- >News

- >China’s BTC Hashrate Is Declining, Here’s Why That’s Bullish for Bitcoin

China’s BTC Hashrate Is Declining, Here’s Why That’s Bullish for Bitcoin

China has long dominated Bitcoin. The Chinese yuan accounted for most bitcoin trading as early as 2013 (later superseded by the use of USDT), while Chinese mining pools have made up over 50% of global Bitcoin hashrate since at least 2017.

This percentage had in fact increased in the years following 2017, with one 2018 study putting the percentage of Bitcoin’s hashrate located in China at nearly 80%. This same research paper concluded that China’s dominance represents possibly the biggest threat to Bitcoin’s stability, with its authors claiming that the Chinese government has “motivation to undermine Bitcoin.”

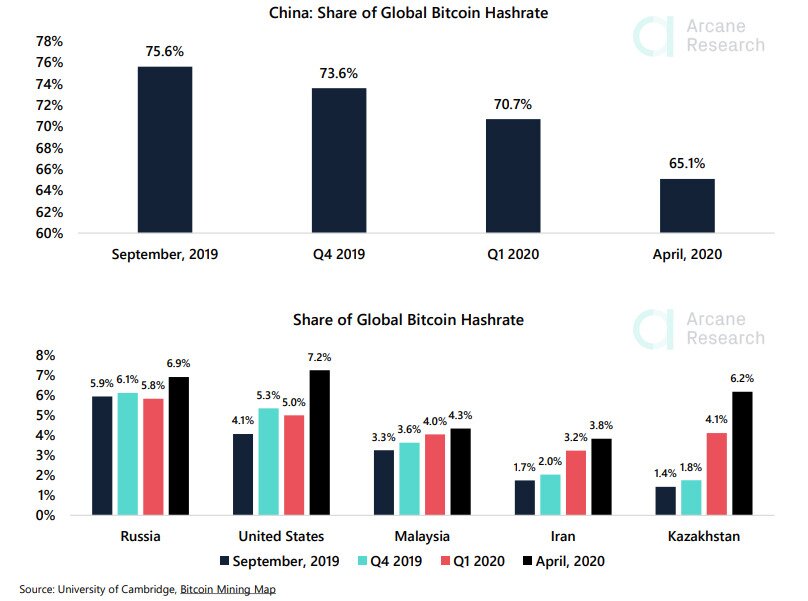

However, the latest data from Cambridge University shows that China’s share of Bitcoin mining is consistently declining from one quarter to another, with April 2020’s percentage dropping to 65%. This is still a high figure, but with other countries gradually increasing their interest in bitcoin, it suggests that China’s domination of Bitcoin mining will wane, making Bitcoin more secure in the process and drawing even more investors towards it.

China’s Share of Bitcoin Hashrate Falling

What’s most striking about Cambridge’s latest data is just how quickly China’s share of Bitcoin mining has dropped off. As of September 2019, its share stood at a very large 75.6%, falling to 73.6% in Q4 2019, then 70.7% in Q1 2020, and then 65.1% in April (the latest month for which Cambridge has data).

Source: University of Cambridge/Arcane Research

In its place, more countries are increasing their respective shares of Bitcoin mining, with the United States enjoying a 2.2% rise share between Q1 2020 and April. It now has the second-highest share of Bitcoin hashrate worldwide, and while it’s still some way off China’s percentage, the leap from 5% to 7.2% in a matter of months is still impressive.

What This Means For Bitcoin

It’s very likely that this trend will continue, with China’s overall share of mining declining consistently over the coming quarters. This is because, as bitcoin’s price continues to increase, mining will become more profitable in other parts of the world (where electricity isn’t quite as cheap). Similarly, bitcoin’s recent price rises will generally attract more attention towards the cryptocurrency in other parts of the world, leading to a gradual increase in mining pools outside of China.

Recent months have seen companies such as MicroStrategy, Stone Ridge, Snappa, Square, and (most recently) Mode buy up bitcoin as a reserve asset, while PayPal has finally joined the party by launching its own cryptocurrency service. This is all adding momentum to Bitcoin as a brand, and in parallel with more direct investment in bitcoin in the rest of the world, we’ll also see an associated growth in Bitcoin mining.

It’s hard to say when China will lose its majority share of Bitcoin’s hashrate. If it continues to lose, say, 3% per quarter, we could reach such a point by the end of 2021.

This will be very bullish for bitcoin, and for a variety of reasons. Firstly, the dominance of China has long cast a shadow over Bitcoin, with skeptics, pessimists and naysayers all basically claiming that, because over 50% of mining takes place in China, the Chinese government could effectively shut down Bitcoin whenever it wants.

Source: Twitter

Such alarmism isn’t unfounded, with the aforementioned 2018 research paper from Princeton University outlining a number of significant risks following from China’s dominance of Bitcoin mining.

As the authors of this paper write in their conclusion, “We singled out China for analysis because they are the most powerful potential adversary to Bitcoin, and we found that they have a variety of salient motives for attacking the system and a number of mature capabilities, both regulatory and technical, to carry out those attacks.”

The most obvious attack that could be launched via the Chinese state is the notorious 51% attack, whereby at least 51% of Bitcoin’s hashrate is used to validate invalid transactions (or censor valid transactions.

In sum, the authors noted in the paper’s abstract, “China threatens the security, stability, and viability of Bitcoin through its dominant position in the Bitcoin ecosystem, political and economic control over domestic activity, and control over its domestic Internet infrastructure.”

Such findings have likely had a significant cooling effect on the wider adoption of Bitcoin.

A self-identifying former banker tweets that no one can trust Bitcoin. Source: Twitter

With China’s share of mining likely to fall below 50% sooner or later, such criticisms will become less credible. In turn, the rise in investment Bitcoin has recently witnessed will be accelerated further, as more people become more reassured that Bitcoin really is as stable as its champions claim it is.

Side Effects of China’s Decreasing BTC Dominance

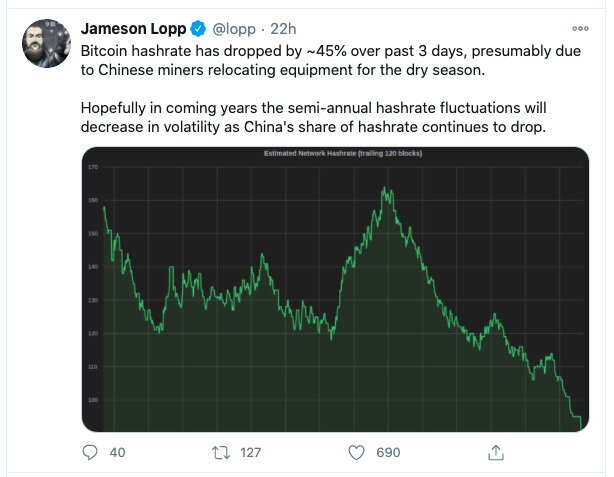

There are also a number of peripheral effects China’s dominance has on Bitcoin. For one, Bitcoin currently observes seasonal fluctuations in hashrate, with sudden drops in hash power making it theoretically easier to attack. Such fluctuations occur largely because China-based miners relocate their equipment in preparation for dry/wet seasons.

Source: Twitter

It’s also highly probable that the spread of mining to countries other than China will have positive knock-on effects for the global bitcoin/cryptocurrency economy. With countries as diverse as Iran, Kazakhstan, Malaysia, Russia and the U.S. increasing their respective mining shares, miners in these countries will increasingly want to trade the bitcoins they mine in local/regional exchanges. This will create business and demand for such exchanges, which in turn will be able to expand to other customers.

So if Bitcoin didn’t already have good enough news from rising institutional, corporate and retail investment, the data on China’s falling share of mining makes the picture look increasingly rosy for the cryptocurrency. This falling share will reinforce the increasingly popular sense that Bitcoin is a safe haven, while the price increases that will follow will enable hash power to spread further throughout the rest of the world. And so on.