- >News

- >Tether Settles With the New York Attorney General for $18.5 Million

Tether Settles With the New York Attorney General for $18.5 Million

After nearly two years of subpoenas, documents and delays, the New York Attorney General’s investigative case into Tether has finally been settled. For a “penalty” of $18.5 million, the NYAG has closed its investigation into the stablecoin issuer, its parent company and the Bitfinex exchange, while Tether has agreed (among other things) to publish a breakdown of its reserves at least every quarter for a period of two years.

On the face of it, this is good news for the bitcoin and cryptocurrency market. Yes, the New York Attorney General did indeed find that Tether misrepresented its reserves between March 2017 and February 2019. However, the scale of misrepresentation arguably isn’t as damning as some critics have claimed, with Bitfinex holding a large portion of Tether’s reserves up until September 2017, and with Tether lending Bitfinex a total of $900 million by March 2019 to cover losses resulting from frozen bank accounts.

However, while the agreement to publish Tether’s reserves will theoretically lend some much-needed credibility and legitimacy to crypto, trouble will ensue if Tether fails to do this. And given that the supply of USDT has exploded by nearly 1,600% since the NYAG filed its initial court order against Tether on April 24, 2019, it still remains to be seen whether it can demonstrate that it’s “100% backed” by reserves.

13.8% Direct Backing, 100% Direct and Indirect Backing

First things first, while a penalty of $18.5 million is basically a slap on the wrist for a company that reportedly sits on reserves of some $34 billion, the New York Attorney General’s settlement agreement makes for worrying reading if you think Tether has always been spotlessly clean.

The first main finding of the NYAG is that, because Tether “did not have a significant bank relationship in its name from at least March 2017 until September 15, 2017,” the 442 million USDT in circulation (up until September 2017) was effectively only 13.8% backed.

Source: New York Attorney General

This looks bad, and longtime Tether critics such as author David Gerard have painted it as such. However, the NYAG found that the USDT in circulation up until September 2017 was in fact indirectly backed, with Bitfinex holding “approximately $382 million of Tether’s funds in a com[m]ingled account.”

Source: NYAG

According to David Gerard, commingling of funds is one of those “sure tells of both fraudulence and incompetence — a complete lack of internal controls.” This may be true, but Tether and Bitfinex are arguably a special case, since as the NYAG notes, their former bank Wells Fargo decided in March 2017 “to no longer process U.S. dollar wire transfers from Bitfinex and Tether accounts.”

This put Tether in the position of being unable to find a settled banking arrangement over the next few months, and ultimately Bitfinex was forced to hold around $382 million of Tether’s funds. Note that the NYAG concludes that these were “Tether’s funds,” and not funds taken from, say, Bitfinex’s customers, which would indeed be a sure tell-tale sign of fraud.

Bitfinex then transferred “Tether’s funds” — $382,446,847.71 — into an account with the Puerto Rico-based Noble Bank, an account which Tether opened for itself on September 15, 2017.

Given that $382 million added to $61 million equals $442 million, this would indicate that the 441 million USDT in circulation on September 15, 2017 (when Tether opened an account with Noble Bank) were, after all, 100% backed.

Source: CoinGecko

A History Of Misrepresentation, AKA Lies

But while the NYAG’s findings for the 2017 period exonerate Tether from allegations that it was printing virtual money out of thin air, its findings regarding the 2018-2019 are much less flattering.

Basically, Tether flat-out lied regarding its reserves, according to the NYAG. This stems from its relationship with Bitfinex.

Bitfinex had essentially lost $850 million of its funds (largely composed of customer deposits), because a bank it had been using — the Panama-based Crypto Capital — had had its accounts in Poland and Portugal frozen. As a result, Tether lent Bitfinex at least $625 million from its reserves, doing so in November 2018 (when the USDT supply was around 2 billion).

The NYAG also finds that Tether was indeed still claiming that USDT was 100% backed at this time, despite transferring such a substantial sum to Bitfinex. The agreement states, “Tether updated its website to note that “[e]very tether is always 100% backed by our reserves.” It also states that at “no time did Bitfinex or Tether disclose to the market that Tether had transferred at least $625 million to Bitfinex.”

It’s this misrepresentation which is the crux of the NYAG’s case, and it’s ultimately why Tether and Bitfinex have settled for $18.5 million, despite the NYAG’s acknowledgment that, officially, “Bitfinex and Tether neither admit nor deny the OAG’s findings.”

Even if they neither admit nor deny the findings, the mere fact of settling would indicate that they don’t fancy their chances in court. More generally, the fact that Tether didn’t disclose its loan to Bitfinex is concerning, insinuating that, having lied once, Tether continues to lie now.

But What About Bitcoin?

Nonetheless, the fact remains that the NYAG didn’t find evidence of the large-scale production of unbacked USDT. Yes, Tether didn’t have its own bank account for several months in 2017, but during this period related entities held the reserves needed to back the then-current supply of USDT.

This is encouraging news for bitcoin, which has long been harassed by the suggestion that much of its price can be accounted for by “fake unbacked dollars.” When news of the settlement broke, bitcoin’s price recovered from a drop down to $45,600, and now stands (as of writing) at around $50,000.

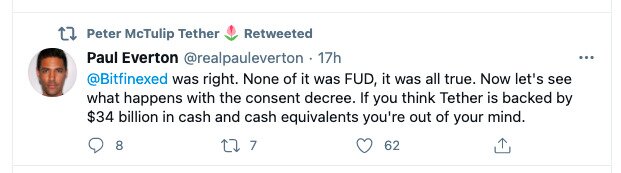

Source: Twitter

As part of the settlement agreement, Tether has agreed to publish full breakdowns of its reserves at least every quarter. This, again, is good news for bitcoin and crypto on the face of it, since the regular publication of Tether’s reserves will provide the market with reassurance, while also helping to improve crypto’s reputation in the eyes of the wider public.

Source: NYAG

The thing is, even though Tether continues to claim that the supply of USDT is “100% backed” by its reserves, it’s still an open question as to whether it can make good on its agreement and actually follow through with quarterly publication.

Given that the NYAG found no evidence of printing unbacked dollars for the period it investigated (from 2017 to early 2019), it’s possible that Tether can do this. However, it has been on something of a USDT printing spree since the NYAG opened its case in April 2019.

In April 2019, there were roughly 2 billion tethers, while now there are 34 billion. This is a 1,600% increase, something which has drawn plenty of attention from Tether’s critics.

Source: Twitter

As David Gerard notes in his blog piece on the settlement news, Tether is now in a position where it “has to do stuff in an orderly way, that [it has] been utterly unable to do so far.” It (still) hasn’t undergone a full audit, although now it will essentially have to undergo an audit every three months.

If it doesn’t, the NYAG writes in the agreement that it “may initiate a subsequent investigation, civil action, or proceeding to enforce this Settlement Agreement.”

As such, if Tether is actually unbacked — and the NYAG’s investigation offers no evidence either way as to Tether’s reserves post-April 2019 — it has succeeded only in kicking the can further down the road. If it’s not sufficiently backed, it will fail to satisfactorily publish its reserves, and the NYAG will come after it again.

There’s little doubt this will be bad for bitcoin and crypto, at least in the short-to-medium term. So let’s hope it doesn’t happen.