- >News

- >Institutional Investors Could Help Push Bitcoin to New Heights

Institutional Investors Could Help Push Bitcoin to New Heights

Institutional investors are increasingly dominating the cryptocurrency market in North America, according to new data from Chainalysis. Around 90% of North America’s cryptocurrency transfer volume in June came from transfers worth $10,000 or more, indicating that professional and institutional investors account for the lion’s share of trades.

Some outlets have framed this as ‘bad news’ for retail investors, with institutional investors reputedly “edging” them out. However, the opposite is actually the case: the growing interest of institutional investors is great news for all kinds of bitcoin and cryptocurrency traders.

Institutional investors bring greater liquidity, more price stability, and considerably improved reputability to the crypto sector. As such, they will ultimately provide retail investors with more opportunity to trade crypto, and to trade it profitability, with less of the volatility that has characterized crypto up until now.

Institutional Investors Bring The Money

Chainalysis’s 2020 Geography of Cryptocurrency Report turned up some interesting data for those of us who’d been patiently waiting for institutional investors to arrive.

It’s headline finding was that “90% of North America’s cryptocurrency transfer volume came from professional-sized transfers” in June. By “professional-sized transfers,” Chainalysis refers to trades worth at least $10,000.

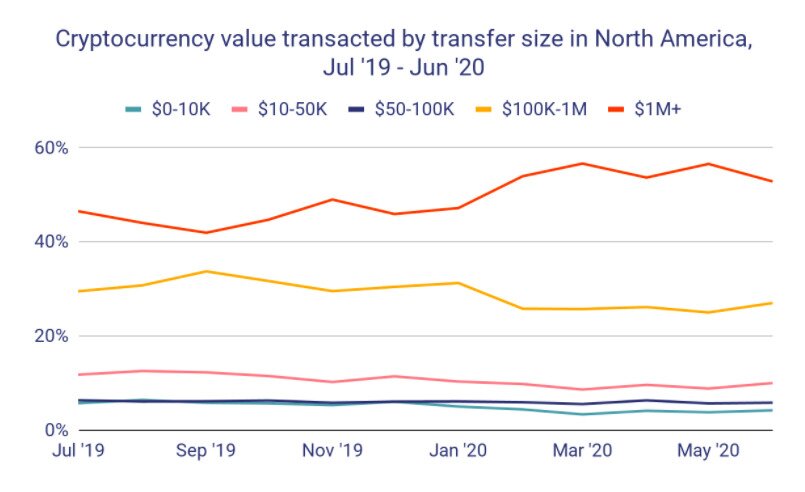

Even more interestingly, Chainalysis also found that big institutional investors are increasingly playing a role in the cryptocurrency market. In particular, transfers worth at least $1 million accounted for 57% of all North American trades in May 2020, having stood at 46% in July 2019.

Source: Chainalysis

As the market research firm concluded, the growth in such $1 million-plus trades explains why “professional” investors command 90% of the cryptocurrency market.

“In other words, the increasing dominance of North America’s professional market since December 2019 appears to be almost entirely driven by transfers of $1 million or more worth of cryptocurrency, many of which we believe are coming from institutional investors.”

There’s plenty of evidence to suggest that institutions are indeed plowing increasing sums of money into crypto. Fidelity Investments published a survey in June of 800 institutional investors in the U.S. and Europe, finding that 36% are “currently invested in digital assets.” It also found that nearly 80% of investors “find something appealing” about cryptocurrencies, with 60% stating that digital assets have a place in their portfolios.

In the U.S., Fidelity’s research revealed a growth in institutional exposure, from 22% in 2019 to 27% in 2020. Only 47% believed that crypto had a place in their portfolios.

Summarizing these findings, Fidelity Digital Assets Tom Jessop said, “These results confirm a trend we are seeing in the market towards greater interest in and acceptance of digital assets as a new investable asset class.”

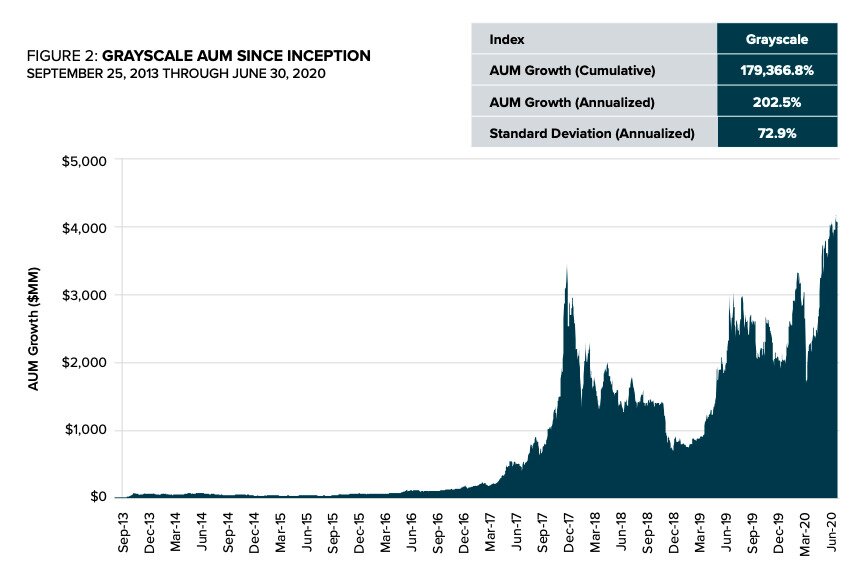

It’s not only surveys that have revealed a greater influx of institutional money this year. Cryptocurrency investment fund Grayscale revealed a doubling of the amount invested into its fund in Q2 2020, when inflows hit $905.8 million, having been only $503.7 million in Q2 2019.

As the chart below indicates, Grayscale’s assets under management (AUM) reached an all-time high in Q2 2020.

Source: Grayscale Investments

It’s very likely that this figure has increased even further since the end of Q2 (June). Because with bitcoin hitting $12,000 and other cryptocurrencies witnessing similarly strong surges, it’s likely that further institutional money has flowed into crypto. Particularly when institutional money accounts for most trades, and particularly when a weakened U.S. dollar and economy is making crypto seem increasingly attractive.

Bullish for Bitcoin Price, Bullish for Crypto

This growth is extremely bullish for Bitcoin and crypto in general, indicating a growing demand for cryptocurrencies at a time for economic uncertainty and weakness.

It’s also an extremely positive development, since the increasing participation of institutional investors will provide the market with a number of benefits.

Firstly, institutions will bring greater liquidity and market depth. This will make the cryptocurrency market less volatile and unpredictable, which in turn will attract more institutional and retail investors.

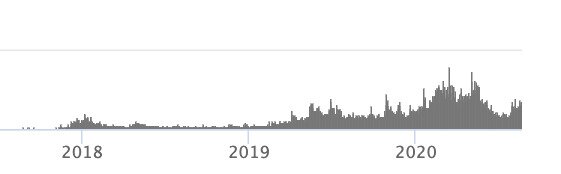

Bitcoin’s volatility has already been declining over the long term, with fewer spikes and generally smaller spikes (save for the March coronavirus-inspired crash). This is the product of longer term increases in volume, which helps to shield the cryptocurrency market from excess volatility.

Trading volume (in USD) for the cryptocurrency market as a whole. Source: CoinMarketCap

Institutional investors will also bring wider benefits. As eToro wrote in a January analysis blog, their increasing involvement will improve crypto’s image, particularly in the eyes of retail investors:

Institutional investors instill confidence … Institutional investors not only invest large amounts of their capital, but also put their reputations at stake. Confidence is key when it comes to investing. People will not put their money into something they do not clearly understand unless they see some reputable and genuine source doing the same.

The entry of institutions will also likely help win over regulators and governments, who may be less inclined to pass restrictive legislation if they see financial heavyweights trading crypto.

Taken together, the arrival of institutional investors indicates a longer term increase in the price of bitcoin (although to how high no one could possibly say). That said, it’s important not to get too carried away too soon, since the role of institutions may not be increasing as dramatically as the headlines suggest.

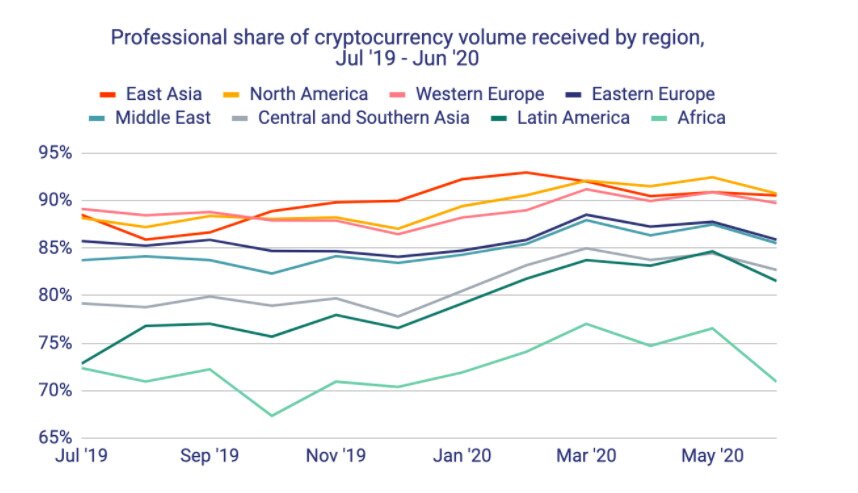

For example, if you look at the professional share of cryptocurrency trading throughout the world, it has already been at a high percentage for at least a year.

Source: Chainalysis

In North America, Western Europe and East Asia, it already stood at just under 90% in July 2019. This means “professional traders” have already been playing a dominant role in crypto markets for a while, without producing a massive bitcoin rally to $20,000 or beyond.

So don’t expect that rally to happen just yet. But with bigger institutions gradually warming up to crypto, it may only be a matter of time.