- >News

- >JPEG Money? The Six Best NFT Cryptocurrencies

JPEG Money? The Six Best NFT Cryptocurrencies

Non-fungible token was one of the biggest things in crypto in 2021, so big even Collins Dictionary made it the word of the year. And despite the slowdown the market has suffered this year, it still remains one of the hottest areas in crypto, drawing massive interest and criticism alike.

In fact, NFT-related cryptocurrencies represent one of the biggest categories in the entire market, accounting for just over $15.6 billion in market capitalization (as of writing). And with a long list of brands — including Estée Lauder, Gucci, Burberry and Louis Vuitton (to name only a few) — now involving themselves in non-fungible tokens, it’s very arguable that the whole sub-sector could see another big takeoff when market conditions become more favorable.

In view of such a future scenario, this article offers a primer on the six best NFT cryptocurrencies in the market today. It lists them in order of market cap, while also explaining their main features and fundamentals.

Flow (FLOW)

Flow is a layer-one blockchain that has been designed for uses related to Web3, gaming and non-fungible tokens. First outlined in 2019 and using an adapted proof-of-stake consensus mechanism that separates consensus and computation (thus improving speed), its native FLOW token became tradeable at the beginning of January 2021.

FLOW’s price chart since launch in Jan 2021. Source: CoinGecko

Since then, FLOW’s price history has been mixed. Designed to have low inflation, it reached an all-time high of $42.40 in April 2021, but apart from a resurgence in September of that same year, it has declined to $1.76. However, with a supply of just over 1 billion FLOW, this price is enough to make it the most valuable NFT-related cryptocurrency. It’s also worth pointing out that it has risen by 42.5% since reaching an all-time low of $1.24 in June of this year, meaning it may be on the way up.

In terms of its fundamentals, Flow has benefited from a number of important partnerships and launches. It runs the popular NBA Top Shot NFT marketplace/collection, while in August 2022 it announced that it would be partnering with Instagram, which would begin letting its users share their Flow NFTs on its social network.

ApeCoin (APE)

ApeCoin is a decentralized autonomous organization (DAO) that oversees the development and treasury of the Bored Ape Yacht Club (BAYC) ecosystem. Launched in April 2021, BAYC has since become probably the most famous NFT collection in crypto, with celebrities such as Paris Hilton, Tom Brady, Serena Williams, Jimmy Fallon and Madonna (and many others) reportedly among owners.

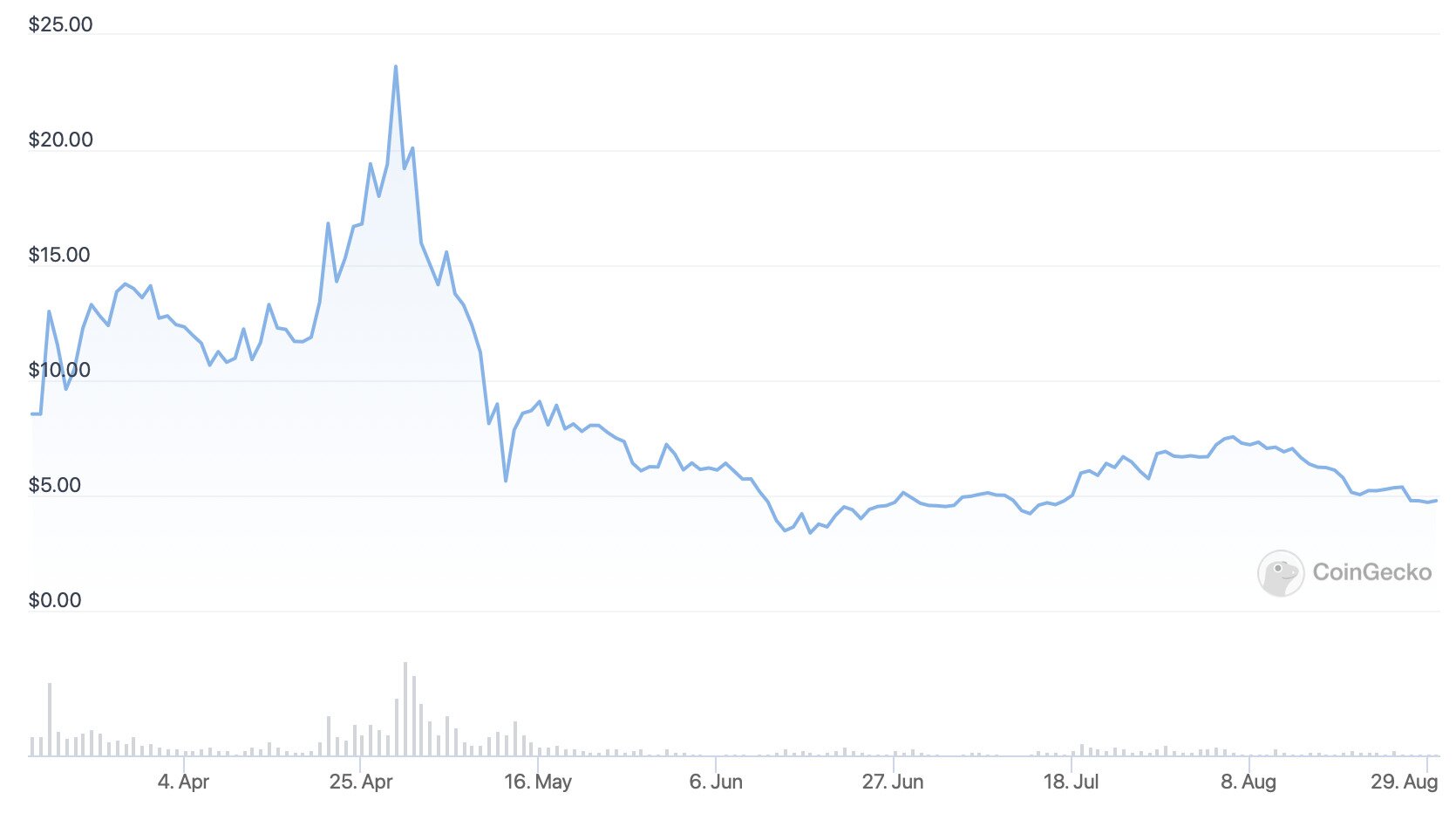

ApeCoin DAO itself launched in March 2022, with its native governance token APE becoming tradable around the same time. APE’s price history pretty much follows that of the wider market, reaching an all-time high of $26.70 in April 2022, before sliding downwards to $4.78 as of writing.

APE’s price history since launch in March 2022. Source: CoinGecko

Aside from being associated with the most famous NFT collection around, ApeCoin has few other good reasons to be interested in it. Most notably, it has witnessed adoption in the form of BitPay making it available as a payment option for millions of users and merchants. It is also awaiting the imminent launch of its own metaverse platform, known as the Otherside.

These developments all suggest that Bored Ape is no longer just about a simple NFT collection. Again, as with Flow, it should grow amid a renewed bull market.

The Sandbox (SAND)

The Sandbox is an Ethereum-based metaverse platform enabling users to develop and monetize their own gaming experiences. It first launched way back in 2012 as a mobile-only game, before shifting to blockchain — and NFTs — in 2018 after a takeover from Animoca Brands.

The Sandbox didn’t really make a name for itself until 2021, when two key things happened. First, Facebook announced a pivot towards the metaverse in October, a move which ignited a market frenzy for pre-existing metaverse-related blockchains. Secondly, Animoca Brands announced the next month that it had raised $93 million in venture capital, with SoftBank leading the round.

SAND’s price history. Source: CoinGecko

In response to these big developments, SAND’s price rose from about $0.80 in early October 2021 to a record high of $8.40 by late November. It has since declined, but remains the third-biggest NFT-related cryptocurrency by market cap, due largely to its funding and strong user base.

Decentraland (MANA)

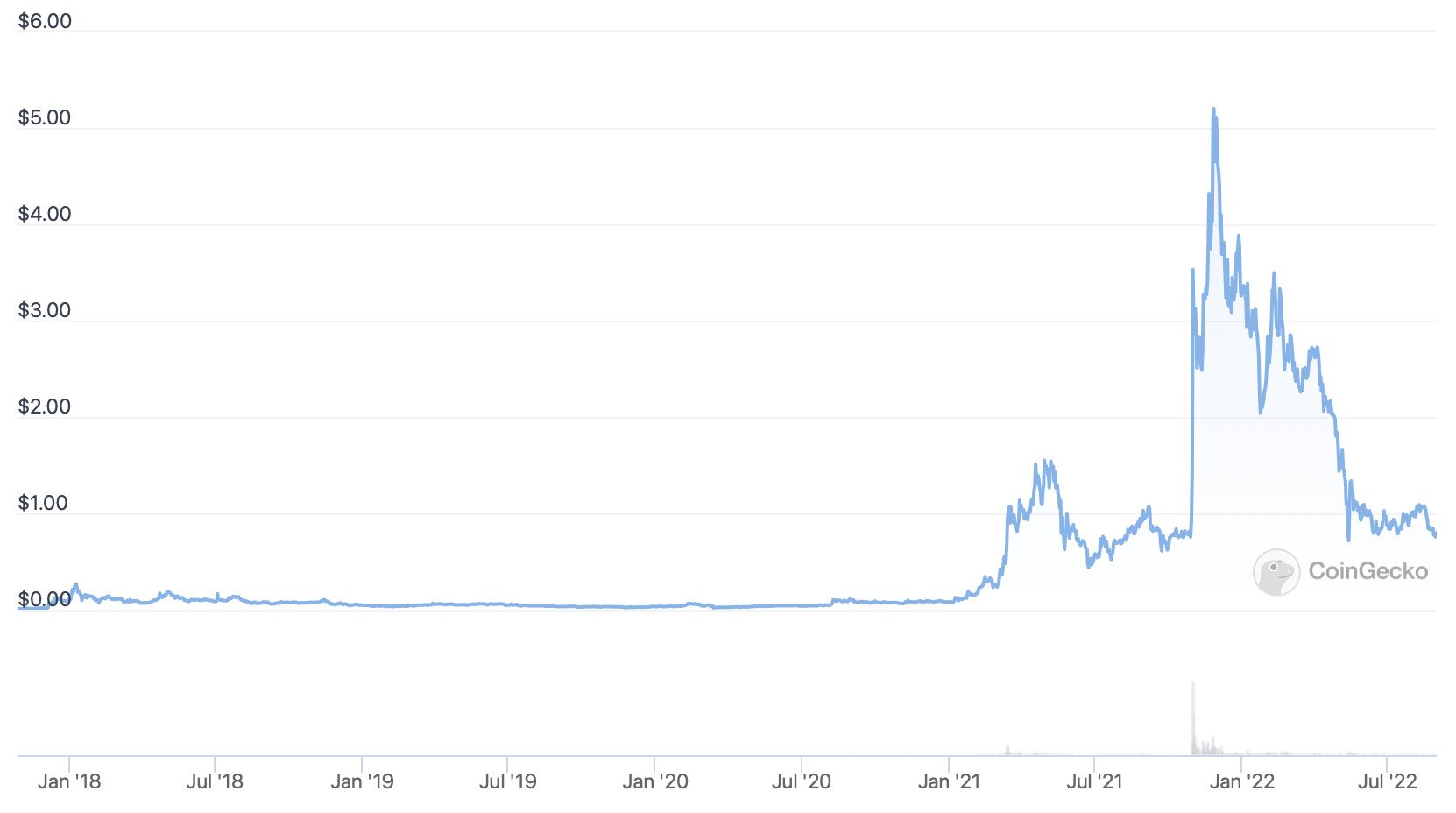

Launched in February 2020, Decentraland is an Ethereum-based virtual world in which users can purchase digital items as NFTs. As with the Sandbox, it really took off after Facebook’s pivot to the metaverse put it in the spotlight, with the price of its MANA native token jumping from about $0.75 in mid-October 2021 to an all-time high of $5.85 by late November.

MANA’s price history. Source: CoinGecko

Whereas the Sandbox is more focused on gaming, Decentraland bills itself as a kind of blockchain-based Second Life. In other words, it’s a digital world where users can live out virtual lives, and purchase virtual land (known as LAND) in the process. Since the boom in the NFTs and the metaverse began, it has hosted a number of high-profile virtual events, including Metaverse Fashion Week in March.

Decentraland has also witnessed a number of big brands open virtual presences in its metaverse, including Samsung, Netflix, JPMorgan and Taco Bell.

Axie Infinity (AXS)

Axie Infinity is a play-to-earn video game running on the Ronin Network, an Ethereum-linked sidechain developed by the game’s maker, Sky Mavis. It went live in March 2018, making it one of the earliest blockchain-based games to include NFT elements.

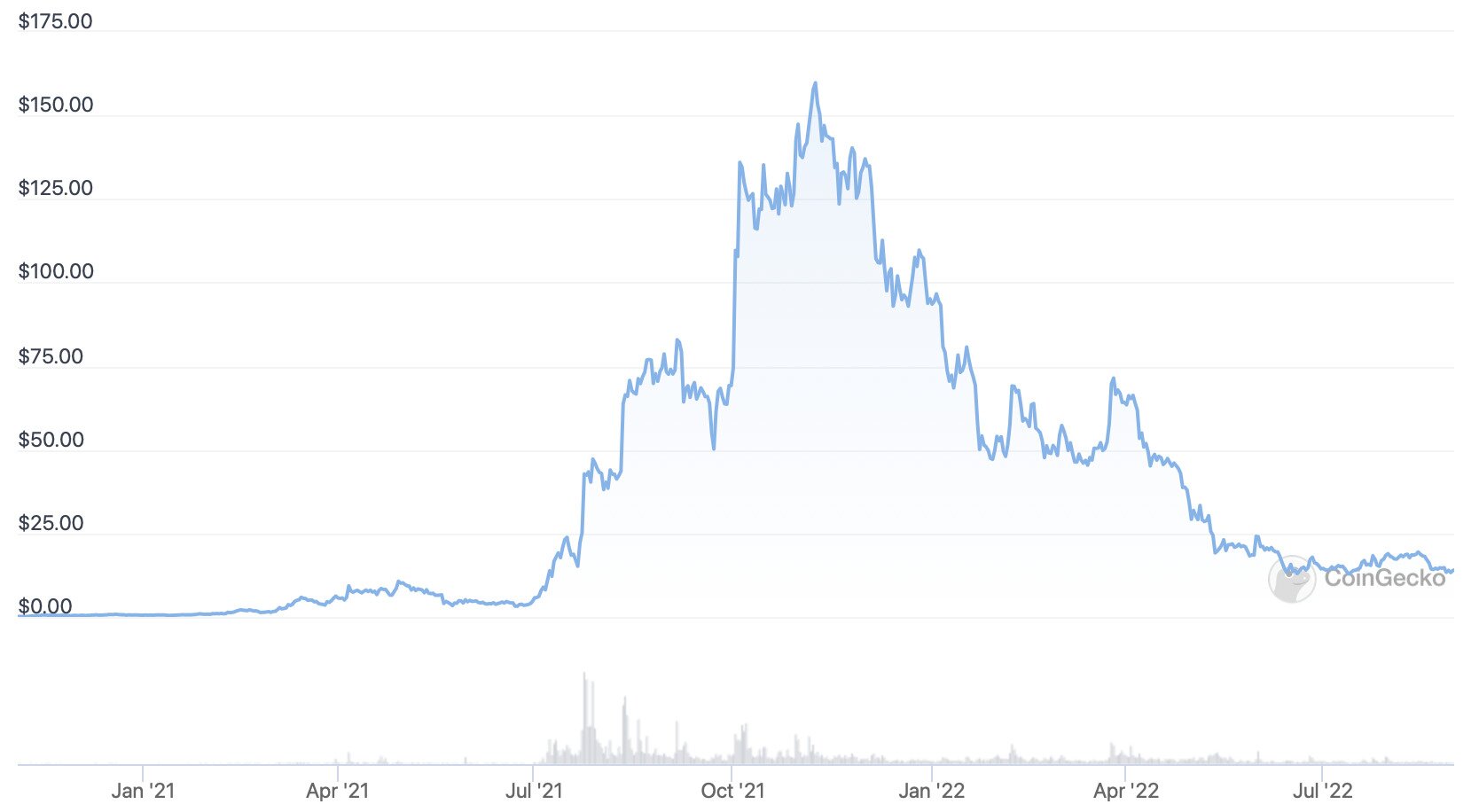

What’s interesting about Axie Infinity is that, in contrast to the Sandbox and Decentraland, it enjoyed significant rallies before Facebook announced its newfound interest in the metaverse. It rose a then-ATH of $82.90 in early September 2021, before Facebook helped push it even further, to $164.90 in November.

AXS’ price history. Source: CoinGecko

Axie Infinity offers players the opportunity to raise Pokémon-style monsters, which are NFTs that can be battled and traded. It has seen a decline in user numbers since its peak in November 2021, but continues to accommodate some 250,000 daily active players. It famously suffered a hack in March 2022, but has since undergone a number of updates that set it up for the future.

Theta Network (THETA)

Launched in March 2019, the Theta Network is a decentralized video delivery network that has more recently expanded into various other areas. In particular, it began integrating NFTs into its streaming network in 2021, with various partners releasing non-fungible tokens to go with their media content.

Even more recently, the Theta Network is working on the launch of the fourth core version of its mainnet, which will be known as the Theta Metachain. Due in December, this will be tailored towards Web3 functionality, and will provide more scalability and efficiency for NFT users and traders.

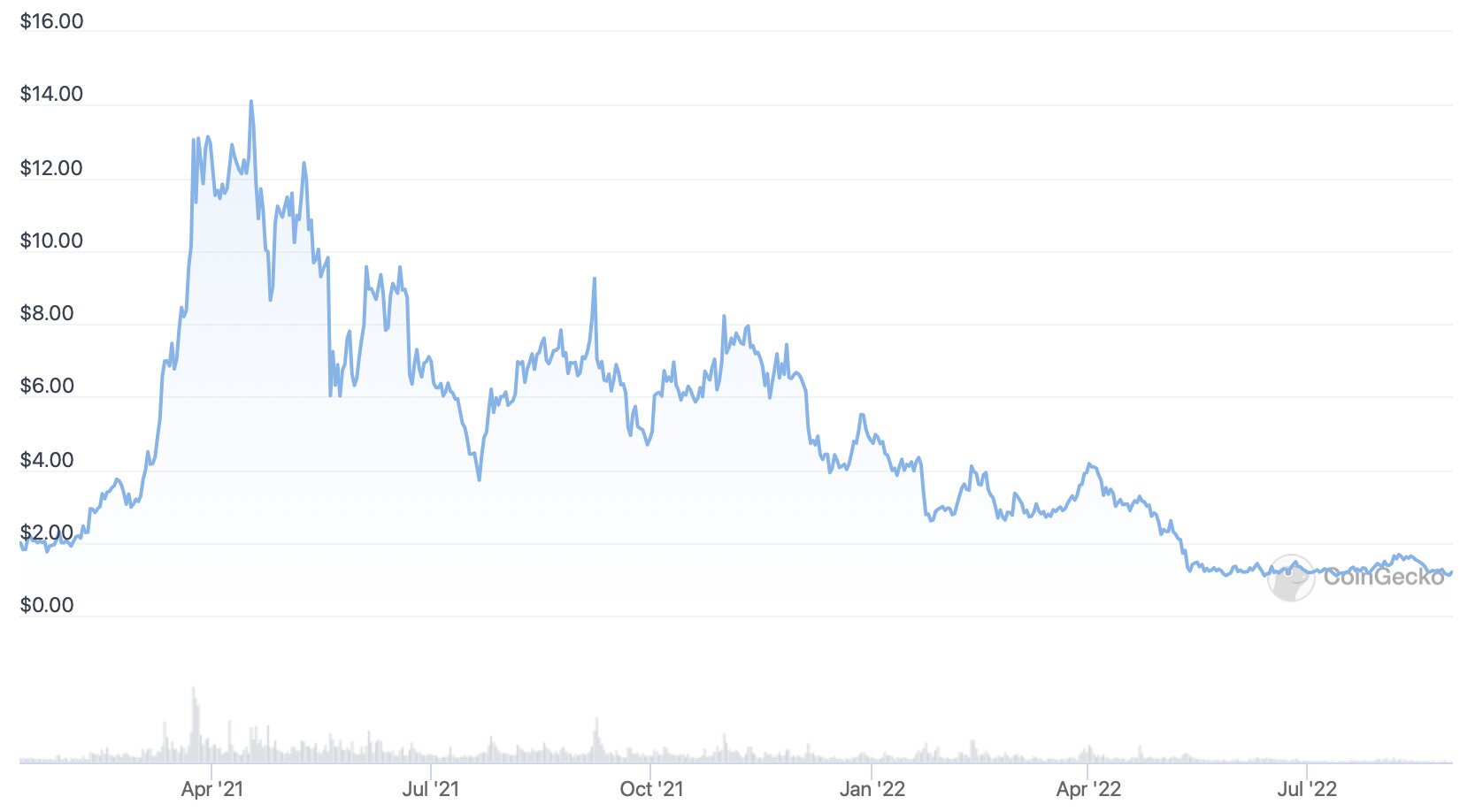

THETA’s price history. Source: CoinGecko

In terms of THETA’s price history, it reached a record high of $15.72 in April 2021. It has since witnessed a number of peaks and troughs, yet the news of the Theta Metachain has helped to push it up from a low of $1.09 in July to $1.67 in early August, signaling a potential recovery once the new version of its mainnet is live.