- >News

- >Does Kraken’s Settlement with the SEC Mean the End of Crypto Staking in the US?

Does Kraken’s Settlement with the SEC Mean the End of Crypto Staking in the US?

In its long-running war with crypto, the SEC has struck another blow. This time it’s the turn of Kraken to take the hit, with the US regulator charging the exchange’s parent company (Payward) last week with failing to register the offer and sale of securities.

‘But what securities?’, a casual observer might ask. Well, in this case it was Kraken’s staking-as-a-service program — its service of staking users’ cryptocurrencies on their behalf — that fell afoul of the regulator’s hyper-vigilant eye. And instead of being dragged into a protracted legal battle with the regulator (much like Ripple has), Kraken chose to quickly settle with the SEC to the tune of $30 million, while also agreeing to end all staking services for its US-based customers with immediate effect.

This is undoubtedly a big loss for Kraken and its American customers, but this article will also explain how this short case impacts the wider cryptocurrency industry in the United States and beyond. And while it may seem like the SEC’s action here could mean the end of crypto staking in the US, it’s already clear that the industry isn’t going to let this happen without a big fight.

SEC Charges Kraken for Offering Unregistered Securities, Kraken Ends Crypto Staking

There was nothing special about Kraken’s crypto staking service, which enables users to earn a yield (i.e. interest payments) by staking/locking up their proof-of-stake cryptocurrencies. Multiple other exchanges and platforms in the US and elsewhere offer a similar service, yet for whatever reason — which the SEC has not shared — the regulator chose Kraken for its first enforcement action on such a service.

The important thing here is that for the SEC, offering a crypto staking service constitutes an ‘investment contract,’ largely because such a service also offers users a return.

As SEC Chairman Gary Gensler explained it in the press release, “Whether it’s through staking-as-a-service, lending, or other means, crypto intermediaries, when offering investment contracts in exchange for investors’ tokens, need to provide the proper disclosures and safeguards required by our securities laws.”

Gensler reiterated such remarks in an interview with CNBC’s Squawk Box, adding that the element of risk involved in crypto staking also reinforces the SEC’s view that Kraken had been selling unregistered securities.

And as noted above, Kraken responded to the SEC’s assertiveness by closing its crypto staking service to US customers. It noted in an official blog that this closure means several things for customers on a practical level:

-

US-based customers will no longer be able to stake cryptocurrencies on Kraken.

-

Previously staked cryptocurrencies will be automatically unstaked on behalf of customers. Such cryptos will be automatically returned to the customers’ normal spot wallet and will no longer earn any staking yields.

-

All staked ethereum will become unstaked after the Shanghai upgrade, which is due in around the second half of the year. Staked ETH will continue to earn rewards until then.

-

Lastly, Kraken will prorate final rewards through to February 9. This means customers will receive a percentage of what they would have earned had they been able to keep their crypto staked for the full (monthly) staking period.

It’s also worth adding that staking for non-US customers remains entirely unaffected by this change. So if you’re in Canada, Australia, the UK, Europe or elsewhere, your staked crypto will remain staked and you can continue staking new proof-of-stake tokens.

Staking Tokens Respond By Falling, Industry Remains Defiant

Almost needless to say, the cryptocurrency market responded to this news on Thursday February 9 by taking a little dive. And while the market as a whole fell by around 6%, proof-of-stake cryptos declined harder than others.

For instance, ethereum (ETH) is currently down by 6.5% in the past week, compared to a 4.5% drop for bitcoin (BTC). Likewise, cardano (ADA) is down by 7.5% and solana (SOL) by close to 10%, underlining the fact that the reaction of (some) investors to this news is to get their money out of proof-of-stake cryptocurrencies.

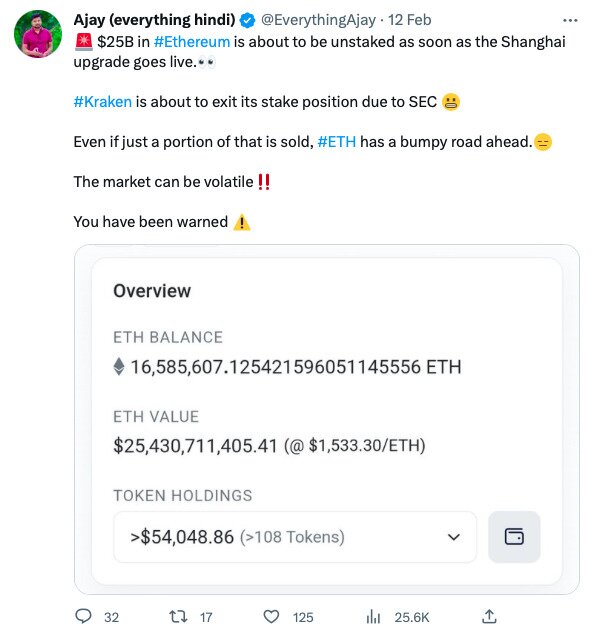

In fact, some observers are predicting the worst for ethereum as a result of the SEC’s latest adventures. This is also because the impending Shanghai upgrade will mean that millions of ethereum stakers will be able to unstake their tokens and sell them, potentially resulting in a flood of ETH coming onto the market.

Source: Twitter

And based on the SEC’s remarks surrounding the Kraken charge, it’s possible that other US-based staking-as-a-service providers will feel the heat from the regulator in the coming months.

As Gary Gensler put it in the accompanying press release, “Today’s action should make clear to the marketplace that staking-as-a-service providers must register and provide full, fair, and truthful disclosure and investor protection.”

Gensler also warned in the aforementioned CNBC interview that other US-based exchanges are likely to face similar scrutiny, since they too are likely violating US “federal securities laws.”

“When a company or platform offers you these kinds of returns, whether they call their services ‘lending,’ ‘earn,’ ‘rewards,’ ‘APY,’ or ‘staking’ – that relationship should come with the protections of the federal securities laws,” he said.

However, while this might imply the worst as far as crypto staking in the US is concerned, other exchanges have already come out to declare that they won’t cave in quite so readily to any SEC action. This includes (biggest US exchange) Coinbase, whose CEO Brian Armstrong tweeted on February 12 that its “staking services are not securities” and that the exchange “will happily defend [such services] in court if needed.”

Source: Twitter

The blog advertised in Armstrong’s tweet makes several strong arguments as to why staking crypto is not a security. Here is perhaps the most convincing:

“Staking services do not constitute an investment of money […] When a customer asks us to stake some of their crypto, they aren’t giving up one thing to get something else – they own exactly the same thing they did before. Staking customers retain full ownership of their assets at all times.”

The blog also touches on an important distinction which has relevance to the Kraken case and to the question of whether other US-based staking services may now be impacted. That is, it notes that the rewards Coinbase distributes to users comes from the underlying blockchain protocol itself, rather than from Coinbase. In other words, Coinbase doesn’t determine the yield customers receive for crypto staking, nor does it add any extra interest in order to entice customers.

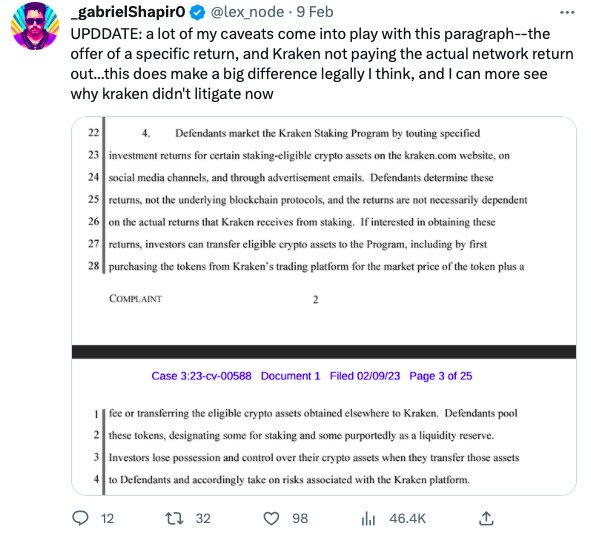

By contrast, it appears that the rewards Kraken paid out to customers was not determined solely and exclusively by the corresponding blockchain protocol. Instead, as attorney Gabe Shapiro commented in his tweets on the case, it seems that Kraken determined rewards itself, and may have marked yields in excess of what underlying protocols themselves were offering.

Source: Twitter

As such, it would be rash to conclude that Kraken’s settlement with the SEC means that crypto staking in the US is now dead. So with other platforms offering staking services inside and outside America, investors still have plenty of options when it comes to earning passive rewards from their tokens.

Furthermore there are decentralized liquid-staking tokens such as Lido and Rocket Pool that likely won’t receive the same attention from the SEC as they are not centralized entities like exchanges. Particularly tech-savvy crypto users can also skip intermediaries altogether and stake directly with the protocols.