- >News

- >How Rolling Stone Got It Wrong: NFTs Are Down But Not Out

How Rolling Stone Got It Wrong: NFTs Are Down But Not Out

Just as with Mark Twain, reports of the death of NFTs have been greatly exaggerated. The most recent example of such exaggeration appeared on September 20, when the Rolling Stone website published an article titled, “Your NFTs Are Actually — Finally — Totally Worthless.” The gist of this piece was that a study had revealed that around 95% of all NFTs in existence are worth next to nothing, and that the weekly traded value of all NFTs is only 3% of what it was in August 2021.

Of course, crypto is no stranger to premature reports of death, with Bitcoin being subject to such declarations as far back as 2011. And much the same applies to the above declaration about NFTs. Because while volumes and values for non-fungible tokens are undeniably down, this doesn’t mean that such tokens won’t make a comeback in terms of both usage and prices.

Indeed, NFTs remain one of the newest elements of the still-very-young cryptocurrency sector, and as a concept they’ve proven that they’ll have exciting potential applications in multiple areas of the global economy. So any declaration that they are “finally” (i.e. permanently) worthless is bound to be proven wrong as soon as the wider crypto market and ecosystem recovers once again.

NFTs Are Dead, A Strong Rebuttal

Rolling Stone’s article is basically a simple repackaging of a study by crypto-focused analytical firm dappGambl, albeit reframed in a way to suggest that NFTs will never really recover from their current slump.

In fact, the framing is key here, since it’s arguable that the way Rolling Stone reports on the study is fundamentally misleading.

For instance, the headline statistic – that 95% of NFTs are basically worthless – is arguably not as significant as it may initially seem, in that no mention is made of the percentage of NFTs that had actual value back in August 2021 (when the market cap of such tokens peaked).

As such, it can’t be confidently concluded that the NFT market has collapsed in some kind of catastrophic, terminal way, since it’s possible that most non-fungible tokens were worthless even during their initial, much-hyped appearance.

Sadly, there’s no similar data from earlier periods, so a direct comparison or timeline can’t be produced. Yet it should perhaps be remembered that there are many areas of human activity and production (especially in art, music, culture) where most products are ‘worthless’ in a monetary sense. This, however, doesn’t necessarily invalidate the area in question.

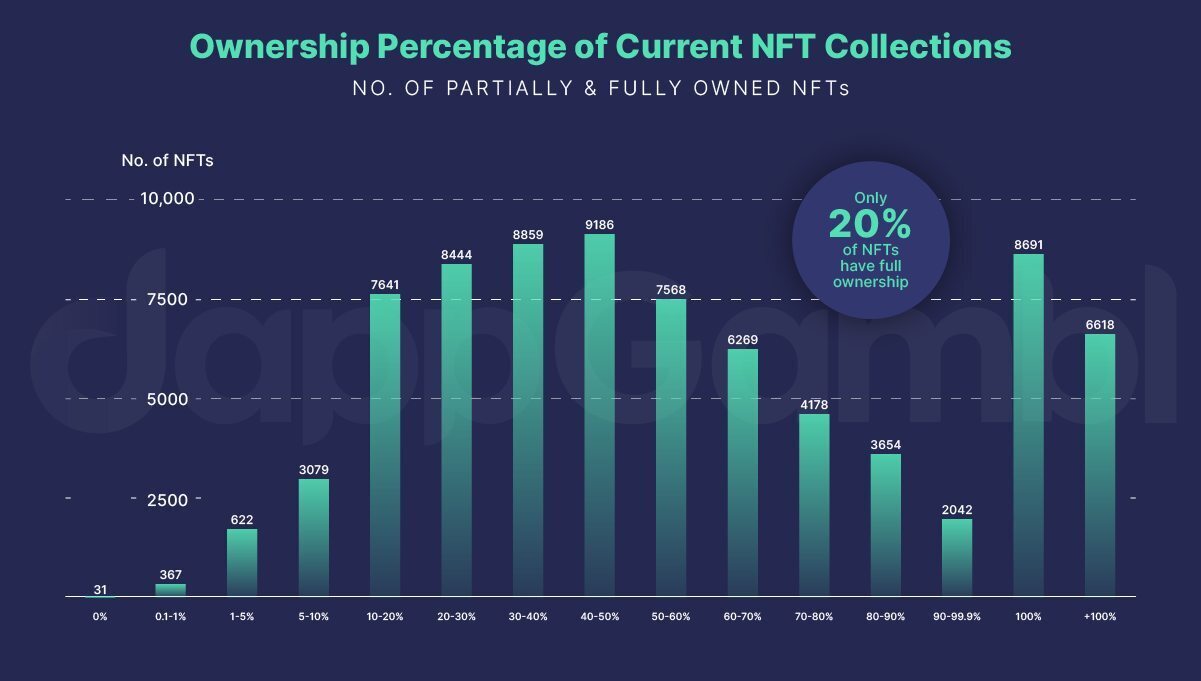

It’s also worth pointing out that the study itself found that only 21% of all NFTs were actually owned, with the remainder unsold. It therefore becomes a bit less momentous to declare that 95% of all NFTs are worthless, since most of these have never been purchased, and have never lost anyone money.

Chart above shows that only one fifth of all NFTs have ever been owned. Source: dappGambl

The other key finding of the study is that the weekly trading volume in NFTs is only $80 million, or 3% of what it was in August 2021. To be fair, this is a significant piece of information, and it can’t be denied that the NFT market has witnessed a real slowdown over the past year or so.

Yet this data should be considered within the context of the wider cryptocurrency market, which has also witnessed substantial decline over the same period. For example, CoinGecko data reveals that the entire market (not including NFTs) has seen its 24-hour trading volume drop from around $223 billion in November 2021 – when the market’s entire cap reached a record-high of $3 trillion – to around $20 billion today.

This is a drop of 91%. Or to put it differently, the market’s current trading volume is only 9% of what it was back in November 2021.

This puts the NFT market’s decline in perspective, given that both declines of a very similar magnitude.

Why NFTs Still Matter

Based on the above criticisms and points, it would be very premature to take the Rolling Stone article and the dappGambl study as conclusive proof that NFTs are dead and buried. Unless you’re of the opinion that crypto is also dead once and for all, then the fact that the NFT decline is comparable to the wider crypto decline would mean that non-fungible tokens are mostly suffering from a loss of investor bullishness, rather than from a fatal illness.

And as crypto has already witnessed more than once in its still short life, market cycles come and go. This would imply that interest in NFTs will also come back soon enough, and there are plenty of reasons to think that they will.

Firstly, non-fungible tokens have arguably been proven to have interesting applications in numerous areas. Possibly the most logical and convincing of these is in video games, with NFTs offering gamers the ability to own and trade their in-game items in a way they couldn’t have done previously. That this is a potentially fruitful area is evidenced by the fact that numerous video game publishers and developers have signaled their intentions to introduce NFTs at some point or another, including Square Enix, Electronic Arts, Ubisoft, Bandai Namco and Sega, among others.

NFTs also potentially have application in music and the arts, as indicated by NFT-linked record launches by the likes of Kings of Leon, Muse, the Amazons and Snoop Dogg. Actually, media outlets including, um, Rolling Stone have published articles highlighting the potential NFTs carry for artists, and given just how young non-fungible tokens remain, it would be rash to write them off just because most of them are worth nothing.

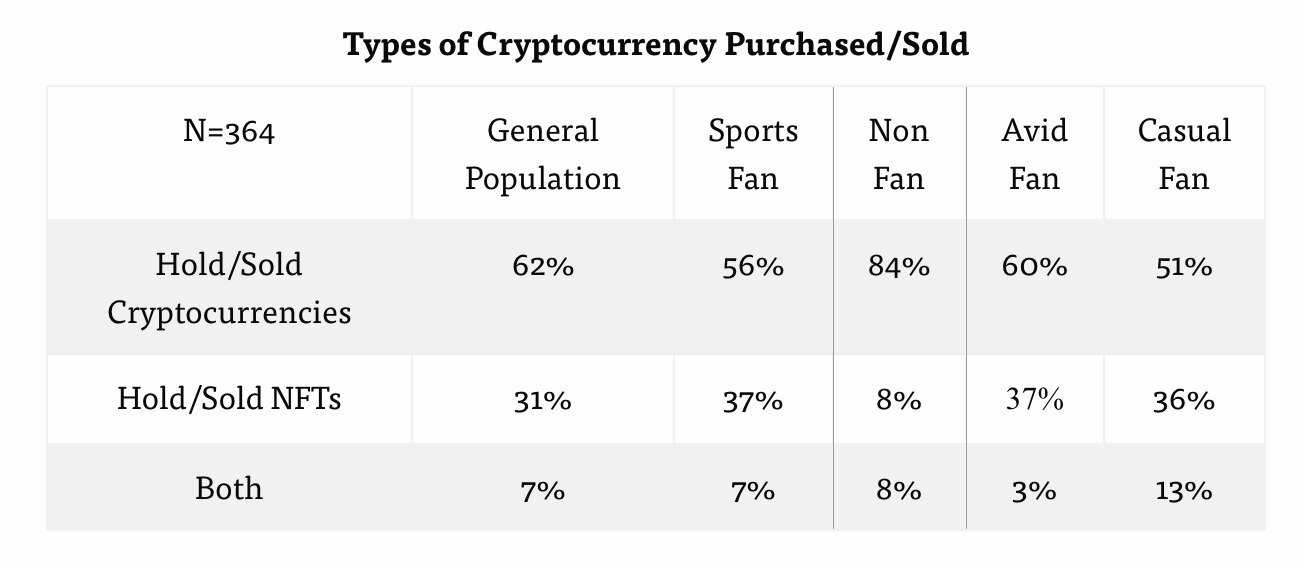

NFTs have also seen widespread uptake in the fashion world (and also sports), which isn’t surprising given that they are a form of digital collectible. Then there’s data which indicates that as many as 24% of Americans have owned cryptocurrencies and/or NFTs, providing evidence that the general population has already become familiar with the (relatively) new token standard, despite its immaturity.

Crypto vs. NFT ownership among cryptocurrency investors. Source: Stillman School of Business

Such familiarity provides the foundation for renewed growth in NFTs once the wider cryptocurrency experiences its eventual resurgence. Yes, non-fungible tokens are down now, but important steps have already been taken in proving them as a concept with applications in numerous fields. So when the next bull market comes, they may finally gain some traction and real-world use.