- >News

- >Crypto Volatility Increases as COVID-19 Spreads, Long-time Users Still Holding

Crypto Volatility Increases as COVID-19 Spreads, Long-time Users Still Holding

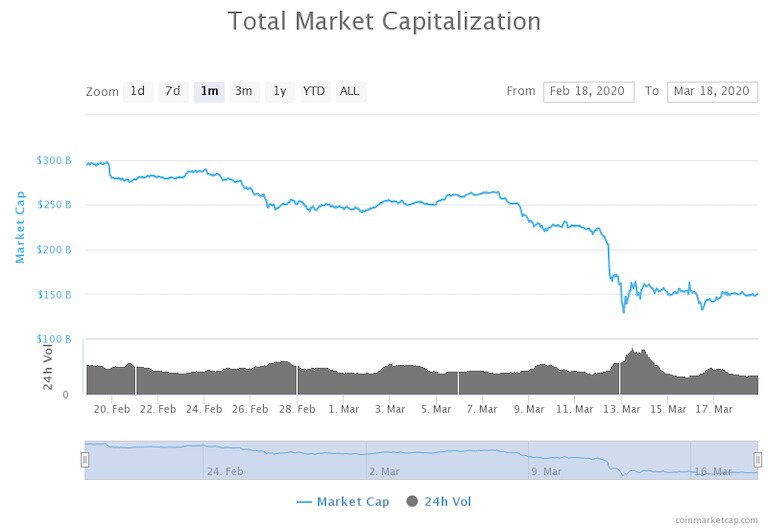

Cryptocurrency prices are all over the place. Bitcoin has lost almost 50% of its value in less than a month, while its volatility reached a record high last week, according to crypto analytics company Skew. Meanwhile, every other cryptocurrency has seen its market cap slashed by comparable (or greater) percentages, as the coronavirus continues to take its toll on the global economy.

Predicting where exactly crypto prices will go in the coming months is a fool’s errand, particularly if COVID-19 continues to spread throughout the world and further infect market sentiment. However, two features of the recent price crash are worth highlighting for crypto traders, since in the long term they place limits on just how far crypto can rise and on how low it can sink.

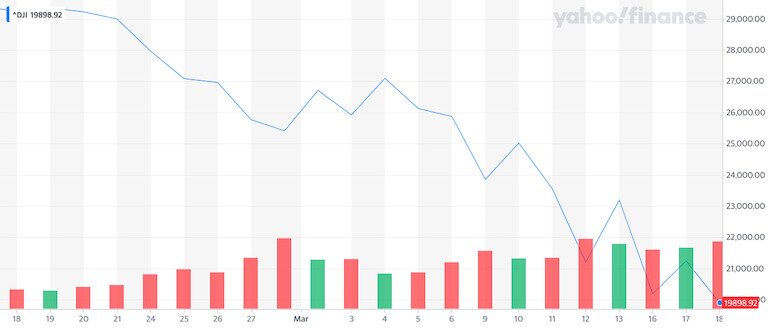

For one, it’s now patently obvious that cryptocurrency prices are correlated with stock market prices, at least when it comes to large macroeconomic events (such as a global pandemic). This correlation will increase precisely to the extent that cryptocurrency attracts more mainstream and institutional investment, which tends to shrink during periods of wider economic distress.

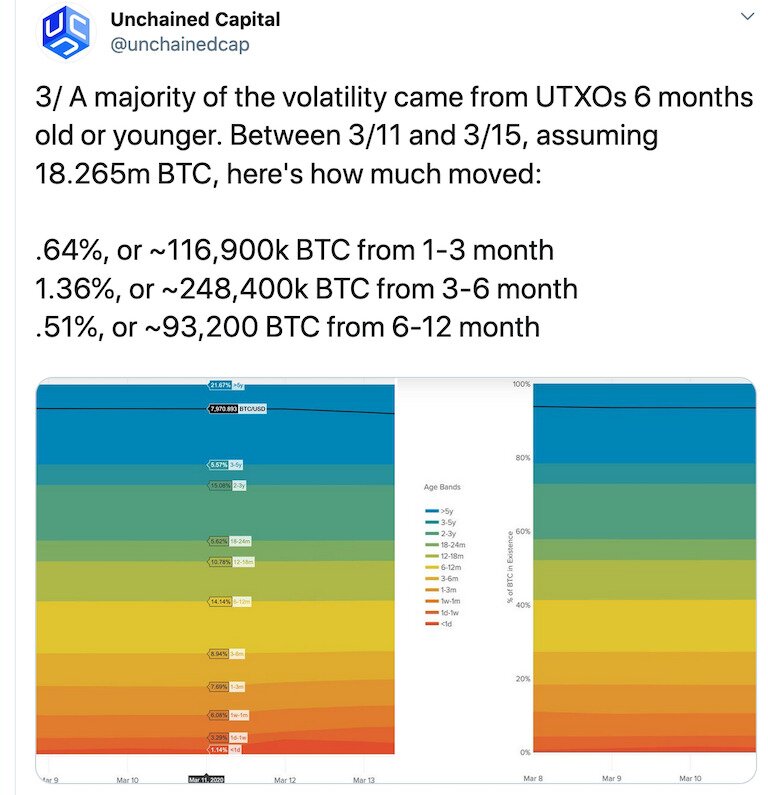

That the recent plunge is mostly the result of newer crypto investors was indicated by a study published this week by Unchained Capital, which found that most Bitcoin volatility has come from traders with recently acquired BTC. In other words, Bitcoin owners who have held their coins for longer periods of time (i.e. for a couple of years or more) have by definition held onto their coins during the recent turbulence. This means that it’s unlikely Bitcoin (and other cryptocurrencies) could lose the vast bulk of its value, assuming that holders remain firm.

When Crypto Market Is Correlated With Stock Market

As of writing, Bitcoin is priced at $5,212, down 48.7% from its one-month high of $10,172, and down 34.2% from its one-week high of $7,925 (on March 12). Much of this decline has therefore happened in the past week, with its drop on March 12 coinciding with the Dow Jones falling by 10% on the stock market’s worst day since 1987.

Things look even worse for Ethereum, at $114. It’s down 59.7% from a one-month high of $283, and down 41.2% from a one-week high of $194 (also on March 12).

As for XRP, it hasn’t had quite as bad a time as Ethereum, but it’s still lost more than half of its value in a month. It’s down by 52.8% from its one-month high of $0.303, to $0.143. It’s also down by 31.2% from a one-week high of $0.208.

Bitcoin Cash’s declines are almost as bad as Ethereum’s. At $177, it lost 57.9% compared to a one-month high of $421, and lost 33.5% compared to a one-week high of $266 (again, March 12).

Rounding out the top five cryptocurrencies (not including Tether), Litecoin has fallen by 58.2% from a one-month high of $79, to $33. It has also fallen by 31.25% from a one-week high of $48.

Basically, every other non-stablecoin cryptocurrency follows this same basic pattern, give or take a few percentage points. And from this pattern, it becomes clear that the crypto market is, at least in certain cases, correlated with the ‘traditional’ stock market.

Not only have the most recent drops followed March 12’s 10% decimation of the Dow Jones, but the falls from one-month highs similarly coincided with another bad day for stock markets. For the five cryptos above, and for basically every other coin, these one-month highs fell on or just after February 18, the day when Apple issued a coronavirus warning that caused markets to slide.

Likewise, the crypto market witnessed another drop from February 24, the same day global stock markets plunged by 3% or more. And so on.

Newbies Responsible For Crypto Volatility

There’s now little doubt that the cryptocurrency market does follow the stock market, at least during macroeconomic upheavals. Previously, commentators had claimed that Bitcoin was a ‘safe haven’ asset, so this correlation may be bad news for some. (Although gold has also lost value in recent weeks.)

Source: Yahoo!

Source: CoinMarketCap

However, it is possible to see it as a positive sign that Bitcoin and other cryptocurrencies have attracted the kind of mainstream investment necessary for them to gain wider adoption.

An analysis published this week supports this view. Posted by Unchained Capital on Twitter, it reveals that most recent Bitcoin selling has been carried out by traders who had only recently acquired their BTC:

Source: Twitter

Put more simply, during the four days between March 11 and March 15, 458,500 bitcoins were sold that had been minted within the past year. By contrast, only 26,000 bitcoins were sold that had been minted between 18 and 24 months ago, 9,132 bitcoins that were between two and three years old, and only 3650 bitcoins that were at least five years old.

What this shows is that the so-called HODLers really do hold onto their bitcoin. More importantly, it also indicates that a considerable chunk of the Bitcoin price (and likely the prices for other cryptocurrencies) is a function of new investors. It’s a function of traders who treat crypto like any other kind of asset and stock, and who rush headlong to cash when the global economy is taking a big turn for the worse.

The diehards may sneer at such investors, but it’s encouraging that such traders are interested in crypto. They’ll be vital if cryptocurrency is to become truly mainstream. They’ll be needed to push Bitcoin and other cryptos to new record highs, once a coronavirus-induced recession (or depression) has been cleared.

And speaking of the coronavirus, it holds the key to cryptocurrency prices for the foreseeable future. Because if COVID-19 does drag the global economy to a severe recession, it’s unlikely that new investors will flock to a speculative investment such as cryptocurrency. If nothing else, a prolonged recession or depression may drive further value out of the cryptocurrency market, as even the HODLers sell of some of their stashes in order to make ends meet during what could be an economic meltdown.