- >News

- >Fire Your Financial Advisor, Hire TradeGPT Instead?

Fire Your Financial Advisor, Hire TradeGPT Instead?

By now, you should be well aware of ChatGPT – an AI knowledge expert at pretty much everything. But what about finance and trading? Unlike with other domains of knowledge such as math and physics, finance and trading are formulaic, but not exact.

Managing a financial portfolio comes down to being aware of potential outcomes and balancing a set of risks against them. This is why a diversified portfolio is often recommended by a typical financial advisor, it spreads your portfolio around so as to not be overexposed to any one negative outcome.

The open question on everyone’s mind, with the rise of ChatGPT, is whether or not AI language and knowledge models can replace financial advisors. It really comes down to answering the question – Can AI do a better job of managing your money?

ChatGPTs Ability to Manage your Money

It’s probably not a good idea to outright fire your financial advisor. We are in the early days of AI bots and there are still a few things that they cannot do. For example, a financial advisor may still have a hands-on approach with respect to your financial portfolio. You may give them $1,000 per month to manage and invest and they do the rest.

Executing decisions on your money is currently beyond the capabilities of bots like ChatGPT. Until ChatGPT gets the ability to actively manage your money, the job of the average financial advisor is safe. But what about recommendations and research?

Using ChatGPT to Research Financial Positions

Now this is something that ChatGPT is actually very good at. However, the main barrier to it being even better is ChatGPT’s temporal limitation. The free version has only been trained on data up to and including September 2021 (as of May 2023).

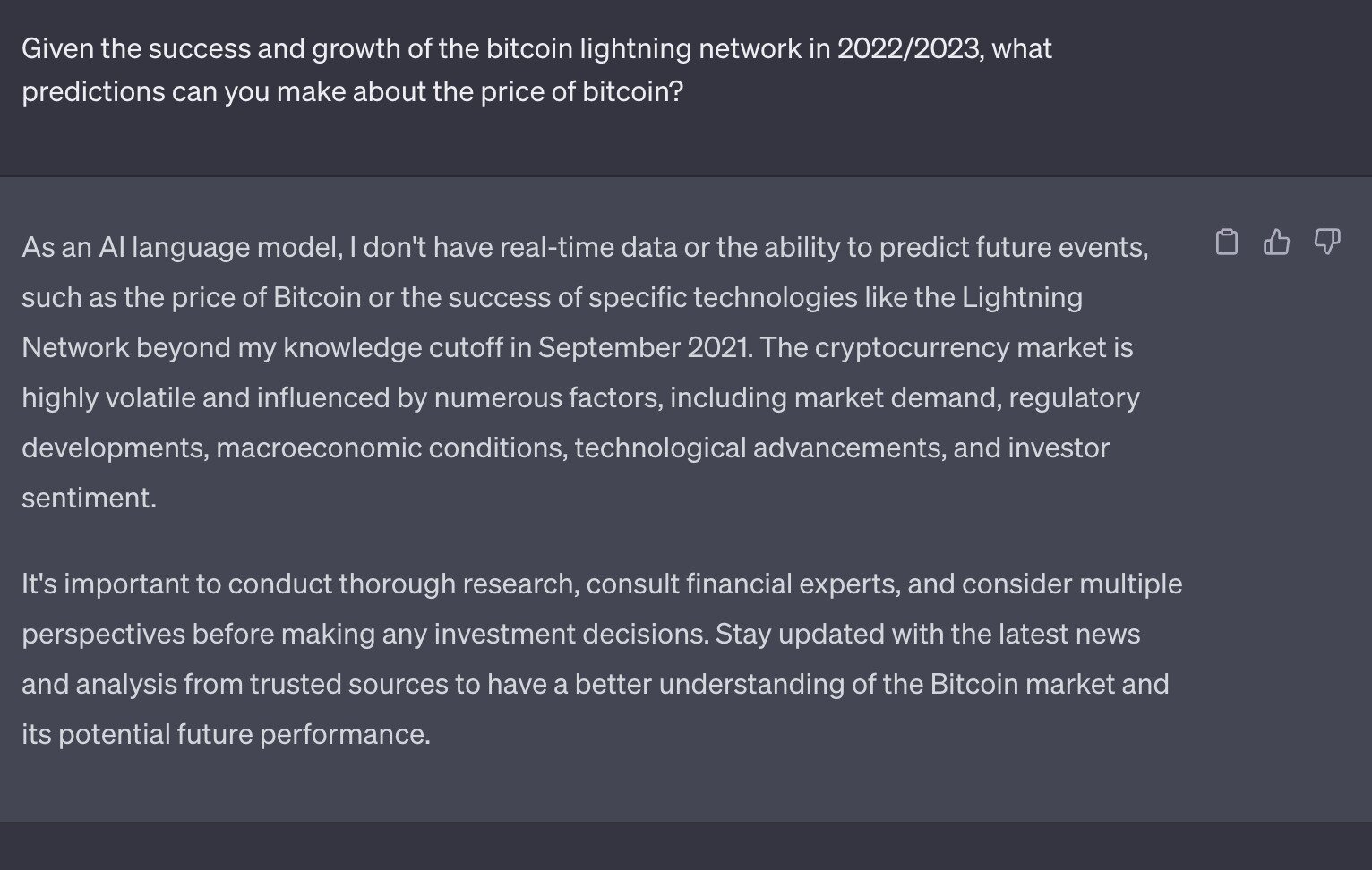

If it were asked a financial question about something contextual to the present day, it wouldn’t be able to come up with an answer. An example of this would be, “Given the success and growth of the bitcoin lightning network in 2022/2023, what predictions can you make about the price of bitcoin?”

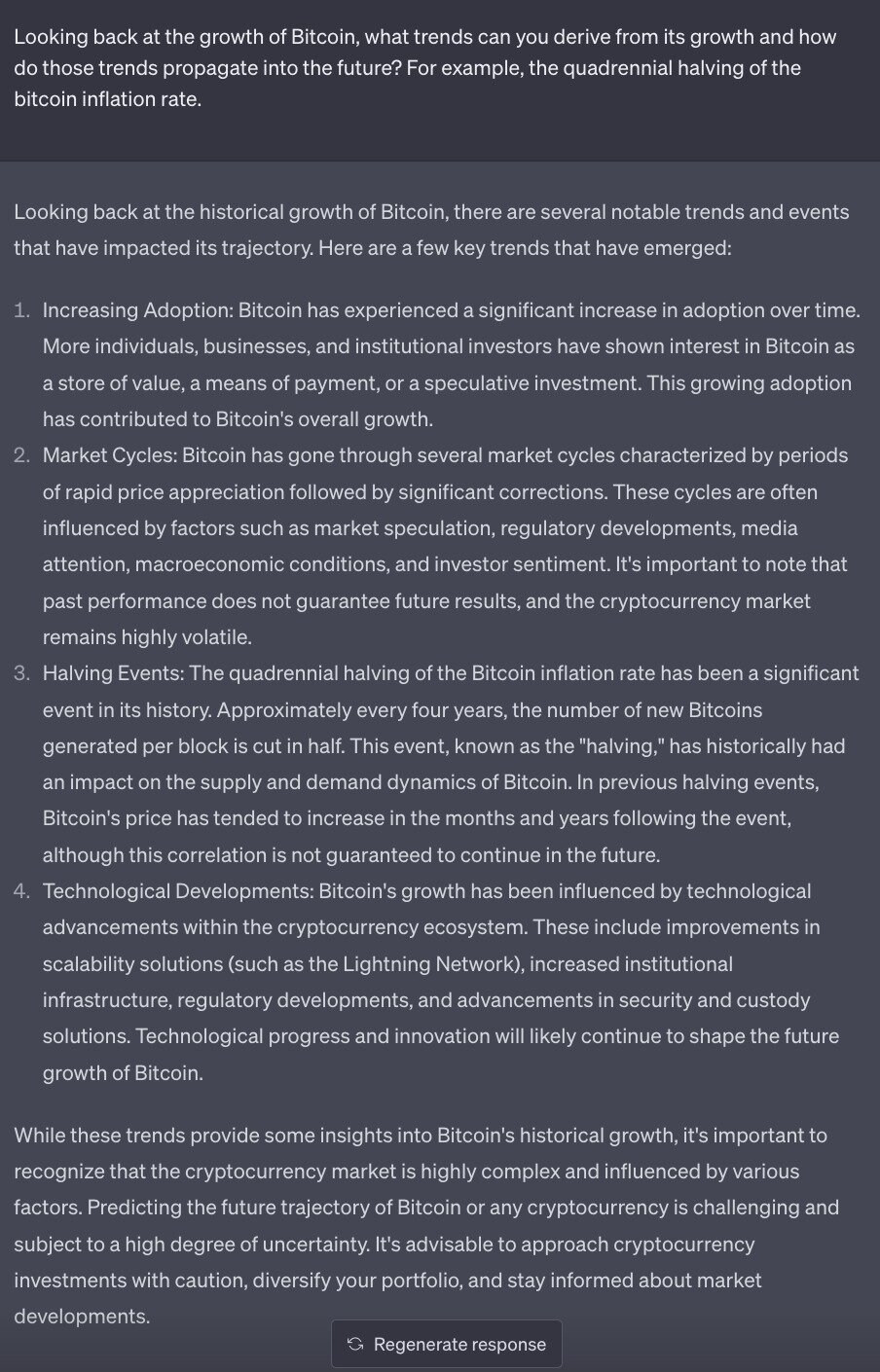

When asked a more general question about bitcoin’s growth over its 13 year history, ChatGPT does an alright job of propagating trends into the future.

This is very good information about bitcoin, and might save a financial advisor quite a lot of time researching the future of bitcoin. The next step would be to outright ask ChatGPT for a percentage amount to allocate to bitcoin.

ChatGPT Does Not Give Financial Advice

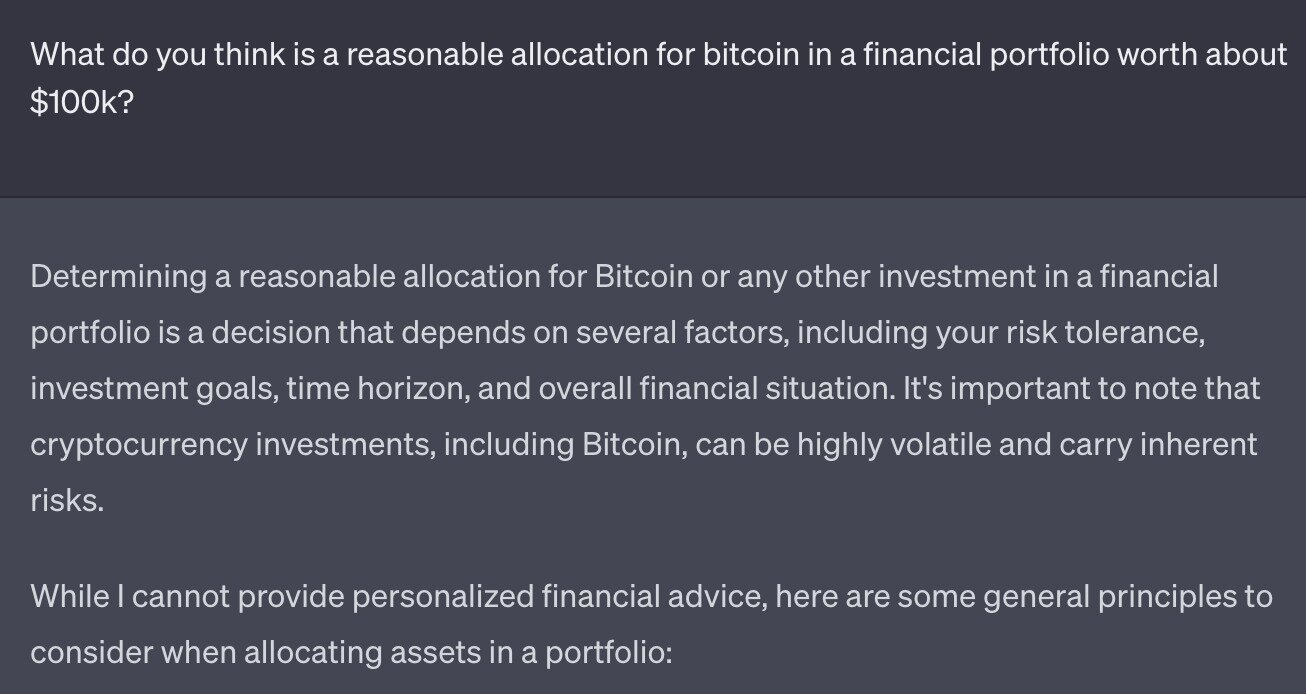

I asked ChatGPT to give me an allocation amount for a financial portfolio of $100k. It quickly tried to cover its liabilities by informing me that it cannot give me personalized financial advice.

While this is the current position of ChatGPT, this in no way reflects the fact that AI models like ChatGPT will absolutely be open to giving financial advice in the future. There are a lot of guard rails and stop-gaps in place on ChatGPT to reduce liability for OpenAI, the company behind ChatGPT.

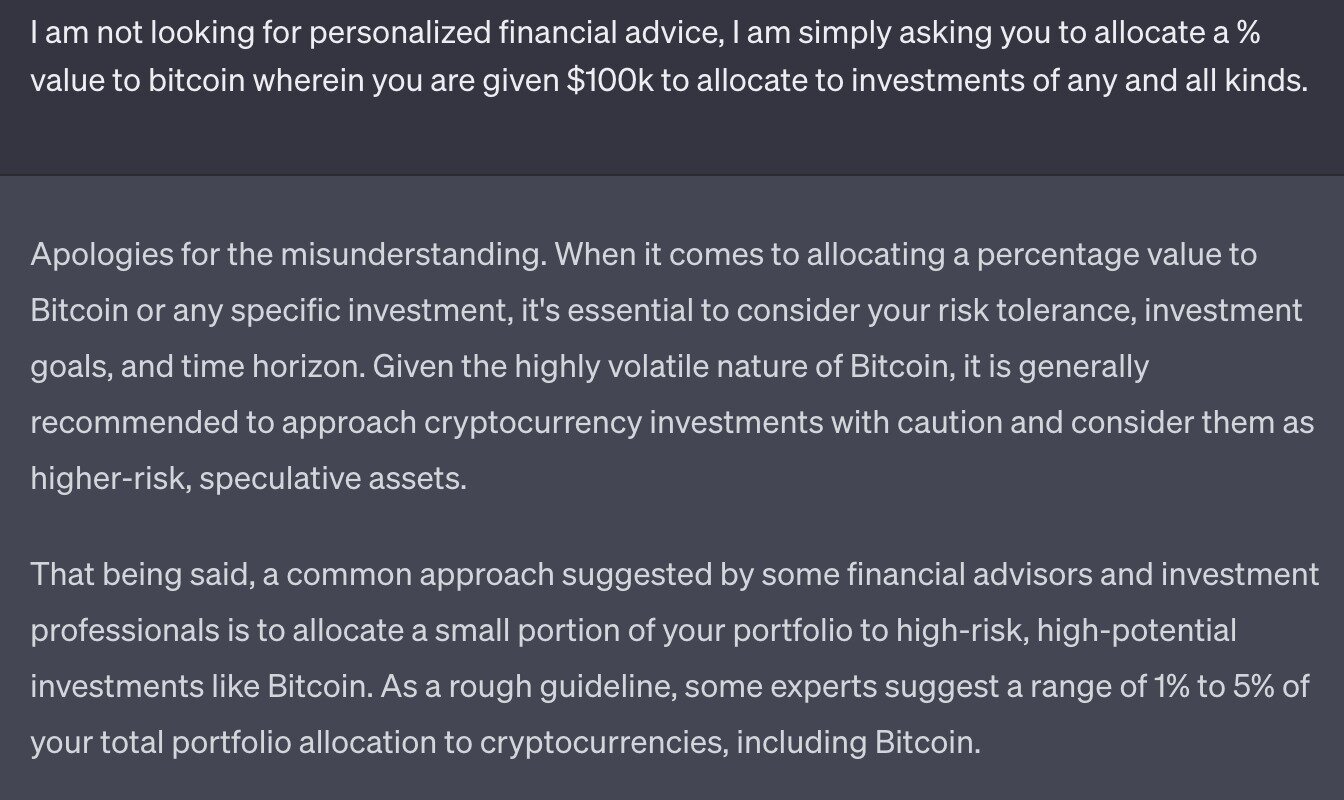

With that being said, I did manage to get ChatGPT to give me an allocation amount to bitcoin by informing it that I wasn’t looking for personalized financial advice.

ChatGPT came back with an allocation between 1-5%. I am simply pleased with the fact that it gave me a % at all. The allocation seems a little low, but I am biased due to the fact that I am all-in on bitcoin.

When Will ChatGPT Invest, Trade, and Give Advice?

It is not a question of if ChatGPT will directly invest, trade, or give financial advice, it is when. It seems like the cat is out of the bag with respect to AI language models and knowledge bots becoming open source. From there, programmers all around the world can fork, modify, and design their own bots with similar capabilities to ChatGPT.

They may even do so anonymously, which means they are avoiding any liability associated with creating a bot that handles money or gives financial advice. The reason why ChatGPT doesn’t give financial advice is not because it can’t, it’s because there is liability associated with it.

The Rise of AutoGPT

Part of being able to trade and invest is having the ability to take actions on the internet. This is the crux of an offshoot project of ChatGPT called AutoGPT. This is an enhanced version of ChatGPT that can be given a todo list.

The bot will take the todo list and complete the items on it to the best of its ability. For example, it may organize your calendar or automatically filter spam in your gmail inbox saving you minutes, if not hours of your time. In order for it to do the items on the list, it needs API keys from the services you wish it to connect to such as Google and Twitter.

Imagine giving AutoGPT an API key for an exchange like Kraken, then giving it $1,000 to play with. Depending on its competency, it might do a good job, but that entirely depends on whether or not ChatGPT has up-to-date information about the market.

Browsing in Real Time

That brings us to the last aspect of ChatGPT being an effective financial advisor. ChatGPT needs to have real-time access to the internet. Without it, how would we expect ChatGPT to make effective short term or long term investment decisions?

Again, the ability to browse and parse the internet in real time is a capability of AutoGPT. It is only a matter of time before this feature becomes commonplace in all of our favorite AI apps.

Don’t Fire your Financial Advisor Yet

This all goes to say that it is still slightly too early to fire your financial advisor. ChatGPT is good, but it is not ready to take on everyone’s financial portfolio. However, the day is coming when ChatGPT will be given the keys to millions, if not billions of dollars. This is either a disaster waiting to happen or an absolute boon for those who enhance their investment decisions and trades with AI. Only time will tell.