- >News

- >How to ‘Do Your Own Research’ When Investing in Cryptocurrency

How to ‘Do Your Own Research’ When Investing in Cryptocurrency

Do your own research. This phrase has become something of an empty platitude within crypto, something that prominent figures repeat in order to absolve themselves of any liability in the event that a trader, having been encouraged into investing in cryptocurrency, ends up losing significant sums of money.

However, regardless of how much it may be overused and abused, ‘do your own research’ (‘DYOR’) does point to a number of important truths as far as (cryptocurrency) investing is concerned. In this article, we unpack them in order of importance, explaining just why they’re significant and how the average retail trader can use them to their advantage.

Of course, no amount of ‘your own’ research will help when the market goes through a downturn, meaning that understanding cycles is just as important as researching individual cryptocurrencies and platforms.

The Basics of Crypto Research

Here’s a look at some of the major starting points for researching prospective cryptocurrencies.

This list is by no means comprehensive but should serve as a good starting point for anyone looking to get involved with crypto:

Obtain Reliable Usage and Transaction Data

A useful analogy in cryptocurrency investing is that purchases of any given coin are bets on its future value. In other words, if you’re betting that a cryptocurrency and its blockchain will be significantly bigger in the future, it’s therefore a good idea to find reliable evidence to support this bet.

There are various sources of data that can help traders ascertain whether a blockchain is growing.

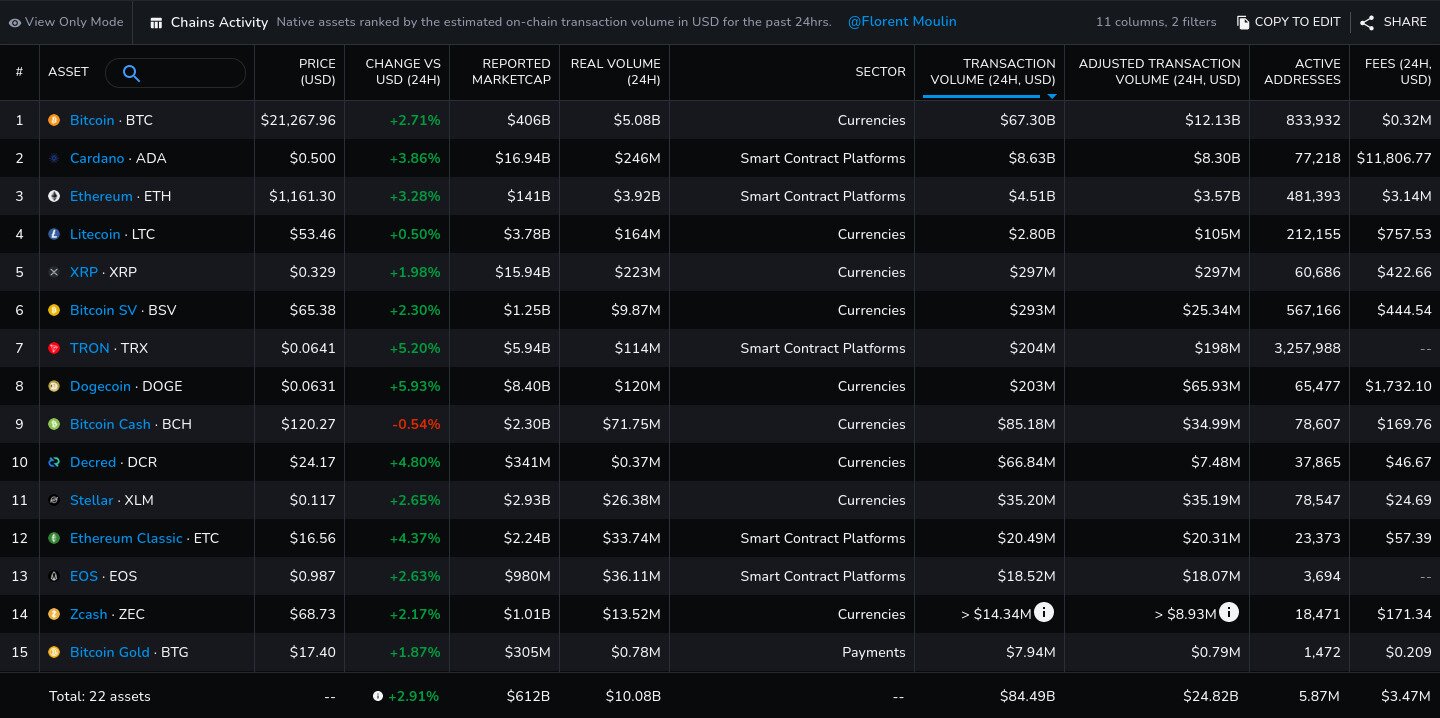

For example, Messari (as well as other cryptocurrency research and investment firms) produces a regularly updated table that tracks on-chain activity for various major platforms. As shown below, it tracks 24-hour volume (in US dollars) as recorded by major blockchains

Messari’s Chain Activity table tracks 24-hour transaction volume on major blockchains. Source: Messari

The table above highlights an important lesson which all traders need to learn when using data to ‘do their own research.’ It contains two transaction volume columns: ‘Transaction Volume’ and ‘Adjusted Transaction Volume.’ Only one of these — ‘Adjusted Transaction Volume’ — is meaningful, since it has been filtered to exclude ‘spam’ transactions that don’t involve transfers between actual people.

A similar rule of thumb applies to other kinds of data. As another example, the table above also includes a ‘Real Volume’ column, which charts the ‘real’ trading volume of a given cryptocurrency on major exchanges (i.e. reported trading volume minus potential ‘wash’ trades). While the Messari chart includes only a ‘real’ metric for trading volume, investors need to be mindful when using other sources of trading/transaction data that they may be looking at unreliable or misleading numbers.

Consider Total Value Locked (TVL)

Aside from on-chain and exchange-based trading data, there are a number of other useful pieces of info available for blockchains.

One is total value locked in, which indicates the value of the total amount of cryptocurrency that has been staked or locked into all of the apps based on a given blockchain. The higher this number, the more DeFi-related activity a blockchain is seeing, with Ethereum currently leading the rest of the cryptocurrency ecosystem by a wide margin, according to DeFiLlama.

User numbers are another important area. The exact for this takes can vary from platform to platform, with ‘pure’ cryptocurrencies such as Bitcoin having only active addresses, and with some gaming platforms (e.g. Axie Infinity) having active users. A good source of address figures (for major cryptocurrencies) is BitInfoCharts, while users may need to search online (e.g. via a search engine) for data for specific platforms.

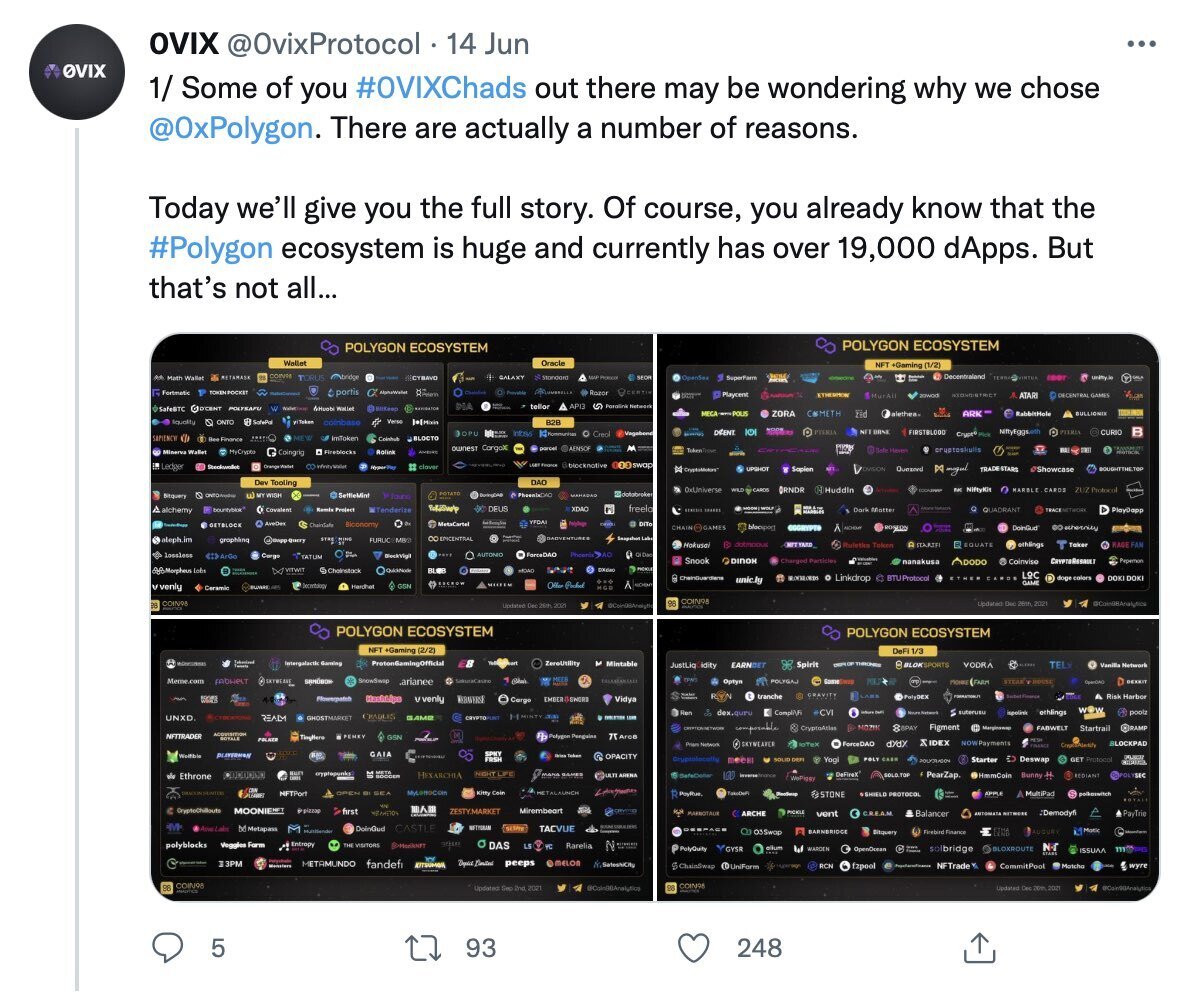

Lastly, many blockchain platforms also publish (often via Twitter) info and infographics on the size of their ecosystems, meaning how many apps are built or building on their networks. What’s important to note about such data is that it’s often very forward-looking, in that some platforms can have hundreds or thousands of apps building on them without much actual use (because these apps are still in development). Still, when combined with evidence on whether actual use is actually growing, ecosystem counts can be a good indicator of how big a platform may be in the future.

Source: Twitter

Data on Market Liquidity

Allied to usage data is market data. In particular, investors looking for a new cryptocurrency to buy need to check that it’s listed on a variety of reputable exchanges. They should also check whether a coin’s market is liquid and exhibits organic price/volume patterns.

For the biggest coins, such as Bitcoin, Ethereum, Cardano and others, there’s going to be little doubt that most exchanges list them. However, many newer coins are often listed on only one or two trading platforms, making them highly illiquid and ripe for manipulation by unscrupulous whales.

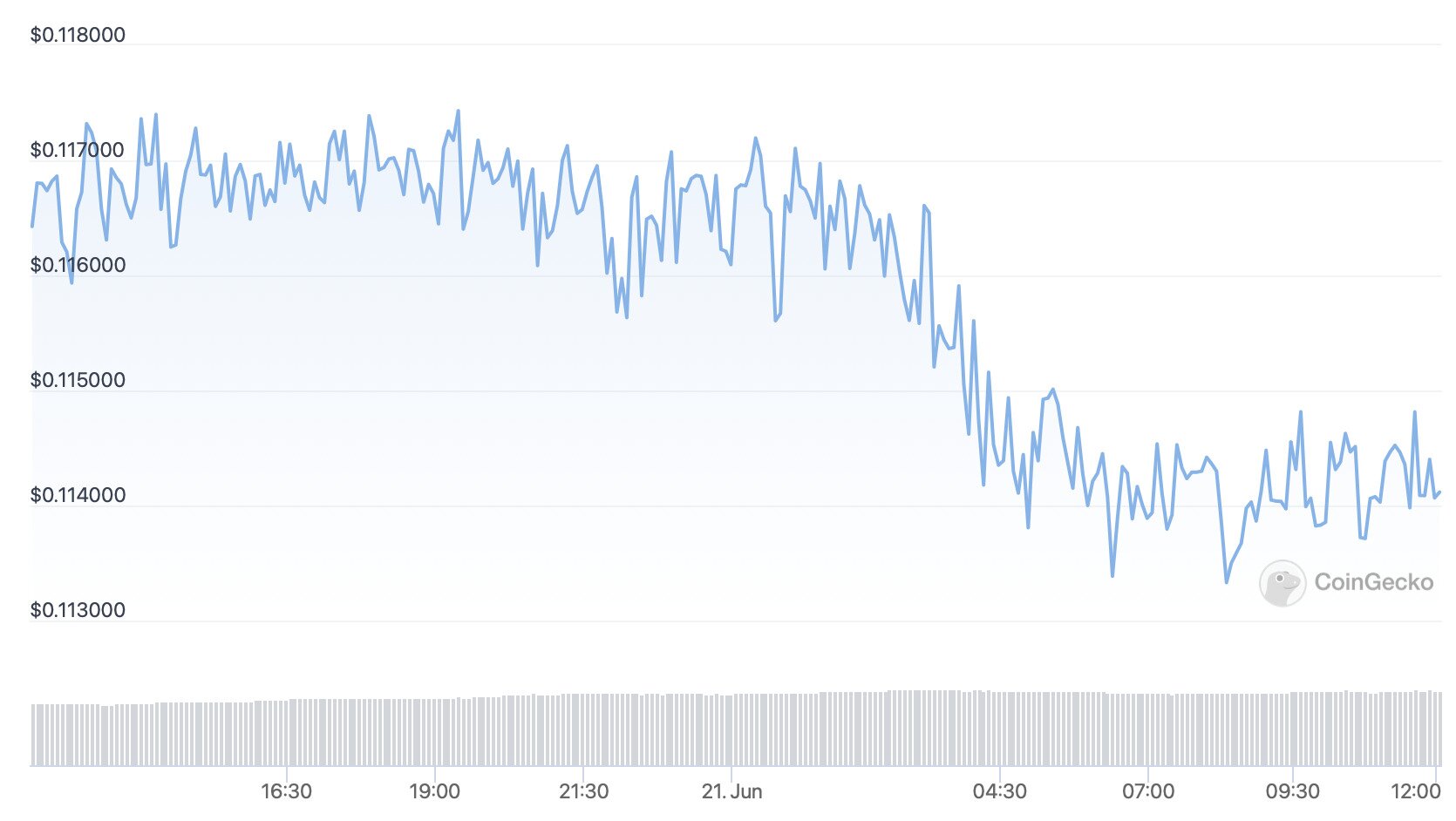

Such coins are noticeable via their price data, which you can view on CoinGecko and CoinMarketCap (and similar sites). As shown in the image below, illiquid coins tend to have their price move up and down steeply, exhibiting a kind of jagged ‘sawtooth’ pattern that suggests artificial trading (e.g. bots).

Source: CoinGecko

Reputable Experts and Developers

No — and we really mean ‘no’ — analyst is an especially accurate predictor of the future. However, it’s always worth paying attention to analysts who support their views with good fundamental (i.e. related to whether a platform is being used) analysis and who have a decent enough track record.

This means always ignoring celebrities and influencers, but considering the opinions of people who have been in crypto for a while and have their reputations to lose if they make bad forecasts. Of course, this doesn’t mean going solely on what an expert says, but on using their pronouncements to narrow your field of research. While we can’t name names, such experts can be found on Twitter, YouTube and on various news websites.

It’s also worth paying attention to developers, and from a variety of different platforms. Such people often shed valuable light (for the layperson) on the technical defects of particular projects or chains, helping traders to understand whether a hyped network isn’t all that it’s made out to be.

Understand Market Cycles

Finally, it needs to be remembered that you can’t research your way out of a market downturn. Sometimes, the market goes down as a whole (as it has been doing for the past few months), so no amount of research can help you identify a cryptocurrency that will secure consistent returns in such situations.

You may therefore have to wait out bear markets. Nonetheless, it’s always worth continuing with research in order to identify the coins that you may invest in once market and macroeconomic conditions become more favorable. On top of this, it’s always worth paying attention to wider market and economic conditions, so that you always have a good idea of when the market may become bullish or bearish.