- >News

- >Here’s Why Ethereum Broke Through $1,000 In A Few Hours

Here’s Why Ethereum Broke Through $1,000 In A Few Hours

Ethereum has stolen back some of its thunder from bitcoin. Having been consigned largely to the sidelines during bitcoin’s march towards $30,000 and beyond, it jumped to $1,000 at the end of January 3, rising by 25% — from $800 — in only a few hours. It has since climbed to $1,100, cementing its level above $1,000 and also ensuring that bitcoin’s previously rising market dominance remains at around 68%.

Given that the price of bitcoin fell by over $4,000 in the hours after ethereum’s push to $1,000, the question arises as to what caused this specific movement, since it certainly wasn’t the product of general crypto rally.

There are three main reasons for ethereum’s jump to $1,000 and over. These range from growing interest in staking with Ethereum 2.0 to an increase in ethereum options and the likelihood that bitcoin profits have been reallocated to Ethereum, which arguably has more space to rise than its older rival.

Ethereum 2.0, Staking and Growing Demand for ETH

Possibly the biggest reason for ethereum’s rally — and the one that is most specific to Ethereum itself (as opposed to any other cryptocurrency) — is the arrival of Ethereum 2.0.

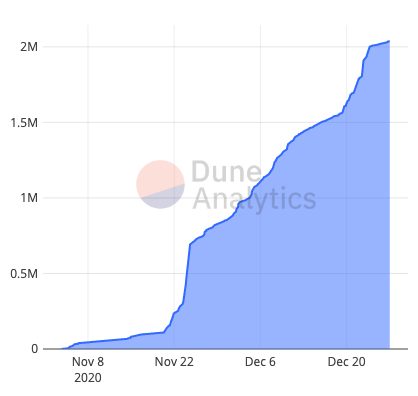

Ethereum 2.0’s Phase 0 “beacon chain” launched on December 1, after the necessary 524,588 ETH was staked in its contract deposit address. Since then, the quantity of staked ethereum has only grown.

Source: Dune Analytics

According to data from Dune Analytics, 2.25 million ETH is now staked in the contract, meaning that it has passed 434% of the necessary threshold. In other words, a large and growing quantity of ethereum is being taken out of circulation, where it can’t be traded. But while the supply of circulating ethereum declines, demand for ethereum — particularly because of the opportunities afforded by staking — is growing.

This is a potent cocktail, and it’s likely that this dynamic will serve to push ethereum’s price up over the longer term (assuming that the ongoing rollout of Ethereum 2.0 proceeds successfully).

This effect has been flagged up before, most notably by computer scientist and Metacartel Ventures partner Adam Cochran. In fact, Cochran argued in April that staking could result in as much as 30% of ethereum’s overall supply being taken out of circulation.

Given that the current 2.25 million is only about 2% of ethereum’s current supply, the long-term effect could indeed be significant.

Options Interest

As we noted with bitcoin’s Christmas rally, expiring options is a big reason for price movements. Even if the strike price of an expiring option is below the current price of the cryptocurrency it’s for, it can still have the effect of decreasing supply relative to demand, since it usually results in a trader buying that cryptocurrency (and not always selling).

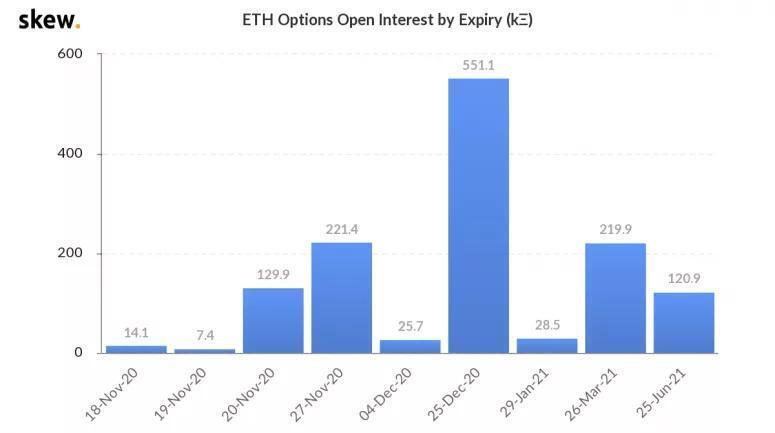

The same applies to Ethereum, which has witnessed growing options interest over the past few weeks. As with bitcoin, ethereum saw a then-record number of options expiring on Christmas Day, for 551,100 ethereum.

Source: Skew

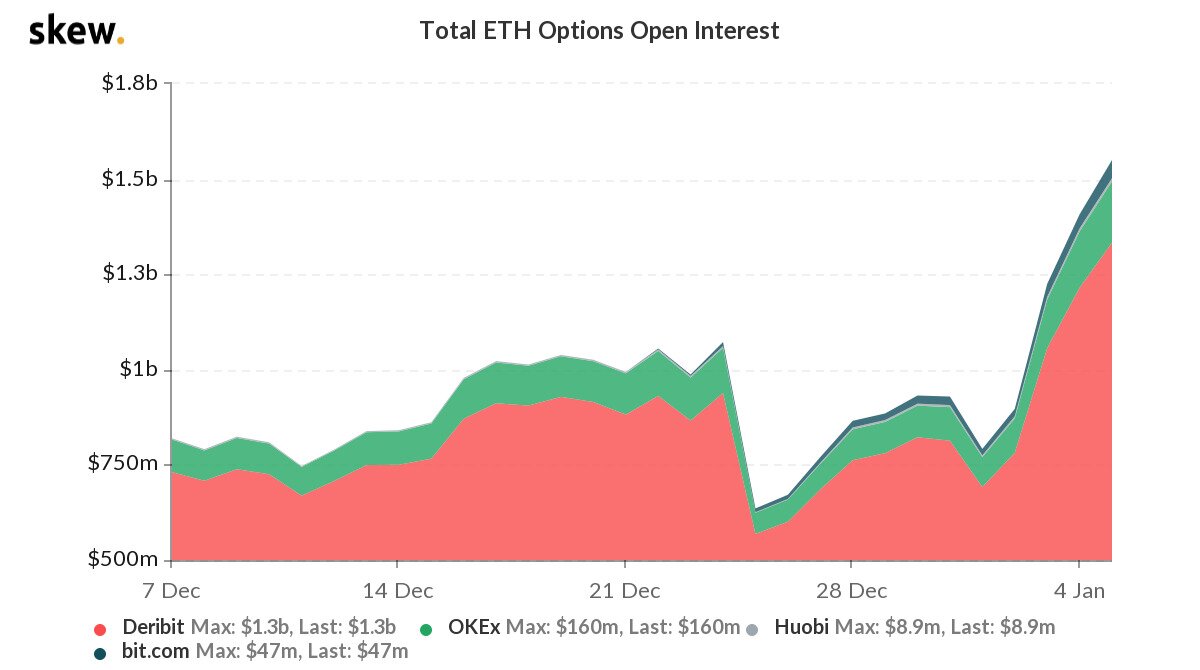

Open ethereum options only increased in the days following December 25. For example, on January 3 — the day ethereum’s price shot above $1,000 — there was around $1.3 billion in open options interest across Deribit, OKEx, Huobi, and bit.com.

It’s therefore likely that the large number of option expiries on January 3 resulted in a significant price squeeze, particularly in tandem with rising quantities of ETH being staked.

Source: Skew

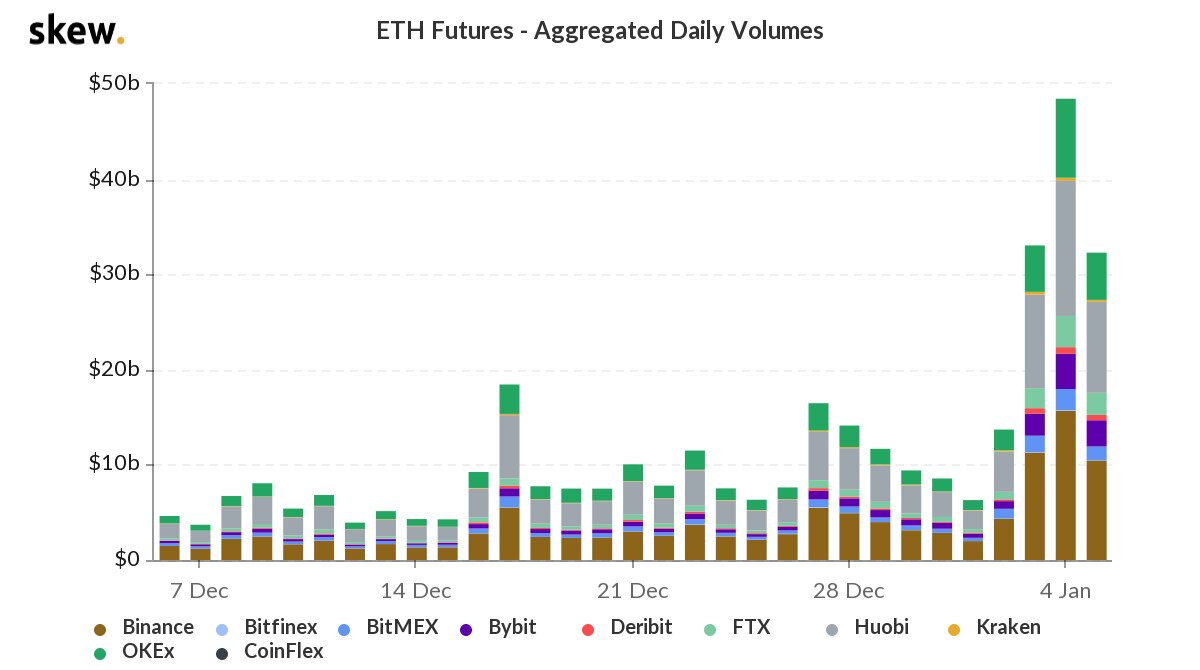

Likewise, futures are also growing significantly for ethereum. Aggregated daily futures volumes hit a record peak of $18 billion on December 17, and also hit $16 billion on December 27, potentially presaging purchases at the start of January.

Futures also continue to rise: daily futures volumes jumped by 122% on January 2, to $14 billion, rose by 133% on January 3 (to $33 billion), and then rose to $48 billion on January 4. So there may be yet more price action to come in the near future.

Source: Skew

Cashing Out Bitcoin, Pumping Ethereum

Another likely cause of ethereum’s solitary rally is that quite a few holders and traders cashed out some of their bitcoin profits and bought ethereum, which hadn’t risen as much prior to January 3.

When ethereum began to shoot up towards $1,000 on January 3, bitcoin began to fall, declining from just over $33,000 to around $29,500. This switchover is indicated by the rise of ethereum’s price relative to bitcoin

ETH-USD (blue), ETH-BTC (yellow). Source: CoinMarketCap

Traders may have been motivated to shift some of their allocation from bitcoin to ethereum by the fact that ethereum still hasn’t passed its all-time high of $1,448, which was set back in January 2018. The cryptocurrency therefore still has plenty of room to rise, especially when bitcoin has exceeded its previous December-2017 high of $19,783 by over 80% (having reached $36,000 on January 5).

Such a large relative shift from bitcoin to ethereum was likely to have been caused mostly by larger traders and whales. As such, it’s interesting to note that noted Ethereum figures like Vitalik Buterin and Joseph Lubin have acknowledged owning bitcoin in the past, although obviously neither have said anything about selling bitcoin and buying ethereum recently.

Regardless of who exactly precipitated ethereum’s rise and bitcoin’s relative dip, it’s clear that some re-allocation has happened. We may witness other similar instances in the near future, particularly with ethereum remaining under its ATH despite the recent bull market.

And ultimately, with Ethereum 2.0 eating into the supply of ethereum and increasing demand, it seems hard to shake the suspicion that ETH will continue rising over the long term.