- >News

- >JP Morgan Says That Bitcoin’s Price Could Double or Triple

JP Morgan Says That Bitcoin’s Price Could Double or Triple

It may not have entirely shed its checkered reputation, but Bitcoin is now officially mainstream. If PayPal’s launch of its own cryptocurrency service wasn’t already proof enough, America’s biggest bank — JPMorgan — provided further confirmation earlier this month. In a note to investors, it predicted that bitcoin will increasingly take a slice of gold’s store-of-value market over the coming years, with its price likely to double or triple as a result.

This wasn’t just a prediction, but a confirmation of Bitcoin, an anointment. By signalling bitcoin’s likely price rise, and by explaining that millennials often favor the cryptocurrency over gold, JPMorgan gave a signal to mainstream investors that it’s good to include BTC in their portfolios.

As we all know, predictions in the world of economics and finance often function as self-fulfilling prophecies, with forecasts of a run on a bank, for instance, generally helping to cause a run on that very same bank. The same thing will apply to JPMorgan’s ‘forecasts’ of bitcoin’s price, which now has an even better chance of appreciating significantly over the medium- to long-term.

From ‘Tulip Bulbs’ to ‘Tripling of Bitcoin Price’

JPMorgan’s recent note on Bitcoin and its likely appreciation is bullish news for the cryptocurrency on a number of counts.

First of all, it represents a massive turnaround in the attitude of JPMorgan. Back in September 2017, the bank’s CEO, Jamie Dimon, labelled Bitcoin as a “fraud.” He went so far as predicting at a New York conference that the cryptocurrency is a bubble that “won’t end well,” and that it’s “worse than tulip bulbs.” He even had the following to say to about any JPMorgan employee who traded bitcoin:

“I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

Well, how times have changed. In its most recent note, JPMorgan analysts admitted that Bitcoin is a genuine alternative to gold, and that even “a modest crowding out of gold” would indicate a “doubling or tripling of the bitcoin price.”

Millenials Seem to Prefer Bitcoin to Gold

It also suggested that such a crowding out is quite likely, given that millennials seem to prefer bitcoin to gold, and that these same millennials will eventually take over from Generation Xers and Baby Boomers as the dominant group of investors.

“The potential long-term upside for bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given that millenials would become over time a more important component of investors’ universe,” wrote JPMorgan’s analysts.

Wait, because it gets even better. The analysts also acknowledged that you can use bitcoin and other cryptocurrencies as more than stores of value, something which will further put upwards pressure on their prices.

“Cryptocurrencies derive value not only because they serve as stores of wealth but also due to their utility as means of payment. The more economic agents accept cryptocurrencies as a means of payment in the future, the higher their utility and value.”

And with PayPal now letting its users pay merchants using cryptocurrency, it’s likely that the utility and value of cryptocurrencies will gradually inch further upwards.

Taken together, this all indicates that Bitcoin now has more things going for it than against it. And now, it’s not only people within the cryptocurrency industry who are claiming it will rise strongly, but possibly the most ‘credible’ bank in America.

Writing On The Wall

As significant as it may have been, JPMorgan’s embrace of Bitcoin shouldn’t come as a surprise: banks and financial institutions had been increasingly producing optimistic bitcoin forecasts over the past year, so the writing was already on the wall for those who cared to look.

Bloomberg wrote in a June report that Bitcoin would rise close to 2020, as indicated by patterns following its previous halving in 2016. It also noted how the cryptocurrency is increasingly “becoming a digital version of gold.”

Bloomberg has in fact become even more bullish in the months following June. In October, its analyst Mike McGlone predicted a price of around $100,000 by 2025. This prediction was based largely on the amount of time bitcoin has historically taken to add an extra zero onto its price, so it should be taken with a pinch of salt. Nonetheless, it shows that growing mainstream support for Bitcoin is already out there.

Another highly bullish prediction from a bank arrived in October of 2019, when Germany’s BayernLB suggested that the price of bitcoin would rise to $90,000 by the end of 2020, largely as a result of the Bitcoin halving in May. This was again highly optimistic, but the bank’s general point — that the tightening of bitcoin’s supply would help it to begin accelerating faster than gold — remains valid.

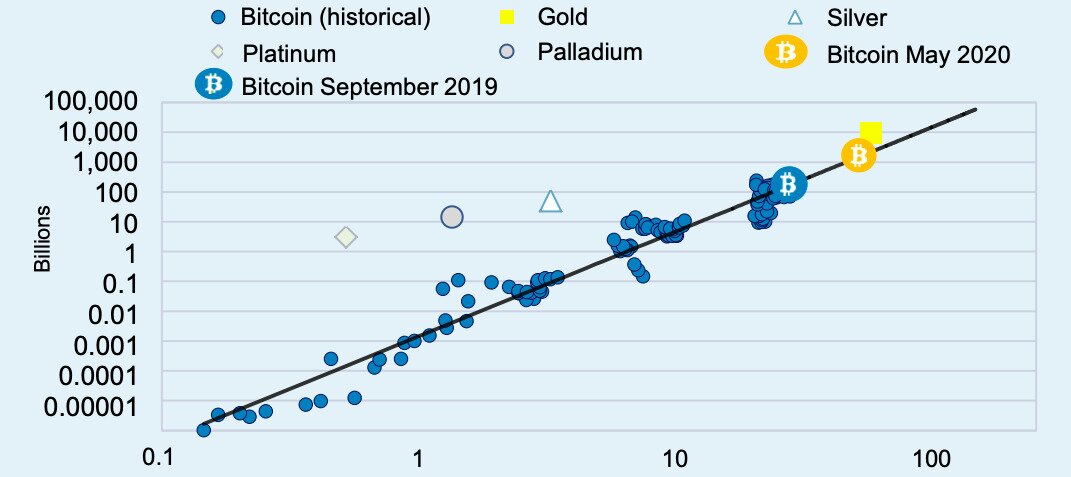

This chart displays the market cap of various assets. Source: BayernLB

Yes, it’s true that some people still remain highly skeptical when it comes to Bitcoin. But it’s now abundantly clear that the direction of travel is towards more people embracing and fewer people disregarding it.

Not only is this made apparent by JPMorgan, Bloomberg, and BayernLB, but also by the recent moves of MicroStrategy, Square, Snappa, Stone Ridge, and Mode, as well as by Paul Tudor Jones’ admission in May that a small percentage of his assets are kept as bitcoin.

In turn, the fact that more people are being turned on to bitcoin than turned off also entails that its price will inevitably rise over the longer term. This is particularly the case over the long term, given the fixed supply of bitcoin.

As we’ve written in previous pieces, it’s nigh-on impossible (and a little foolish) to predict just how high bitcoin will rise and when. But with JPMorgan — and others — officially consecrating bitcoin as a legitimate rival to gold and as an asset in its own right, it’s clear that the cryptocurrency is likely to climb higher in the coming months and years.