventures’ Adam Cochran, who has suggested that older wallet generators may have used “a bad source of ‘random’ that isn’t really random,” meaning that certain seed phrase combinations “are more likely than others, and therefore much easier to brute force.”

Source: Twitter

Cochran isn’t the only person who has raised this possibility, yet there are two things that need to be said against it. Firstly, there has been no positive confirmation or detection of a compromised wallet generator, meaning that the speculation above remains precisely that, speculation.

Secondly, there have been other isolated instances of once-dormant whales moving bitcoins and other cryptocurrencies, with numerous examples in 2022, 2021, 2020, and even further back. Whales transferring funds and possibly selling some of their holdings is nothing new, and while a few large bitcoin and ethereum transfers happening at the same time seems like a big ‘coincidence,’ it could easily be explained by economic factors (e.g. the cryptocurrency industry has weathered a semi-meltdown in recent months).

Long-Term Holding at All-Time High

Accordingly, it would be very premature to conclude that a compromised wallet generator is behind the recent transfers. It would also be wrong to conclude that the recent whale transfer portend a big cryptocurrency market collapse.

In fact, recent data shows that, on various levels, whale accumulation and ownership are at particularly healthy levels. Glassnode data shows that the percentage of the overall bitcoin supply that hasn’t moved for at least two years has actually just reached an all-time high of 53.8%, and it’s steadily ticking upwards.

Source: Twitter

Dormancy is actually increasing overall, while additional glassnode data also shows that whales (i.e. holders of 1,000 BTC and upwards) have begun accumulating bitcoin in the past few weeks, during the very period when the big transfers of long-inactive BTC and ETH occurred.

Given such overall accumulation, it shouldn’t be feared that the market is on the cusp of a huge selloff. Yes, it had a bad 2022, but 2023 has for the most part witnessed some positive recovery, with BTC and ETH up by 75% and 62% respectively since January 1.

And it’s precisely in this context of recovery — but still relatively low prices compared to 2021 — that whales have begun accumulating cryptocurrency again. For they suspect that, with the next Bitcoin halving due in 2024, we’re also not too far from the next bull market.