- >News

- >New Data Shows Crypto Crash Isn’t As Bad as Previous Downturns

New Data Shows Crypto Crash Isn’t As Bad as Previous Downturns

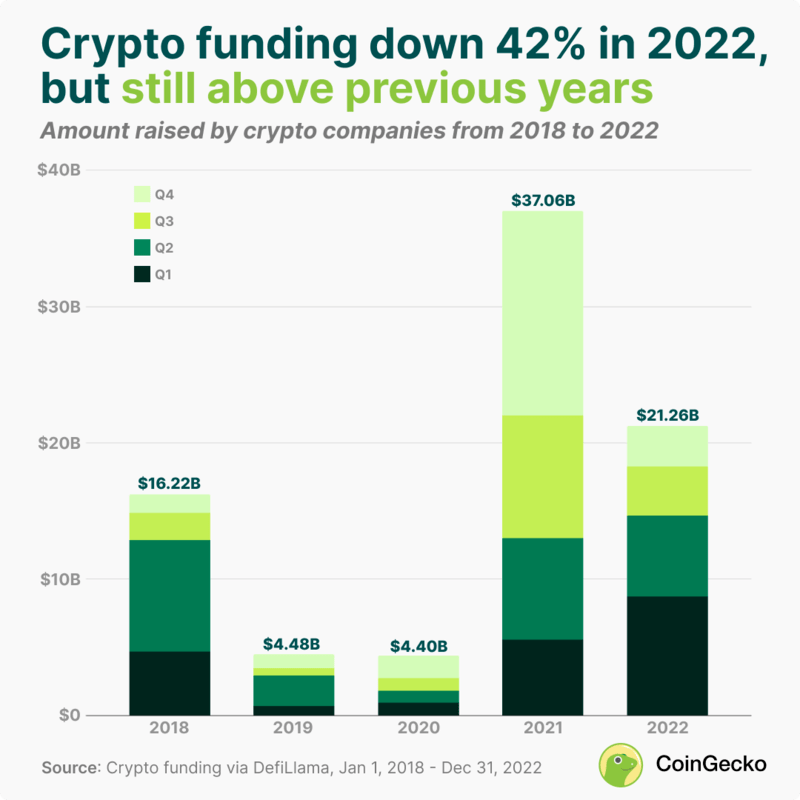

Venture capital funding for projects in the cryptocurrency industry topped $21 billion in 2022, surpassing all other years on record besides 2021. According to new data compiled by CoinGecko, there was a gradual quarter-by-quarter decline in funding as the 2022 crypto crash worsened, yet the year’s total was actually 84% of the total amount raised in 2018, 2019 and 2020 combined. If nothing else, this suggests that the ongoing bear market is not actually as bad as it’s often portrayed, and that it’s arguably much milder than previous declines, even with the FTX collapse and other similar bankruptcies.

Not only does the latest funding data reveal an ongoing interest in crypto from the wider global economy, but so too does other data and recent news. From NFT adoption by fashion brands to banks opening crypto services and central banks piloting CBDCs, there’s no shortage of evidence to indicate that crypto continues to grow. And by extension, it indicates that when the next bull market comes around, it could be even bigger than previous cycles.

Crypto Funding Continues Despite 2022 Crypto Crash

2022 started off promisingly, with its first quarter raising $8.7 billion, the third-highest amount in crypto’s short history, behind Q3 2021 and Q4 2021. Its second quarter was also pretty good at $5.9 billion, making it crypto’s fifth-biggest quarter for VC funding.

Chart showing funding raised per year since 2018. Source: CoinGecko

Of course, things went downhill from there, soured by Terra’s collapse in May, worsening macroeconomic troubles and then FTX’s bankruptcy in November. The thing is, as disappointing as Q3 and Q4 2022 were from a funding standpoint, they still each raised more than every quarter in 2019 and 2020, as well as more than Q3 and Q4 2018.

So even if 2022 raised 42% less money for crypto projects than 2021, it was still a strong year relative to crypto’s history, despite last year’s bear market. This testifies to how big the industry has already become, and to how big it could become in the not-too distant future.

In fact, even after the FTX and BlockFi bankruptcies, various cryptocurrency firms continue to raise fresh funding even now. Here are only a few examples from the past couple of months:

-

Social NFT platform Revel raised $7.8 million from Dragonfly Capital.

-

Trading firm Amber raised $300 million in mid-December from Fenbushi Capital US and other investors.

-

Market maker/liquidity provider Keyrock raised $72 million in early December from Ripple, SIX Fintech Ventures and Middlegame Ventures.

-

‘Social-impact’ NFT startup Metagood raised $5 million in early December.

-

Decentralized identity provider Carv raised $4 million in late November.

-

NFT fraud detection platform Yakoa secured $4.8 million in funding in mid-November from Collab+Currency, Volt Capital and Brevan Howard Digital.

-

Web3 game developer Wemade raised $46 million from Microsoft in early November.

This list of funding rounds for crypto companies doesn’t include acquisitions (e.g. United Fintech’s purchase of Cobalt), yet it nonetheless shows that the industry isn’t struggling as much as some might think to attract outside money.

Adoption, Pilots and Trials Continue Apace

The above isn’t the only sign that the 2022 crypto crash isn’t as bad as previous downturns. Also supporting this suspicion is the fact that many major companies and institutions continue to deepen their involvement with crypto in one way or another.

For one, let’s just look at the major banks and financial service companies that have recently announced crypto-related plans, services or rollouts in recent months. Most notably, December revealed that Goldman Sachs is now using the post-FTX fallout as an opportunity to acquire various cryptocurrency firms on the cheap, with the firm’s head of digital assets, Mathew McDermott, telling Reuters, “We do see some really interesting opportunities, priced much more sensibly.”

In October, BNY Mellon — one of the oldest surviving banks in the world — announced it would be offering cryptocurrency investment services, joining an already fairly extensive list of US and international banks to offer similar services.

A little more recently, Mastercard launched a Web3 incubator in partnership with Polygon earlier in January, with the aim of training artists and musicians to use Web3-related tools to connect with fans and make their work more financially sustainable. Its main rival, Visa, has also been working on crypto in various ways, with its researchers publishing a technical paper in December on how it might automate recurring payments from self-custodial cryptocurrency wallets.

Beyond the financial sector, other industries are also doing more with crypto, even with the continued downturn. This is particularly the case in fashion, which seems to be falling over itself to do things with NFTs and Web3. Already, illustrious fashion houses such as Gucci, Balmain, Prada, Paco Rabanne, Guerlain, Phillip Plein and Louis Vuitton (among others) have launched collections that provide consumers with non-fungible tokens to go with their real-world clothing, highlighting the potential for crypto to create new ownership dynamics within fashion.

Something similar can also be said for the art world, with 2022 even heralding the opening of some of the world’s first NFT-based galleries (e.g. in London and Australia). The year also saw more than a few musical groups release their albums as NFTs, with rock band Muse becoming the first act to top the UK album charts with an NFT-based album in September.

Actually, it’s not just industries, with the United Nations Refugee Agency (UNHCR) working with the Stellar Development Foundation in December to pilot the use of blockchain technology for the disbursement of financial aid to people in Ukraine.

The Next Bull Market

This all goes to show that the potential of crypto and blockchain remains enormous. Not only that, but with so many companies, banks and institutions moving to produce something related to crypto and digital currencies (e.g. all the central banks using or planning CBDCs), the foundations have been set for a very big bull market next time around. That’s because the next time retail and institutional investors experience a widespread desire to buy or use cryptocurrencies, there will already be so many platforms and companies ready to provide them.

Of course, just when this bull market arrives is anyone’s guess, although with the next Bitcoin halving due next year, and economic conditions slowly improving in certain parts of the world, it may not be that far away.