- >News

- >Here’s Why Bitcoin’s Price Surged Beyond $28,000 This Christmas

Here’s Why Bitcoin’s Price Surged Beyond $28,000 This Christmas

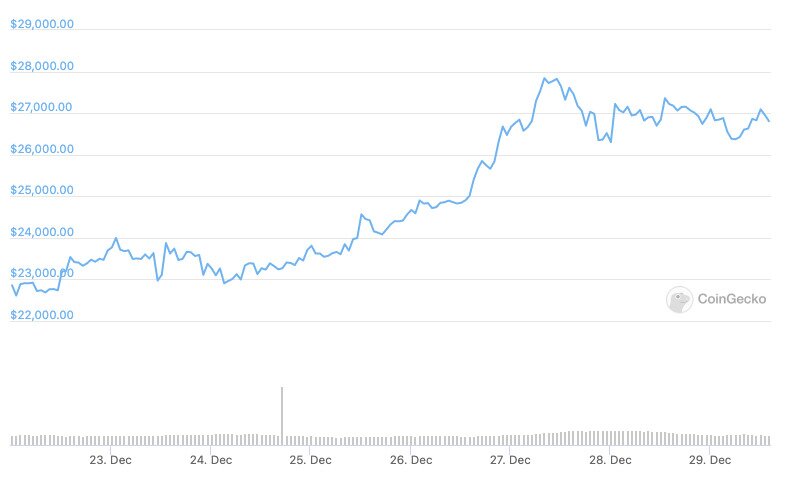

Just when you thought Bitcoin’s 2020 couldn’t really get much better, the original cryptocurrency received possibly the best Christmas present from Santa Claus this year. Beginning December 25 at approximately $23,600, it closed the day $1,000 higher, at around $24,600. It then proceeded to climb over the next couple of days, hitting an all-time high of $28,600 on December 30, according to prices from CoinGecko.

This makes for a 21% rise in five days. Yet while this jump might look like a Christmas miracle to the casual — and bemused — observer, there are at least four clear reasons as to why bitcoin jumped so bullishly when much of the world was taking some much-needed time off work.

Not only did the bitcoin market benefit bigly from a collapse in the price of Ripple (XRP), but it also saw a very large number of options contracts close on Christmas Day. At the same time, the ongoing 2020 bitcoin bull market helped push resulting price rises even higher, while the fact that traditional financial markets were closed probably helped draw the attention of investors towards the cryptocurrency.

The Demise of Ripple

If Bitcoin had a great 2020, then Ripple has certainly had its worst year on record. On December 22, the U.S. Securities and Exchange Commission announced that it’s suing Ripple and two of its executives, Christian Larsen and Bradley Garlinghouse. The main charge is that XRP is in fact a security, and that Ripple has “raised over $1.3 billion through an unregistered, ongoing digital asset securities offering.”

Source: Twitter

If successful, this case — filed in Manhattan — could result in Ripple being issued not only with civil penalties, but with the requirement to pay “disgorgement with prejudgment interest.” In other words, Ripple will be forced to pay back the proceeds of its sale of XRP, as well as interest.

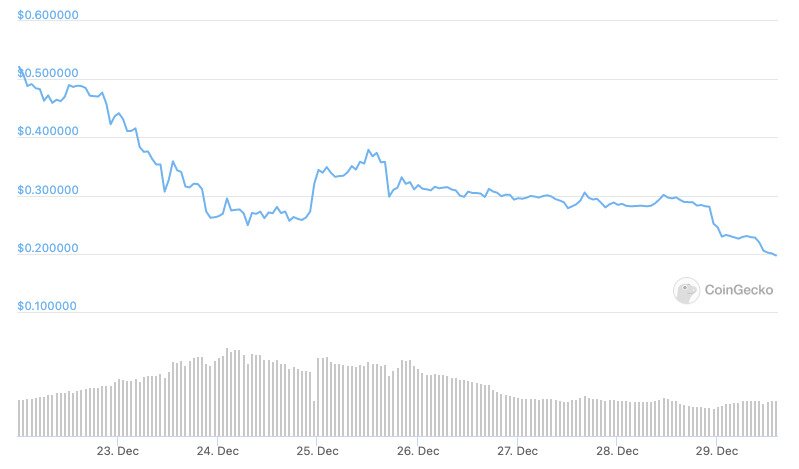

This is bad. So bad that the cryptocurrency market responded to the news of the SEC’s action by selling masses of XRP. The news broke early on December 22, at which point XRP was priced at $0.521214. It then fell to $0.459336 within eight hours, before slumping to $0.306822 by 11:00am (GMT) on December 23, and then $0.249187 at around 7:00am on Christmas Eve.

The price of XRP from December 22 to 29. Source: CoinGecko

All told, this was a fall of 52%. But XRP’s former value didn’t simply disappear. It was to a large extent pumped into bitcoin, which rose almost in parallel with XRP’s decline.

Bitcoin’s price from December 22 to 29. Source: CoinGecko

If you look at the volume bars below each price chart, you’ll see that the 24-hour average volume for XRP hits a peak on December 24, reaching $17.1 billion at around 2:00am (having been $10.7 billion on December 23). At this time, bitcoin’s 24-hour average volume hit $45.3 billion, having risen from $39.1 billion a day previously. It also rose again on December 28.

What’s interesting is that average volumes for XRP and bitcoin rose by similar amounts between December 23 and 24 ($6.4 billion in the case of XRP, and $6.2 billion in the case of bitcoin). This indicates that many traders were selling XRP and buying bitcoin, which is a little more immune against charges from the SEC.

Expiry of Options

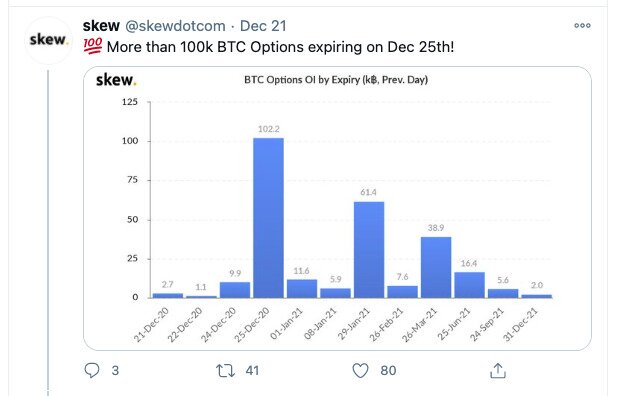

Options were another major cause of the Christmas bitcoin bull rally. As London-based analysis firm skew tweeted on December 21, options contracts for over 100,000 in BTC were due to expire on December 25.

Source: Twitter

To put this into perspective, this is the biggest amount ever. The amount dwarfs figures currently scheduled for the coming year, indicating that the expiry of these contracts had a significant impact on bitcoin’s price.

As an explainer, the expiry of an options contract means that the holder of that contract has the option to purchase a pre-specified quantity of bitcoin at a price set when the contract was signed (the ‘strike price’).

As skew outlined in a follow-up tweet, most of the strike prices were below the then-price of bitcoin at 0:00am on December 25, which was roughly $23,600. Nonetheless, even if most of the options contracts allowed traders to buy bitcoin at a discount, the purchase of as much as 100,000 BTC will have caused a surge in demand. Relative supply of bitcoin would have shrunk, forcing traders to offer more in order to acquire BTC. When coupled with increased demand for bitcoin as a result of the Ripple situation, the upshot of all this was to push bitcoin prices ever higher.

Ongoing Bullishness

Needless to say, demand for bitcoin was already higher and growing higher still before any of this happened. 2020 had witnessed a number of corporations and institutions pile into the bitcoin market, increasing demand for bitcoin as a consequence. This trend continued into December, with major insurer MassMutual revealing on December 11 that it had purchased $100 million in bitcoin.

Galaxy Digital’s Mike Novogratz called this “the most important $BTC news of 2020,” which is saying something in a year when PayPal announced it would let its customers buy and sell various cryptocurrencies for the first time.

Source: Twitter

Regardless, it shows that interest in bitcoin is and was growing organically anyway, something which helped the short-term triggers (of expiring options and Ripple’s woes) provoke a bigger surge from Christmas Day onwards.

Nothing Else to Do

And speaking of Christmas Day, it’s also worth pointing out that traditional financial markets are closed on December 25. This might seem like an innocuous detail, but it probably provided a little more fuel to bitcoin’s Xmas fire, with the cryptocurrency setting a then-ATH of $24,560 on the 25th.

Source: Twitter

Importantly, bitcoin has maintained its momentum since December 25. As XRP continued to nosedive ($0.214095 as of writing), bitcoin continued to reach new heights. Even though it has declined a little from its current ATH of $28,600, it doesn’t seem to be at risk of slipping significantly below $27,000.

And with more institutional and corporate investors likely to buy bitcoin in the New Year, 2021 could also end up being very good to the cryptocurrency.