- >News

- >Social Data Reveals A Strong Base of Public Interest in Crypto, Despite a Decline in Growth

Social Data Reveals A Strong Base of Public Interest in Crypto, Despite a Decline in Growth

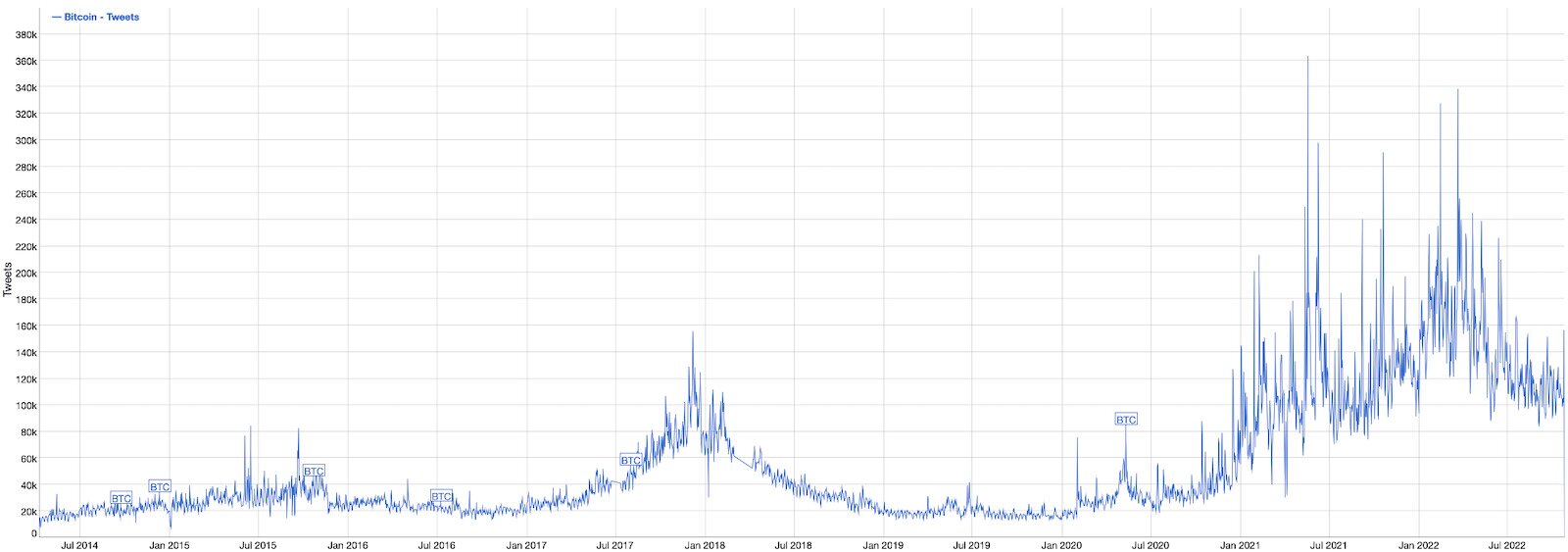

Crypto may still be in a bear market, but that doesn’t mean people have stopped talking about it. In fact, the latest data from BitInfoCharts shows that tweets mentioning Bitcoin are higher than they’ve been at any point in the cryptocurrency’s 13-year history. Much the same goes for Ethereum, which is also seeing average tweets per day at considerably higher levels than during the last bear market (in 2019) and even during the 2017-18 bull market.

What such data reveals is that, despite the lull in prices, the cryptocurrency market and wider industry remains large. Its size and activity levels continue to be such that, should macroeconomic conditions pick up once again, it will rise strongly. Indeed, this was more or less confirmed this past week, with the likes of bitcoin and ethereum witnessing jumps of 7% and 14% (respectively) in 24 hours, solely because some major multinationals were expected to post positive earnings reports.

However, a wider survey of the available social data reveals that interest from retail investors is still relatively low overall, and may in fact be declining as the bear market continues. As such, there’s likely no immediate end to the downturn on the horizon, even if strong activity on Crypto Twitter paints a different picture.

Crypto Twitter vs. Google

The data from Twitter shows that, compared to previous years, there are more mentions of Bitcoin, Ethereum and other major cryptocurrencies.

As of writing, Bitcoin attracts around 156,000 tweets per day. While this figure is dwarfed by peaks witnessed in 2021 (e.g. there are several days where tweets per day passed 300,000), it has consistently been above 100,000 this year, despite the bear market.

Tweets per day mentioning Bitcoin. Source: BitInfoCharts

By contrast, the famous late-2017 bull market saw tweets per day pass 150,000 on only one occasion, with most other days in December (when BTC set a then-record high) seeing fewer than 100,000 tweets. Such figures then fell well below 50,000 (even consistently below 20,000) for much of 2019, while they were often below 20,000 for most of 2017.

The point here is that, even with a gradual decline in activity over the course of 2022, the bigger, long-term picture remains highly positive. Interest in Bitcoin (and by extension, in crypto) remains high relative to other periods, providing the market with a good launchpad for when conditions become more favorable.

That said, we should be careful not to read too much into Twitter data. Yes, it is a ‘social’ network, but it’s one dominated by professional accounts that tend to be responsible for the lion’s share of content, with one report finding that 10% of users account for 80% of tweets. In other words, more mentions of Bitcoin (and other cryptocurrencies) may simply be an indicator of an increase in professional or semi-professional profiles that focus on crypto, rather than an indicator of high(er) public interest.

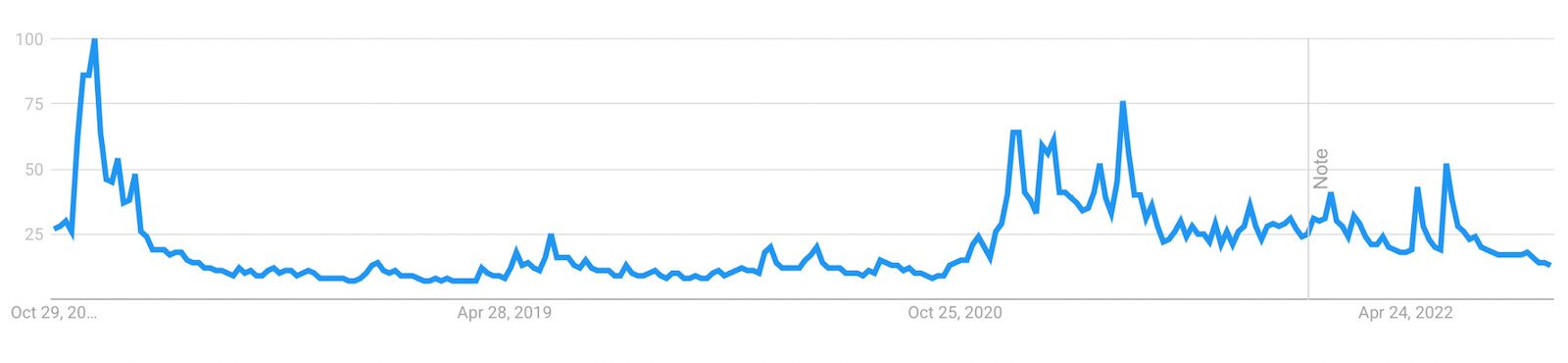

Put differently again, they show that the industry itself remains large, rather than anything else. This is a claim supported by Google Trends data, which in contrast to the Twitter data, shows that fewer members of the public have been searching for ‘Bitcoin’ and other cryptocurrencies this year, when compared to previous periods.

Looking at searches for ‘Bitcoin,’ the current volume remains low in historical terms. Peak interest in the cryptocurrency was evident in December 2017, when volume topped 100 (out of 100). By contrast, the latest figure is 13, suggesting that the public’s interest in Bitcoin isn’t particularly high right now.

Worldwide search volume for ‘bitcoin’ over the past five years. Source: Google

Even worse, zooming in on the current year shows that search volume has declined over the past 12 months, as declining prices have further dampened wider interest. Having started the year with a volume of 48, relative interest rose to 84 in May and then 100 in July, before declining steadily over the following months to 24.

It’s a similar story for Ethereum and other major tokens, which has also seen a steady decline across 2022, even with its successful Merge. This confirms the view that wider public interest has declined this year and is still declining.

Bitcoin’s price over the past 12 months. Source: CoinGecko

Of course, it needs to be emphasized that what the public is losing ‘interest’ in is not so much cryptocurrency itself, but rather declining prices. If you look at the price chart for bitcoin or ethereum (or pretty much any other major crypto), you’ll see another gradual decline over time.

This implies that the public’s interest in crypto will revive again once macroeconomic conditions recover and prices rebound. And it’s likely that the public will indeed follow prices (and not the other way around), since the market is now set up for institutions to lead the way with the next bull run.

Other Indicators of Social Sentiment

Twitter and Google data aren’t the only sources of info on sentiment. One other very key metric of how the public perceives crypto is provided by ownership data, which has been growing for most countries in the past few years.

As compiled by Statista, all major crypto-owning nations witnessed a growth in ownership (in percentage terms) between 2021 and 2022.

Cryptocurrency ownership by country. Source: Statista

This is a highly encouraging statistic. While the Google search data implies that fewer new people are seeking out cryptocurrency (i.e. that the rate of increase is currently declining), existing owners are staying put, with overall ownership levels continuing to inch steadily upwards. As the table above shows, the biggest jump in ownership came in 2021 (with its bull market), yet crypto continues to steadily accumulate more owners even now.

Again, as with the Twitter data, this highlights how the cryptocurrency market remains in a strong position. Yes, it’s not making headlines with new all-time highs and record trading volume, but its current size provides it with an ideal foundation to begin growing again strongly under more positive economic conditions.

Of course, the million-dollar question is when such conditions will arrive. With inflation still high in most developed countries and with most central banks threatening more rate hikes, the cryptocurrency market may continue to weather bearish sentiment for at least several months yet (particularly when the Ukraine-Russia war still rages on).

This means we may continue to see public interest in crypto (as measured in particular by Google data) continue to drip downwards in the coming months. However, with the market having a strong base of pre-existing owners and holders, it has every chance of rebounding strongly when sentiment becomes more bullish.