- >News

- >Does Bitcoin Have ‘Intrinsic Value’?

Does Bitcoin Have ‘Intrinsic Value’?

You’ve probably heard some variation of this argument before: Bitcoin has no ‘intrinsic value,’ or so say a number of prominent skeptics. It’s not backed by anything, it’s not really practical as a currency, it doesn’t pay dividends or interest (like stocks or bonds), and it has no practical utility (i.e. you can’t use it to make jewellery). As such, its price history is solely the result of opportunistic speculation, with investors hoping to find a ‘greater fool’ somewhere down the line who will pay more for their bitcoin than they did.

As persuasive as this argument may seem at first glance (at least for some people), it’s based on two fundamental flaws.

The first is that, like gold, Bitcoin does inherently possess certain features which have resulted in people taking an interest in it. Secondly, there’s not really any such thing as ‘intrinsic’ value, since value is relative, and something has value only to the extent that people value it.

Bitcoin Has ‘No Intrinsic Value’: A Very Brief Summary

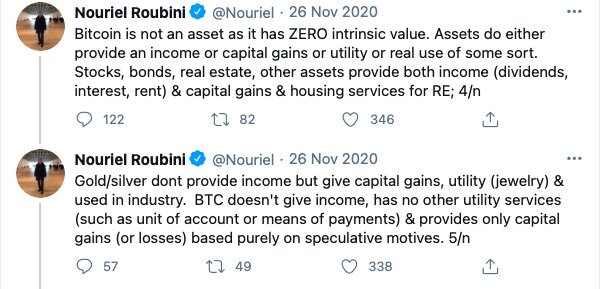

Perhaps the two most prominent/notorious proponents of the ‘bitcoin-has-no-intrinsic-

While they say different things about this and come from slightly different angles, a good summary of their views was provided in November by Roubini.

Source: Twitter

Digital Gold?

Roubini famously predicted a collapse in house prices in 2006, a year before the subprime mortgage crisis sent shockwaves through the US economy. Now his focus seems largely to be on Bitcoin and crypto more generally, proving that a broken clock, despite being correct twice a day, is wrong for the other 22 hours.

To be fair, it’s not unreasonable to sympathize with anyone who claims that Bitcoin has less intrinsic value than gold or other assets. It certainly can’t be used to make jewellery or iPhones, and it doesn’t pay a fixed income.

The problem with Roubini, Schiff and other critics, however, is they don’t say Bitcoin has little intrinsic value. They say it has no intrinsic value (or “ZERO” in the hyperbolic, Trump-esque language used by Roubini). This is an extremely strong (and overly rhetorical) statement to make, and ultimately it’s a false one.

To begin with, even Roubini himself has admitted that bitcoin has at least one use, thereby giving it some value greater than 0.

Source: Twitter

In other words, bitcoin can be useful for money laundering and other illicit activities (as seen with Silk Road and other illegal marketplaces). Of course, this isn’t really a use that any law-abiding individual would feel comfortable promoting, but it does at least undermine the argument that Bitcoin has “ZERO” intrinsic value.

What’s more, Bitcoin does possess a number of properties which do make it intrinsically valuable, or rather, which do make people want to possess it. In this respect, it’s no different from gold or any other valuable object, which are ‘intrinsically’ valuable only to the extent that they possess properties people covet.

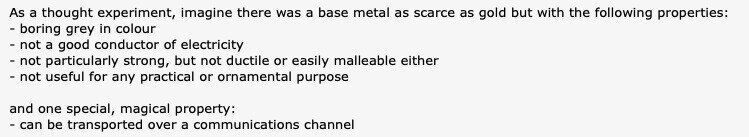

Satoshi Nakamoto himself (or herself or themselves) summarized these properties in Bitcoin’s case, in a Bitcointalk post from August 2010.

Source: Bitcoin Forum

Put simply, Bitcoin is “scarce” (as in it has a limited supply) and “can be transported over a communications channel.” These two properties may not be much, but in combination with the fact Bitcoin’s “communications channel” (i.e. its blockchain) is decentralized and secure, this provides the cryptocurrency with all the basic internal properties it needs to acquire value, and for its price and ‘value’ to snowball from there.

Admittedly, Nakamoto admits in the same post that Bitcoin may not have ‘intrinsic value’ in the sense this concept is usually understood (in another post he acknowledges that bitcoins pay no dividends, for example). But he also affirms that it has a “potential usefulness for exchange,” and that scarcity alone can be enough to make it valuable (in the sense of at least making some people want it).

“But if there were nothing in the world with intrinsic value that could be used as money, only scarce but no intrinsic value, I think people would still take up something,” he wrote.

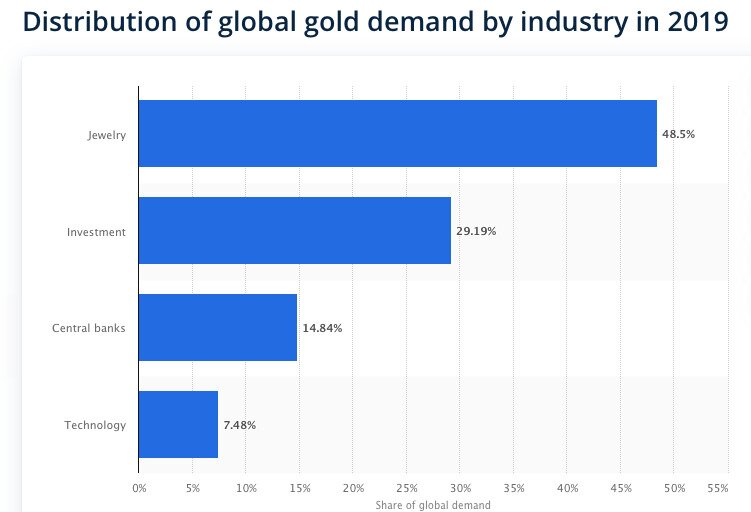

Basically, even though it’s “not useful for any practical or ornamental purposes,” Bitcoin’s scarcity makes it comparable to gold. Gold is a sought-after store of value largely as a function of its scarcity, and its price has risen against the US dollar because its supply is largely fixed (while the dollar’s isn’t). And much like bitcoin, it’s arguable that many investors (and central banks) now buy gold not because it has intrinsic value, but simply because other investors buy it.

Source: Statista

This latter point is important: gold’s intrinsic value (i.e. its usefulness for industry) may have resulted in it becoming a desirable commodity in the first place, but now that it has become a desirable commodity, such value is largely irrelevant (at least to investors).

The same thing applies to Bitcoin: its basic properties resulted in people taking an interest in it, and now that people do have an interest in it, its scarcity is enough for its price to continue rising.

It’s All Relative

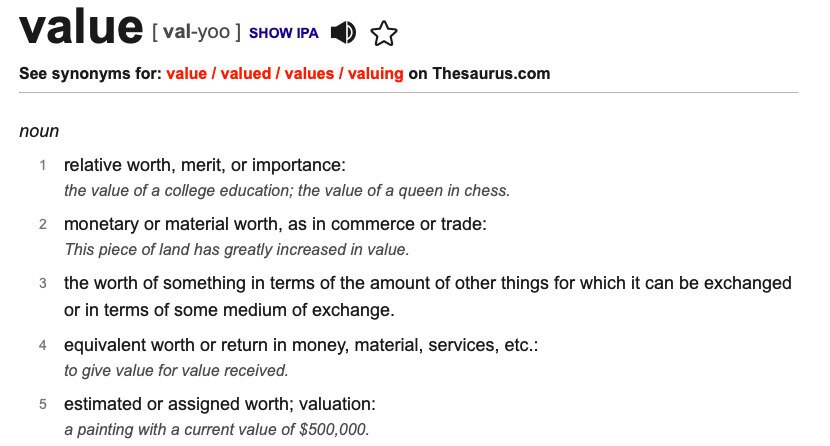

Ultimately, there is no such thing as ‘intrinsic value,’ since value is a relational concept. Something is of value only if somebody values it.

Source: dictionary.com

Because of this, the most we can say is that something possesses certain properties which are valued by people or are likely to be valued by people. Gold possesses such properties and so, for that matter, does Bitcoin. Its scarcity, its decentralization and its immutability are all things which have resulted in people valuing it. And with the state of the global economy being such as it is, these properties have been enough for an increasing number of people to join early adopters in valuing the cryptocurrency.