- >News

- >Here’s Why Bitcoin’s Price Fell by Nearly $1,000 in Less Than An Hour

Here’s Why Bitcoin’s Price Fell by Nearly $1,000 in Less Than An Hour

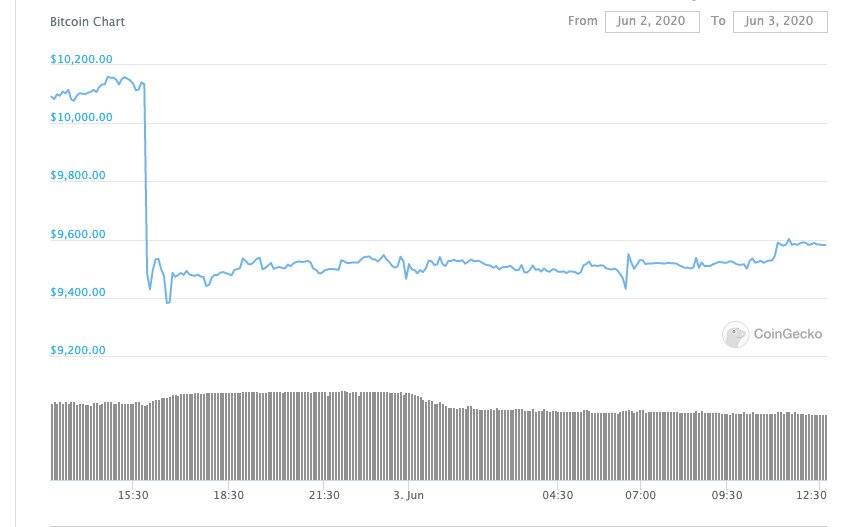

You may have noticed this past week that the bitcoin price fell by 7.4% in less than an hour. Yes, on Tuesday, the bitcoin price stood at around $10,133 at 15:45 UTC, before falling to $9382 at 16:30.

This dizzying $751 drop certainly had bitcoin traders and holders scratching their heads, particularly when the vast bulk – $650 – of it went down in five minutes.

Source: CoinGecko

Given that the bitcoin market still remains relatively immature and anarchic, we may never pinpoint the exact reason why this flash crash occurred. However, there are three strong candidates as to why it happened: squeezed miners dumping BTC, long contracts being liquidated by whales, and irrationality.

These three factors are likely to have played into each other, causing a sudden dip to become a sharp drop. And taken together, the fact that they could cause such a dive highlights once again just how volatile cryptocurrency markets can be.

Bitcoin Price Hit By Struggling Miners

Not so long ago, bitcoin completed its third halving event. This reduced the rewards miners received from 12.5 BTC to 6.25 BTC, with many analysts predicting that a 50% reduction in revenues would force many miners to sell much of their bitcoin.

At the time of the halving, the bitcoin price didn’t suffer a significant drop. However, it now seems that financially hit miners may have finally put the squeeze on bitcoin, choosing to sell when prices hit a short-term high.

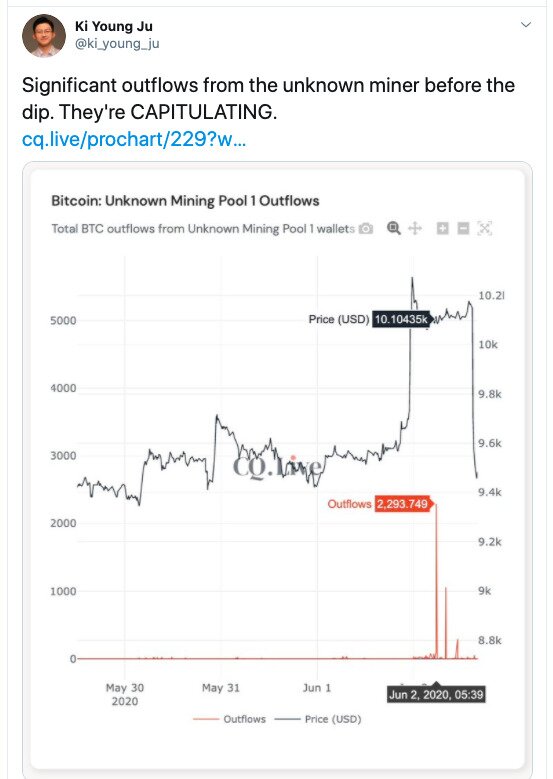

In fact, this is essentially the theory put forward by the CEO of South Korea-based analytics company CryptoQuant, Ki Young Ju. In a tweet, Ju noted that the fifth biggest bitcoin mining pool in the world (by hashrate) happened to send over 3,000 BTC to exchanges just before the flash crash.

The graph above illustrates the bitcoin outflows from the fifth biggest mining pool. Source: Twitter

As Ju explained in a subsequent tweet, this particular mining pool – which happens to be anonymous – only moves its BTC when the bitcoin price hits the top of a cycle. In other words, it moves its BTC just before the bitcoin price declines.

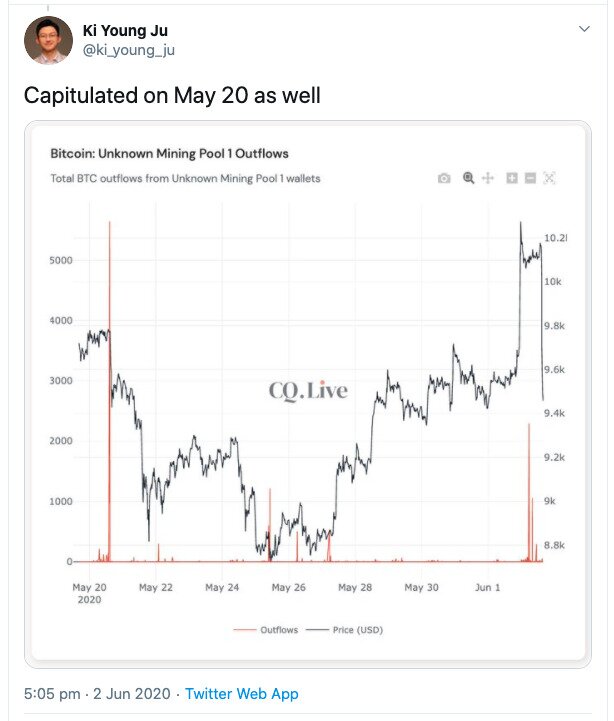

Strengthening the theory that miner outflows had a big part to play in the price crash, Ju also explained that the same mining pool moved over 5,000 BTC on May 20. On this date, the bitcoin price fell by around 3.3% in less than an hour, from $9,761 to $9,438. As the chart below indicates, the mining pool moved its bitcoin just before the May 20 dip occurred.

Source: Twitter

Whales and Institutions Liquidating Long Positions

Aside from miners, other big movements could be seen with the liquidation of bitcoin long contracts.

Basically, bigger traders had increasingly been taking out long positions in the runup to the Bitcoin halving. Becoming increasingly bullish as a result of the halving, they expected the bitcoin price to continue rising.

However, when the price of bitcoin began falling on June 2, long positions held by bigger traders were liquidated almost immediately. This drove the bitcoin price down even further, explaining why the dip was so sudden.

Source: Twitter

Of course, this wouldn’t explain what set off the decline, but it does account for why it was magnified so dramatically. Something similar occurred with the March 12 crash, where the price of bitcoin fell by nearly 50% over night.

Speaking to Forbes in March, Digital Assets Data research Geoff Watts explained that a buildup of long contracts can make losses more severe during declines:

“On March 12th, bitcoin fell below $4,000. At one point, due to a backlog of liquidations, the price of bitcoin on BitMEX was over $300 below the price on other exchanges. We’re seeing a lot of leveraged trades in the crypto markets and that leverage can lead to extreme corrections during periods of high volatility.”

Likewise, Binance CEO Zhao Changpeng warned in July 2019 that it was leveraged trading – long positions – which had been largely responsible for driving up bitcoin’s price at that time. Meaning that, if these positions were liquidated, the bitcoin price would fall.

Illiquidity and Irrationality

Lastly, in a market that still remains relatively illiquid and immature, there’s still a role to play for irrationality and fear. For example, the forex market currently has a daily volume of around $6.6 trillion globally. By contrast, bitcoin’s daily volume is about $31.9 billion, which is just 5% the size of the forex market.

Put simply, bitcoin is still a fairly small market. As such, movements can be amplified and multiplied quite dramatically. This is why the liquidation of futures contracts can have such a sharp impact on price, with the same applying for big mining pools selling up.

At the same time, the relative illiquidity of bitcoin means that irrationality and fear have a bigger role to play in determining the bitcoin price. If traders see a move in the price of bitcoin, and they fear that it may be the beginning of a pronounced dip, then they’re more likely to sell. On top of this, their selling of bitcoin will have more of an effect on bitcoin’s price, which in turn could encourage yet more traders to sell after them. And so on.

In combination, these three factors all contributed to the June 2 price dip. And given that we may continue to see pressured miners and growing long positions in the coming months, we may also see similar flash crashes. So stay safe.