- >News

- >Four Signs We’ve Entered a Bitcoin Bull Market

Four Signs We’ve Entered a Bitcoin Bull Market

We’ve entered a bitcoin bull market. Yes, the bitcoin price may not have rushed off to $20,000 already, but there are clear signs that the general, medium-to-longer term market for bitcoin has become more bullish. In other words, we’re increasingly seeing more sources of upwards pressure on the bitcoin price. There are four main signs that we’ve entered a bitcoin bull market. From rises in volumes to the growing exposure of institutional investors, they all indicate that interest in and demand for bitcoin is steadily rising.

Bitcoin Volumes Are Up Across the Board

The first sign of a bitcoin bull market is that trading volumes are hitting new highs. Regardless of whether people are buying or selling, the bigger the volume the bigger the interest.

To begin with, bitcoin spot price volumes are the highest they’ve ever been. This is the volume in US dollars of all the bitcoin being bought or sold directly (usually for US dollars). According to data from CoinMarketCap, the average daily bitcoin spot volume in May has so far been $46.81 billion. By contrast, the average for April was $38.1 billion, while it was $41.6 billion on average in March.

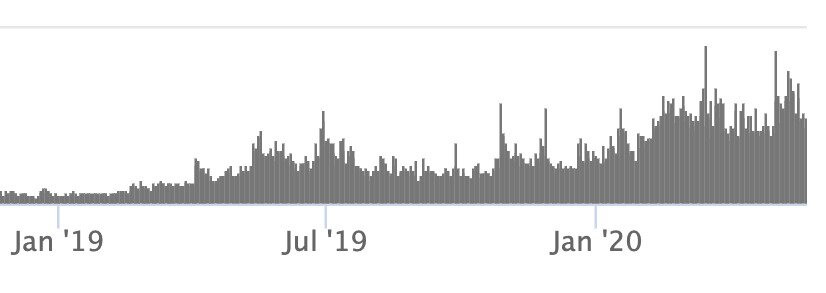

As the chart shows below, the general trend in volumes has been upwards since the beginning of 2019. In fact, volumes are higher now than they were at the height of the 2017 bull market.

Source: CoinMarketCap

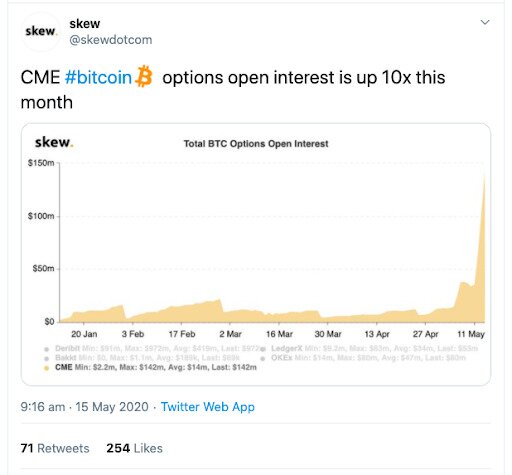

Likewise, as analytics firm Skew recently reported, CMG (Chicago Mercantile Exchange Group) bitcoin options interest is up by ten times this month. Volumes for bitcoin options with CME hit a peak of around $142 million in the few days after the bitcoin halving on May 11. By contrast, during February (when the stock market was booming before its coronavirus-induced crash), bitcoin options volume failed to hit even $25 million.

Source: Twitter

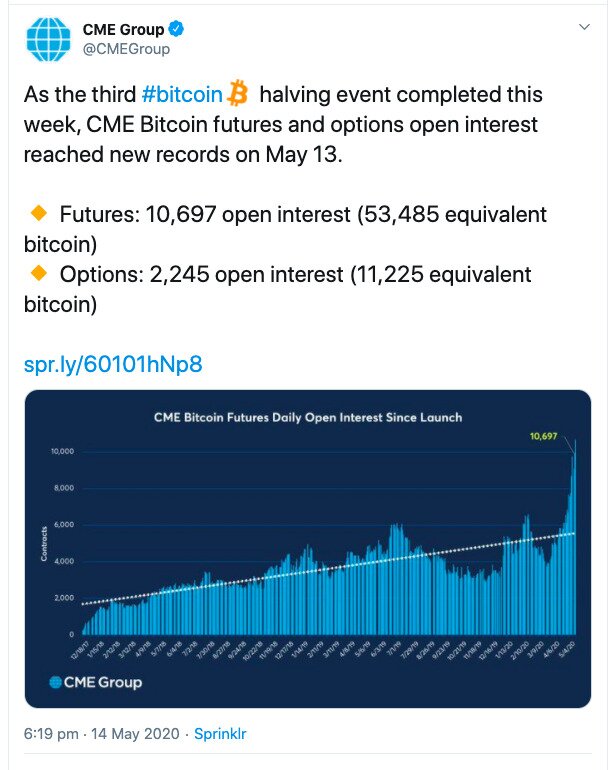

Actually, CME Group itself reported this rise, along with a rise in interest in bitcoin futures. On May 14, it tweeted that volumes of options and futures hit record highs two days after the Bitcoin halving.

Source: Twitter

Bitcoin Above its 200-Day Moving Average

Another key sign of a bitcoin bull market is that the bitcoin price is comfortably above its 200-day moving average. As things stand, the bitcoin price’s 200-day moving average is $8,446. As of writing, the current price of bitcoin is $9,183.

Why is this important? Well, in the past, analysts have highlighted that a price above the 200-day moving average is correlated with higher probabilities of further increases and growth. As Fundstrat’s Tom Lee tweeted in January, when the bitcoin price is above the 200-day moving average, the “win-rate (6M forward) jumps to 80%” and we begin “essentially ‘re-entering’ [a] bull market.”

Source: Twitter

Because the 200-day average covers a longer time frame, it’s regarded as a good gauge of general long-term interest, of bitcoin’s ‘natural’ or ‘resting’ price. That it’s being exceeded shows that market conditions are changing and that fundamental demand is growing.

Bitcoin Price is 33% Up Over A Month Ago

Thirty days ago, the bitcoin price stood at roughly $6,829. It now stands at around $9,351, putting it about 33% up over a month ago.

Yes, you might think that, across this period, it simply recovered from its severe crash in March, when it fell by as much as 40% in a single day. However, it’s hovering close to the same level it was before its losses in March, whereas the US stock market still hasn’t fully recovered from its own March plunge.

For instance, the Dow Jones stood at a peak of 29,551 on February 12, 2020, on which date the bitcoin price was $10,226. It now stands at 24,575. This is a 16.8% fall. By contrast, bitcoin is down 10% from its price on February 12.

Likewise, the Dow Jones is only 6.7% up today from where it was 30 days ago.

Source: Yahoo!

Compared to traditional stocks, it would seem the market is more bullish for bitcoin.

Institutional Investors Are Taking Notice of Bitcoin

Lastly, it’s important to note that highly prominent ‘traditional’ investors are starting to sit up and take bitcoin seriously as a store of value.

Most notably, veteran hedge fund manager Paul Tudor Jones revealed earlier in May that he has around 2% of his assets in bitcoin. 2% may not be an awful amount, but given that Jones’ Tudor Investment Corp. has around $9 billion in assets under management, it’s certainly not an insignificant amount, particularly given Jones’ stature.

Jones also called bitcoin “a great speculation,” and that it represents an historic “birthing of a store of value.”

More significantly, Jones’ ‘coming out’ in support of bitcoin is likely to lead other institutional investors to follow his example, as predicted by BitMex’s CEO Arthur Hayes:

Source: Twitter

Even before May, figures within the cryptocurrency industry were reporting growing interest from institutional investors. As CoinShares’ Meltem Demirors told Euromoney in February:

In the last month, I have had more inbound queries about bitcoin from investors than I have known before, because this whole conversation around central bank digital currencies is making them curious.

Bitcoin Bull Market

Taken as a whole, the above indicates that we’re likely to be entering a longer term bull market. Indeed, this is what a growing number of crypto analysts believe, with investor and Adamant Capital founder Tuur Demeester recently affirming in an interview that he believes the bitcoin market is already bullish.

Of course, while most of the available signs do point in the direction of a bitcoin bull market, it’s also worth pointing out that we’re in the middle of a recession. Because of the coronavirus, we could even enter a very deep depression, which may cause a flight to cash and a selling of bitcoin. So if things get even worse, all bets may be off.

On the other hand, with central banks printing money like nobody’s business, and with negative interest rates becoming a real possibility, bitcoin may become more attractive to people wanting to save money. So even in the worst case scenario, bitcoin may still do better than other assets.