- >News

- >Is Bitcoin’s Price Correlated to the Rise in Inflation?

Is Bitcoin’s Price Correlated to the Rise in Inflation?

During the 2020 bull market run, when Bitcoin hit its all-time high price of $68,566.83, several inflation narratives emerged. One of the most prevalent is that Bitcoin could be used as a hedge against inflation.

Bitcoiners often associate the fiat monetary system’s printing of additional currency with the malicious act of central banks to exercise control over a population. Debasing the value of a currency by increasing its supply will lead to inflation, which will, in turn, lead to a more precarious workforce that is easier to control.

Whether you agree with this narrative or not, understanding inflation’s relationship to Bitcoin can benefit everyone.

Cause of Inflation

Most modern societies subscribe to the principles of Modern Monetary Theory (MMT) and the idea that creating a small amount of inflation is a net benefit for society. Increasing the money supply will devalue the current amount of a currency in circulation. Small increases in inflation (2-3%) encourage people to spend their money today rather than save it for tomorrow. This stimulates the economy, creates jobs, and leads to overall societal growth.

However, inflation will accelerate outside these manageable levels when a large amount of new money enters the system over an acute period. When this happens, a population can no longer absorb its impact, eventually leading to increased resentment towards governments, a contraction in the economy, and an overall destabilizing effect on society. This will ultimately lead to runaway or hyperinflation if interest rates are not raised to combat it. Unfortunately, institutional and retail investors are left in an unwinnable situation in these circumstances. They will either pay more for goods and services through rising inflation or face higher interest payments on new and flexible loans like mortgages and lines of credit.

Is Bitcoin a Hedge Against Inflation?

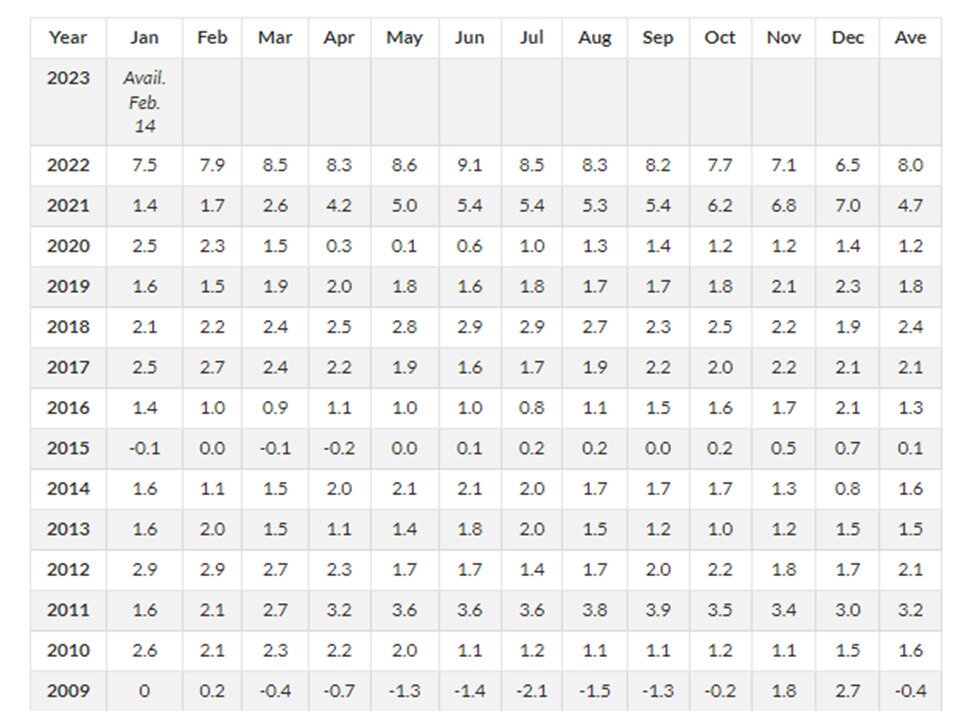

Many believed when Bitcoin reached its all-time high, it would remain a strong hedge against inflation. The reasoning was based on Bitcoin’s intrinsic value being correlated to its absolute scarcity. Since increasing the amount of something will devalue the current supply, it was believed that because Bitcoin’s supply couldn’t be increased, its value could not be reduced. It was then posited that because Bitcoin’s value wouldn’t decrease based on its supply, people searching for a safe haven to protect them against high fiat inflation would turn to it. This would push the price of Bitcoin higher and create a virtuous cycle. At a time when inflation was accelerating up towards double digits before peeking in June 2022 at 9.1%, it was seen by many as a plausible outcome.

We now know that this thesis was incorrect. At least in the short term. Several pressures worked against the hedge theory. First, the macroeconomic environment had shifted faster than most market operators were ready for. High levels of inflation meant disposable income from retail investors was significantly reduced. Similarly, institutional investors were now facing increased prices on goods and services in the supply chain, alongside higher wages. There simply was not as much money left over to invest in a higher-risk asset like Bitcoin.

The second major headwind Bitcoin ran into was the rapidly increasing prime borrowing rates. From March to December 2022, the Federal Reserve introduced rate hikes from 0.25% up to 4.50% and further into the start of 2023. These rate hikes left many investors scrambling for liquidity to cover these new interest payments while simultaneously reducing the amount of liquidity being borrowed. To cover these new interest rates, investors were forced to sell off their higher-risk assets, including Bitcoin. This downward pressure created a negative spiral whereby the value of Bitcoin dropped from forced sellers. This spooked other sellers to exit their positions and drop the price further.

The black swan events and collapses of the Terra ecosystem, Celcius, and FTX only compounded these effects, as massive amounts of BTC were sold off to try and stave off bankruptcy filings. Each time one of these failed, Bitcoin’s price tumbled further.

Is Inflation Correlated to Bitcoin?

Since Bitcoin’s creation, inflation remained relatively stable from 2009 to 2021, only extending past the Federal Reserve’s target of 3% in 2011 before coming right back down. Similarly, federal interest rates never ventured above 2.50% during this time frame and retreated quickly after hitting that height.

During the same period, Bitcoin saw several volatile swings that correlated closely with its halving rewards.

Only 2022’s high inflation and rising interest payments can be correlated with the value of Bitcoin falling. Its correlation appears more in line with the larger macroeconomic environment and black swan events within the crypto industry than anything else. This leads us to believe that while there may be some degree of correlation, it is less likely than many expect. In addition, the correlation does not lead us to believe that Bitcoin’s value is caused by or determined solely by inflation.

Conclusion: Still the Best Long-Term Asset

Bitcoin has been around since 2009. It has been through multiple bull and bear cycles that have occurred roughly every four years. Despite not appearing to be a short-term hedge against inflation, it also acts relatively independently. While not a hedge against inflation in the short term, it has undoubtedly become the best-performing asset in the last ten years. As a result, investors who have bought and held Bitcoin have been rewarded handsomely.

This entire narrative around Bitcoin also presupposes that it is an asset to be held. Yet, its primary goal is to become a peer-to-peer electronic cash. While many investors will always view it as a long-term store of value for many more millions, it serves its original purpose regardless of price valuation.