- >News

- >Report: Bitcoin Price Increasingly Buoyed by Institutional Investors

Report: Bitcoin Price Increasingly Buoyed by Institutional Investors

Bitcoin’s price is increasingly being held up and determined by investors, new research suggests. Data collected by analytics firm The TIE shows that bitcoin is trading at an all-time high relative to its social media activity, indicating that recent increases and movements in bitcoin price aren’t coming from retail investors.

At the same time, other recent data and research also reveals an influx of institutional investors into the bitcoin market. From a growth in the realized cap of bitcoin to the expansion in bitcoin trusts, most available info suggests that institutions are gradually increasing their exposure to bitcoin, particularly as the coronavirus pandemic and economic fallout continues.

This is very good news for Bitcoin. Not only will institutional interest help push the bitcoin price higher in the long run, but it will serve to provide the cryptocurrency with greater mainstream legitimacy. In turn, we will eventually see more retail investors trade bitcoin, and more overall adoption.

Bitcoin Price And New Traders

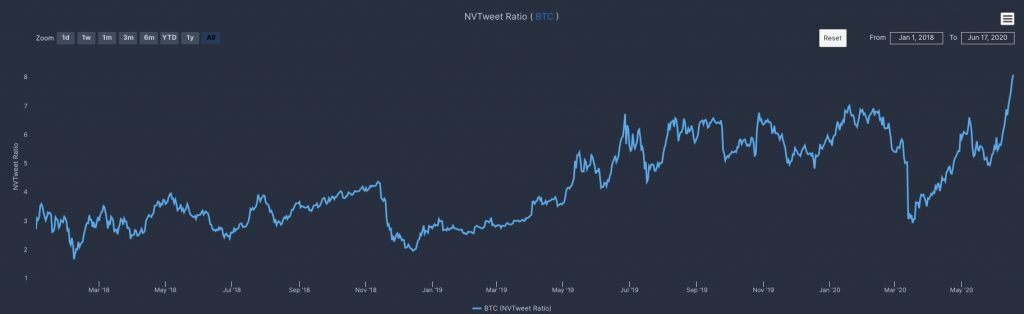

Last week, New York-based crypto research company The TIE posted a chart indicating that bitcoin “is trading at an all-time high relative to its social activity.”

Source: Twitter/The TIE

What the above chart measures is bitcoin price relative to tweets about bitcoin. Basically, the price of bitcoin has risen ahead of social media activity since the end of May. According to The TIE, this “may suggest BTC is now more driven by institutional trading as market cap is increasing faster than social volume.”

On its own, such a ratio may not be the most reliable indicator of institutional interest in bitcoin. However, other sources of data support The TIE’s interpretation of what’s currently happening in the bitcoin market.

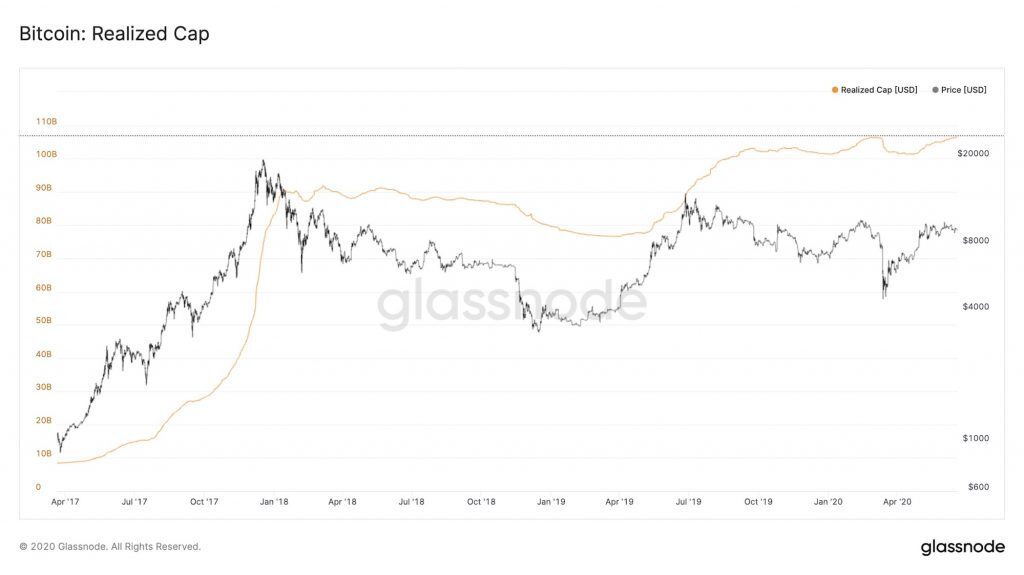

Also last week, Glassnode published data showing that bitcoin’s realized cap has also hit an all-time high. Compared to total market cap, what realized cap measures is the price at which all bitcoins were last traded. In other words, if the vast majority of mined bitcoins last moved back when the price was $1 (in 2011), then the realized cap would be very low. Conversely, if most bitcoins moved recently, when the price was hovering close to $10,000, the realized cap would be much higher.

Source: Glassnode

This is exactly what Glassnode found. Bitcoin’s realized cap is now $106.63 billion, passing the previous record set in March. Put simply, more bitcoin is being traded, suggesting that new traders are entering the market.

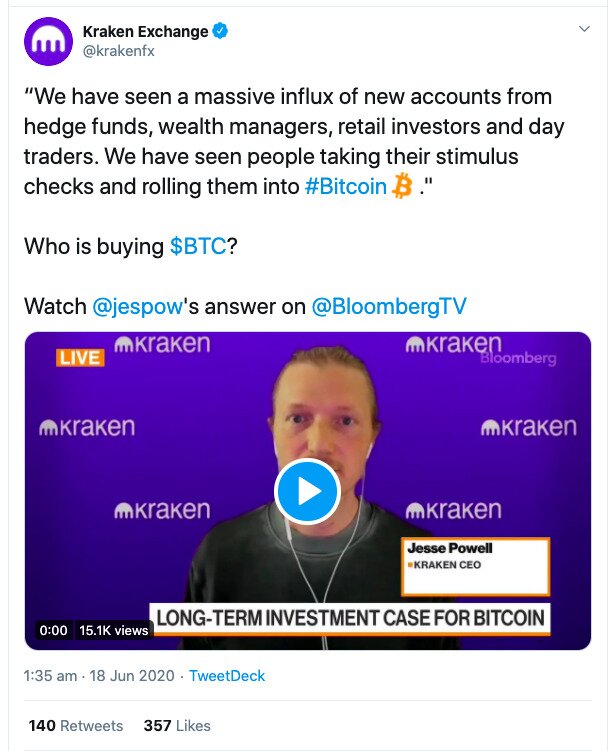

Of course, new traders may not necessarily be institutional traders. However, testimony from exchanges themselves indicate that many of the new bitcoin investors are indeed institutional. This is exactly what Kraken CEO Jesse Powell told Bloomberg last week.

Source: Twitter

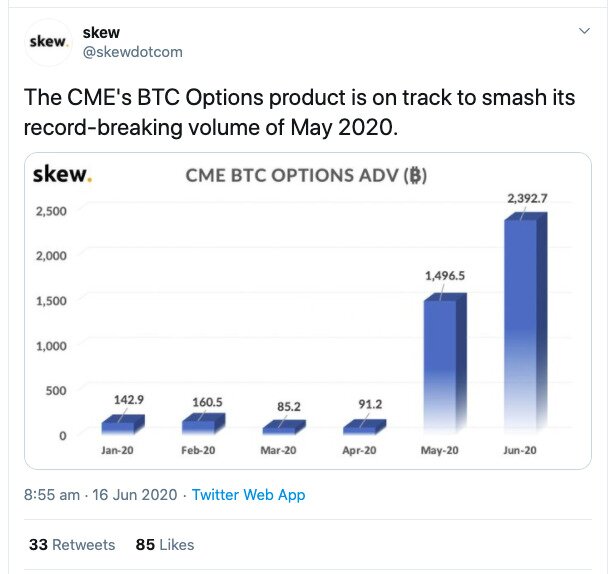

Likewise, CME Group has reported record-breaking bitcoin options interest in June, even breaking the records set in May around the Bitcoin halving. What’s significant about this is that CME tends to be favored more by institutions rather than retail investors, so it’s another sign of growing interest from the world of ‘traditional’ finance.

Source: Twitter

In fact, CME’s bitcoin options increased tenfold between May 11 and June 10, rising to $373 million from $35 million.

Similar growth has been observed in bitcoin futures interest for Bakkt, Bitfinex, Kraken, and FTX. Taken together, such movements indicate steadily rising institutional interest in bitcoin. Again, this is backed up by other data, with Fidelity Digital Assets’ 2020 Institutional Investors Digital Assets Survey finding that 58% of American institutional investors have a positive or neutral attitude towards digital assets, up from 43% last year.

New Institutional Bitcoin Services

New services for institutional investors are being launched to capitalize on this encouraging trend. In turn, they’re helping to accelerate it, by providing institutions with a means to see for themselves that they can profit from bitcoin.

For instance, Grayscale Investments launched a bitcoin fund in January. Aimed squarely at institutional investors, it has expanded considerably in recent months. Since May 11, it has purchased bitcoin equivalent to 150% of the total mined since the halving. It’s slowly eating up the market, driven by growing demand from institutional customers.

Unsurprisingly, other funds have been launched in recent months in order to tap into the same institutional markets. Custody firm BitGo launched an institutional trading service at the end of May, while investment management firm Wilshire Phoenix is planning to launch a bitcoin fund as soon as it gains permission from the Securities and Exchange Commission.

It would seem that, with the global economy still in a precarious situation, a growing number of institutions are beginning to view bitcoin as a hedge against risk and inflation. Veteran hedge fund manager Paul Tudor Jones admitted in May that 2% of his assets are in bitcoin, and it’s now likely that others are turning around to his point of view.

But what are the implications for increasing institutional interest in bitcoin? Well, firstly, it has kept the bitcoin price up. Even though social media activity – and also trading volumes – are currently down, the added demand from institutions is keeping the bitcoin price afloat. If and when the market heats up in the coming months, this demand will help the price of bitcoin rise higher still.

In parallel, the more the general public hears about institutions and ‘experts’ entering the bitcoin market, the more it will be willing to do the same. And with more retail and institutional investors, the bitcoin price can really only move in one direction over the long term.