- >News

- >Could LBRY Victory Against SEC Represent a Turning Point for Crypto?

Could LBRY Victory Against SEC Represent a Turning Point for Crypto?

LBRY has scored a victory for crypto. The Web3 platform has managed to get a US judge and the Securities and Exchange Commission (SEC) to admit on record that the sale of its native LBC token on exchanges does not constitute the sale of an unregistered security. In other words, the sale of cryptocurrencies on the secondary market does not violate securities law in the US, and the SEC therefore has no jurisdiction over such sales.

This is a big win not only for LBRY, but for the cryptocurrency industry in general and for Ripple, which itself is famously locked in a long-running legal battle with the SEC. And while LBRY lost its case against the securities regulator in November, its latest appeal against this decision forced the presiding judge to provide a clarification that may end up helping Ripple to emerge victorious in its own case.

Of course, the judge’s ruling in LBRY’s appeal is not as clear-cut as some observers are making it out to seem. Because while it protects the secondary market for cryptocurrencies from the SEC, it does nothing to overturn November’s ruling against LBRY that it violated securities law by directly offering LBC tokens to investors.

LBRY Appeal Scores One for Crypto

Back in November, LBRY — a a blockchain-based file-sharing and payment network — famously lost its case against the SEC, with potentially serious ramifications for the cryptocurrency market and for Ripple. In particular, US District Judge Paul Barbadoro sided with the securities regulator, ruling that LBRY offered its LBC token as securities. This essentially means that LBRY sold LBC as if it were a speculative investment that would rise in value in parallel with the growth of LBRY’s business.

In concluding, Barbadoro declared, “no reasonable trier of fact could reject the SEC’s contention that LBRY offered LBC as a security, and LBRY does not have a triable defense that it lacked fair notice.” As a result, he granted the SEC’s motion for summary judgment.

Speaking at the time, LBRY CEO Jeremy Kauffman said that the ruling “threatens the entire U.S. cryptocurrency industry,” insofar as it sets a precedent that would classify “almost every cryptocurrency” as a security. And in the immediate wake of the decision, the XRP price fell from about $0.49 to $0.33, doing so in a matter of days.

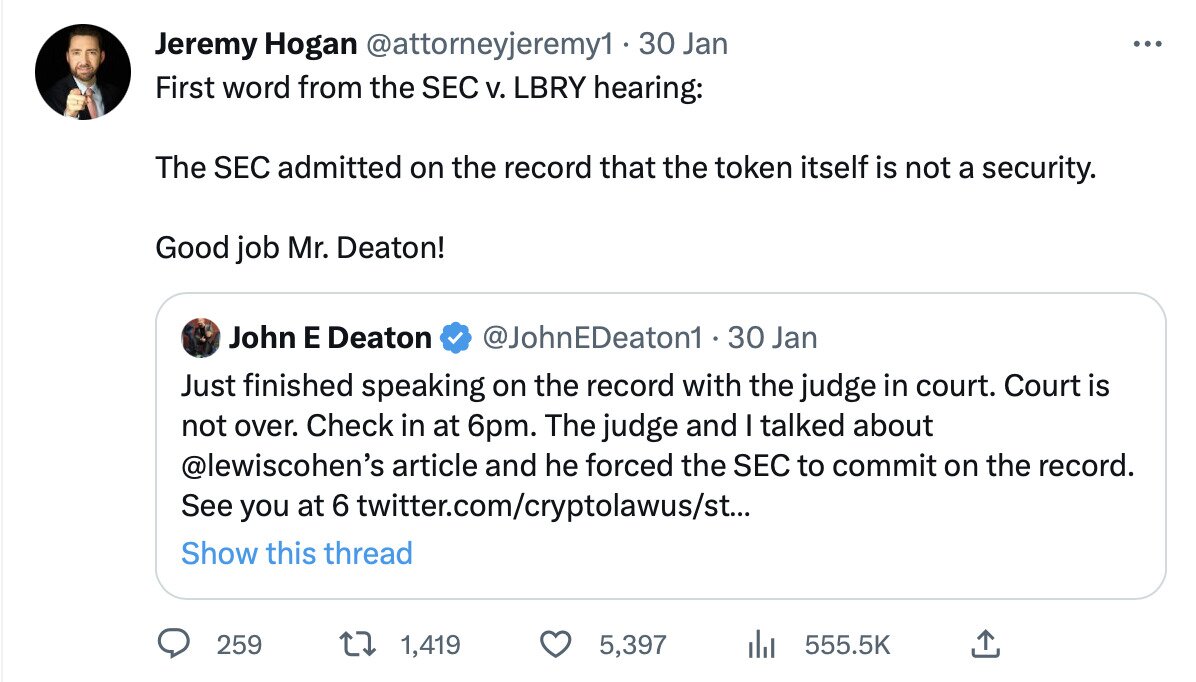

However, some of the negative implications have potentially been dispelled by LBRY’s appeal hearing in New Hampshire. Speaking on Monday January 30, the judge clarified that the summary judgment made in November does not apply to secondary sales of LBC, as made on crypto-exchanges and other trading platforms.

Source: Twitter

Not only that, but the SEC was ultimately forced to agree with the judge’s ruling here, with its lawyers acknowledging on the record that secondary sales of LBC do not count as sales of unregistered securities.

Source: Twitter

Again, this is big news for LBRY, for Ripple and for crypto, since it creates a legal precedent to the effect that the trading of cryptocurrencies on exchanges does not violate securities laws. This even applies to cryptocurrencies that had initially been offered by their creators as securities, meaning that exchanges won’t be liable for the violations of token issuers.

This is important because, as observers may recall, many exchanges responded to the SEC opening a case against Ripple by delisting XRP. Yet now, the judge has effectively ruled that exchanges cannot be held liable for listing any cryptocurrency that may have been offered as an unregistered security by its issuer.

Good and Bad for Ripple Case with SEC

Of course, it’s important to note at this point that this new ruling may not have any direct bearing on Ripple’s long-standing case with the SEC. Yes, many within the community have now concluded that LBRY’s appeal means Ripple will win, but it arguably doesn’t change anything in terms of what the SEC is actually alleging in its case against Ripple.

Source: Twitter

Specifically, the appeal doesn’t overrule November’s decision that LBRY itself offered LBC tokens as unregistered securities. And by extension, Judge Analisa Torres — who will be deciding the Ripple-SEC case — could still rule that Ripple itself sold XRP as an investment (i.e. as a security), even while agreeing that the sale of XRP on the secondary market isn’t in violation of securities laws.

As such, Ripple could still easily lose the case. That said, this week’s development raises the possibility that Ripple could lose its fight and receive a slap on the wrist (e.g. a fine), but that XRP could still legally be sold via exchanges to US residents. This would enable Ripple to continue its business, and would potentially encourage major exchanges — e.g. Coinbase — to relist XRP.

So we could even see XRP continuing to rise in price even in a scenario where Judge Torres’ grants the SEC’s motion for summary judgment.

Case Drawing to a Close

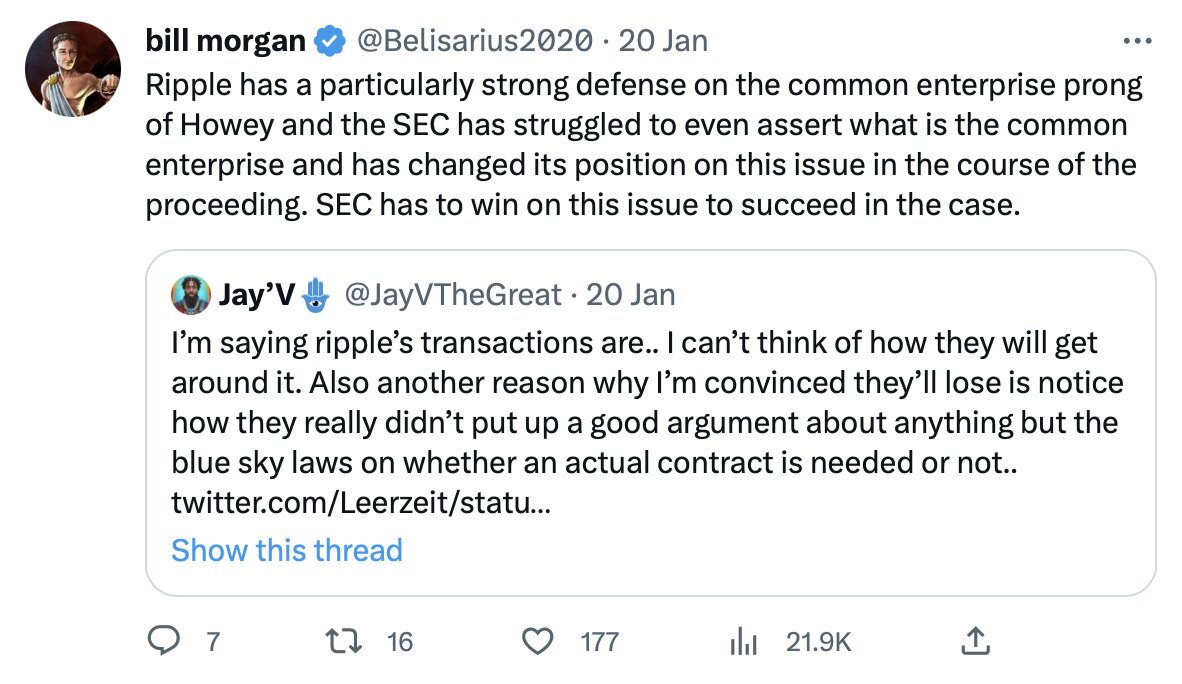

Having said all of this, plenty of recent developments suggest that Ripple has a fair-to-good chance of winning the case.

For example, Ripple CEO Brad Garlinghouse told CNBC a couple of weeks ago that he expects the case to conclude by the end of the first half of 2023, or by the end of the year at the very latest.

“I feel very good about where we are relative to the law and the facts,” he said, highlighting Ripple’s confidence. Such confidence isn’t unearned either, with many in the cryptocurrency community believing that Ripple has presented a strong case. By contrast, many argue the SEC has mounted a weak one, with the regulator allegedly unable to establish how Ripple developed a ‘common enterprise’ — as described in the Howey test — that would increase the value of XRP.

Source: Twitter

On top of this, Ripple has succeeded in having 14 amicus briefs (evidence submissions from third parties) filed to the court, including one from Coinbase. By contrast, the SEC succeeded in filing only one, reinforcing the suspicion that its case isn’t’ that strong.

Not only that, but Ripple has also secured a number of small victories en route to the case’s impending conclusion. This includes the court upholding its right to present a fair notice defense, as well as being given access to important documents and emails related to the 2018 Hinman speech, in which the then-chairman of the SEC declared that neither bitcoin or ethereum were securities.

Lawyer James K. Filan tweets that everything important in the SEC-Ripple case has been briefed. Source: Twitter

While none of these rulings can guarantee a favorable outcome, they at least suggest that Ripple has a better chance than LBRY and previous litigants. And if it does succeed, there’s no doubt that XRP is going to do very well as a result, with the coin potentially on track to pass its 2018 record high of $3.40.