- >News

- >The Metaverse is a Trainwreck for Facebook But It’s a Different Story for Crypto

The Metaverse is a Trainwreck for Facebook But It’s a Different Story for Crypto

Facebook is hemorrhaging money and value. The reason? The metaverse, which since Facebook changed its company name to Meta in October 2021 has represented its long-term strategic goal. The thing is, while the metaverse has seemingly captured CEO Mark Zuckerberg’s attention in a very big way, it has done nothing but cost the social networking firm masses of money so far.

From the beginning of 2019 to September 2022, Meta invested $36 billion into Reality Labs, its metaverse and VR division. Yet over the same period, Reality Labs has made an operating loss of $30.7 billion, while Meta’s stock price has fallen from 378.69 in September 2021 to a low of 90.79 at the end of October, a drop of 76%. This decline has effectively wiped $700 billion off Meta’s value, with the company announcing in November that it would be shedding 11,000 jobs (or 13% of its global workforce).

Yet despite such losses, Meta continues to soldier on with its metaverse bet, even in the face of continued skepticism. And while it may not have delivered much in the way of tangible success for Meta, it has arguably helped the cryptocurrency and blockchain industry, with Zuckerberg’s championing of the metaverse helping to increase the visibility and adoption of decentralized versions of the metaverse.

The Facebook Metaverse Bet One Year On: Promises But No Product

When Meta released its third quarter earnings report in late October, one Wall Street analyst called it a “train wreck,” such was the extent of the financial damage it described. Indeed, Meta reported a 52% decline in net income between Q3 2022 and Q3 2021, as well as a 19% increase in costs and expenses.

There are a variety of reasons for Meta’s year-long downturn, from the same macroeconomic pressures that have hurt the cryptocurrency market to growing competition from rival upstarts such as Tik Tok and Snapchat. Yet perhaps the most glaring cause is the company’s continued investment in the metaverse, which has yet to deliver anything but a loss.

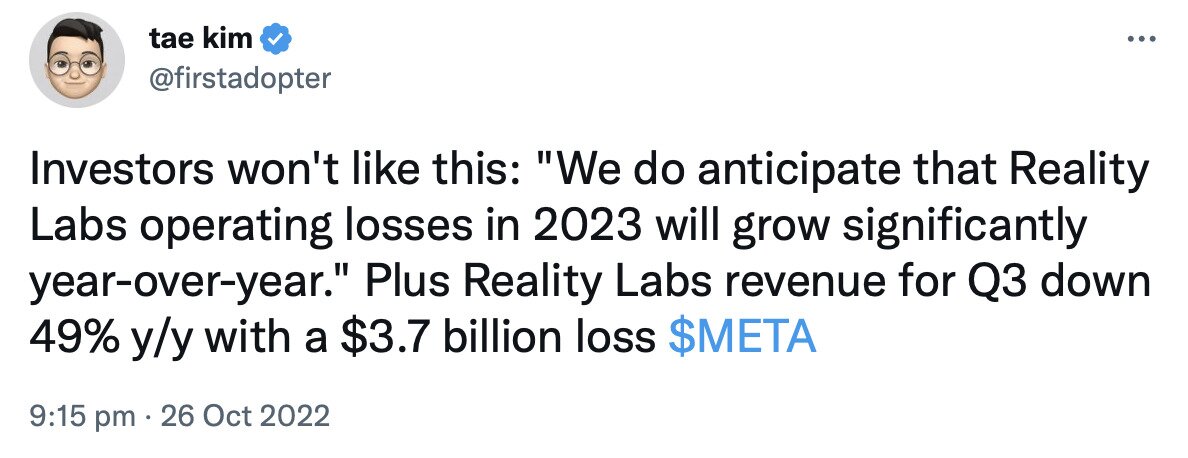

Its metaverse division, Reality Labs, lost $9.4 billion in 2022 alone, and Meta expects such losses to increase in 2023. It said in a statement released in October, “We do anticipate that Reality Labs operating losses in 2023 will grow significantly year-over-year.”

Source: Twitter

From this financial information alone, it’s pretty safe to infer that Meta has produced very little in the way of a viable metaverse-related product that people or businesses actually want to use. Yet to be fair, it has been developing new VR headsets for the metaverse as well as various services, including a Meta Quest for Business service it unveiled last October.

The idea behind this particular concept is a virtual collaborative space of companies and their employees, kind of like a Microsoft Teams with virtual office spaces. In fact, Meta even partnered with Microsoft for the (yet to be released) product, meaning that it will be offering a VR experience for Teams, through which employees can communicate and even access Microsoft applications through the Meta Quest Pro VR headset.

Meta has also partnered with professional services company Accenture, which has been testing the social media firm’s VR offerings, and which will be working alongside Meta and Microsoft to encourage other businesses to delve into the metaverse. But while Meta is now starting to have actual VR products that businesses could use for virtual conferencing and work, observers have argued that these remain fairly primitive at the present moment in time, to the extent that they offer no tangible improvement over existing tele-working and -conferencing tools.

A tweet about Accenture’s Meta office from Paul Nightingale, the Associate-Dean for Research at the University of Sussex Business School. Source: Twitter

As for individual consumers, Meta has actually been releasing VR headsets ever since it acquired Oculus in 2014. It released the Oculus Quest 2 (now known as the Meta Quest 2) in October 2020, for example, making a range of VR-based games available to ordinary members of the public, as well as a variety of social apps.

However, the extent to which people are actually buying the Meta Quest 2 headset is unclear, with reliable sales data available only up until November 2021, showing that around 10 million units of the headset had been sold up to then. Compared to Facebook’s reported two billion users, this is a mere drop in the ocean, while sales of VR headsets in general declined worldwide in 2022, indicating that things have slowed down more recently.

Meta has revealed that its Meta Quest store (through which users can buy apps for its VR headset) has hit $1.5 billion in total revenue to date, so it is at least doing something with virtual reality. But then again, $1.5 billion isn’t much for such a big corporation, while it’s also entirely arguable that such revenues represent interest simply in VR entertainment rather than in the metaverse, which is a much more ambitious and all-encompassing concept where people ostensibly ‘live’ and ‘work’ in VR.

Crypto Piggybacking on Meta’s Efforts

Still, Meta is undoubtedly plowing ahead with its metaverse bet, for better or for worse. It has new products planned, including Meta Horizon Worlds (which will let people phone friends who are playing in VR), as well as a new consumer-focused headset due this year. And while it’s hard to say whether it will ever really profit from its own metaverse gamble, there’s little doubt that it has benefited crypto in a variety of ways.

Back when it announced its name change to Meta, it caused a big rally among the cryptocurrencies of metaverse-related platforms, such as Decentraland, the Sandbox and Axie Infinity (among others). Obviously this rally has subsided in the wake of 2022’s bear market, yet the fact remains that such platforms have much more visibility and traction than did prior to Facebook making its metaverse bet.

For example, the Sandbox has celebrated partnerships with a wide range of big names following Facebook’s shift, with the likes of Warner Music Group, HSBC and Forbes all establishing presences in its virtual world. Much the same goes for Decentraland, which has also seen tie-ins with Netflix, Samsung, La Liga, Hershey’s and Skechers.

The point here is that, by making the metaverse its long-term goal, Facebook/Meta has forced a very, very large number of other companies and brands to look into how they might also exploit this new area. As exemplified above, they’ve therefore reached out to existing metaverse platforms, in the process increasing the size and reach of the latter.

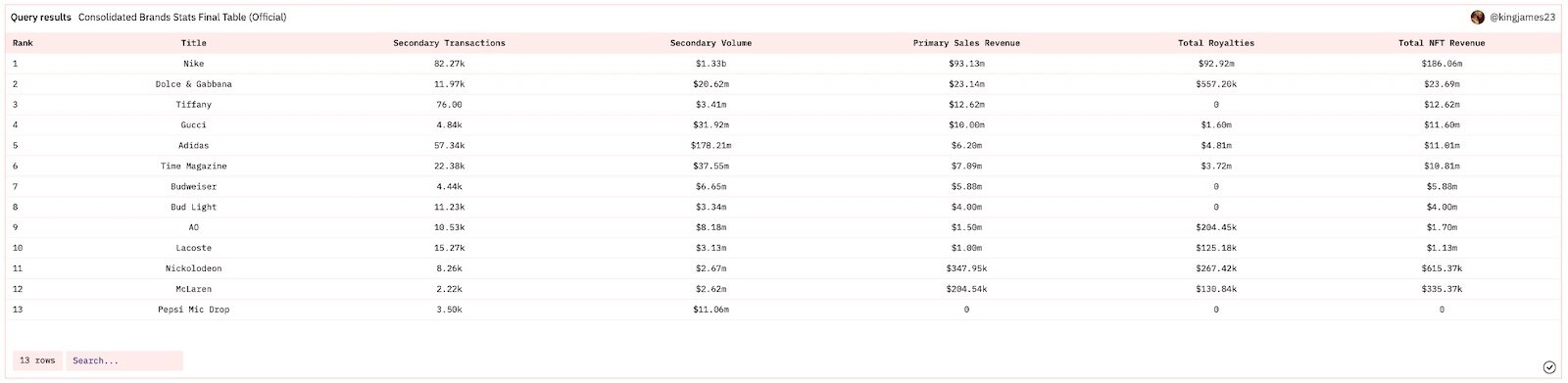

Many companies have also sought to tap into the burgeoning area of the metaverse and Web3 in their own particular ways. Possibly the most notable example of this is in the fashion sector, which has seen nearly every major fashion house and brand delve into non-fungible tokens and beyond in the past 12 months or so. This includes names such as Nike, Balenciaga, Jimmy Choo, Dolce & Gabbana, Gucci, Louis, Nike, adidas, Prada, Balenciaga, Tommy Hilfiger and Ralph Lauren, many of which have used existing platforms to harness NFTs and other elements of the metaverse.

Source: Dune Analytics

Ethereum has been possibly the biggest beneficiary of this influx, seeing as how it hosts the vast majority of crypto’s NFTs. A Dune Analytics dashboard actually shows that branded NFTs hosted on Ethereum have generated hundreds of millions of dollars in revenues for their respective companies owners, meaning they’re already no small matter.

It’s completely arguable that such volumes would never have been achieved if it hadn’t been for Facebook, which in becoming Meta has made the metaverse a battleground for companies wanting to dominate the future. And regardless of which companies do end up dominating the metaverse, it’s already clear that crypto will be the main winner.