- >News

- >Is Ethereum as Massively Undervalued as Everyone Thinks?

Is Ethereum as Massively Undervalued as Everyone Thinks?

ETH is dramatically undervalued, according to a growing chorus of figures within and outside of the Ethereum community. Its usage is growing at a steady rate, particularly in the context of decentralized finance (DeFi). Meanwhile, the coming shift to Ethereum 2.0 promises a supply shock that may send ETH prices flying.

However, the question remains: just how undervalued is it?

For other commentators and industry figures, the answer to this question is: not much. Because while usage is steadily rising and Ethereum 2.0 is on the horizon, absolute numbers are still pretty low, with Ethereum and DeFi’s wider appeal likely to remain limited.

Why Ethereum Is Undervalued

You don’t have to look too far or wide to find people in crypto who believe Ethereum is undervalued. In recent months, such people have been growing in number, and many even argue that Ethereum is grossly undervalued.

Crypto investor and STORE Labs advisor The Crypto Dog is one of them. Last month, he noted on Twitter that the ratio of ethereum’s price to bitcoin’s price is at around the same level it was in March 2017, when it began a strong rally.

Source: Twitter.com

Mythos Capital founder Ryan Sean Adams also believes Ethereum is “doubly” undervalued.

Source: Twitter

Adams cites two reasons for why ETH is undervalued and should have a higher price.

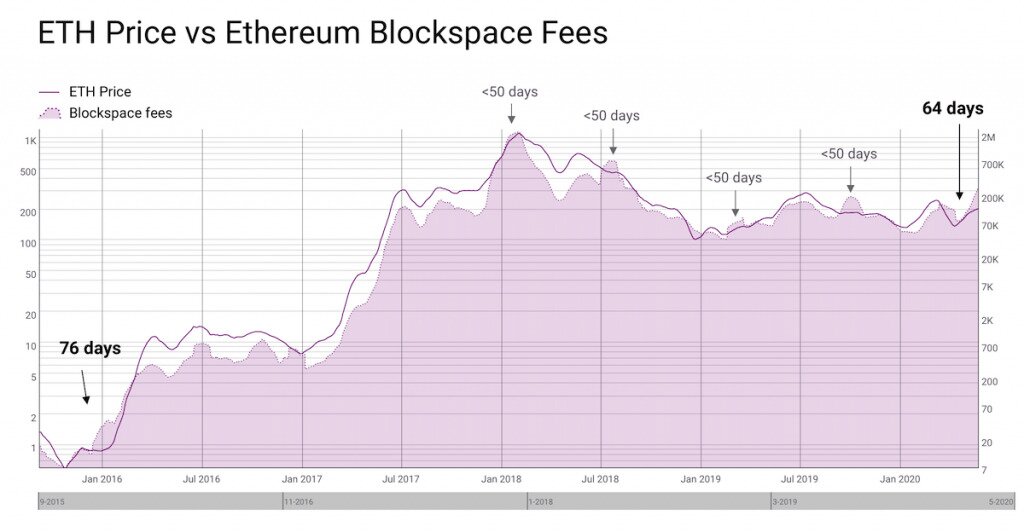

Firstly, he explains that use of the Ethereum network has reached all-time high levels in recent months. The amount of ETH paid as transaction fees (also known as ‘gas’) has been climbing since the end of March, and now tops the equivalent of over $200,000 per day. More individuals, companies and platforms are using the Ethereum network for various purposes (mostly for DeFi and stablecoins).

Adams observes that the ethereum price has historically been correlated with the total value of transaction fees. However, since the recent growth in transaction fees, the price of ethereum has lagged behind.

Source: Bankless/Ryan Sean Adams

In other words, for this relationship to continue to hold, the ethereum price needs to rise soon. And given that rising demand for space on the Ethereum blockchain should result in rising demand for ETH, it seems reasonable to assume that this will happen.

Secondly, Adams believes that Ethereum will soon transition to being a recognized store-of-value digital asset, in much the same way Bitcoin is one now. By increasingly proving its ability to maintain a stable (or rising) price, more investors will flock to it.

DeFi and Ethereum 2.0 Will Boost ETH

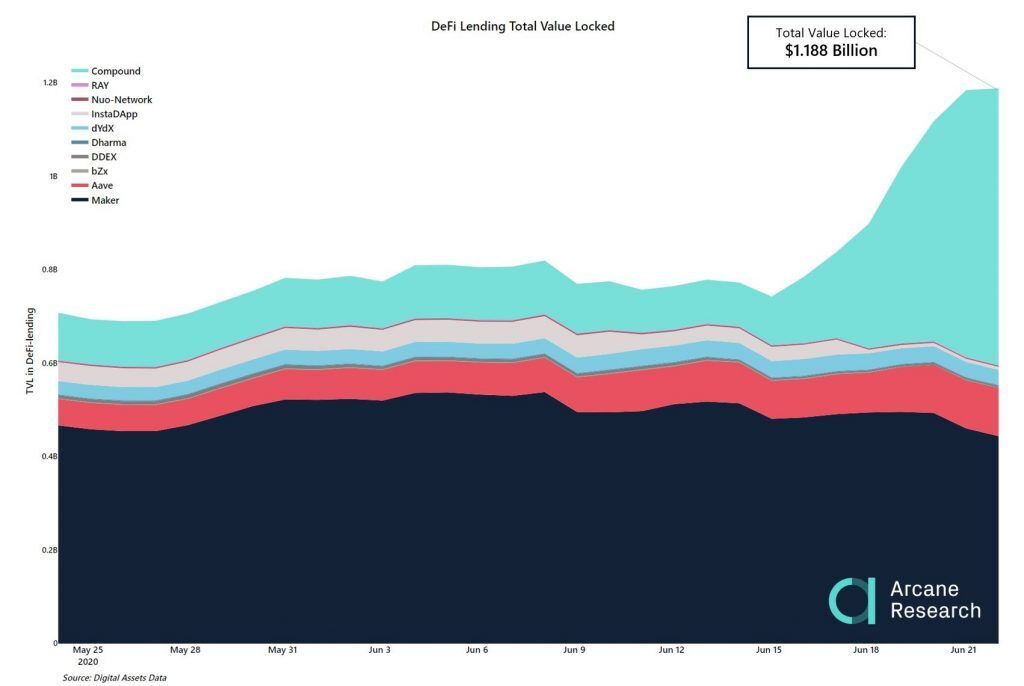

DeFi will be a big part of this transitional process. It has been growing very strongly in recent months, with the total amount staked in DeFi platforms growing by 60% in a single week in June.

Source: Arcane Research/Twitter

Ethereum is generally the platform-of-choice for decentralized finance applications, which offer an expanding range of financial products based on decentralized blockchains and smart protocols.

This sector is expected to see significant growth in 2020 and beyond. In 2019, the total value locked in DeFi apps on Ethereum more than tripled, growing from $190 million in December 2018 to $610 million in December 2019.

The launch of Ethereum 2.0 will also be a big boost to ethereum’s price. Due at some point later this year, the platform will see the Ethereum blockchain move to a proof-of-stake consensus mechanism. Basically, rather than solving resource-intensive computations to validate blocks, nodes will validate them by staking ETH.

This will not only make Ethereum more efficient and scalable, but it will have an effect on the Ethereum economy that should squeeze ETH’s price upwards.

This was the argument made by Adam Cochran, a Conestoga College information science professor and partner at Metacartel Ventures. In April, Cochran published a blog about Ethereum 2.0, which he argues “could prove to be the largest economic shift in society” in quite some time.

As far as ethereum’s price goes, Cochran argues that staking ETH in order to validate blocks will use up around 10% to 30% of its outstanding supply. Such a supply shock will ultimately drive up the price of ethereum, which investors, traders and DeFi users will find increasingly hard to obtain.

Undervalued, But Not That Undervalued

Such reasoning has led some commentators to suggest that we’ll eventually see the ethereum price at $9,000, or even higher.

Source: Twitter

Not everyone is convinced, however. Here’s notorious Ethereum skeptic and Bitcoin maximalist Udi Werthheimer making fun of the idea that Ethereum 2.0 will fundamentally change anything:

Source: Twitter

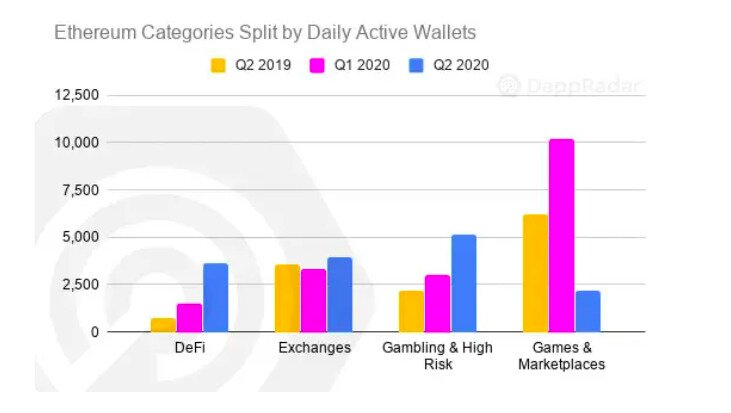

More seriously, there’s not enough evidence to suggest that ethereum is dramatically undervalued. Looking at the DeFi numbers, for example, they’re still fairly low in absolute terms, as indicated by DappRadar’s Q2 Dapp Industry Review.

Published at the beginning of July, DappRadar’s data revealed that the number of daily active Ethereum wallets used for DeFi purposes grew by just over 100% between Q1 and Q2 2020. This sounds great, yet the total number of daily active DeFi wallets is still hovering under 5,000.

Source: DappRadar

The same goes for wallets in other Dapp categories. Relative interest is growing fast, but the absolute numbers are still very low.

Likewise, much mileage was recently made out of the fact that Ethereum transactions passed one million in late June, nearing all-time highs. Transactions had also passed one million in January 2018 and May 2018. They also peaked just below one million in June 2019, before descending to under 500,000 by January 2020.

Ethereum’s growth may continue to falter for the foreseeable future. DeFi may become more popular within the crypto ecosystem, but it may struggle to become more than just a niche sub-sector of a niche sector. Indeed, the Cambridge Centre for Alternative Finance has estimated that decentralized platforms such as Ethereum account for only 3% of corporate blockchain projects.

So yes, Ethereum may be a little undervalued. The jury’s still out on whether there’s enough evidence to prove that it’s massively undervalued.