- >News

- >SEC Wages War on Binance, Coinbase But BlackRock Might Flip Crypto Bullish

SEC Wages War on Binance, Coinbase But BlackRock Might Flip Crypto Bullish

If there were any doubt that the Securities and Exchange Commission is on a mission to cut the US cryptocurrency industry down to size, it was dispelled at the beginning of June. The reason? The SEC sued Binance and then Coinbase in quick succession, charging both exchanges with offering unregistered securities to American investors, among other alleged offenses.

The effect on the market was immediate and pretty dramatic, with the bitcoin (BTC) price falling from about $27,000 at the start of June to $25,000 by the 15th of the month, with investors spooked by the SEC’s aggressive actions. But the situation was even worse for altcoins, many of which were actually identified as unregistered securities by the regulator in its legal filings. As a result, market makers and investors in general pulled liquidity out of altcoin markets, with many major alts (e.g. Cardano, Solana and Polygon) down by 30% or more since the SEC moved into gear.

To date, the SEC has actually classified 69 cryptocurrencies as securities in its various legal actions, and for many figures within the cryptocurrency industry, such a sweeping move is evidence that the regulator is attempting to “destroy” crypto (at least in the United States). While it’s hard to deny the SEC is attempting to restrict certain parts of the US cryptocurrency industry in their current form, it would be premature to conclude that it’s going to succeed. Because not only is Ripple successfully fighting back against the claim that most cryptocurrencies aren’t securities, but the recent news of BlackRock’s Bitcoin ETF shows that the US financial industry has an interest in seeing crypto expand.

SEC Sues Binance and Coinbase: Why?

The SEC filed its legal action against Binance on June 5, alleging 13 charges against the world’s biggest cryptocurrency exchange, its US subsidiary and its founder, Changpeng ‘CZ’ Zhao. Aside from the sale of unregistered securities, these charges include the operating of unregistered exchanges, broker-dealers and clearing agencies, as well as manipulative trading (in order to inflate platform volumes) and the misrepresentation of the trading controls and oversight used on Binance.US.

Perhaps most alarmingly, the SEC claimed that Zhao and Binance often took control of their customers’ assets, enabling them to commingle or divert customer cryptocurrencies “as they please.” The text of the full complaint against Binance expands on this, alleging that customer funds were “subsequently transferred to a third party apparently in connection with the purchase and sale of crypto assets.”

These charges largely mirror those previously leveled against Binance by the CFTC, which in March sued the platform for operating an illegal digital asset derivatives exchange. As with the CFTC, the SEC is also seeking similar penalties against Binance, including disgorgement of ill-gotten gains and prohibitions against operating an exchange in the US.

Summing up their claims against the exchange, Gurbir S. Grewal — the Director of the SEC’s Division of Enforcement — said, “We allege that Zhao and the Binance entities not only knew the rules of the road, but they also consciously chose to evade them and put their customers and investors at risk – all in an effort to maximize their own profits. By engaging in multiple unregistered offerings and also failing to register while at the same time combining the functions of exchanges, brokers, dealers, and clearing agencies, the Binance platforms under Zhao’s control imposed outsized risks and conflicts of interest on investors.”

As noted above, the filing of these charges had an immediate impact on the market, yet things were to get even worse on the very next day, with the SEC filing similar charges against Coinbase. The regulator also accused the latter of operating an unregistered securities exchange, broker and clearing agency, while also charging the exchange in relation to its staking-as-a-service program.

While the SEC’s charges against Coinbase aren’t as damning, their arrival 24 hours after Binance’s charges introduced a sense of panic into the cryptocurrency market. More than a few commentators presented the two sets of complaints as a coordinated attack on crypto, with Republican Senator Bill Hagerty tweeting that the regulator is “weaponizing” its role in order “to kill an industry.”

Source: Twitter

Implications for Altcoins… and Ethereum

While the SEC’s complaints against Binance also include charges related to misrepresenting trading controls and commingling user funds, the heart of both actions involves the very thorny question of which cryptocurrencies are and are not securities. And for the regulator, it would seem that a large number are.

This includes such major tokens as Cardano (ADA), Solana (SOL), Polygon (MATIC), Cosmos (ATOM), NEAR Protocol (NEAR), Binance Coin (BNB), Filecoin (FIL), and Algorand (ALGO). Predictably enough, all of these suffered bigger-than-average falls in the wake of the SEC’s filings, with the fear being that US-serving exchanges would rush to remove them from their platforms.

This was indeed the case for US-based trading app Robinhood, which delisted Cardano, Solana and Matic in response to the SEC’s actions. This sets a dangerous precedent for the rest of the US cryptocurrency industry, while it almost goes without saying that, if the SEC wins its cases against Coinbase and Binance, American exchanges will almost certainly be forced to delist the altcoins the regulator classifieds as securities.

One interesting omission from the SEC’s case files is Ethereum, which was not named as a security by the regulator. At first glance, this would seem to put ETH in the clear, especially when the SEC already has a history of regarding the altcoin as not a security. However, there are a couple of points in the regulator’s complaints which would suggest that, at some point, it may come after Ethereum too.

Firstly, the SEC takes issue with a couple of altcoins — in particular, Solana and Polygon — for having a burn mechanism. In the regulator’s view, the intentional burning/destruction of coins creates an expectation of profit among investors, which is one of the conditions needed to satisfy the infamous Howey test. As such, if the two altcoins mentioned above are securities because of having a burn mechanism, then so too must Ethereum, which introduced fee burning via the EIP 1559 update of 2021. This has been pointed out by numerous commentators, as illustrated in the tweet below.

Source: Twitter

Secondly, the SEC also charged Coinbase with securities violations for its Ethereum staking-as-a-service offering. So if the regulator’s charges are upheld, they would prevent other exchanges in the US from offering similar services, substantially reducing the number of ETH holders who stake their tokens.

Given that the SEC has already successfully stopped Kraken from offering a similar service for ETH, there’s a pretty good chance that it will succeed on this front.

The Industry Fights Back

But as gloomy as things currently seem for the market, the industry isn’t going to let the SEC win without a fight. Coinbase, for one, seems ready and more than willing to defend itself in court, with CEO and co-founder Brian Armstrong posting a confident tweet in response to the SEC’s charges. In particular, he pointed out the fact that there’s no clear way for cryptocurrency exchanges to register with the SEC, while he also underlined how the securities regulator and the CFTC have often produced conflicting statements on what is or isn’t a security, meaning that industry players haven’t received clear guidance up until now.

While Binance’s case is a little more complicated, Coinbase arguably has a strong basis for defending itself against charges of trading unregistered securities. This is evidenced by the ongoing Ripple case, which has taken a turn for the positive in recent weeks. In particular, documents and emails were released pertaining to a 2018 speech given by William Hinman, who at that time was the SEC’s Director of the Division of Corporation Finance. In this speech, Hinman famously declared that Bitcoin and also Ethereum were not securities.

Ripple sought access to emails and docs related to this speech in order to clarify the SEC’s position on securities law in relation to cryptocurrencies. And when these emails were released, they revealed that the SEC itself had internally acknowledged that Hinman’s speech may actually confuse the issue of which cryptocurrencies are securities, while discussion also suggested that the regulator knew securities laws are incomplete as they stand in relation to cryptocurrencies.

While the release of these emails won’t be enough on their own to secure a positive outcome for Ripple, they at least show how the SEC filing charges against cryptocurrency firms doesn’t necessarily mean the SEC is going to win. And if Ripple does receive a positive summary judgment or settlement, it could really pave the way for Coinbase to triumph against the securities regulator in its turn.

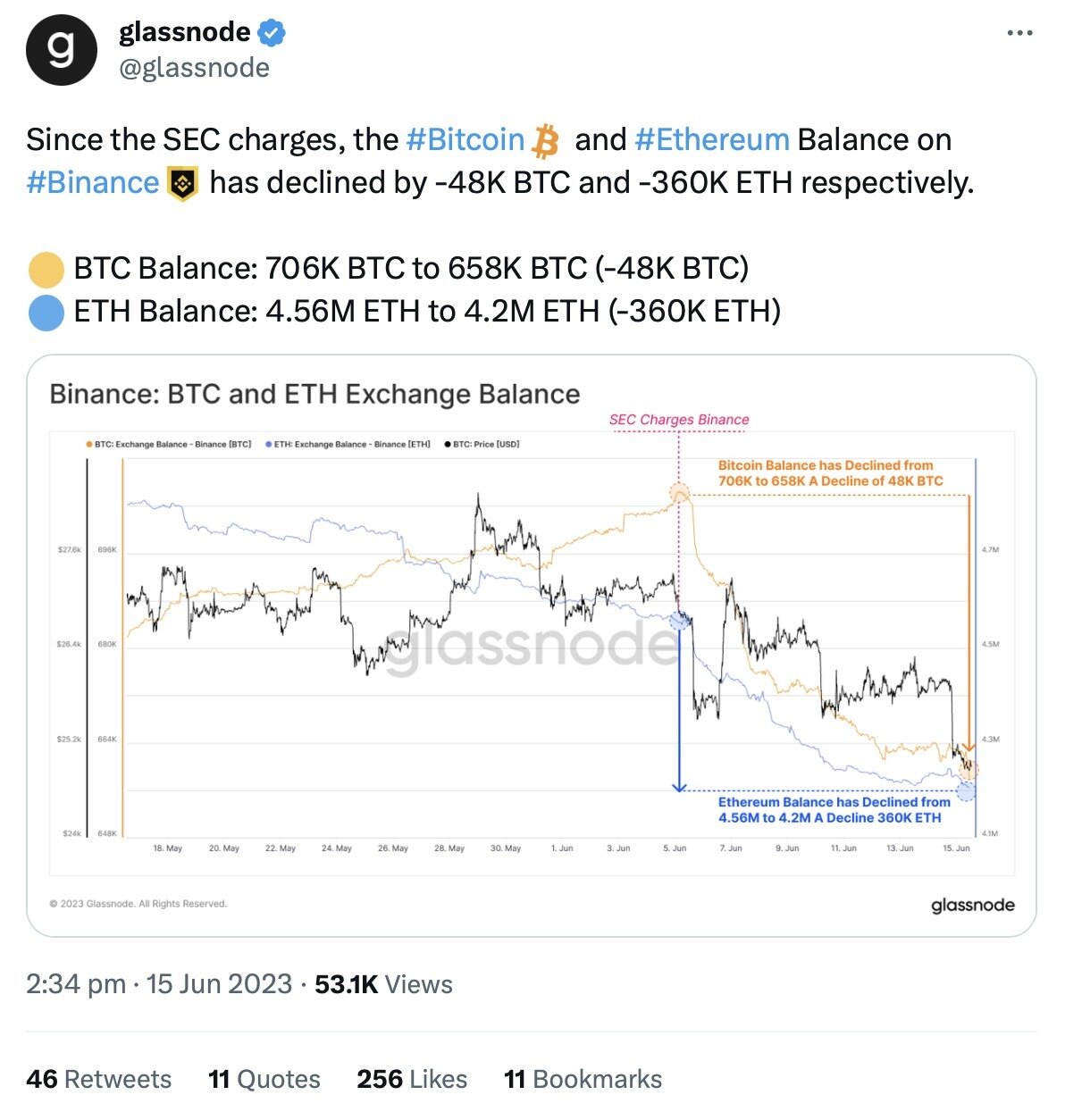

As such, things may not be as bad as they currently seem. On the other hand, this analysis can’t quite be applied to Binance, which is also facing additional charges related to a lack of oversight, market manipulation and commingling of user funds. Indeed, Binance appears to have been hit harder than Coinbase since the SEC filed its recent actions, with data showing that some 48,000 BTC and 360,000 ETH had been withdrawn from Binance since early June. It has, however, reached an agreement with the SEC whereby its US subsidiary (Binance.US) will keep control of its customers’ assets, enabling it to continue until the case is resolved.

Source: Twitter

Finally, it’s also worth pointing out that this latest SEC gambit happens at a time of steadily growing adoption of and interest in crypto, despite the ongoing bear market. For instance, no sooner had the regulator filed its charges against Binance and Coinbase than major asset manager BlackRock — which has around $8.59 trillion in AUM — filed to launch its own Bitcoin ETF. While the SEC has rejected all spot Bitcoin ETFs up until now, some have suggested that BlackRock’s application will be helped by the fact that it has entered into a surveillance-sharing agreement with Nasdaq, meaning that its ETF (if approved) will be more transparent and more resistant to manipulation.

If that weren’t enough, Germany’s biggest bank (Deutsche) has applied for a digital asset license, so that it can open its own cryptocurrency custody service. Combined with BlackRock’s application and previous entries from other banks, this kind of development shows that crypto still has a future, despite the SEC’s attempts to reduce the kind of cryptocurrencies and crypto-related services that can be offered in the United States.

All of which means that, when the dust settles on the SEC’s attacks, crypto will be in a very good position to grow once again. And with the latest Bitcoin halving due next year, 2024 may end up being as good for the cryptocurrency market as 2023 was bad.