- >News

- >It’s Not Long Before Your Bank Will Begin Accepting Bitcoin and Crypto

It’s Not Long Before Your Bank Will Begin Accepting Bitcoin and Crypto

Banks have been highly skeptical of Bitcoin and cryptocurrency in recent years, but not for long. This year has seen a gradual shift in attitudes, with JPMorgan predicting a doubling or tripling of bitcoin’s price, and with California-based Silvergate Bank announcing that its cryptocurrency deposits hit as high as $586 million in Q3 2020.

But Silvergate Bank’s involvement with crypto is only the tip of the iceberg, since a number of other banks throughout the world — including Gazprombank and DBS Bank — have recently announced new cryptocurrency services. As such, they raise an important question: when will mainstream banks begin accepting bitcoin and cryptocurrency deposits?

This is a difficult question to answer, since no major bank has given any concrete indication that it plans to begin accepting and holding actual deposits in cryptocurrency. However, with PayPal launching cryptocurrency trading/holding services, it must be only a matter of time before they begin offering their own similar services, for fear of being left behind.

Silvergate Bank Profits From Accepting Crypto Business

Silvergate Bank was one of the first traditional financial institutions to get in on the act of accepting business from cryptocurrency firms. Back in Q4 2017, it took in $835 million in deposits from crypto companies.

This remains its record, but after falling in the months following Q4 2017, its crypto-related deposits have begun climbing up again this year. Not only did it accept $586 million in deposits from crypto firms, but its fees from digital currency customers increased by 107% (or by $2.1 million) in the year to June 30, 2020, rising from $2 million to $4.1 million.

In other words, the bank has doubled its cryptocurrency business over the past year, and recent events elsewhere in the world of crypto suggest that this business will only continue growing.

“The Bank’s infrastructure has provided Silvergate with the foundation to succeed in what has become a very digital world and we see an ample runway for further growth,” said Alan Lane, the bank’s CEO.

That there’s an ample runway for further growth is indicated by a number of market and regulatory developments.

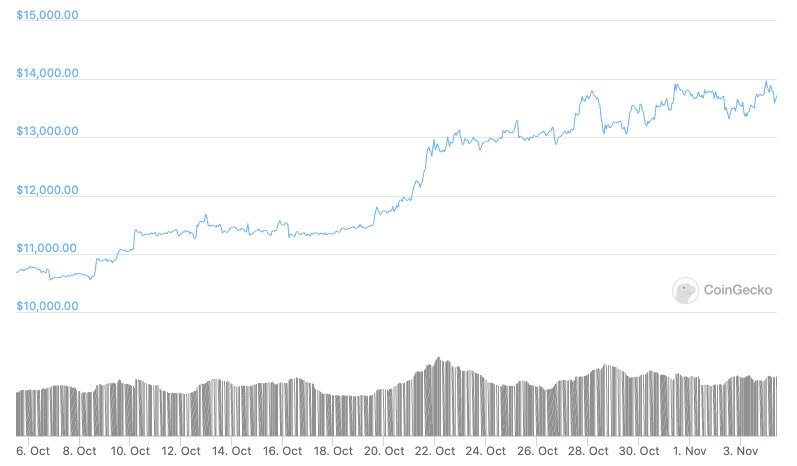

Most notably, the price of bitcoin has jumped by over 30% in less than 30 days, with BTC costing $10,552 on October 8 and touching as high as $15,909 November 5.

Source: CoinGecko

This growth has been spurred by a number of factors which will continue to push bitcoin’s price higher, such as PayPal’s aforementioned announcement, as well as recent moves by the likes of MicroStrategy and Square to make bitcoin a reserve asset.

But on the regulatory side, the U.S. Office of the Comptroller of the Currency announced in July that federally chartered banks may provide cryptocurrency custody services.

“The OCC has found that the authority to provide safekeeping services extends to digital activities and, specifically, that national banks may escrow encryption keys used in connection with digital certificates because a key escrow service is a functional equivalent to physical safekeeping,” it wrote in a letter.

This was — and still is — very significant news. The OCC’s letter was a response to JPMorgan’s May decision to provide banking services to two major crypto-exchanges, Coinbase and Gemini. It was reported at the time that JPMorgan won’t be handling actual cryptocurrencies, but with the OCC’s directive confirming that it’s legal for banks to hold crypto, these two events pave the way for major American banks to begin offering cryptocurrency custody services.

The Inevitability of Cryptocurrency

The specific timeframe can’t be known for sure, but it now looks almost inevitable that major banks will be letting customers hold crypto with them in the not-too distant future.

With new companies announcing their own purchases of bitcoin as a reserve asset virtually every week, there’s a rising demand for custodial services that banks will almost certainly want to meet, on pain of losing business to upstarts.

In fact, a small number of banks have already begun meeting this demand, indicating that most others will eventually follow. In the United States, Standard Chartered began offering a cryptocurrency custody service for institutions in July, while South Korea’s KB Kookmin Bank began doing something very similar in August.

But banks won’t stop with custody services for institutions. With PayPal taking an early lead in offering cryptocurrency buying-selling and holding services, it’s highly likely that banks will follow, again out of fear of being left behind.

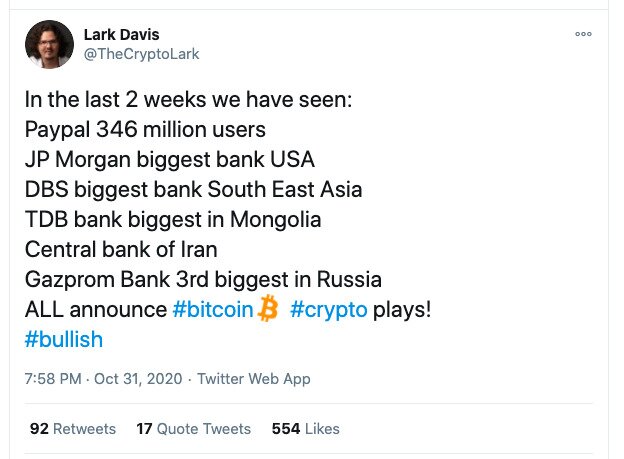

PayPal’s effect on major banks was almost immediate, with a small number announcing cryptocurrency-related initiatives in the days and weeks following PayPal’s own announcement.

In Switzerland, Gazprombank announced it would be offering crypto-trading services, while Singapore’s DBS Bank announced its own exchange, complete with custody solutions. And in Mongolia, TDB Bank announced a wide suite of crypto services, including custody, deposits, remittances, loans, and crypto-asset management.

Source: Twitter

The floodgates are now open, and it’s only a matter of time before larger numbers of major banks elsewhere follow suit. And as the tweet above indicates, central banks may also warm to bitcoin, making it easier for commercial banks to follow.

What This Means For Bitcoin

Needless to say, this is all highly bullish for Bitcoin, and for crypto in general. By making cryptocurrency more accessible to a wider customer base of consumers and businesses, banks will feed demand for crypto. They’ll endow cryptocurrency with a stronger reputation that will draw additional investors, and in the process these additional investors will push the price of bitcoin and other cryptocurrencies higher.

At the same time, the involvement of banks will also potentially invite stricter regulation from national governments and regulators. With major banks exposing themselves to crypto, governments will want to make sure that the financial system doesn’t end up becoming more vulnerable to instability. However, while this may suggest a reining in of crypto to an extent, an increase in regulation will ultimately provide further reassurance to retail and institutional investors, pushing demand for crypto upwards.

In sum, banks will be good for crypto, and crypto will be good for banks.