- >News

- >Is It Only a Matter of Time Before Bitcoin Becomes Biggest Smart Contracts Platform in Crypto?

Is It Only a Matter of Time Before Bitcoin Becomes Biggest Smart Contracts Platform in Crypto?

Smart contracts are the lifeblood of the cryptocurrency ecosystem. As self-executable programs, they power everything from the cryptocurrency transactions to music royalties and supply chain management. In other words, they provide the foundation of claims that blockchain technology is giving birth to a decentralized and more open global economy, one in which Web3, non-fungible tokens, DeFi and the metaverse will all play an increasingly prominent role.

While such claims are becoming increasingly common, most people within the cryptocurrency ecosystem have grown used to thinking of the new smart contract-based economy in terms of Ethereum, Cardano, Solana or any number of proof-of-stake networks. However, recent weeks and months have seen the emergence of a new narrative, one in which the Bitcoin blockchain itself will become the underlying layer of a smart contract-based ecosystem.

Caused largely by the launch of the Ordinals NFT protocol in January, this narrative has been manifested in the growth of Stacks, a layer-two network that brings smart contracts to Bitcoin. Its native token STX has been one of the best-performing tokens of 2023 so far, rising by 50% in a week, 230% in the last 30 days, and by 366% since the start of the year (as of writing). Its increasing adoption and traffic has coalesced with other attempts to transform Bitcoin into more than just a store of value, and given its recent progress, it looks like it could succeed in doing just that.

What Is Stacks? How Does It Transform Bitcoin into a Smart Contracts Platform?

As explained on its website, Stacks is a layer-two network that “brings smart contract functionality to Bitcoin, without modifying Bitcoin itself.” It operates its own nodes, has its own native token and enables developers to run smart contracts and dApps (decentralized apps) on top of it, yet all of its transactions are ultimately settled on the underlying Bitcoin blockchain. As such, it brings additional capabilities and more scalability to Bitcoin, but also ensures that the latter remains the “most decentralized, most secure, and most immutable blockchain network” in the cryptocurrency ecosystem.

Stacks is different from many layer-two solutions (e.g. ‘sidechains’ like Polygon and Optimism) in that it records its entire history to the Bitcoin blockchain. Because of this, it claims to be as immutable as Bitcoin itself, and more robust than other layer-twos for other blockchains.

Price history of Stacks (STX) since the platform launched in 2019. Source: CoinGecko

Since launching in 2019, Stacks has been steadily growing in terms of usage and the number of apps running on it. It currently lists 88 apps on its website, including open-source DeFi platforms such as Alex and messaging-based social networks like Console. As for its total value locked in (a measure of how much cryptocurrency is stored on its apps), this remains modest at $353 million. That said, this figure has risen by more than 250% since the beginning of the year, indicating just how quickly Stacks is growing.

Why Is STX Rallying? And What Is Ordinals?

As for why Stacks’ growth has accelerated in recent weeks, this is largely the result of a new narrative that emerged in January and has only picked up steam since. This is the narrative surrounding Bitcoin-based NFTs, which began on January 21, when developer Casey Rodarmor launched Ordinals, a protocol that enables “digital artifacts native to the Bitcoin blockchain.”

The launch of the Ordinals mainnet sparked a wave of excitement, controversy and activity when it arrived late last month. It enabled Bitcoin-based non-fungible tokens, with numerous observers commenting that it also marked the birth of a new era, one in which Bitcoin becomes more than just a cryptocurrency.

Source: Twitter

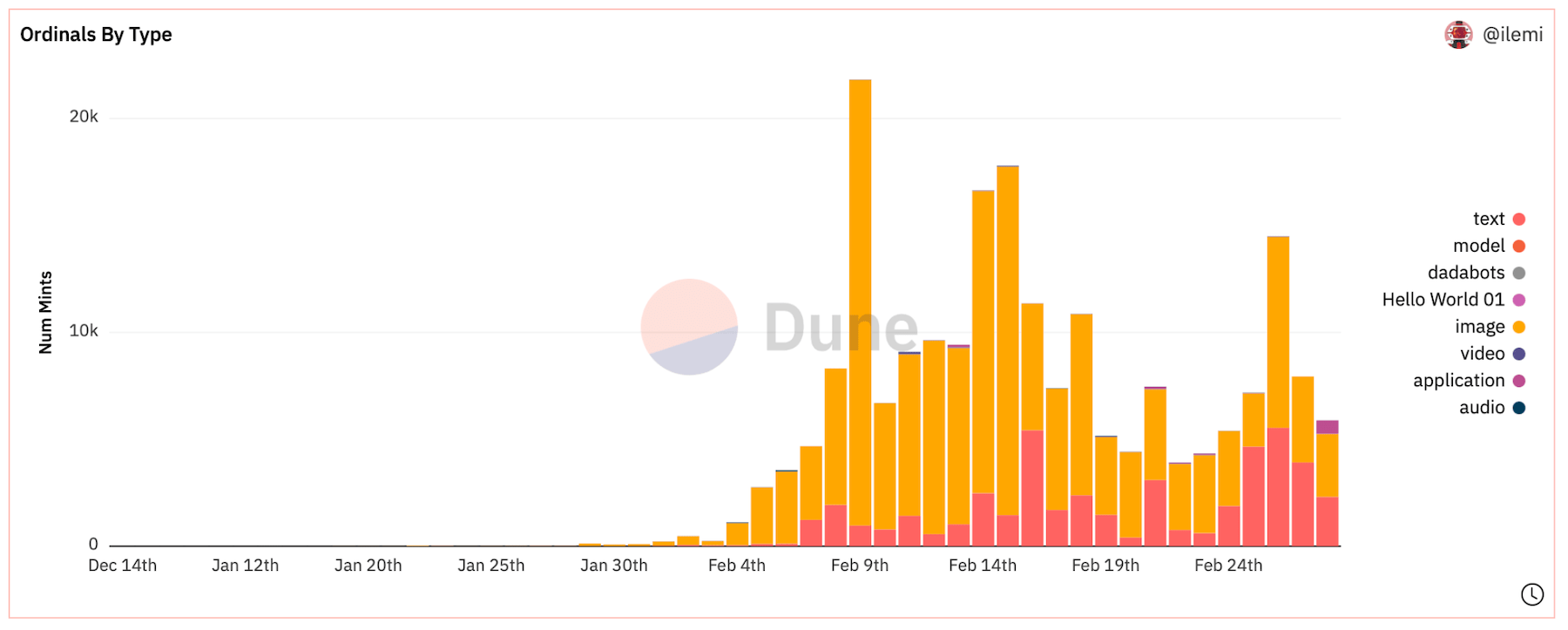

What’s perhaps most exciting about the launch of Ordinals is that it has already attracted an influx of new Bitcoin users. According to data compiled by Dune Analytics, just over 210,000 Ordinal inscriptions have been created to date, indicating just how popular they — and other Bitcoin-based NFTs — could become in the future.

Ordinal inscriptions created on the Bitcoin blockchain to date. Source: Dune Analytics

The point to make here is that the rush to create these NFTs indicates the strong demand there is for Bitcoin as the base layer for novel cryptocurrency services, digital objects, and whatever else. This was also indicated by just how strongly Stacks (STX) rose in the wake of the launch of Ordinals, in that the market recognized that Stacks could also help bring about a new Bitcoin-based ecosystem in conjunction with protocols such as Ordinals.

It has also been indicated by the more recent news that Yuga Labs — the makers of the Bored Ape Yacht Club NFT series — will be launching its very own collection of Bitcoin-based NFTs. And it probably won’t be the first company to do so this year.

Why Bitcoin Could Become the Biggest Smart Contract Platform in Crypto

Needless to say, there’s a strong demand for a cryptocurrency ecosystem that’s settled into Bitcoin, and not simply from users. Such demand — perhaps the most demand — will come from entrepreneurs, startups and businesses, who want to use a new wave of NFT and DeFi apps to tap into Bitcoin’s $500 billion market cap.

Source: Twitter

As noted above, Bitcoin remains the most secure blockchain in the cryptocurrency industry, given its large network and its steadfast use of a proof-of-work consensus mechanism. On top of this, with a fixed cap of only 21 million BTC, it also remains the ‘hardest’ money in the ecosystem, likely to be deflationary over time.

What this means is that, if it becomes technologically feasible to run smart contracts and various dApps over the Bitcoin blockchain, most users and developers will choose to do so. They will prefer the security and immutability of Bitcoin over its proof-of-stake rivals, and layer-two networks such as Stacks will help them take advantage of such security and immutability.

And it’s not only Stacks, because other platforms are bringing smart contracts to Bitcoin, testifying to how eager people are to tap into the latter as a solid foundation for an app ecosystem. This includes the Internet Computer, which last year integrated with Bitcoin at the protocol level, enabling users to run IC-based smart contracts that transact with BTC’s on the Bitcoin blockchain.

When added to existing layer-two solutions such as the Lightning Network and Liquid Network, such platforms reveal that Bitcoin really does have the potential to become a major settlement layer for smart contracts and apps. Yes, it may itself be slow and not very scalable, but with Stacks and innovations like the Ordinals protocol, Ethereum may have yet another new rival with which to compete.