- >News

- >Here’s Why Bitcoin Rallied Above $11,000 and Will Surge More in 2020

Here’s Why Bitcoin Rallied Above $11,000 and Will Surge More in 2020

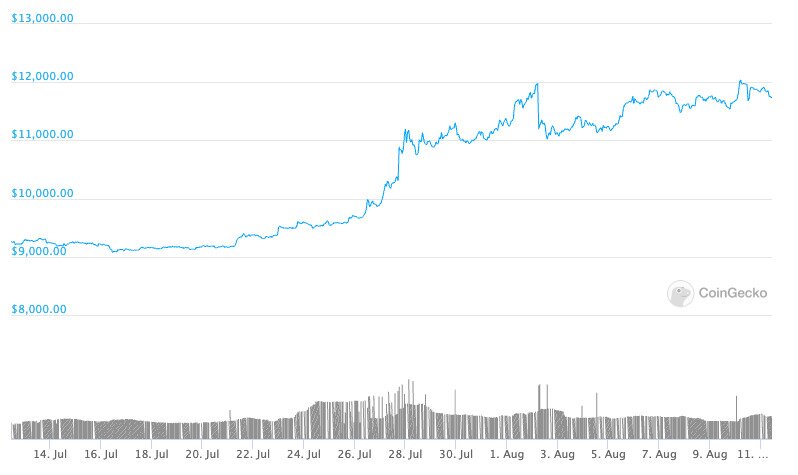

After two months of very low volatility, the bitcoin price is moving again. It began rising from a resistance level of $9,500 on July 25, and reached a high of $12,000 on August 2 and August 10, before settling at around $11,400 (as of writing).

Bitcoin often works in mysterious ways, and many people within the market have stopped asking themselves why it moves up (or down). However, there are two clear factors in bitcoin’s recent jump from low volatility to a sub-$12,000 price level.

The first is economic and political instability, with accumulating economic damage and US-China tensions increasing the appeal of stores of value. The second is a usual yet sometimes forgotten suspect: Tether, which had increased in supply in parallel with bitcoin’s strong surge.

Bitcoin Price Rallies With Gold

The bitcoin price had spent nearly two months in between a very narrow range. From the beginning of June until nearly the end of July, it hovered very dependably between $9,000 and $9,500, with its volatility level hitting a 19-month low of about 18% on July 25.

It then began rising steadily, hitting $10,000 — and then $11,000 — on the same day, July 27. From there it dipped slightly, before rising above $11,000 from July 31. It also witnessed very strong gains on August 1 and August 2, when it hit $12,000 before suffering a flash crash back down to $11,000.

Source: CoinGecko

Since this week of positive volatility, the bitcoin price has been more or less stable again, in the sense of veering between the $11,000 to $12,000 range.

The question therefore emerges: what exactly happened between July 25 and August 2 to make the price of bitcoin rise?

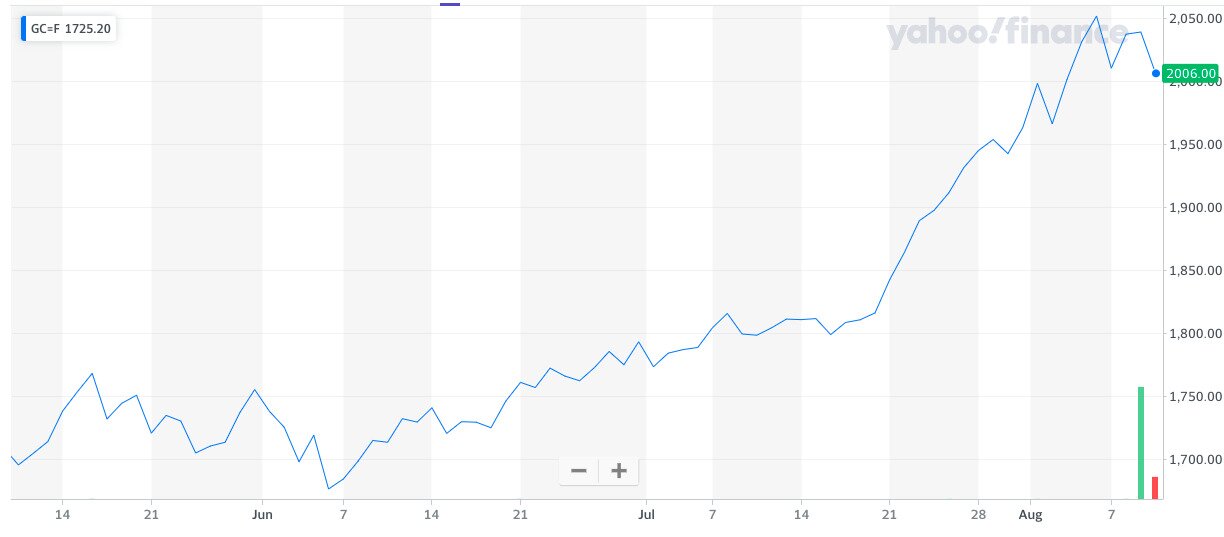

The first point to make is that bitcoin rallied at around the same time as gold, which had stuck to roughly $1,800 per ounce for most of July, before rising to just below $2,000 by the end of that same month.

Source: Yahoo!

As with bitcoin, the price of gold has almost settled (for now) since the beginning of August, coming to $2,050 before dropping a touch to $2,000. In its case, analysts have identified a number of interlinked factors in this rise: a spike in coronavirus cases in the US, US economic difficulties, and growing US-China (trade) tensions.

In other words, the global economy has become more uncertain, so investors have flocked to gold as a store of value, particularly when interest rates are low and the US dollar has weakened.

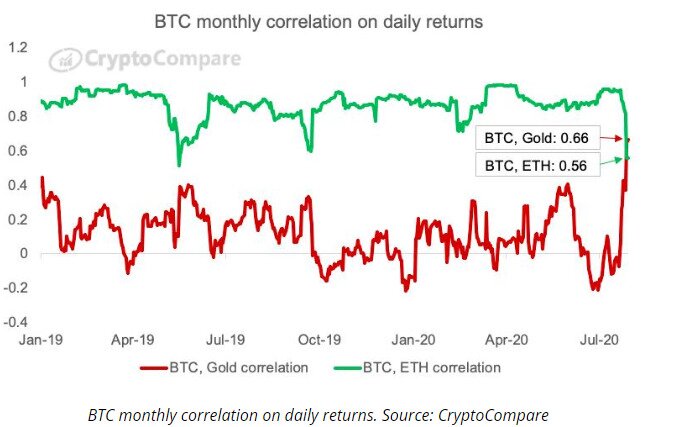

In turn, it also means that investors have increasingly flocked to bitcoin, also as a store of value. This view is supported by a growth in the correlation between bitcoin and gold, which rose to 0.66 at the end of July.

The BTC/gold correlation (red) has increased in parallel with a decrease in the BTC/ETH correlation (green). Source: CryptoCompare

The growing correlation between bitcoin and gold also confirms reports that even a small portion of ‘mainstream’ investors are now using bitcoin as a hedge, as signalled by Paul Tudor Jones’ admission in May that 2% of his net value is in BTC.

Tether May Be Behind Bitcoin Bump

Yet nothing in crypto is so simple it can be reduced to a single factor. There is at least one other major cause of July’s rally above $11,000, and that is Tether (USDT).

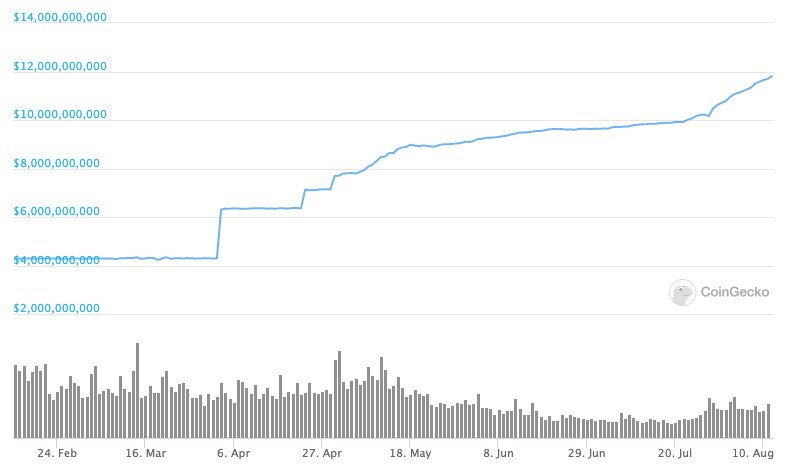

Few cryptocurrency analysts and reporters have noted that the supply of USDT increased in late July, around the time of bitcoin’s rally. According to CoinGecko, its supply stood at approximately $9.92 billion on July 22. This rose to $11 billion by August 2, at the peak of the rally to $12,000.

Put simply, the supply of USDT increased just before bitcoin began rising from July 21/22 onwards. It had in fact begun increasing significantly from early April, when its supply jumped from $4.3 billion to $6.3 billion (on April 2).

This may have helped bitcoin recover from lows of around $6,000 in April, after the big March crash. USDT may have even helped bitcoin to rise up to $10,000 by May 8, after its supply had been increased even further: it’s market cap was $8 billion by May 8.

Tether’s market cap, which indicates its supply. Source: CoinGecko

Research has suggested that Tether is a big factor in driving bitcoin’s price and providing liquidity to the bitcoin market. A 2018 study from the University of Texas at Austin indicated that USDT was indeed correlated with bitcoin price rises, and that “purchases with Tether are timed following market downturns and result in sizable increases in Bitcoin prices.”

This research was updated in 2019, when a paper suggested that Tether — and mostly “one large account at Bitfinex” — was largely responsible for the late-2017 bitcoin rally.

More recent research has challenged this narrative, with a 2020 (non-peer-reviewed) article from researchers at UC Berkeley and Warwick Business School concluding that its authors can “find no systematic evidence that stable coin issuance affects cryptocurrency prices.”

It’s worth pointing out, however, that this research was funded by the Berkeley Haas Blockchain Initiative, which is “a five year partnership with Ripple.” So there’s a financial interest in presenting crypto in a more legitimate and flattering light.

Weakening Dollar = Strengthening Bitcoin

Putting Tether to one side, there nonetheless remains a strong case that global instability and the weakening of the US economy is increasing demand for bitcoin. The effects of the coronavirus pandemic are likely to remain active for many years to come, with Harvard economist Kenneth Rogoff predicting in May that the world will need at least five years to fully recover.

In this context, bitcoin will continue steadily rising in price. Just don’t ask when exactly the next surges will happen.