- >News

- >Coinbase Removes XRP From Listings, What’s Next for Ripple?

Coinbase Removes XRP From Listings, What’s Next for Ripple?

The year 2020 may have been a great one for crypto, but it wasn’t so great for Ripple and its native cryptocurrency, XRP. Even though XRP reached a year-and-a-half high of $0.70 in late November, it fell off a cliff on December 22, when the Securities and Exchange Commission charged Ripple and two of its executives with selling an unregistered security (namely, XRP).

XRP has lost more than half of its former value since these charges. At the same time, Coinbase — the biggest crypto-exchange in the United States — has delisted XRP, while a growing number of other platforms have followed suit, undermining the possibility that the crypto will make a recovery anytime soon.

So is Ripple finished? Things don’t look promising for XRP, particularly when its current support level of around $0.23 is largely derived from Ripple execs themselves holding onto a large proportion of the crypto. And if the SEC does succeed in having XRP confirmed as a security, it will make the cryptocurrency untradeable in the United States.

SEC Charges Ripple, A Brief Summary

The SEC’s allegations are fairly simple: Ripple and two of its execs, Brad Garlinghouse and Christian Larsen, raised over $1.3 billion by selling XRP, which the SEC claims is an unregistered security. $600 million of these proceeds were for personal use, according to the SEC.

Explaining the rationale behind the charges, Stephanie Avakian, the Director of the SEC’s Enforcement Division, said, “Issuers seeking the benefits of a public offering, including access to retail investors, broad distribution and a secondary trading market, must comply with the federal securities laws … We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP and Ripple’s business and other important long-standing protections that are fundamental to our robust public market system.”

The SEC outlined its reasons for regarding XRP as a security in a 71-page complaint. Possibly its strongest argument is that Ripple seemed to be well-aware that the main purpose of acquiring XRP was for speculation, and that the crypto was liable to be deemed a security, given that its value was largely dependent on Ripple’s activities as a business. Here are a couple of statements the SEC culled from various Ripple sources:

“The Ripple ecosystem’s reliance on the efforts of Ripple Labs — the single largest holder of XRP — to promote and expand the ecosystem, creates greater risk that XRP might be deemed a security as compared to other virtual currencies … The primary use case for XRP today is speculative.”

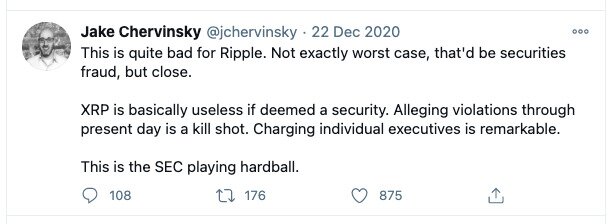

While it certainly isn’t guaranteed that the SEC will be successful in prosecuting Ripple, the current picture looks grim. Here’s noted cryptocurrency lawyer Jake Chervinsky commenting on the case in December:

Source: Twitter

The Market, Coinbase, Other Exchanges React

Needless to say, the cryptocurrency market responded to this news by offloading XRP en masse.

Having been priced at $0.521214 on December 22, XRP can now be bought for around $0.23, representing a drop of around 55.7%. On the one hand, this plunge was caused directly by the SEC’s charges, which may result in Ripple being forced to pay a disgorgement penalty (i.e. repayment of the proceeds of its sales of XRP). On other, it was also caused by Coinbase announcing on December 28 that it would stop facilitating the trade of XRP from January 19.

Source: Twitter

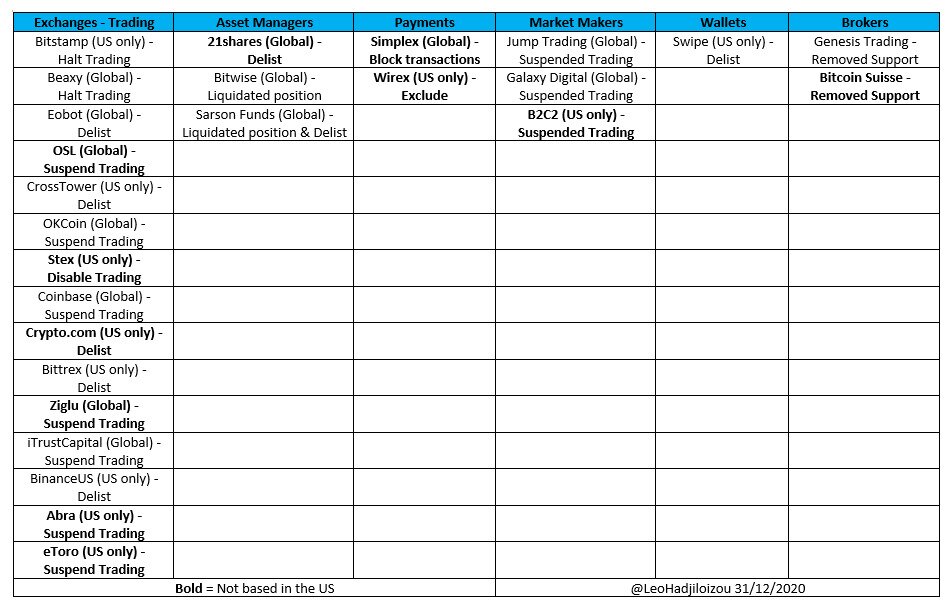

Numerous other exchanges have done much the same, either stopping XRP services only in the United States, or going so far as to delist the crypto globally. According to XRP analyst Leonidas Hadjiloizou, at least 26 trading platforms have now de-listed XRP to some degree.

Source: Twitter/Leonidas Hadjiloizou

At the moment, some American exchanges — Kraken being the most notable example — haven’t delisted XRP. However, it would seem to be only a matter of time, at least if you believe certain figures in the industry.

Source: Twitter

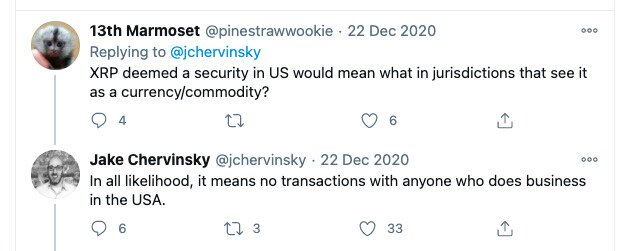

In fact, the SEC’s action doesn’t mean only that US-based exchanges will de-list XRP, it also means non-American exchanges will be forced to avoid letting US-based customers transact in XRP.

Source: Twitter

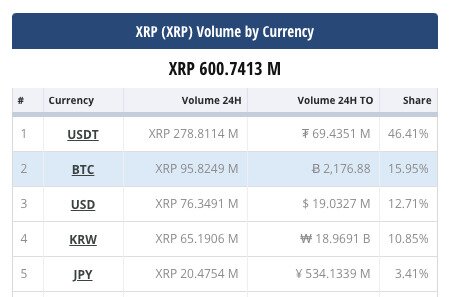

It’s not clear how big the American XRP market is (relative to the global market), but it’s likely to be significant. Prior to the SEC’s action, USD accounted for around 12% of XRP trading, according to CryptoCompare.

Source: CryptoCompare

Is XRP A Zombie Crypto?

Regardless, the massive drop in XRP’s price indicates that the US market is vitally important for Ripple and XRP. Indeed, it’s likely that, without the US market, much of XRP’s remaining value is being maintained by Ripple, which remains the largest holder of the cryptocurrency.

For example, a 2019 report from Messari suggested that 48% of XRP’s ‘circulating supply’ is actually held by various Ripple execs or entities (e.g. RippleWorks). In other words, XRP’s price is holding firm (for now) at the $0.23 level largely because much of its supply is still held by Ripple.

To state this another way, without Ripple’s ownership of large quantities of XRP, it’s likely that the cryptocurrency may have crashed even further following the SEC’s announcement on December 22.

This makes things look very bleak for the cryptocurrency. However, while much of the market has lost faith in XRP, it’s not guaranteed that the SEC will be successful in prosecuting Ripple.

Could XRP End Up on Stock Exchanges?

Several days before the SEC filed its action, former SEC Commissioner Joseph Grundfest wrote a letter to Chairman Jay Clayton, arguing that “no pressing reason compels immediate enforcement action” against XRP.

More importantly, Grundfest suggested that the arrival of the Biden administration on January 20 could potentially undermine the SEC’s case, insofar as Biden and his team may have views more favorable to Ripple.

“The views of a soon-incoming Administration and Congress as to the regulation of transactions similar to those at issue can differ substantially from current perspectives,” he warned.

Alternatively, even if the SEC were to successfully prosecute Ripple, a few figures optimistically believe that Ripple could end up issuing shares and listing them on actual stock exchanges.

“This call could eventually allow Ripple to list on traditional stock exchanges and potentially open it up to a far wider market, which means that there could be extremely positive price action in the long term,” said OKEx CEO Jay Hao, speaking to CoinDesk.

However, it’s not clear whether this would be the same thing as listing XRP itself on a stock exchange, so for now, it may be best to steer clear of the crypto, and wait for the SEC’s case to run its natural course. At the very least, it may end up providing the cryptocurrency industry with a degree of clarity it had previously lacked.