- >News

- >One Year Later, Is El Salvador’s Experiment With Bitcoin a Failure?

One Year Later, Is El Salvador’s Experiment With Bitcoin a Failure?

El Salvador stunned much of the world in June 2021 when it announced it would make bitcoin legal tender, with crypto skeptics expressing a mix of disbelief and surprise at the time. Even some of crypto’s supporters were slightly ambivalent about the move, despite the more bullish among them heralding it as an important step on Bitcoin’s road towards world domination.

On September 7 of that same year, bitcoin did officially become legal tender, with the El Salvadoran government distributing $30 in BTC to every resident who downloaded its official app (named Chivo) for crypto payments. Even at the time, there were reports of technical difficulties in receiving and/or sending the $30 in BTC, and with the government accumulating 2,381 bitcoin itself since September 2021, it has suffered losses on its investments.

However, while there hasn’t been much in the way of massive public uptake of bitcoin payments, this doesn’t necessarily mean that El Salvador’s Bitcoin experiment has failed. It remains in a very early stage, and with crypto witnessing a bear market for more or less the entire duration since El Salvador made bitcoin legal tender, a new bull market could spark public enthusiasm for the cryptocurrency.

Was El Salvador’s Bitcoin Gamble a Good Investment?

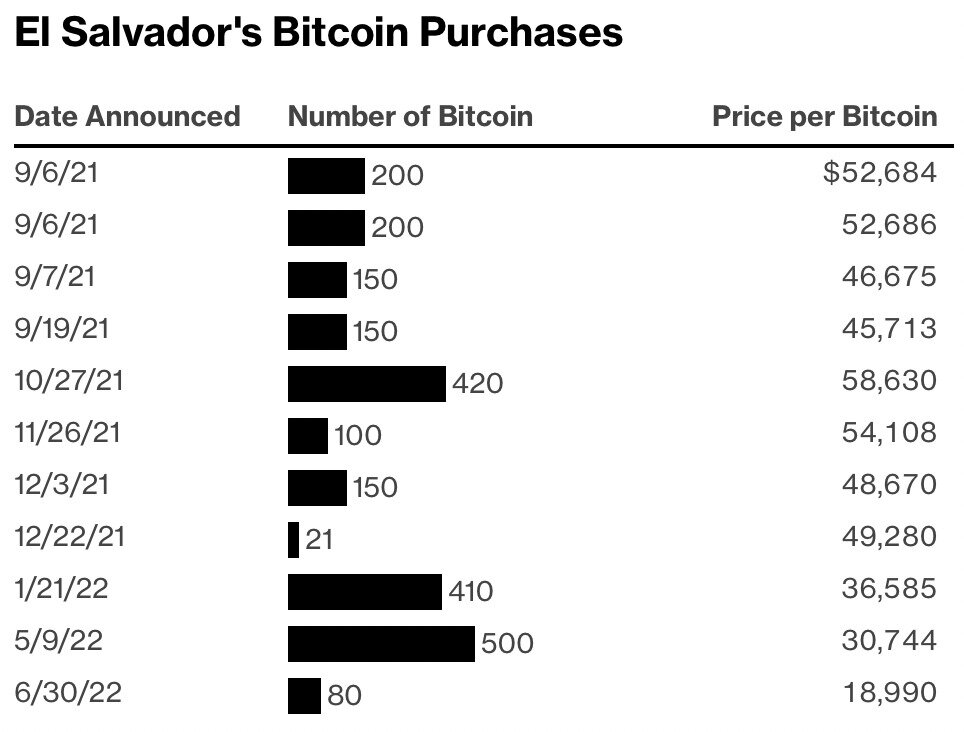

In purely investment terms, El Salvador’s dabbling in the bitcoin market has been a failure, at least given prices today. As the table below shows, its government now holds around 2,381 BTC, the vast majority of which was purchased at prices above bitcoin’s current level.

El Salvador’s purchases of bitcoin to date. Source: Bloomberg

This data reveals that the El Salvadoran government has made a loss of 54.6%, since the total cost of purchasing the bitcoin above was around $106.3 million, while it’s now worth only $48.2 million (as of writing).

This is disappointing for the government not only because it has lost money, but because it had various ambitions from the expected profit of investing in bitcoin. For instance, it had outlined hugely optimistic plans to build a city with the proceeds of a government bond sale and its (hoped-for) bitcoin profits. Aside from the release of a scale model of this city in May, not much has been heard about its development since its original proposal in November 2021.

Likewise, bitcoin’s rise to its current all-time high of $69,044 had emboldened the government to promise to build 20 new schools. Again, nothing has been heard of this school-building plan since November, which isn’t entirely surprising, since the government has less wealth than it started out with before accumulating BTC.

Speaking of wealth, El Salvador has total outstanding debt of around $24 billion, while it’s obligated to repay a sovereign bond debt of $800 million in January. This latter obligation could potentially cause the country to default, particularly when the International Monetary Fund has refused to provide further financing, in part because of its distaste for El Salvador having made bitcoin legal tender.

What El Salvadorans Think About Crypto

While it’s clear that the government hasn’t done too great out of making bitcoin legal tender, it also seems that, one year on, the El Salvadoran public still isn’t particularly enthused about cryptocurrency.

There were protests against the legal tender move around the time it originally happened, and reports indicate that the general population aren’t really using bitcoin. This includes businesses, with the number of merchants accepting bitcoin — despite it being legal tender — being very low, and even falling.

“Now I no longer receive payments in Bitcoin, what’s more, people don’t even ask about it anymore, the truth is it’s not profitable,” said business owner Milton Alexander, speaking to local outlet Elsalvador.com in June.

The same news outlet also reports that $3.15 billion in remittances were sent to El Salvador in the 12 months to this May, an increase of $118 million compared to the previous year. $52 million of this increase came through the Chivo app, although the government hasn’t divulged how much of this was in bitcoin, and how much in dollars.

While other reports suggest very low uptake of bitcoin among locals in El Salvador, there are at least some indications that making BTC legal tender has resulted in an increase in tourists. In fact, El Salvador’s minister for tourism Morena Valdez has claimed that bitcoin adoption was responsible for a 30% increase in visitors, although this is a government claim, with a Washington Post article from July suggesting largely the opposite.

The Jury is Still Out on BTC in El Salvador

Such accounts are all pretty deflating for anyone who thought El Salvador’s embrace of bitcoin would initiate a boom in cryptocurrency adoption. Still, it needs to be argued that one year is hardly sufficient for a significant increase in adoption of a novel technology, particularly when such adoption is so heavily tied to the volatile movements of a market.

In other words, we have told a different story if the bull market of late 2020 and 2021 had continued into 2022. As things stand, bitcoin declined significantly in value from November 2021 until the present day, so it’s perhaps hardly a shock that few people in El Salvador are keen on using the Chivo wallet app or using bitcoin themselves. If the bitcoin market were to reenter a bull market at the end of this year or the next, things may begin looking very different.

It also needs to be said that El Salvador is hardly an indicative test case for what the developed world may look like if bitcoin became legal tender in numerous advanced economies. Only around half of El Salvadorans have internet access as of 2020, while only 29% have access to a bank account. These are hardly ideal conditions for a sudden expansion in bitcoin ownership and usage.

Nonetheless, bitcoin does remain legal tender in El Salvador, and if we remain true believers in another bull market, then the Latin American country will sooner or later be rewarded for its gamble. And if it does make a profit from its bitcoin holdings, it wouldn’t be surprising if more locals began turning to the cryptocurrency themselves.