- >News

- >Tether’s Paolo Ardoino: ‘USDT is 100% Backed and Paid For By Customers’

Tether’s Paolo Ardoino: ‘USDT is 100% Backed and Paid For By Customers’

Tether continues to generate headlines, nearly seven years after it was first launched. The company behind Tether is still the subject of a New York Attorney General investigation, while the ballooning of the USDT supply to over $30 billion in recent weeks has raised more than a few eyebrows. Skeptics and crypto critics remain convinced that USDT has been used to artificially pump the price of bitcoin and other cryptocurrencies, which is a claim that Tether has never been able to shake or disprove.

However, in an interview with CryptoVantage, Tether CTO Paolo Ardoino affirms that the USDT in circulation is “backed 100%” and that charges of market manipulation “are meritless” and contradicted by a number of studies. He also goes into some detail into the process of how — and why — new USDT is actually minted and issued, potentially helping to dispel some of the speculation that tethers are more or less plucked out of thin air.

Tether Says USDT Is Paid For By Its Customers

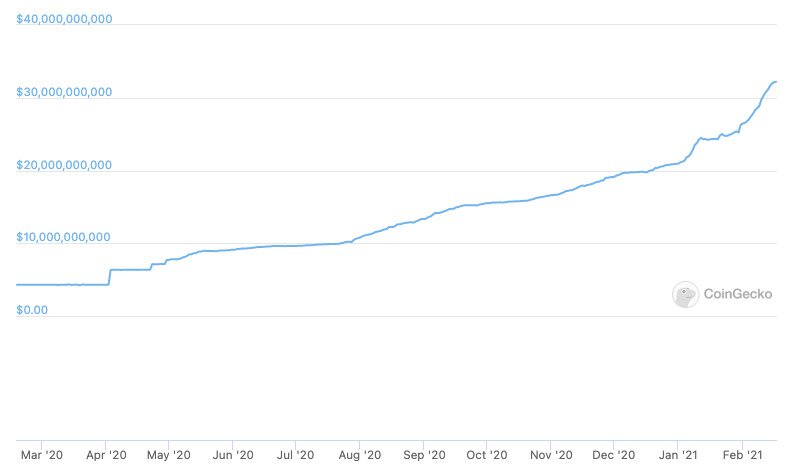

Eagle-eyed observers will be well aware that the total supply of USDT has risen from roughly $4.3 billion on February 18, 2020 to about $32 billion as of writing. This is a 644% increase, substantially more than bitcoin’s 400% rise over the same timeframe.

The supply of USDT as measured by its market cap. Source: CoinGecko

However, Tether’s chief technology officer Paolo Ardoino says there’s a simple reason for the increase in USDT’s supply: “Growing institutional interest has contributed to an increase in demand for new USDT, especially from OTC desks.”

More specifically, Ardoino explains that new USDT “enters circulation based on the amount demanded by and paid for by its customers.” In other words, new tethers are printed only when Tether receives a request from one of its customers, be it an exchange, broker or professional trader.

As for these customers, they need to undertake Tether’s “complete KYC process” and establish their identities, business types and sources of funds before the company will verify them and open a Tether account on their behalf.

Ardoino says, “Once verified, the user will first have to deposit fiat currency into Tether’s bank account,” assuming that this user wants to receive the corresponding amount of USDT.

“Tether will then credit the corresponding amount of USDT into the Tether wallet address provided by the user … Through this process, Tether ensures that all tether tokens are backed 100% by Tether’s reserves,” he adds.

While Ardoino provides no proof or documentation in support of this account, it would — if true — dispel fears that Tether is simply printing unbacked USDT and handing it over to exchanges or traders, who then go about buying bitcoin and other cryptocurrencies with billions of “fake unbacked dollars.”

Editor’s note: we have reached out to two major crypto-exchanges — one based in the US and one in Malta — to confirm Ardoino’s claim regarding fiat deposits, but have so far received no comment (we will update if and when replies arrive).

‘Meritless’ Studies of Price Manipulation

Such claims have haunted Tether since 2017, a year which culminated with bitcoin rising to a then-ATH of $19,783. They were first proposed by the likes of Bitfinex’ed and other bloggers, who drew attention (among other things) to Tether’s failure to undergo a full audit.

In 2018, online speculation was lent further weight by the publication of a peer-reviewed research paper. In it, authors from the University of Texas at Austin and Ohio State University concluded that large purchases with Tether are timed following downturns and result in significant bitcoin price increases.

In their conclusions, the authors wrote, “one large player on Bitfinex uses Tether to purchase large amounts of Bitcoin when prices are falling and following the printing of Tether. Such price supporting activities are successful, as Bitcoin prices rise following the periods of intervention.”

However, Tether strongly denies any such claims. “These allegations are meritless and based on flawed studies using cherry-picked data,” Ardoino tells me.

Ardoino notes that subsequent studies have largely contradicted the USDT-manipulation narrative.

“An academic study in 2018 found that USDT issuance cannot be an effective tool for moving bitcoin prices, while a 2020 study found no systemic evidence of stablecoin issuance driving digital token prices, as stablecoin issuance has been in response to market demand,” he says.

The first study in question, published in the Economics Letters journal, concluded that “we do not find any evidence suggesting that Tether issuances cause subsequent increases in Bitcoin returns.” On the other hand, its author concludes that USDT issuance does cause “subsequent increases in Bitcoin (and Tether) trading volume over the short term,” while he also acknowledged that his work “does not examine whether the newly issued Tether coins are indeed backed by US dollars or not.”

The second study — “Stablecoins don’t inflate crypto markets” — found “no systematic evidence that stable coin issuance affects cryptocurrency prices.” The same authors — who were funded by Ripple — have also published a similar study which found that the main use of USDT appears to be for arbitrage, which involves buying USDT from Tether at its peg and selling it for more than $1 on exchanges.

Such research suggests that, at the very worst, if USDT issuance does boost cryptocurrency prices, the effect may not be as large as some skeptics claim. Other research — such as a November 2020 paper published in Finance Research Letters — has suggested that “the demand for stablecoins is driven by short-term investor demand for cryptocurrencies,” and that price increases follow stablecoin issuance only in the sense of helping traders ‘buy the dip.’

The ‘Most Stable’ Genius Stablecoin

While Bitfinex lawyer Stuart Hoegner has recently suggested that Tether might soon undergo a full audit, it still hasn’t decisively proven that the supply of USDT is 100% backed by reserves.

Still, even with all the recent speculation surrounding USDT, Ardoino ultimately remains confident that the cryptocurrency will remain an important fixture of the cryptocurrency ecosystem for some time to come.

He says, “As the most stable, liquid and innovative stablecoin, USDT is pre-eminent and performs a pivotal role within the digital token ecosystem. We are seeing the Tetherization of trading, with many digital token spot exchanges now denominating pairs in USDT rather than in bitcoin.”