- >News

- >The SEC Threatens to Sue Coinbase: What Does This Mean for Crypto?

The SEC Threatens to Sue Coinbase: What Does This Mean for Crypto?

The SEC has issued Coinbase with a Wells notice, which reveals t it has recommended taking legal enforcement action against the crypto-exchange for alleged violations of securities laws. This potentially opens up a new chapter in the regulator’s apparent war against crypto, with its long-running case against Ripple likely to come to a conclusion within the next few months.

Given the issuing of a Wells notice, it now seems very likely — but not certain — that the SEC and Coinbase will begin their own protracted legal battle. The price of Coinbase stock has fallen substantially in response, dropping by 20% in the wake of the notice, with investors apparently fearing the worst. Meanwhile, the cryptocurrency market has dipped by about 2.5%, with the announcement undermining the momentum crypto had amassed in the couple of previous weeks.

But while a loss for Coinbase in any case with the SEC would be a huge blow for crypto, the exchange has already responded strongly to the regulator’s notice. Indeed, it would fight its corner vigorously in the event of legal action, with its status as one of the most legally compliant exchanges in the industry giving it a solid case. As such, it can’t be assumed that the SEC will succeed in severely restricting what’s permissible in the US cryptocurrency industry.

SEC Hits Coinbase With a Wells Notice: What Does it Mean?

A Wells notice is a formal warning that the SEC has internally recommended taking legal action against some entity or individual. In this case, the entity in question is Coinbase, which according to the Securities and Exchange Commission has violated securities laws via “the Company’s spot market, staking service Coinbase Earn, Coinbase Prime and Coinbase Wallet.”

Basically, Coinbase has allegedly offered unregistered securities, something which the exchange has already come out and publicly denied. On the same day of the Wells notice, it published an official blog in response, in which it declared it’s “confident in the legality of [its] assets and services,” and that it had spent months on trying to agree a “potential resolution [to the SEC’s ongoing investigation] that would include registering some portion of [its] business with the SEC.”

On top of this, CEO Brian Armstrong published a series of tweets in which he noted that the SEC had approved Coinbase’s public listing, with its filing at the time “clearly” explaining its “asset listing process and includ[ing] 57 references to staking.” He also said that the exchange is “right on the law, confident in the facts, and welcome[s] the opportunity […] to get before a court.”

Source: Twitter

While Armstrong talked as if the commencement of legal action is all-but confirmed, it’s worth pointing out that data from the SEC itself suggests that it drops around 20% of probes after issuing a Wells notice. As such, there’s no guarantee that the SEC will actually proceed with legal action. Coinbase will have the opportunity to file a Wells submission as part of the Wells notice process, giving it the opportunity to share any salient info that the SEC may have missed, and that may prove instrumental in either averting action or helping the two parties reach a settlement at the outset.

What Will Happen

Coinbase has until (Wednesday) April 5 to file its submission, at which point the SEC will choose its course of action. Assuming the regulator decides to go ahead and sue the exchange (as it did with Ripple and numerous others), what’s likely to happen?

There are mixed views on this. Many commentators have noted that Coinbase had repeatedly attempted dialogs with the SEC on how it could make itself fully compliant, as stated by Armstrong and also Ripple’s legal officer Paul Grewal. Grewal has tweeted that the exchange sat down with the regulator on multiple occasions, “sharing details of our business to build a path to registration.” He also pointed out that Coinbase even acquired two broker dealers in 2018 in order “to become regulated by the SEC,” although it has been unable to activate the licenses of these two dealers with the SEC so far (although he doesn’t say why).

Source: Twitter

Like Armstrong, Grewal mentions that the SEC failed to help or cooperate with Coinbase on its attempts to gain registration, while noted crypto-focused lawyer John E. Deaton has pointed out that some of the SEC’s lawyers are even on record complimenting Coinbase’s system for determining whether a digital asset is a security.

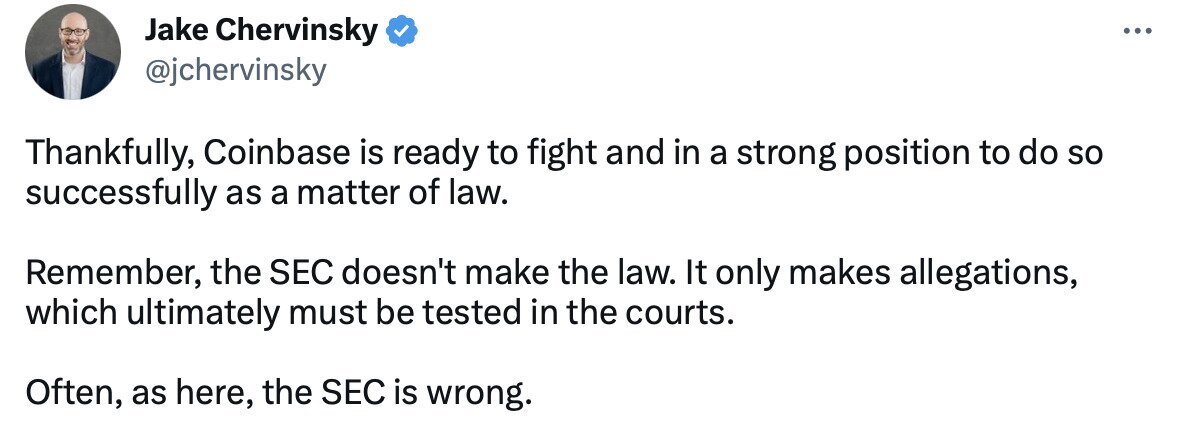

As such, there’s an argument that the SEC hasn’t been entirely helpful in providing Coinbase with fair notice that the exchange could be acting in violation of securities laws. On top of this, numerous observers believe that Coinbase would have a strong defense if the SEC proceeded with legal action.

Source: Twitter

The thing is, there’s also a very credible argument to the opposite effect. For one, Coinbase already knew that it was under SEC investigation, as indicated by a filing from last summer. This undermines any claim that it lacked fair notice, while some observers — most notably ex-SEC official John Reed Stark — have also taken aim at some of the exchange’s other arguments, including the claim that the SEC’s approval of its IPO filing equates to an approval of all of its lines of business. According to Stark, it doesn’t:

“To suggest that the SEC somehow endorsed or approved the various business lines of Coinbase (so Coinbase now has some sort of regulatory safe harbor for everything they do) has no basis in law or in fact. Merely because two years ago the SEC reviewed Coinbase’s registration statement (which Coinbase erroneously refers to as its “business plan”) and approved Coinbase to go public is irrelevant.”

Stark also argues that Coinbase’s having repeatedly met with the SEC has no bearing on whether it violated securities laws. Taking his claims at face value, it would indeed paint a bleak picture for Coinbase, which Stark criticizes for apparently believing that “a Twitter rant against the SEC (who will never respond, unless it is with a lawsuit) is the best way to do battle against a Wells Notice.”

The SEC’s latest move against Coinbase is indeed a negative development for crypto, insofar as it seems to suggest that the securities regulator is intent on cracking down on substantial parts of the industry. This is the interpretation of John E. Deaton, for example, who has suggested that other exchanges will receive similar notices in due course, and that the intention of regulators is to clear the way for existing financial institutions to muscle in on the cryptocurrency market.

However, if this interpretation is true, it would still potentially be positive for the market and industry, insofar as cryptocurrencies would still be traded, albeit by large banks and institutions. Yes, some degree of decentralization might be lost in the process, but you could just as easily argue that having a few dominant exchanges (such as Coinbase, Binance, etc.) isn’t really a model of decentralization anyway.

And at worst, a ‘loss’ for Coinbase in a case with the SEC may result in it ending its various staking services, while it would be free to continue enabling spot trading for most cryptocurrencies. At the same time, an de facto ban in the US on staking services (and possible proof-of-stake cryptocurrencies) would be more of a blow to the American cryptocurrency industry, than to crypto as a whole. Or it could result in the development of an actual workable system for registering cryptocurrencies as securities in the US.

It would therefore be rash to conclude the worst based on the SEC’s latest gambit. There’s no guarantee it will go ahead with an action, Coinbase is confident in the strength of its case, and most of the ramifications would be concentrated on the US cryptocurrency industry and market. Instead, it should be regarded as merely the latest step in crypto becoming a fully regulated and compliant industry.