- >News

- >Is 2021 Going to Be the Year of Non-Fungible Tokens (NFTs)?

Is 2021 Going to Be the Year of Non-Fungible Tokens (NFTs)?

Money is supposed to be fungible. If bitcoin — or any other crypto — wants to qualify as a real currency, then one BTC or any unit of BTC should be exactly equal in value to any other. This actually isn’t something bitcoin always manages, but in the case of so-called non-fungible tokens (NFTs), it’s something that crypto actively avoids.

Put simply, NFTs are meant to be unique. Rather than functioning as interchangeable currency, they’re designed to be or represent an individual object, be it an actual physical artwork IRL or a digital artwork, collectible, or object (e.g. a CryptoKitty). Up until now, such NFTs have remained on the margins of the overall crypto ecosystems, but new data from Dune Analytics reveals that digital goods marketplace OpenSea has enjoyed massive volume growth in recent weeks.

Does this growth indicate that NFTs are about to have a bumper 2021 and begin rivaling the rest of the cryptocurrency market for size? Well, while there are clear indications that NFTs are benefitting from the general growth of cryptocurrency prices, it’s also clear that it will occupy only a fraction of the market for some time to come.

Non-Fungible Tokens Go Exponential

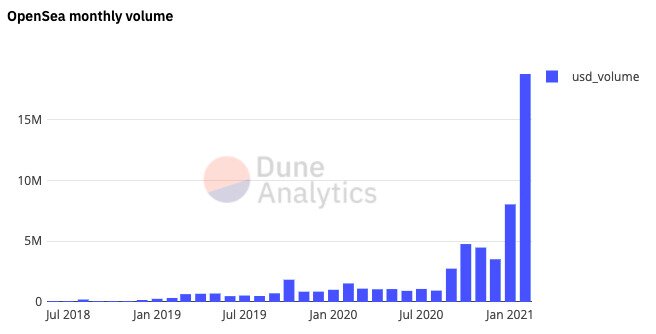

According to data compiled by Dune Analytics, interest in non-fungible tokens — or rather the digital objects they represent — is growing exponentially at the moment.

Its data, which covers the OpenSea platform for non-fungible digital goods, shows a 128% increase in monthly trading volume between December and January. December enjoyed a volume of $3.5 million in sales, while January witnessed a volume of around $8 million.

Source: Dune Analytics

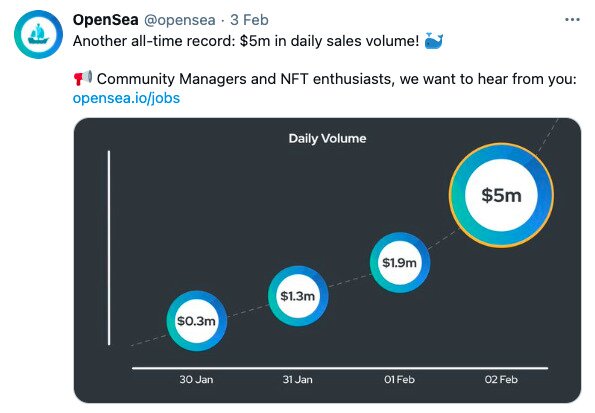

In fact, more recent data suggests that this growth is only accelerating. On February 1 alone, OpenSea enjoyed $1.9 million in sales volume, which was its biggest daily volume ever. However, this record was broken only a day later, with February 2 seeing just over $5 million in trades.

Source: Twitter

At this rate, February’s volume is likely to be just over $70 million, and that’s only for a single NFT platform. But while OpenSea is only a single platform, its performance is indicative of the wider NFT sub-sector, since it’s a marketplace for all NFTs, regardless of where they come from.

As such, it’s a barometer of how quickly the space is growing. It’s also a pretty reliable one, since other data does indeed corroborate the story it tells.

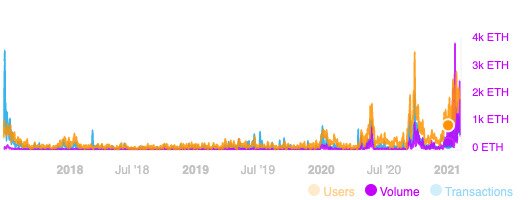

According to DappRadar, the trading volume for CryptoPunks has also shown impressive growth recently. In case you aren’t aware, CryptoPunks are tradeable pixel-art images of punk-type characters, first launched in June 2017 (making them older than CryptoKitties).

Source: DappRadar

As the table above indicates, volumes, users and transactions have all shot up massively for CryptoPunks in the past couple of months. For example, its 30-day volume has increased by 278% compared to the previous period, while transactions have increased by 110%.

CryptoPunks is the leading NFT platform in terms of volumes, yet others can also boast strong growth recently. SuperRare — a marketplace specifically for digital artwork — has seen its monthly volumes go from around $1 million and $1.4 million in November and December, to $2.7 million in January and already $906,000 in the first week or so of February.

Why?

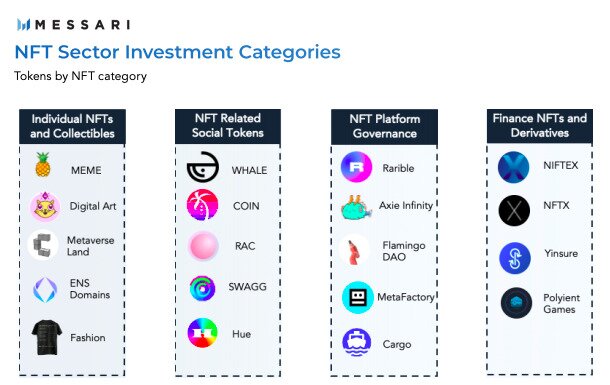

Non-fungible tokens come in all shapes and sizes. Most are digital collectibles, in the sense of being either digital artworks or simply digital items (such as CryptoPunks). Others are digital objects, such as those you can find within certain video games, including Axie Infinity, which is a Pokémon-style battle game involving unique monsters.

Source: Messari

There are a variety of reasons why such NFTs are becoming more popular and valuable. The first, and most obvious, is that they’re simply growing in parallel with the growth of the wider cryptocurrency market.

In other words, platforms such as OpenSea, CryptoPunks and SuperRare are turning over greater volumes largely because the price of ethereum — in which most NFTs are denominated — is rising. This would indicate that the recent growth in NFTs isn’t quite as spectacular as some would have you believe.

That said, the DappRadar chart above shows an increase in CryptoPunks’ volume in ethereum, so it’s clear that much of the growth isn’t simply the result of ETH rising in price, but of people being willing to spend more ETH.

We therefore need to understand what else is driving the NFT sector, and the other main answer relates to the parallel growth of decentralized finance (DeFi).

In terms of the total value locked into DeFi platforms, the sector has grown by over 3,000% since June. This is important for NFTs since there is a considerable overlap between the two.

For instance, a report from Messari highlights the growing importance of liquidity mining within the NFT sector, as seen with such NFT platforms as MEME and $WHALE. This is a practice which is very common in DeFi, and which sees users stake tokens in order to receive some kind of return. Such incentives have driven users towards the NFT sector, in the hope of accumulating future wealth.

Similarly, the second half of 2020 brought a number of platforms offering derivatives of NFTs. This includes NIFTEX, which lets holders of NFTs create and trade fractions of their NFTs, so as to profit from them.

More generally, the cryptocurrency market is characterized by thousands of people (if not more) looking for the next big thing. Bitcoin is already a crowded market and may now be hard to profit from in a spectacular way, so investors are increasingly turning to new areas such as DeFi, and now NFTs.

NFTs still hold out the promise of huge gains: digital artworks sold on SuperRare, to take one example, have risen from prices of around only a few hundred dollars to over $100,000 in three years. This is perhaps why the sector is now seeing higher-than-average growth, with buyers hoping to buy extremely low and sell extremely high.

Drop in the Ocean

However, as healthy as the NFT sector’s current growth is, it remains a drop in the ocean compared to the wider cryptocurrency market. This is most starkly highlighted by the fact that the total volume to date for CryptoPunks is only $16.5 million, which works out at only 0.033% of bitcoin’s 24-hour volume as of February 8 (about $50 billion).

That’s minuscule. And while we will continue to see strong growth for NFTs throughout this year (and beyond), it will always remain a very small part of the overall ecosystem.