- >News

- >Tracking Crypto Adoption is Hard But Data Points to Nearly a Billion Users

Tracking Crypto Adoption is Hard But Data Points to Nearly a Billion Users

Global crypto adoption has come a long way. From around 30,000 active addresses in July 2012, Bitcoin now witnesses more than 800,000 wallets active in the past 24 hours. This is an increase of over 2,500%, indicating just how much the global population has taken to Bitcoin in the past decade.

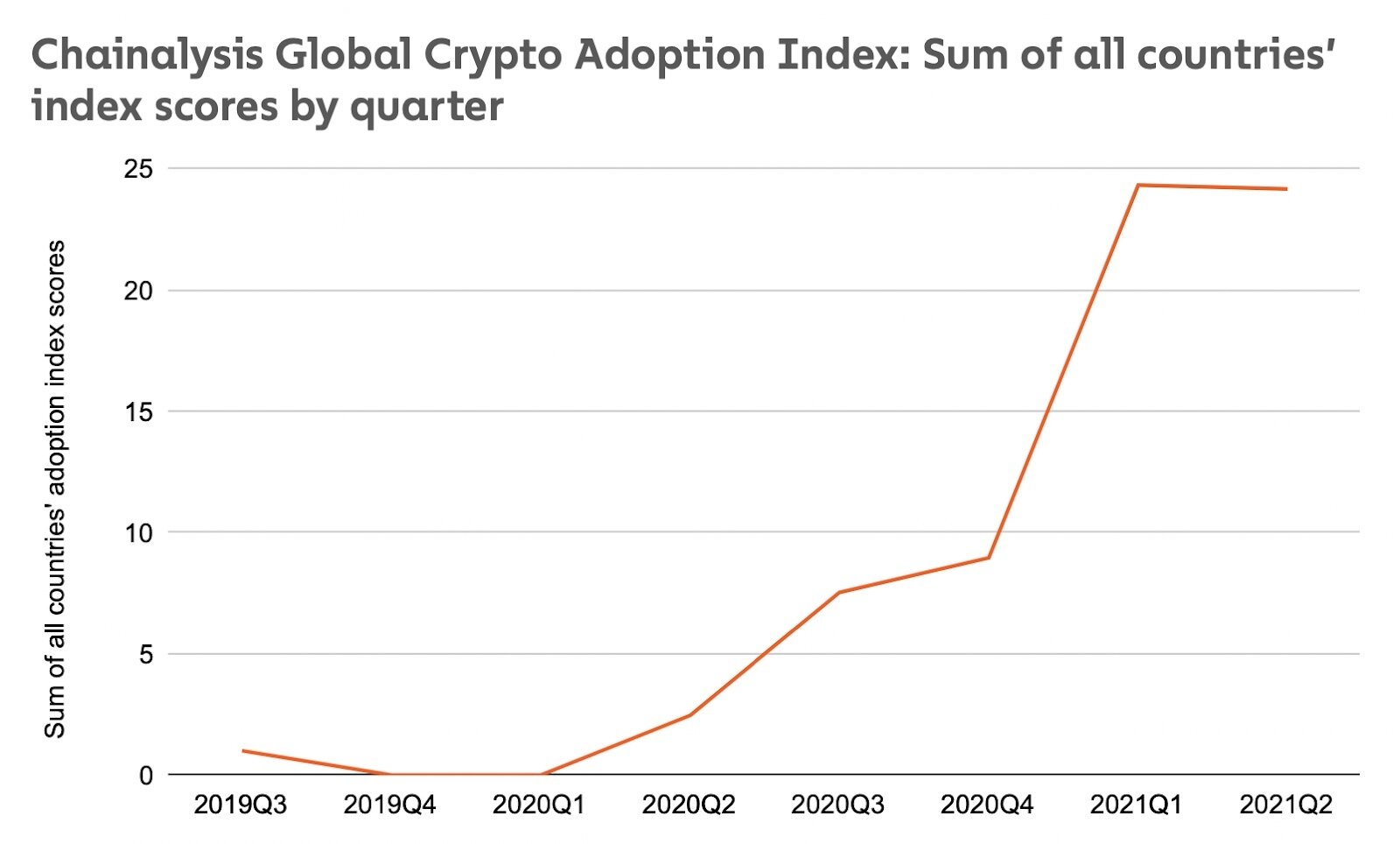

Much the same applies to cryptocurrencies in general, with Chainalysis’ most recent Global Crypto Adoption Index revealing that global crypto adoption — as measured by transfer value and volumes — rose by 880% between Q2 2020 and Q2 2021, and by an impressive 2,300% between the third quarter of 2019 and Q2 2021. It’s likely that updated figures will show a further increase, with Crypto.com forecasting at the start of 2022 that global cryptocurrency owners would reach one billion by the end of the year.

Pretty much all of the available evidence points to a steady growth in cryptocurrency ownership and use, yet what’s just as interesting is how global crypto adoption varies from one coin to another, as well as from one nation or region to another. Indeed, this variation reflects how people adopt crypto for a wide variety of reasons, with some cryptocurrencies offering different use cases, and with some populations having different needs.

Crypto Adoption: Definitions and Differences

Crypto adoption can mean different things depending on who you ask. However, there tends to be two primary ways of tracking it: measuring cryptocurrency ownership, and measuring transfer volumes and values.

Of these two, it seems that simple ownership is the most common. This is evident in a recent report from Blockware, which in June 2022 predicted that global bitcoin adoption would reach 10% by 2030. This means 10% of the world’s population will own at least some bitcoin by 2030, with Blockware basing this conclusion on the historical adoption curves for earlier technologies, such as the car, radio, telephones, televisions, smartphones, the Internet, and social media.

In Blockware’s view, bitcoin ownership will “reach saturation” quicker than many of these earlier technologies for reasons related to monetary incentives, network effects, and how the Internet accelerates transmissions. As it explains later in its report, it defines ownership in terms of “unique wallets on the Bitcoin blockchain,” although it explains that this may become less reliable as an indicator of adoption in the future, with fewer people likely to interact with the Bitcoin base layer over time (e.g. because users may hold their bitcoin on a layer-two network or platform).

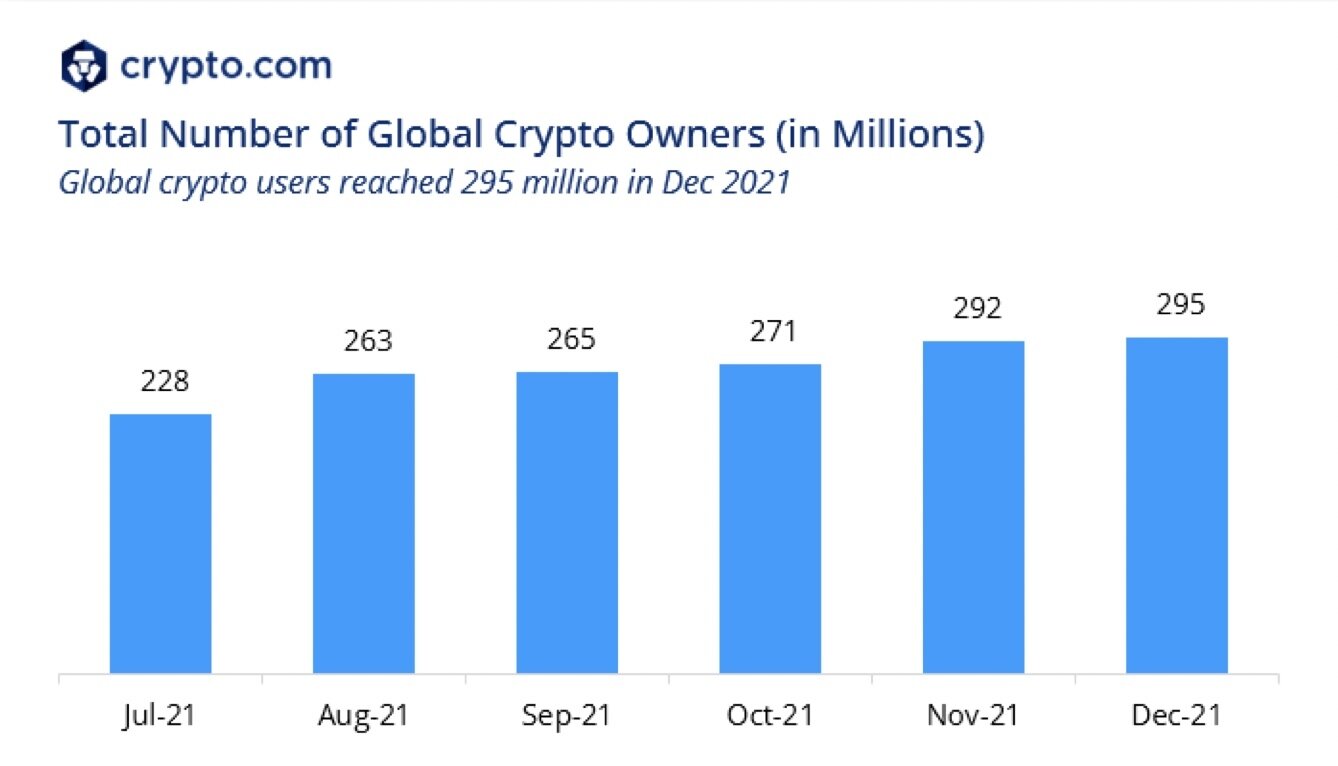

Many other analysts use simple ownership when measuring crypto adoption. In Crypto.com’s Crypto Market Sizing report from January 2022, it found that the number of cryptocurrency owners worldwide rose from roughly 106 million in January 2021 to 221 million in June 2021, and then to 295 million in December 2021.

Source: Crypto.com

However, other firms take a different approach to gauging global crypto adoption. The most notable of these is blockchain forensics outfit Chainalysis, which doesn’t base its adoption metrics on wallet and ownership numbers.

For its Global Crypto Adoption Index, it creates a number of “index scores” for 154 different nations, and then works out an average index score for the world taken as a whole. These scores are based on three things:

-

On-chain cryptocurrency value received, weighted by purchasing power parity (PPP) per capita

-

On-chain retail value received, weighted by PPP per capita

-

Peer-to-peer exchange trade volume, weighted by PPP per capita and number of Internet users

These three metrics arguably provide a more nuanced and accurate picture of crypto adoption from one country to another. The first metric measures the total value of all cryptocurrency received by entities within any given nation, and then weights this figure according to PPP, which is an indicator of that nation’s wealth per person. The second takes the sum total of all transactions under $10,000 (which Chainalysis defines as representing retail transactions), and again weights this against PPP per person. Lastly, the third metric looks specifically at trade volumes on peer-to-peer exchanges, and also weights this according to PPP per capita.

It’s by using these methods that Chainalysis was able to show that global crypto adoption had risen by 880% between Q2 20202 and Q2 2021, and by 2,300% between Q3 2019 and Q2 2022. That is, the sum total of all 154 nations’ index scores had risen by these percentages over these timeframes.

Source: Chainalysis

It’s obviously worth pointing out that, by using a method such as Chainalysis’, you’re almost certainly going to arrive at different percentages for growth than if you used basic ownership numbers. Nonetheless, by combining different measures of crypto adoption from different sources, you can synthesize a reliable picture of how cryptocurrency ownership and use has changed over time.

Factors Influencing Adoption

What’s more, this reliable picture would show that global crypto adoption is indeed growing, with similar metrics from the Federal Reserve, the UK’s Financial Conduct Authority, Gemini, and Finder.com all indicating strong growth over the past few years.

If you spend enough time with such studies and surveys, you’ll also gain a sense of the factors that can influence crypto adoption over time. And right at the top of this list will be price.

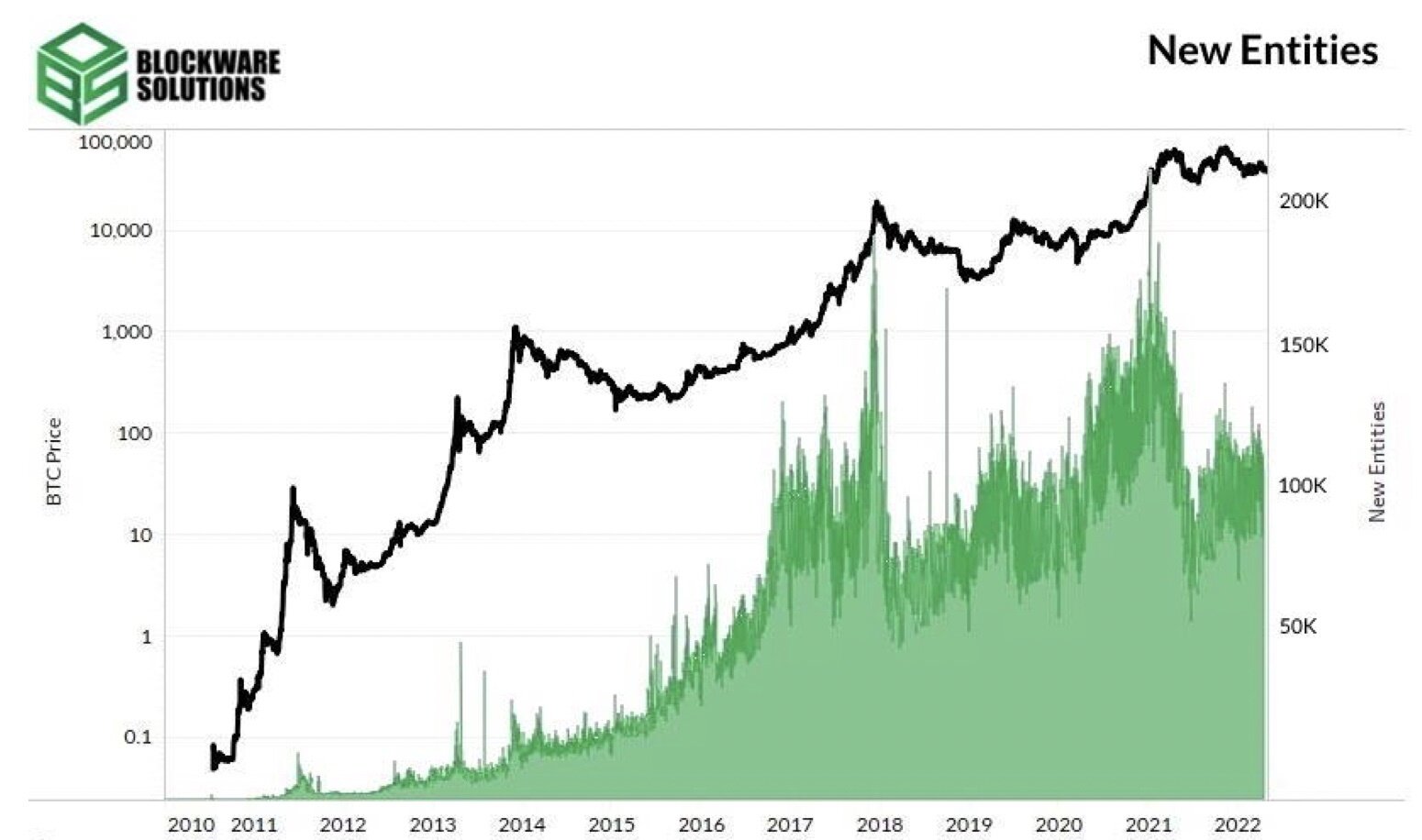

Bitcoin price (in black) plotted against unique Bitcoin addresses (green). Source: Blockware Solutions/Glassnode

Historically, price rises have helped drive new users and holders towards cryptocurrency. As the chart above reveals, increases in the price of bitcoin have resulted in significant upsurges in the number of “new entities” on the Bitcoin blockchain, meaning new unique addresses.

That said, the relationship isn’t simply one-way, with the arrival of new users obviously pushing the price of bitcoin (and other cryptocurrencies) even higher, which in turn may attract yet more new users. Also, if you refer to Chainalysis’ adoption metrics, it becomes apparent that cryptocurrency price rises can push adoption indices up even higher, since these are based on the value of transferred assets, thereby creating the impression that adoption surges massively during bull markets and falls during bear markets.

Of course, a rising price isn’t the only thing driving global crypto adoption. Studies from a variety of industry players indicate that there are a multitude of other reasons for cryptocurrency adoption, all of which tend to vary geographically.

The 2022 Global State of Crypto Report from US-based exchange Gemini is a good source of info in this respect. Breaking its findings down according to region, it shows that motivations for crypto adoption do differ widely depending on where you are in the world. This becomes particularly apparent in countries experiencing high inflation, as reported by Gemini’s authors:

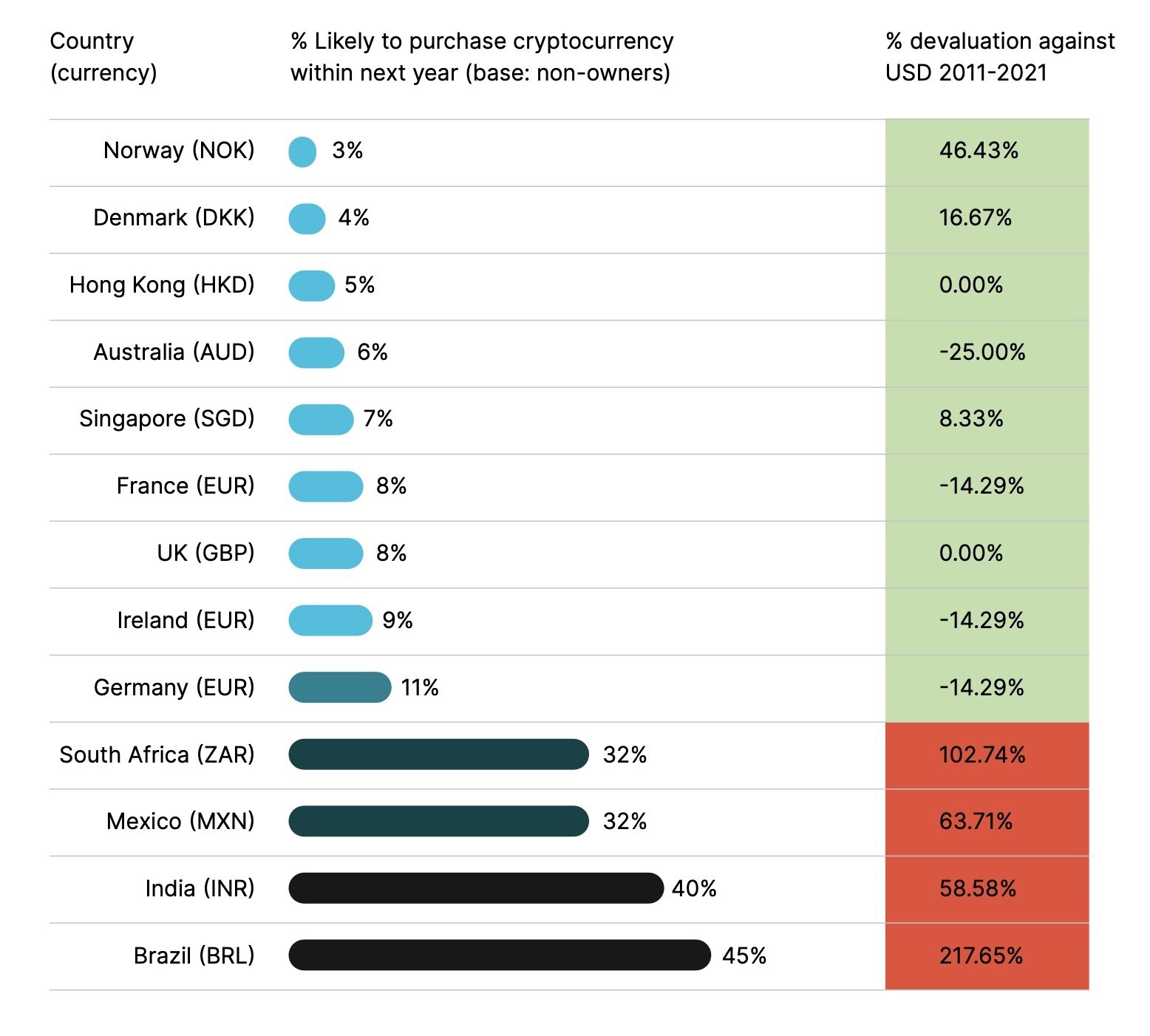

“Respondents in countries that have experienced 50% or more devaluation of their currency against the USD over the last 10 years were more than 5 times as likely to say they plan to purchase crypto in the coming year than those in countries that have experienced less than 50% currency devaluation, including South Africa (32%), Mexico (32%), India (40%), and Brazil (45%).”

In particular, Gemini found that the cryptocurrency ownership rate was 41% in Brazil, where the Brazilian real has devalued against the US dollar by over 200% % in the past decade. This is a pattern that occurs in numerous other nations, including Turkey, Venezuela and Nigeria.

Source: Gemini

Gemini’s findings are supported by Chainalysis’ report, which in ranking the world’s nations according to crypto adoption seems to have leaned more towards developing economies. Indeed, its top ten includes Vietnam, India, Pakistan, Ukraine, Kenya, Nigeria, Venezuela, Togo and Argentina, with the United States (in eighth) being the only advanced economy at the top of its rankings.

Looking at Gemini’s and Chainalysis’ lists, it also becomes apparent that inflation isn’t acting alone in drawing the populations of developing countries towards crypto. There’s also the fact that a greater share of the populations in weaker economies are unbanked, with cryptocurrencies providing easier access to the means to transfer value from one person to another.

While neither Gemini’s nor Chainalysis’ report directly addresses the unbanked turning to crypto, it’s reflected in Gemini’s report via trust scores for cryptocurrency in such regions as Latin America and Africa. That is, fewer non-owners of crypto in these two regions report not purchasing cryptocurrencies because they don’t trust them, something which probably stems from having reduced contact with the traditional banking system.

More direct evidence comes from the Federal Reserve’s Economic Well-Being of U.S. Households in 2021 report, which was published in May 2022. It found that 13% of Americans who used cryptocurrency for payments (rather than investment) lacked a traditional bank account, compared with 6% of non-owners of cryptocurrencies. Likewise, it found that 27% of people who use crypto for transactions lacked a credit card, as opposed to 17% of the general population.

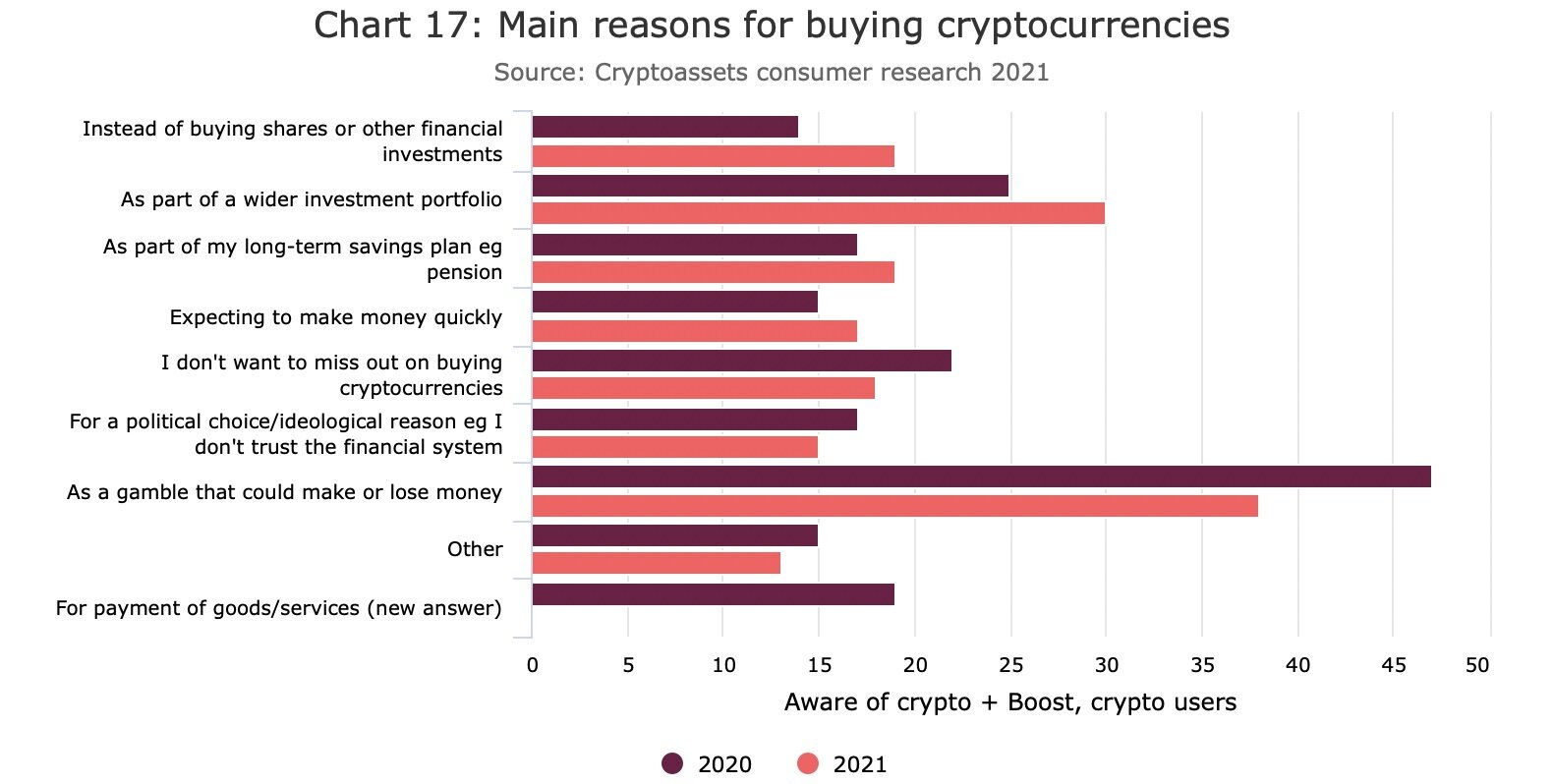

There are also a variety of miscellaneous factors that affect crypto adoption. As the surveys conducted by Gemini and the UK’s Financial Conduct Authority show, one big determinant is related to ideology, politics and trust in government (and financial institutions). For example, the FCA’s survey discovered that around 17% of British cryptocurrency owners list distrust of the legacy financial system as one of their main reasons for trading virtual currencies.

Source: FCA

Similarly, Gemini’s study revealed that 66% of cryptocurrency owners in Brazil regard crypto as the “future of money,” while 23% of US-based cryptocurrency owners regard it as such. This kind of motivation relates to a distrust of institutions and government, which often appears as a big guiding factor in areas such as Eastern Europe, as found in Chainalysis’ most recent report.

Geographical, Gender and Age-Based Variations in Crypto Adoption

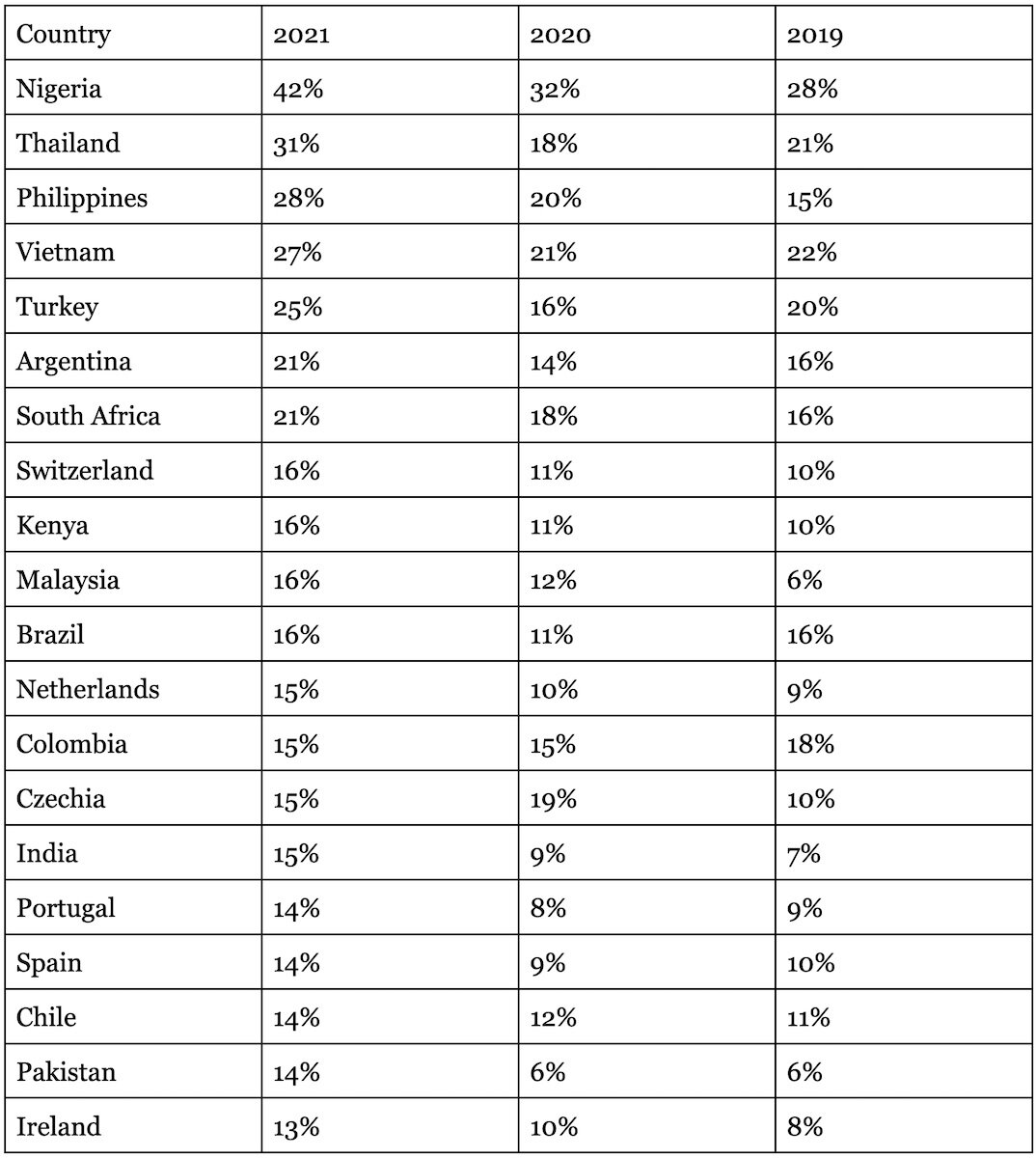

Such factors help to explain variations in cryptocurrency uptake from one country and region to another. And given the reasons cited above, it comes as no surprise to see survey after survey putting developing countries ahead of their developed counterparts in terms of crypto adoption.

This is the picture that also emerges from data compiled by Statista in April, which shows the changing cryptocurrency ownership levels for 56 different countries. Here’s the top 20, spanning from 2019 to 2021:

As with other studies, Statista makes it clear in its review that cryptocurrency ownership is often at odds with trading volumes. That is, when you rank nations according to the absolute volume of cryptocurrency trading, then richer nations such as the United States tend to appear higher in lists.

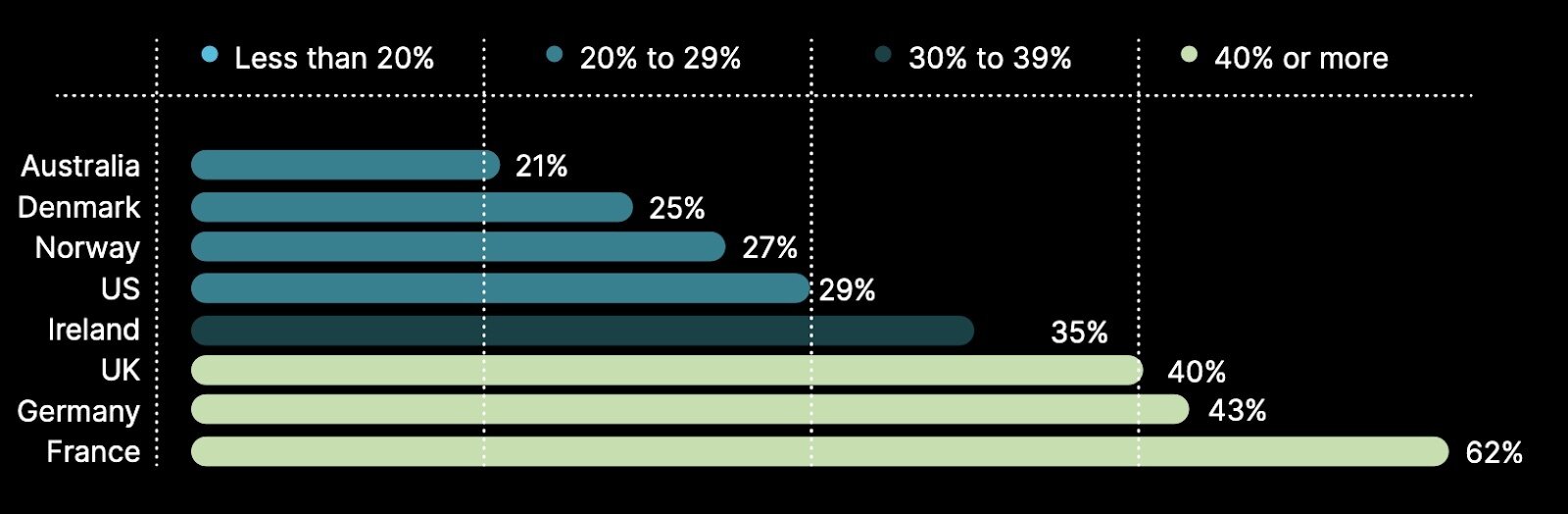

There are also some interesting patterns that emerge in cryptocurrency ownership within more advanced economies. As revealed in Gemini’s research, ownership within more developed nations tends to disproportionately occur among “high-income respondents.” So whereas poorer individuals in poorer nations often turn to cryptocurrencies as a financial lifeline for transactions and payments, richer individuals in richer nations have treated crypto as speculative investments.

This graph shows cryptocurrency ownership levels among “high-income” individuals in various advanced economies. Source: Gemini

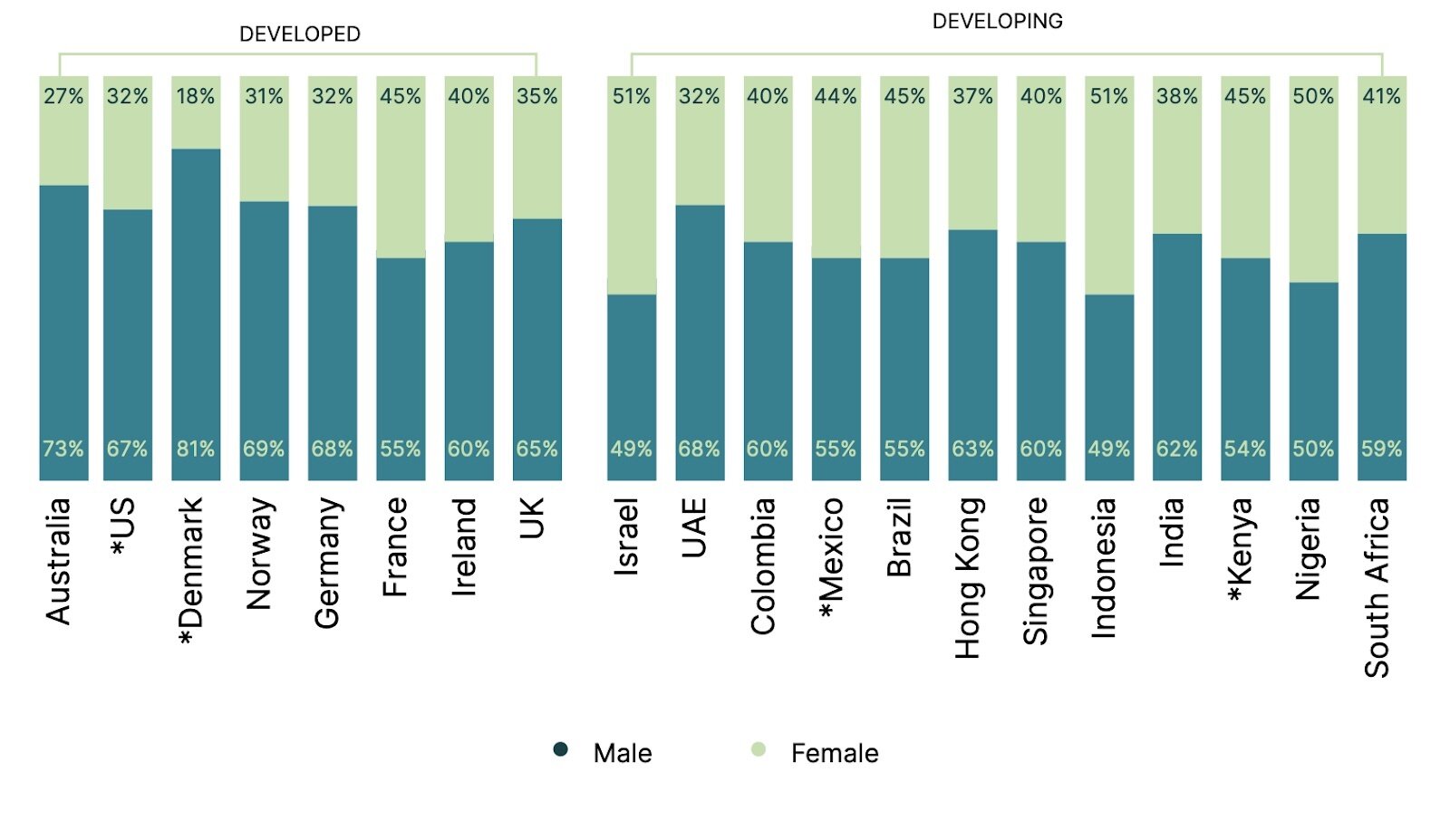

This division between adoption of crypto for payments and for investment also feeds into gender differences across nations. Specifically, developing nations boast a bigger percentage of women owning/using crypto, largely because cryptocurrencies are used more for actual payments and transactions more in such nations.

*1% of respondents identified as “non-binary” or “genderqueer,” or chose “prefer to self-describe” or “prefer not to say.” Source: Gemini

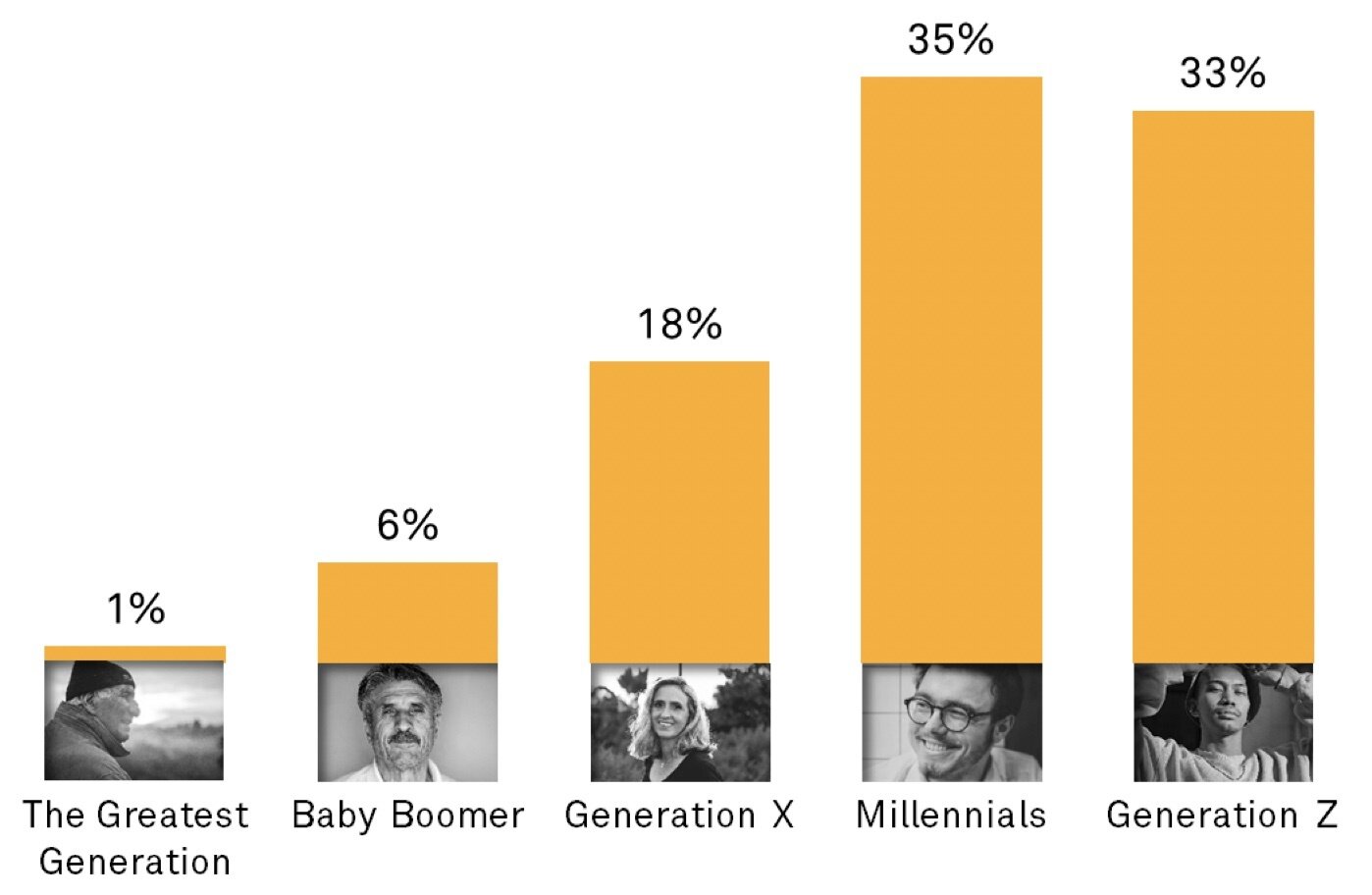

Another widespread pattern relates to age, with different generations showing different levels of uptake of cryptocurrencies. Looking in particular at the United States, data from S&P Global Market Intelligence and 451 Research indicates that younger generations — Millennials and Generation Zers — are much likelier than their older counterparts to have owned or used cryptocurrencies at some point.

As of the first quarter of 2022, an impressive 35% and 33% of Millennials and Generation Zers had bought or received cryptocurrencies, in comparison to 18% of Generation Xers, 6% of Baby Boomers and 1% of members of the Greatest Generation.

Source: 451 Research/S&P Global Market Intelligence

There are likely various reasons for this skewing of crypto adoption towards younger generations. Most obviously, Millennials (born between 1981 and 1996) and Generation Zers (born 1997 onwards) are more technologically literate than their forebears, having grown up with video games, computers, the Internet, smart devices and social media. This likely makes them more favorably disposed towards cryptocurrencies, as well as less intimidated by any perceived complexity.

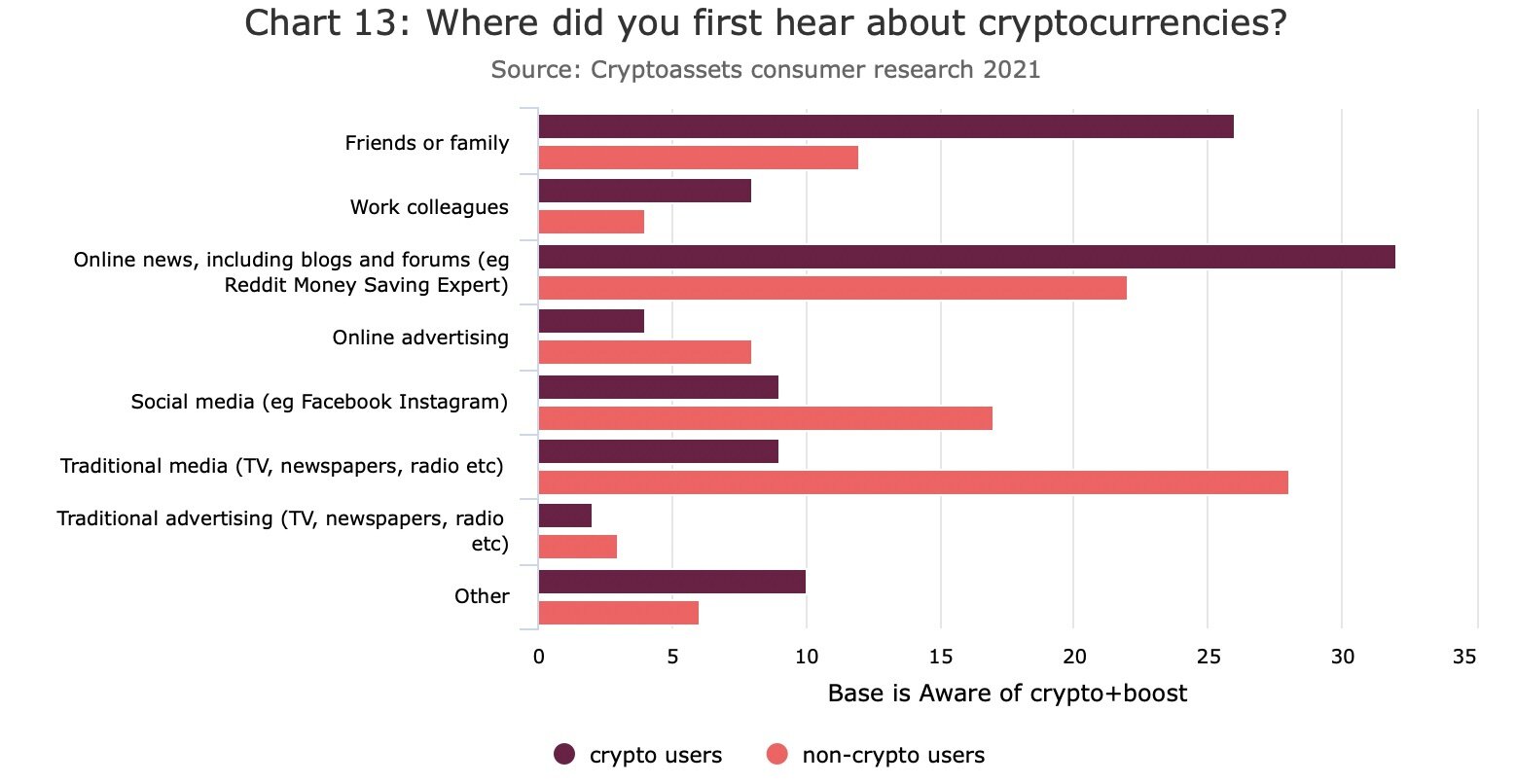

On top of this, the FCA’s report into cryptocurrency ownership in the UK found that most owners and users first heard about cryptocurrencies from either their friends or from online websites and forums. At the risk of stereotyping, interacting and sharing info with friends, as well as sourcing news from online blogs and forums, is something more associated with younger people. Hence the fact that they’re likelier to have owned cryptocurrencies.

Source: FCA

There isn’t much data on how generational trends vary geographically, although the available evidence does suggest that a greater proportion of younger people own cryptocurrencies regardless of where you are in the world.

For instance, Chainalysis put Vietnam at the top of its 2021 Global Crypto Adoption Index, with the Asian ranking highly in terms of on-chain (retail) value received in proportion to per capita wealth and in terms of peer-to-peer trading volume. In explaining why Vietnam has turned so readily to crypto, the analytical firm quoted Binh Nguyen, the coordinator of the Fintech-Crypto Hub at the Royal Melbourne Institute of Technology-Vietnam:

“Young people here don’t have many options for investing. We don’t have a well-developed financial market for ETFs, options, or futures and the stock brokerage penetration rate is lower than 5% in Vietnam.”

Nigeria figured sixth in Chainalysis’ index, and again its report quotes figures who confirm that cryptocurrency ownership is concentrated among the young, with much trading taking place via informal P2P trading on social networks such as Telegram and WhatsApp.

In light of such anecdotal evidence, it’s safe to say that it will be the younger generations who will drive global crypto adoption in the coming years, if only by virtue of generational replacement.

Other Adoption Data, and Future Predictions

While cryptocurrency ownership numbers and transaction data are the two most widely used metrics of adoption, there are a variety of alternative ways of gauging uptake. These are very mixed in their reliability and quality, but combining them together can help to provide a more or less coherent overall picture of adoption.

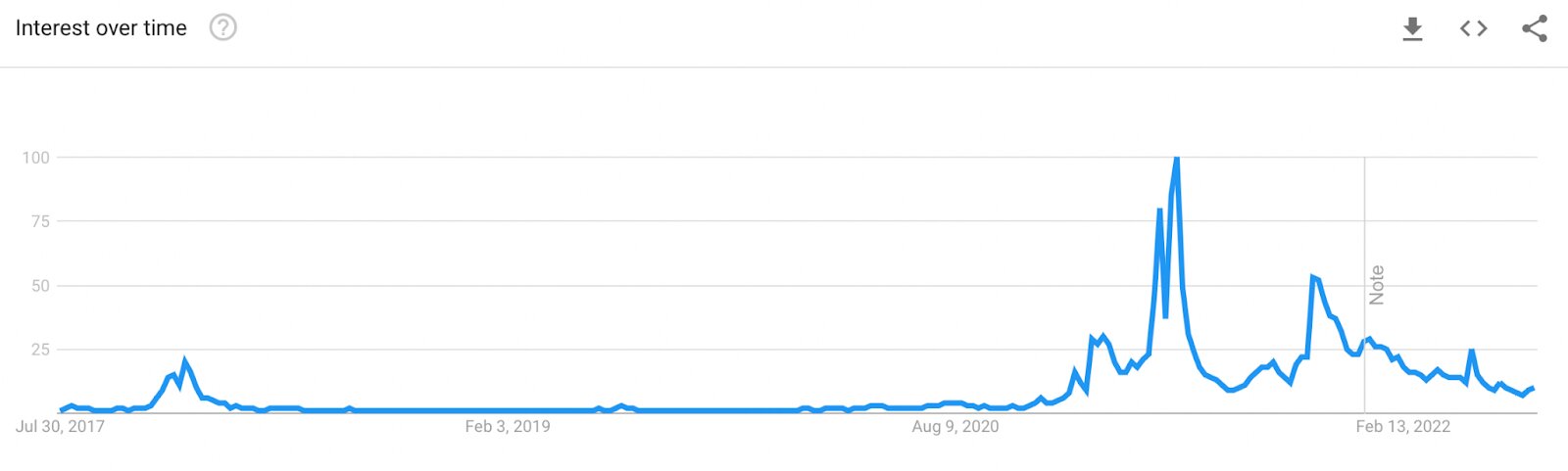

For one, there’s Google Trends data on the popularity of such search terms as “bitcoin” and “crypto.” Such data is variable and hard to compare, with the popularity of some terms peaking at different points in recent history. For instance, “bitcoin” reached its peak of popularity worldwide back in late December 2017, while “buy crypto” peaked in May 2021.

Search interest worldwide for ‘Buy crypto.’ Source: Google Trends

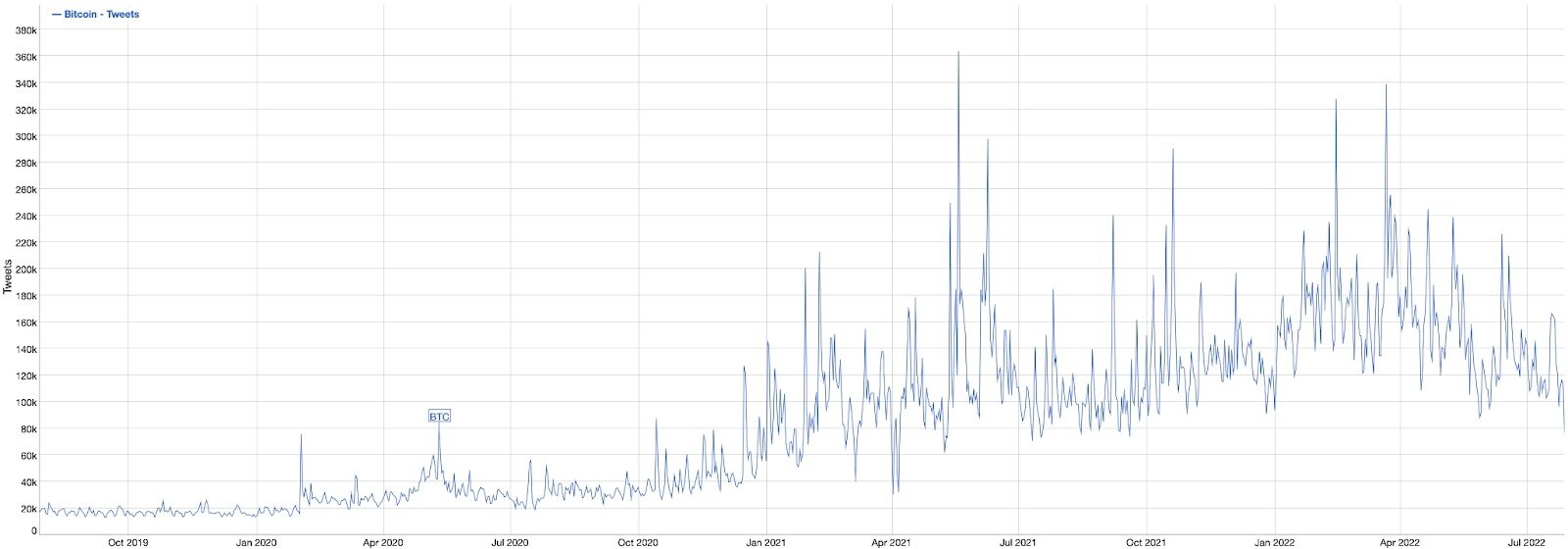

Another good source is social media data. For instance, BitInfoCharts provides data for a number of major cryptocurrencies, spanning everything from transactions per day to average transaction value. It also includes tweets per day that the hashtag of each corresponding cryptocurrency, with most of these showing an overall increase in interest over time.

With Bitcoin’s Twitter mentions, there are isolated peaks in May 2021 and March 2022, yet the bigger picture shows a steady average increase over time.

Source: BitInfoCharts

Another thing to look at is Reddit. Namely, subscriber numbers for subReddits for each major cryptocurrency can be tracked over time using the Wayback Machine. Again, this reveals a gradual increase in interest over time, with Bitcoin’s subReddit going from 600,000 in December 2017, to 1.2 million in December 2019, to 4 million in March 2022, and then 4.4 million (as of writing). Similar increases can be observed with Ethereum and Ripple, to name two other cryptocurrencies.

Such figures should be taken with a pinch of salt, since Twitter mentions and Reddit subscribers doesn’t necessarily indicate active engagement with cryptocurrencies. Nonetheless, they’re a useful barometer of the overall level of interest, and when combined with more reliable ownership and transaction data, they provide a fuller picture of the current state of crypto adoption.

As things stand, this state is a mostly healthy one, with interest in cryptocurrencies remaining strong in spite of 2022’s ongoing bear market (which has arisen largely for macroeconomic and geopolitical reasons). The industry continues to witness banks roll out cryptocurrency custody (and trading) services, small nations have made bitcoin legal tender, and ownership among ordinary retail traders remains at comparatively high levels. And seeing as how crypto is barely ten years old, predictions that it could reach one billion people by 2030 (or even much earlier) don’t seem too far fetched.