- >News

- >Is It Only A Matter of Time Before Every Company Has BTC On Its Balance Sheet?

Is It Only A Matter of Time Before Every Company Has BTC On Its Balance Sheet?

Tesla has bought $1.5 billion in bitcoin. Not only did this news break the Internet, but it broke the hearts of thousands of short-sellers, who summarily liquidated their positions following the news and thereby caused the price of bitcoin to rise even higher.

Bitcoin has been on a wild ride since the disclosure of Tesla’s investment, with the cryptocurrency hitting an all-time high of $48,025 on February 9. However, this ride is only just beginning, since it now seems almost inevitable that other big corporations will follow Tesla’s example in converting US dollars to BTC.

This is the view of a variety of analysts, and while certain others disagree, the logic of competition would dictate that other companies now have to keep up with Tesla, for fear of being left behind. And assuming that most major companies apportion only a tiny fraction of their cash to BTC, this would boost bitcoin’s price significantly.

A Fundamental Change

It’s likely that Tesla spent $1.5 billion on bitcoin around the time Elon Musk infamously updated his Twitter bio to read “#bitcoin.” This was January 29, when bitcoin was priced at around $32,200. Working out at roughly 46,583 BTC (i.e. 1.5 billion/32,200), this suggests that Tesla’s holdings are now worth some $2.16 billion.

Not a bad profit for only a few weeks’ work, and with Tesla repeating the earlier profiteering of MicroStrategy, many commentators and analysts are predicting that we’ve crossed into a new paradigm.

“Companies are very careful when it comes down to their reserves,” said Tanaka Capital Management’s Graham Tanaka, speaking to Reuters. “This doesn’t appear to be a flash in the pan. It appears to be something that may be a fundamental change.”

In particular, investors and analysts believe that Tesla — and Elon Musk — now carry enough clout to make many other companies sit up and take notice.

“If any lesser mortals had made the decision to put part of their balance sheet in Bitcoin, I don’t think it would have been taken seriously. But when the richest man in the world does it, everyone has to take a second look,” said Thomas Hayes, managing member at the New York-based Great Hill Capital.

Staying on the Sidelines

Following Tesla’s disclosure, analysts at the Royal Bank of Canada published an investment note which argued that Apple — the world’s most valuable company — has much to gain if it takes the plunge to offer cryptocurrency services and buy bitcoin itself.

“If the firm decides to enter into the crypto exchange business, we think the firm could immediately gain market share and disrupt the industry,” the analysts said.

In particular, RBC noted that Apple could generate annual revenues of up to $40 billion by adding crypto-exchange services to its Wallet app, given that its hardware ecosystem currently serves around 1.5 billion people.

“If I was working at Apple as a strategy officer, this is legitimately something I would do. Because if you can invest $500 million to potentially create $50 to $80 billion in equity value, that’s a lot more compelling to me than trying to compete against an Elon Musk and Tesla, a distributed energy company where you’re going to spend $15 to $20 billion just for a maybe,” wrote RBC analyst Mitch Steves.

Likewise, by buying $1 billion in bitcoin, Apple would increase the value of any crypto business it launched. This is simply because its own purchase of BTC would boost the cryptocurrency’s price and make more people want to use its crypto service.

For some bitcoin and cryptocurrency bulls, Apple isn’t the only corporation that would benefit from getting in on the action. Galaxy Digital founder Mike Novogratz believes that pretty much every company is likely to buy bitcoin sooner or later.

“You’re going to see every company in America do the same thing […] It doesn’t have to be a lot. It’s the messaging that matters,” he told Bloomberg.

Tesla has joined such publicly traded companies as MicroStrategy, Square, Silvergate, and PayPal in having exposure to bitcoin, and once the roster of corporate bitcoin owners reaches a certain critical mass, they will surely be no turning back.

“If this becomes a trend in corporate treasuries the downside of staying on the sidelines will only become costlier over time,” said blockchain consultant Maya Zehavi, speaking to Reuters.

We may have in fact already reached this critical mass. And with Tesla’s stock rising by just over 7% since its disclosure (not to mention the appreciation of its BTC holdings), the benefits of buying bitcoin are fairly clear.

Say Nay to the Naysayers

Not everyone is convinced that Tesla’s move is a real gamechanger. Speaking to the Financial Times, certain experts in corporate treasury were left bemused by the carmaker’s purchase.

“Corporations invest their cash in very high quality, short-term fixed income securities, and are willing to accept a relatively low rate of return. I don’t think there is a case to be made for investing corporate cash in a risky asset like bitcoin, where they could experience significant declines,” aid Jerry Klein, a managing director at the New York-based Treasury Partners investment firm.

Likewise, Duke University economics professor Campbell Harvey also believes it doesn’t really make sense for companies to convert cash to bitcoin.

“It’s unusual, it’s risky and it won’t necessarily provide that hedge that they are looking for. That to me is OK if you are a hedge fund and your clients know that this is exactly what you do, you make speculative bets and sometimes they work and sometimes they do not […] Tesla is not a hedge fund,” he told the Financial Times.

There are at least two things that can be said in response to such skepticism. Firstly, bitcoin has provided gains in every calendar year save for 2014 2018, while it has appreciated massively in most other years. This makes it a relatively secure hedge if you’re holding it for the long-term.

Secondly, the US dollar continues to weaken, and is likely to weaken further amid plans to provide another massive fiscal stimulus package. This is precisely why companies have begun converting cash reserves to bitcoin, with MicroStrategy citing just this reason when it first bought the cryptocurrency.

Bitcoin Price?

The question remains: how will the transition of corporate cash reserves to BTC affect bitcoin’s price?

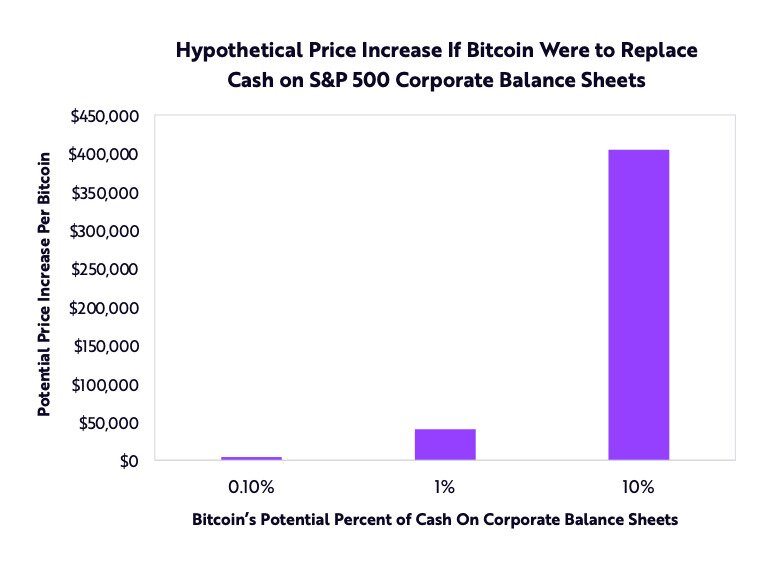

Well, according to a recent ARK Invest report, the price of bitcoin would rise by another $40,000 if every company in the S&P 500 — that’s America’s 500 biggest companies — converted 1% of its reserves to BTC. So at $46,000, this would make for a price of around $86,000.

However, if every S&P 500 company converted 10% of its reserves to BTC, the price of bitcoin would increase by $400,000. Yes, $400,000, and that’s forgetting that companies in other countries would almost certainly be joining in the fun at this stage.

Source: ARK Invest

Regardless of the exact number of companies that will buy bitcoin, Tesla has certainly helped the crypto currency to cross a threshold. More companies will buy it, and its price will continue on its long-term upwards trajectory.