- >News

- >CFTC Sues Binance: Is It Time to Find Another Exchange?

CFTC Sues Binance: Is It Time to Find Another Exchange?

The Commodity Futures Trading Commission has charged Binance with “wilful evasion” of US commodities trading law, among other alleged violations. In a month when the SEC has already threatened Coinbase with legal action, this latest regulatory maneuver comes as a massive blow for crypto in general and Binance in particular, with the exchange facing allegations of some very serious crimes. These include insider trading on the part of CEO Changpeng Zhao and attempts to enable US-based customers to evade compliance requirements.

In initiating its action, the CFTC is seeking a range of punishments for Binance, including “disgorgement, civil monetary penalties [and] permanent trading and registration bans.” As such, Binance now potentially faces an existential threat, with its customers already responding to the news of the charges by withdrawing around $2 billion in funds.

Does this mean that Binance could collapse? That its customers need to find a new trading platform? Well, while some of its clients have seemingly already come to this conclusion, it’s not certain that the CFTC’s charges will be upheld in court (in this case, the US District Court for the Northern District of Illinois). And even if they are, a ban in the US would potentially still leave Binance open to continue its operations in the rest of the world.

CFTC Makes a List of Binance’s Alleged Violations and Misdeeds

Needless to say, the CFTC’s filing with the District Court for the Northern District of Illinois makes for some excellent bedtime reading (unless you’re Changpeng Zhao, of course). It makes the following allegations, all of which could potentially result in Binance being hit with a very severe punishment, assuming the court decides in the regulator’s favor.

-

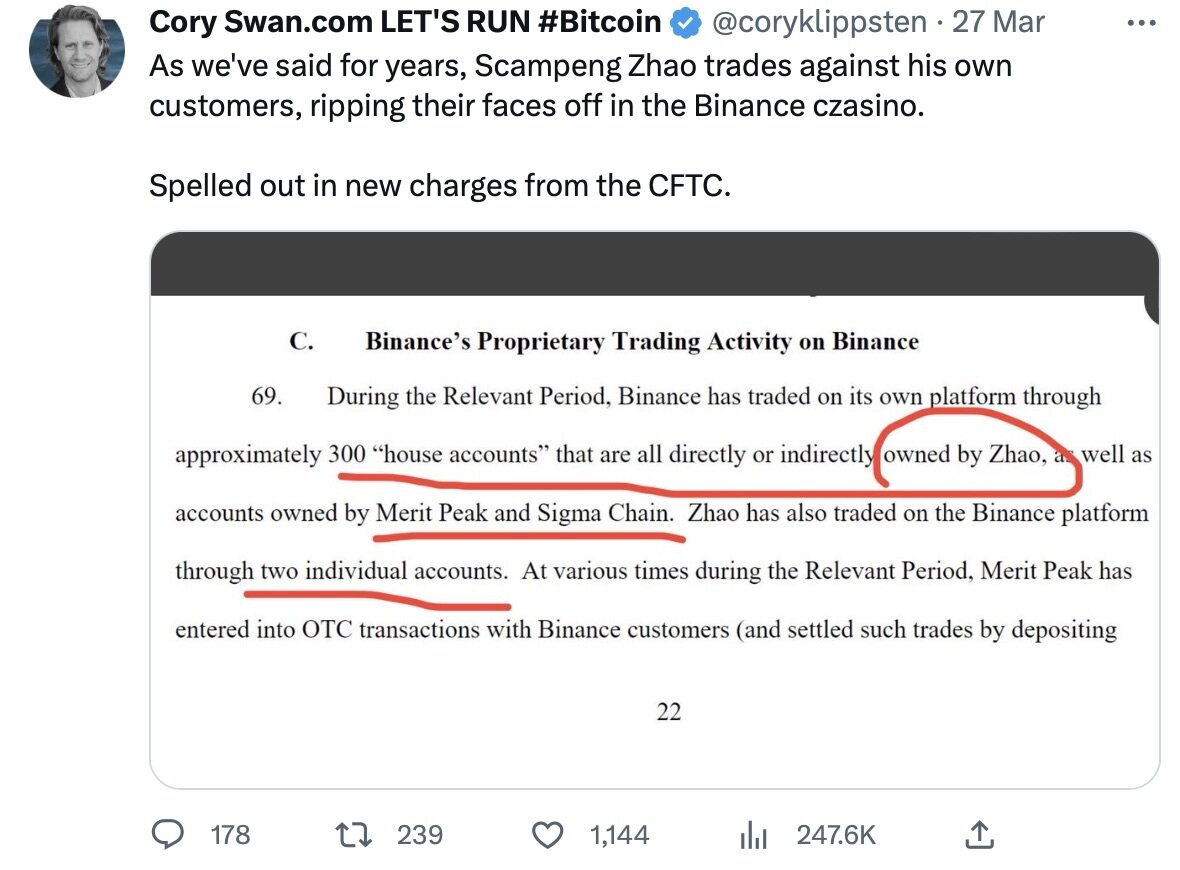

CEO Changpeng Zhao has directly or indirectly operated around 300 Binance trading accounts, with the purpose of conducting insider trading activity on exchange.

-

Binance has repeatedly advised US-based customers (and also its employees) on how to evade CFTC compliance controls, with the exchange having “never been registered with the CFTC in any capacity” in order to legally provide commodity-based derivatives trading.

-

The exchange has deliberately structured its business and network of subsidiaries with the aim of evading US registration requirements, despite the fact that 16% of its accounts were held by customers the platform identified as being located in the US.

-

Binance has disregarded laws that require controls for the prevention and detection of money laundering and terrorism financing.

-

Binance intentionally hides and obfuscates the identities of the business entities operating its platform, as well as their locations.

-

Committed numerous violations of the Commodity Exchange Act (CEA), including seeking and accepting orders for commodity futures, options, swaps, and retail commodity transactions, as well as facilitating swaps without being registered as a swap execution facility.

It’s perhaps unsurprising that, for those within the cryptocurrency community itself, the allegation regarding insider trading has commanded the most attention, and the most criticism. Although for more than a few people, it doesn’t really come as a surprise.

Source: Twitter

What’s particularly damning about the CFTC charges is that the commodities regulator appears to have obtained internal Binance communications, including text messages and emails sent between Zhao and various other members of staff.

Some of the most embarrassing of these reveal that Binance was apparently aware that its platform was being used by terrorists. For example, the exchange’s former chief compliance officer — Samuel Lim — was involved in a February 2019 conversation “regarding HAMAS transactions” on its platform, with Lim explaining to colleague that terrorists usually send “small sums” of money, since “large sums constitute money laundering.”

Is Binance in Deep Trouble?

As bad as all this almost certainly looks, it perhaps comes as no surprise that Binance itself has responded vigorously to the CFTC’s action and allegations, with Changpeng Zhao writing a blog on the day the charges were filed.

He uses it to deny the CFTC’s allegations, declaring that the exchange does “not agree with the characterization of many of the issues alleged in the complaint.” This includes claims regarding the laxity of KYC and AML controls and also regarding insider trading, while it also states that the exchange blocks “US users by nationality (KYC), IP (including commonly used VPN endpoints outside of the US), mobile carrier, device fingerprints, bank deposit and withdrawals, blockchain deposits and withdrawals, credit card bin numbers.”

Of course, this brief blog post doesn’t provide much evidence for these claims. Based on a quick reading of the public facts, it’s therefore reasonable to assume that the US District Court for the Northern District of Illinois will eventually judge in favor of the CFTC’s claims.

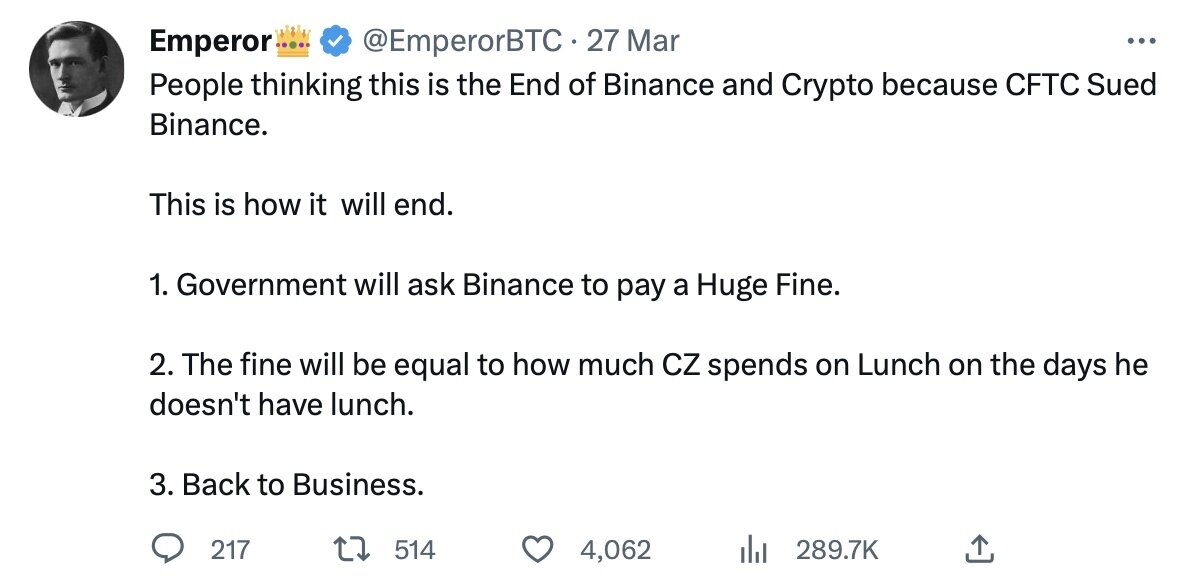

However, this doesn’t necessarily spell doom for Binance. As a small handful of commentators have pointed out (e.g. Bloomberg columnist Matt Levine), even though the CFTC’s report contains a wide variety of claims and details, the actual civil charges boil down to letting US-based customers trade derivatives.

As such, Binance would likely face two penalties: a hefty fine (including possible ‘disgorgement’ of revenues made from US trades) and potentially a “permanent trading and registration ban” (as the CFTC writes in its press release). The latter punishment would obviously mean a ban on trading and registering in the US, which would merely amount to a confirmation of the current status quo (in that Binance isn’t registered to facilitate trades in the US anyway).

Source: Twitter

In other words, Binance will certainly take a hit, with the loss of its (alleged) US customers causing its revenues to shrink. But it will likely continue elsewhere in the world, perhaps with more rigorous and reliable screening mechanisms for customer verifications and so on.

The market seems to think this too. Even though bitcoin (BTC) lost about $1,000 — falling to $26,800 — in response to the publication of the CFTC’s action, it has since recovered, and is now about $500 higher than it was just before the news broke. Even Binance’s BNB has begun recovering, as of writing.

Yes, some observers had initially gone so far as saying that the CFTC has “really strong chances here of succeeding in toppling the Binance empire,” and yes some customers have withdrawn funds. But with Binance still having an on-chain balance of around $64 billion, it may take more than a US regulator to dislodge it from its position at the top of the crypto pyramid.