- >News

- >Is BlockFi Bankruptcy the End of the Road for CeFi?

Is BlockFi Bankruptcy the End of the Road for CeFi?

BlockFi has filed for Chapter 11 bankruptcy, confirming reports that its exposure to FTX had put the cryptocurrency lender and its finances in serious jeopardy. It had received a $400 million credit facility from FTX back in early July, after the collapse of Terra had caused the collapse of (venture capital firm) Three Arrows Capital, to which BlockFi had lent a significant sum of bitcoin. Now, with FTX no longer capable of propping it up, it has lost its months-long battle with financial gravity.

Interestingly, the very same Terra collapse that had proved the downfall of Three Arrows Capital (and ultimately BlockFi) also resulted in the bankruptcies of Celsius and Voyager Digital, with both of these coming in July. As with BlockFi, Celsius and Voyager were lending platforms, with Celsius facing allegations that it had used customer deposits to make highly speculative investments. And now, with fellow lending platform Nexo also facing speculation as to its financial viability, it seems as though CeFi (centralized finance) is facing extinction.

Indeed, the major weakness of centralized lending platforms is that their centralization usually means an absence of transparency, something which in the current context will prevent customers from being able to trust a CeFi platform ever again. And now that so many CeFi lending platforms have collapsed, it seems that the only way for the DeFi sector to survive is to ensure that it becomes more or less fully decentralized.

BlockFi as a Case Study of Why CeFi is Riskier than DeFi

The reasons for BlockFi filing for Chapter 11 bankruptcy are simple enough. It cited significant exposure to FTX, with which it had stored an undisclosed sum of cryptocurrency. And while FTX had extended a $400 million credit facility (i.e. a loan of up to $400 million) to BlockFi in the summer, BlockFi had actually lent funds to (FTX parent company) Alameda Research, which collapsed along with FTX in November.

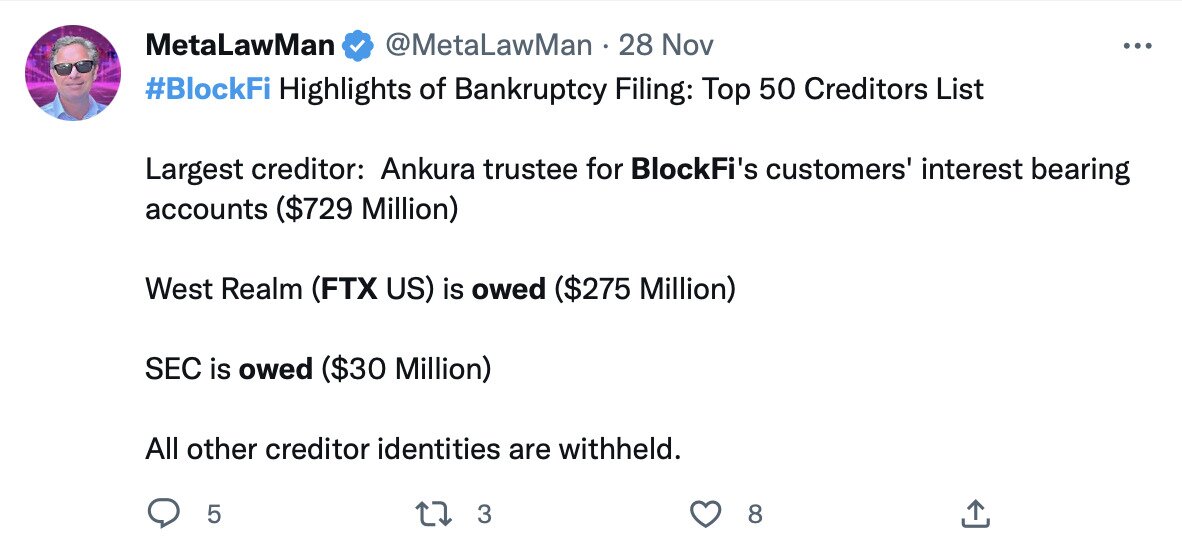

In its filing, it reported it had around 100,000 creditors, with FTX being the second-biggest, owing to the aforementioned loan. It also reported liabilities of between $1 billion and $10 billion, and cash-on-hand of only $256.5 million, indicating the financial hole in which it had found itself.

Source: Twitter

Needless to say, the cryptocurrency market’s decline is a big factor in the demise of BlockFi, along with that of Terra, Three Arrows, Celsius, Voyager and FTX/Alameda. However, it’s also largely the product of how CeFi operates, insofar as the centralized and private aspect of CeFi facilitated the taking of big risks, which are especially unsustainable in an area as volatile as the cryptocurrency market.

DeFi platforms are just that, platforms. As exemplified by MakerDAO, AAVE and Curve (among others), they’re almost wholly defined by their smart contracts and code, while their existence on-chain means that their operation is transparent and publicly visible. This tends to limit the extent to which DeFi platforms can get away with doing reckless things with customer deposits, since savvier users would notice.

This, sadly, is not the case with CeFi. A CeFi ‘platform’ is not really a platform, but a private company. It can set its own rules, and it can adopt whatever business practices and propositions it believes will attract more customers, such as offering high yields.

For example, Celsius offered yields of 18% and beyond, which it could do (for a very short while) by making risky investments with customer deposits. While specific allegations of using customer deposits haven’t been leveled against either Voyager Digital or BlockFi, they nonetheless made risky investments, with both having exposure to Three Arrows, for instance.

Speaking of Three Arrows, BlockFi lent money to the collapsed fund, and even went so far as liquidating the fund’s position in June. It’s likely that the loan it had made to Three Arrows was under-collateralized, meaning that the collateral it accepted from Three Arrows (and which it took when it liquidated the latter’s position) wasn’t sufficient to cover the amount it had lent.

This is something which tends to affect CeFi more than is safe, yet being private companies, CeFi firms fall into the trap of making this mistake, since during good times they think it’s a way of maximizing profit. Yet the good times never last.

How Truly Decentralized Finance Offers a Way Out

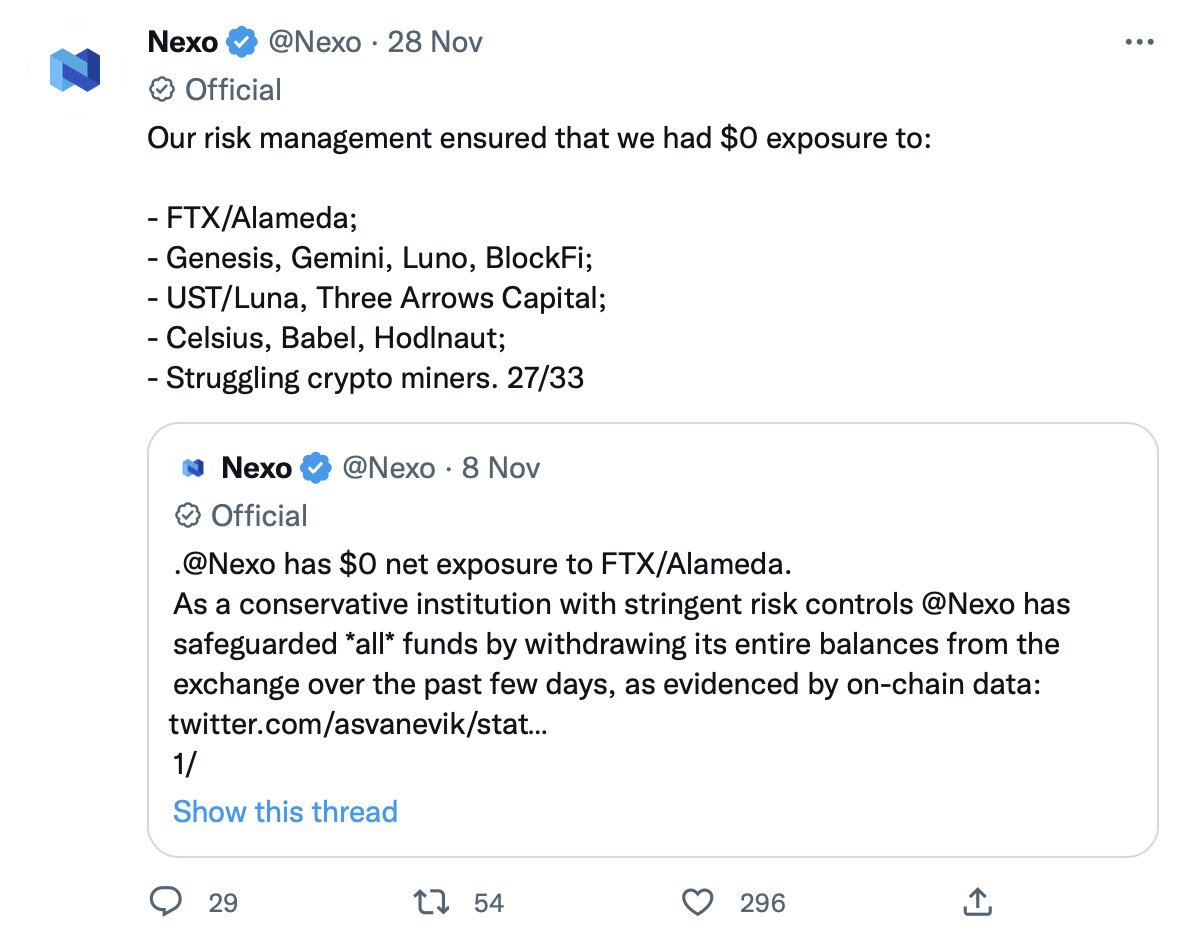

Given the collapse of BlockFi, suspicion has turned to the last-surviving big CeFi company, Nexo. While the latter has quickly moved to affirm that its finances are secure and that it had zero exposure to most of the platforms or companies that have collapsed in the previous few months.

Source: Twitter

The thing is, being a CeFi firm, the cryptocurrency market and community has to take Nexo’s word for it that the latter isn’t in a dangerous position. And given everything that has happened over the past year, few people seem willing to extend them ‘credit.’

Some industry figures have gone so far as to accuse Nexo as “running a hedge fund with customer money,” while others have described the yields it offers as “a red flag.” In other words, the community doesn’t trust Nexo, and it likely no longer trusts any CeFi company.

Source: Twitter

Given such rampant skepticism, it’s now clear that the only way forward for DeFi is to be truly decentralized. Being a centralized company that deals with cryptocurrencies and offers lending, interest and other financial products is no longer enough. Instead, processes and operations must be transferred as much as possible to blockchains and smart contracts, so that they can be continuously audited and monitored by the industry and wider community.

To be fair, a number of platforms already offer this. MakerDAO is a decentralized autonomous organization which makes over-collateralized (rather under-collateralized) loans to users in Dai, with this over-collateralization offering protection against price declines. Meanwhile, Aave is a decentralized lending protocol where users deposit funds into a lending pool to earn interest, and from which users can borrow these same funds.

Such platforms show that meaningfully decentralized DeFi is possible, and while DeFi does come with some technical/cybersecurity risks, the financial risks are arguably much smaller. And the thing is, these technical risks will be reduced over time as DeFi matures, while the risks inherent to centralized firms taking custody of your cryptocurrency will likely never be eliminated.